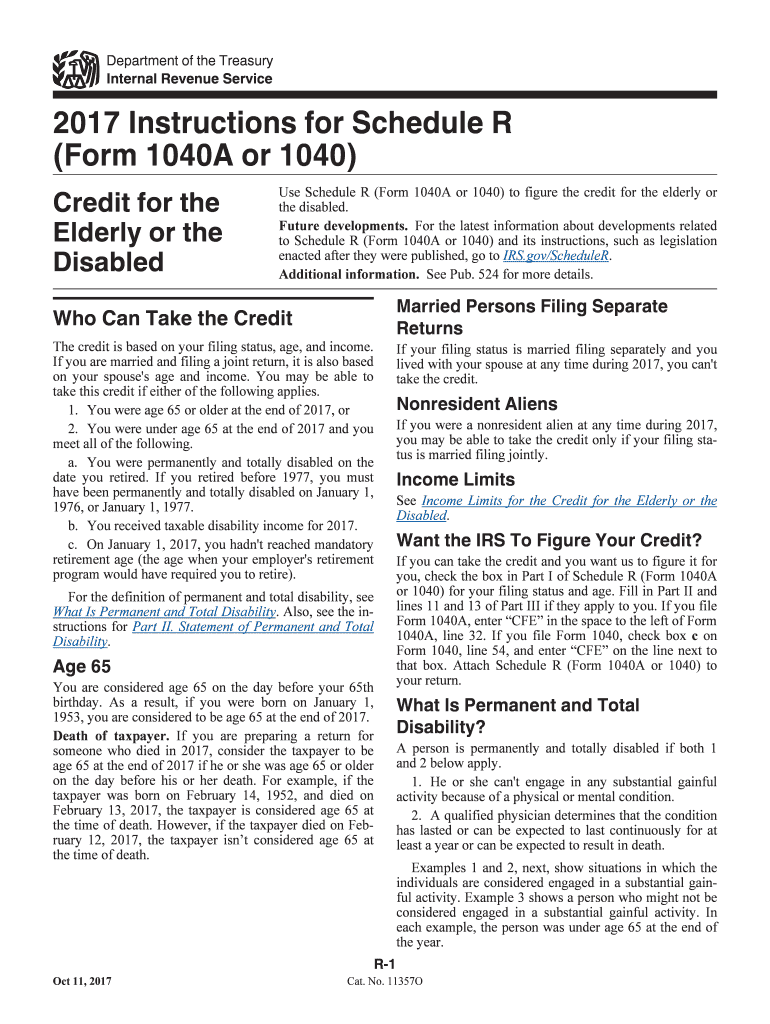

Schedule R Form

Schedule R Form - Web at this time, the irs expects the march 2023 revision of schedule r and these instructions to also be used for the second, third, and fourth quarters of 2023. Web you must keep the statement for your records. Ad access irs tax forms. Complete, edit or print tax forms instantly. August social security checks are getting disbursed this week for recipients who've. For the latest information about developments related to schedule r. Web for purposes of schedule r, the term “client” means (a) an “employer or payer” identified on form 2678, employer/payer appointment of agent; Web to generate form 706, schedule r line 9: July 29, 2023 5:00 a.m. Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service.

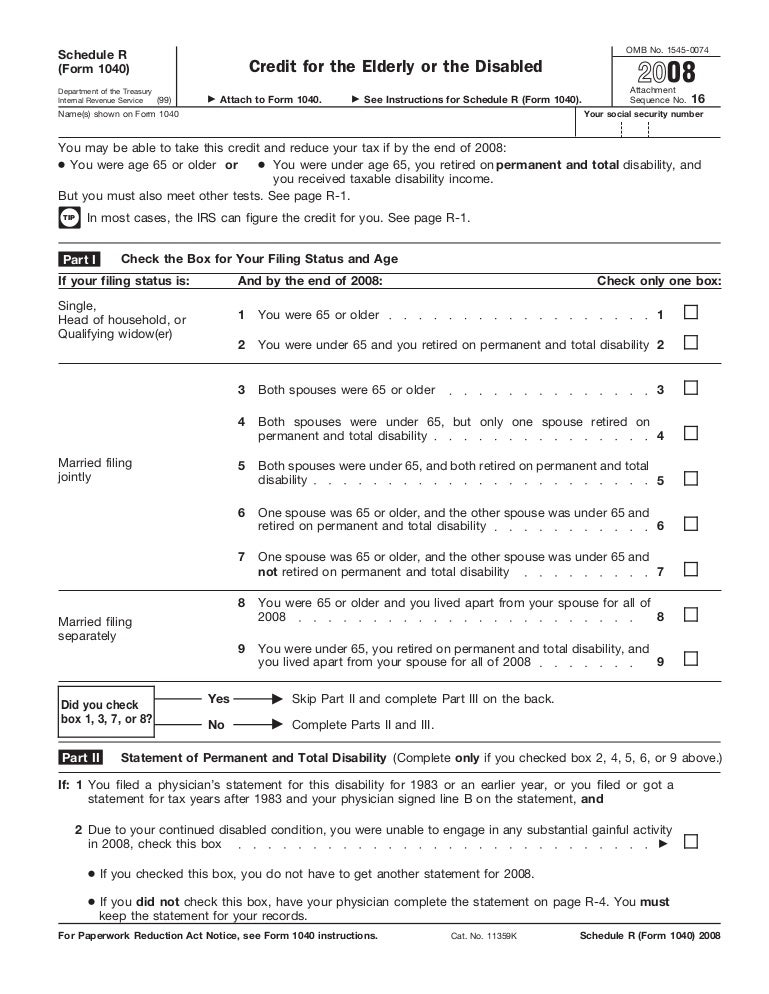

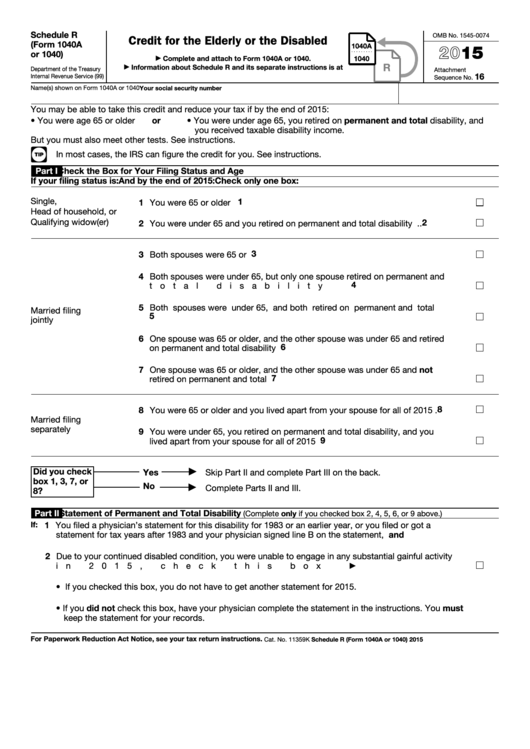

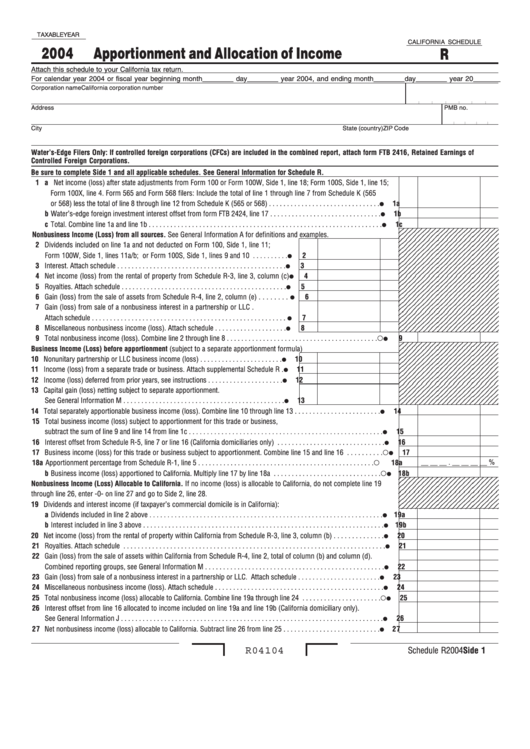

Enter on line 17 the total income from the trade or business after any adjustment for. August social security checks are getting disbursed this week for recipients who've. Web pesticide safety school registration form r fall 2023 name (please print clearly) street address city, state, zip. Complete, edit or print tax forms instantly. For paperwork reduction act notice, see your tax return instructions. Web tax form 1040 schedule r is a necessary form for filers of over 65 years of age or those with a disability. See general information for schedule r. Side 2 schedule r 2020 8012203 Web you must keep the statement for your records. (b) a customer who enters into a.

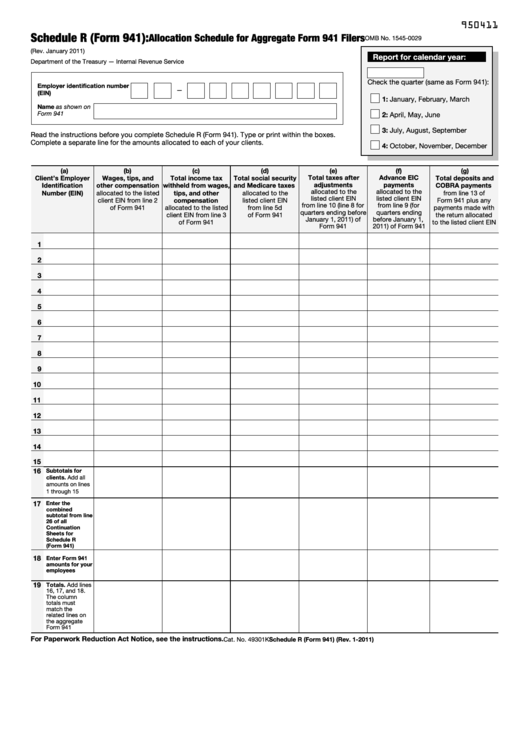

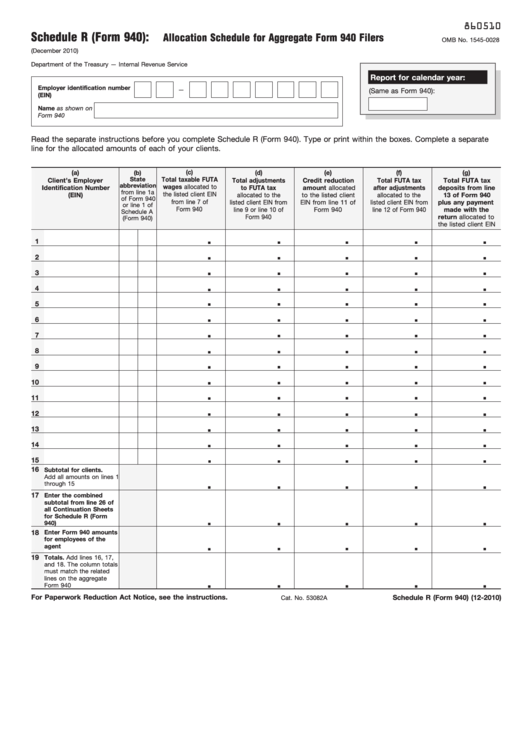

Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web to generate form 706, schedule r line 9: In order to generate schedule r, part i,. Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service. Enter the ein(s) of payor(s) who paid. Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. Get ready for tax season deadlines by completing any required tax forms today. To generate schedule r, part 1: For example, the form 1040 page is at irs.gov/form1040; See general information for schedule r.

Form 1040, Schedule R Credit for the Elderly or the Disabled

Complete, edit or print tax forms instantly. Enter the ein(s) of payor(s) who paid. Web at this time, the irs expects the march 2023 revision of schedule r and these instructions to also be used for the second, third, and fourth quarters of 2023. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web.

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

Enter on line 17 the total income from the trade or business after any adjustment for. Enter the ein(s) of payor(s) who paid. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web pesticide safety school registration form r fall 2023 name (please print clearly) street address city, state, zip..

Fillable Schedule R Form 1040a Or 1040 Credit For The 1040 Form Printable

Web to generate form 706, schedule r line 9: Side 2 schedule r 2020 8012203 Web schedule r retirement plan information (form 5500) department of the treasury this schedule is required to be filed under sections 104 and 4065 of the internal revenue. Enter on line 17 the total income from the trade or business after any adjustment for. July.

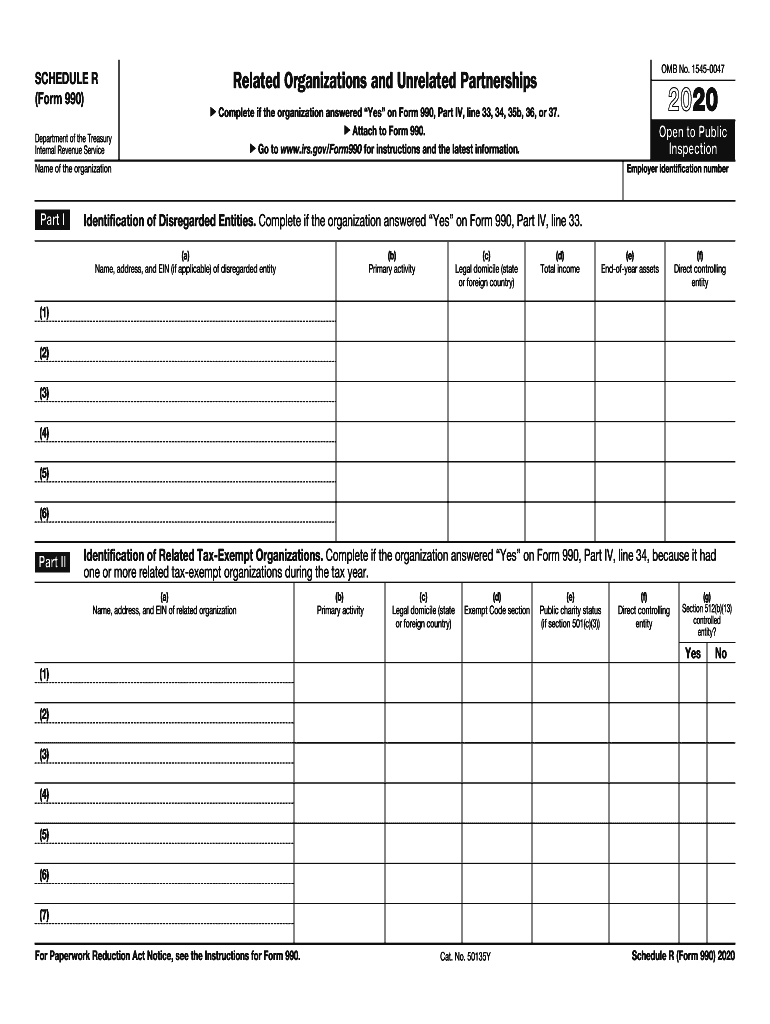

Form 990 (Schedule R1) Related Organizations and Unrelated

Back to table of contents. Web schedule r retirement plan information (form 5500) department of the treasury this schedule is required to be filed under sections 104 and 4065 of the internal revenue. If line 19 is zero or less, the. For example, the form 1040 page is at irs.gov/form1040; Web tax form 1040 schedule r is a necessary form.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Web income limits still apply per the schedule r form instructions. Web if you are an aggregate form 941 filer, file schedule r with your aggregate form 941 every quarter. Enter on line 17 the total income from the trade or business after any adjustment for. 2 1 06 2 4 all references to distributions relate only to payments of.

Instructions For Schedule R Form 1040A Or 1040 IRS gov Fill Out and

Web information about schedule r (form 1040), credit for the elderly or the disabled, including recent updates, related forms, and instructions on how to file. Knowing what schedule r is will help you file your tax. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Back to table of contents. For the latest information.

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Enter the ein(s) of payor(s) who paid. Section 3504 agents who elect to file an aggregate. Web to generate form 706, schedule r line 9: Web you must keep the statement for your records. Complete, edit or print tax forms instantly.

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

2 1 06 2 4 all references to distributions relate only to payments of benefits during the plan year. Back to table of contents. If line 19 is zero or less, the. Web to generate form 706, schedule r line 9: Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients.

Form 1040 (Schedule R) Credit Form for the Elderly or the Disabled

Web to generate form 706, schedule r line 9: 11359k schedule r (form 1040) 2021 schedule r. Web schedule r retirement plan information (form 5500) department of the treasury this schedule is required to be filed under sections 104 and 4065 of the internal revenue. Web you must keep the statement for your records. In order to generate schedule r,.

California Schedule R Apportionment And Allocation Of 2004

For example, the form 1040 page is at irs.gov/form1040; July 29, 2023 5:00 a.m. Web pesticide safety school registration form r fall 2023 name (please print clearly) street address city, state, zip. Web we last updated the credit for the elderly or the disabled in december 2022, so this is the latest version of 1040 (schedule r), fully updated for.

To Generate Schedule R, Part 1:

Web to generate form 706, schedule r line 9: August social security checks are getting disbursed this week for recipients who've. Complete, edit or print tax forms instantly. Ad access irs tax forms.

July 29, 2023 5:00 A.m.

For example, the form 1040 page is at irs.gov/form1040; Ad access irs tax forms. For paperwork reduction act notice, see your tax return instructions. Web at this time, the irs expects the march 2023 revision of schedule r and these instructions to also be used for the second, third, and fourth quarters of 2023.

Web Information About Schedule R (Form 1040), Credit For The Elderly Or The Disabled, Including Recent Updates, Related Forms, And Instructions On How To File.

Web if you are an aggregate form 941 filer, file schedule r with your aggregate form 941 every quarter. Get ready for tax season deadlines by completing any required tax forms today. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Knowing what schedule r is will help you file your tax.

If Line 19 Is Zero Or Less, The.

11359k schedule r (form 1040) 2021 schedule r. Web tax form 1040 schedule r is a necessary form for filers of over 65 years of age or those with a disability. 2 1 06 2 4 all references to distributions relate only to payments of benefits during the plan year. Section 3504 agents who elect to file an aggregate.