Self Employment Record Form

Self Employment Record Form - This form is used to notify the department when business operations change,. The social security administration uses the information from schedule se to figure your benefits under the social security program. This information is to be supplied with your ei rede application. These should be available for irs review. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. The form must be completed regardless of whether or not taxes are owed on the income. > the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. A means for calculating income for qualifying households with a farm loss. What kinds of records should i. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits.

Web why should i keep records? How it works browse for the illinois self employment form customize and esign all kids self employment records form What kinds of records should i. A client uses her home phone to run a business. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income, keep track of deductible expenses, keep track of your basis in property, prepare your tax returns, and support items reported on your tax returns. Web employment tax recordkeeping keep all records of employment taxes for at least four years after filing the 4th quarter for the year. This form is used to notify the department when business operations change,. A means for calculating income for qualifying households with a farm loss. > the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. Show quarterly wage periods and amounts for years prior to 1978;

This form is used to notify the department when business operations change,. > the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. What documents will i need? Show details we are not affiliated with any brand or entity on this form. Show quarterly wage periods and amounts for years prior to 1978; May be required if an unemployment claimant was employed by a school and has a reasonable assurance of returning to that employment in the next term. Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. The form must be completed regardless of whether or not taxes are owed on the income. The following list of documents, are used to verify earned income.

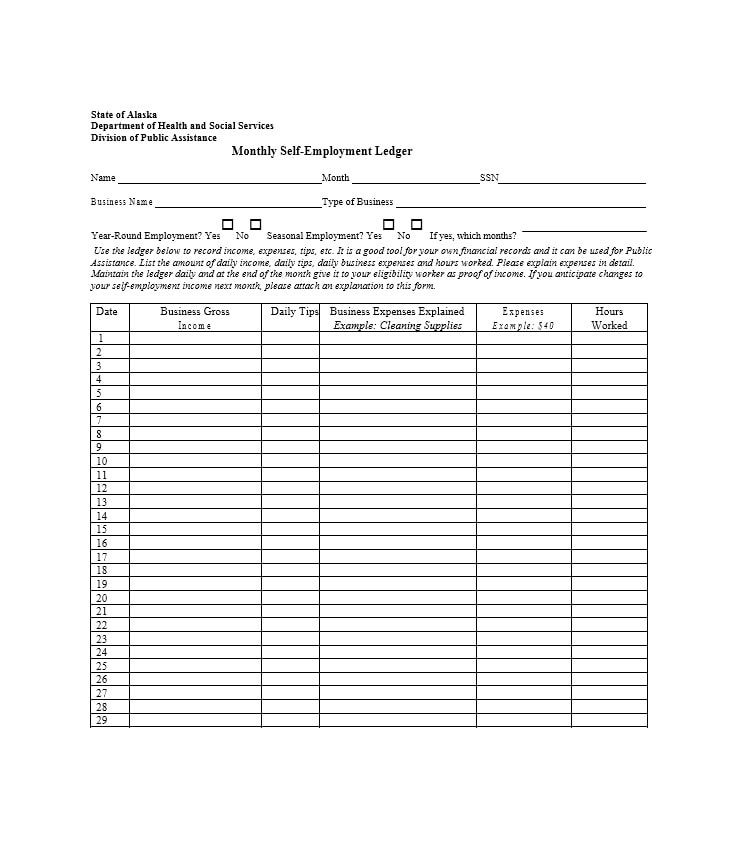

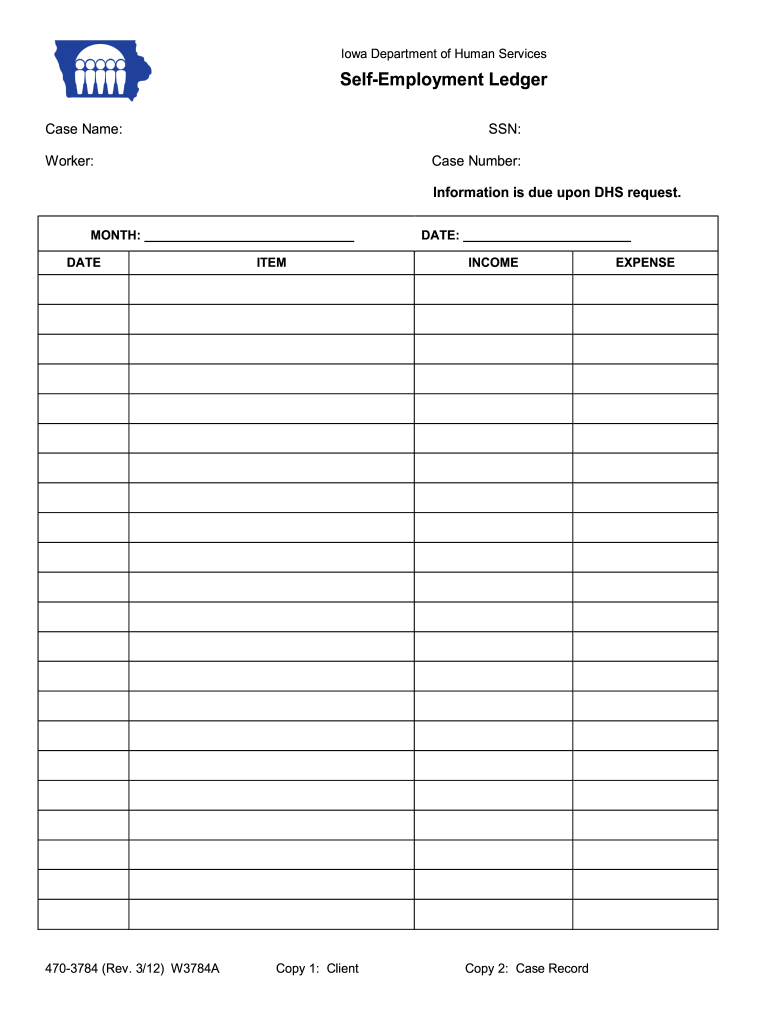

Printable Self Employment Ledger Template Printable Templates

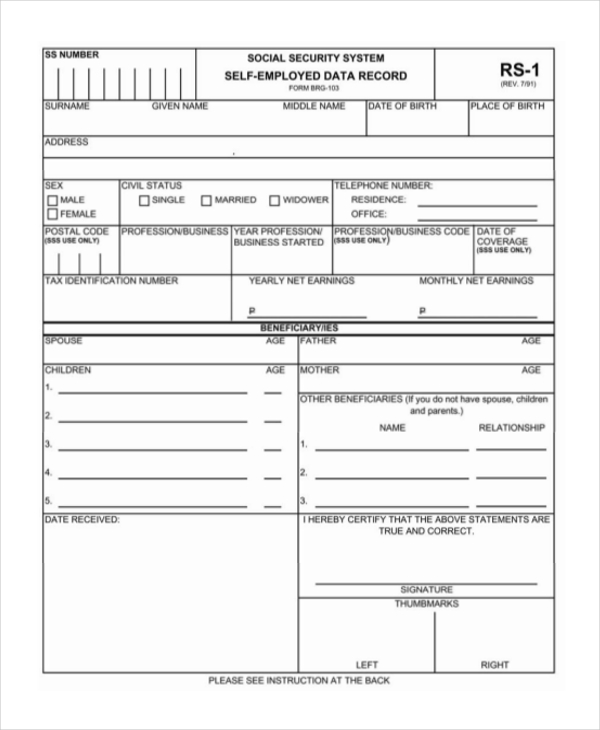

Web print below in date order your employment only for year(s) (or months) you believe our records are not correct. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income, keep track of deductible expenses, keep track of your basis in property, prepare your tax returns, and support items reported on.

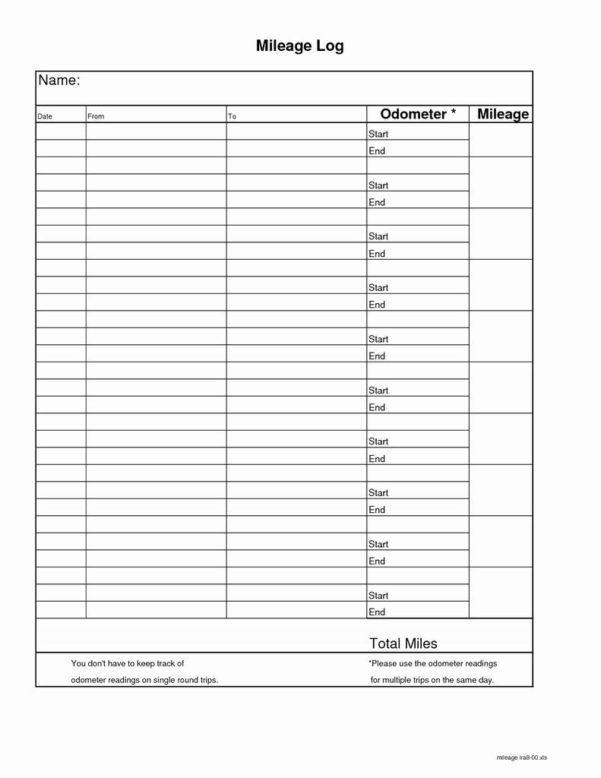

Self Employed Record Keeping Spreadsheet with Self Employment Record

> the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. Use this template for verification. This form is used to notify the department when business operations change,. Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. The following.

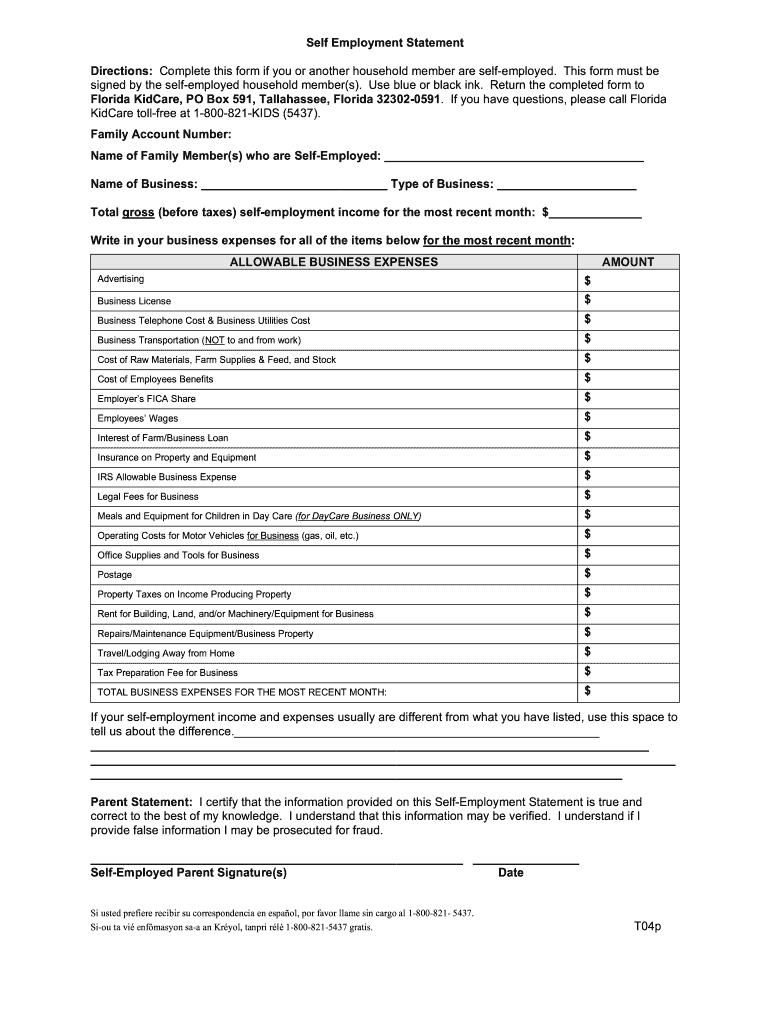

Self Employment Form Fill Out and Sign Printable PDF Template signNow

Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. The social security administration uses the information from schedule se to figure your benefits under the social security program. What documents will i need? This tax applies no matter how old you are and even if you are already getting social.

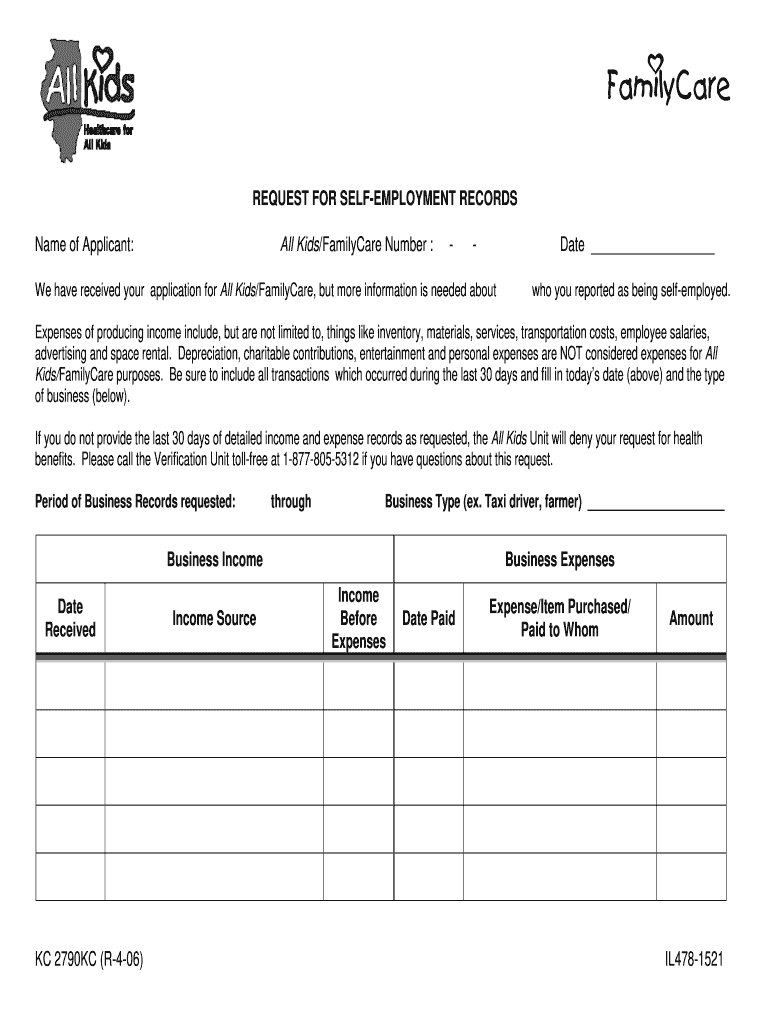

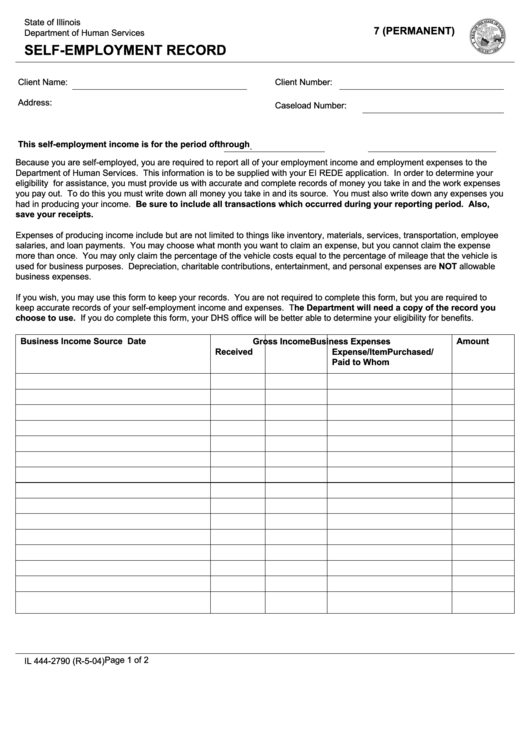

Illinois Self Employment Record Form Fill Out and Sign Printable PDF

Amounts and dates of all wage, annuity, and pension payments. Web why should i keep records? What kinds of records should i. Web print below in date order your employment only for year(s) (or months) you believe our records are not correct. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

Self Employment Il Get Printable Form

Use of form 2790 is not required. This tax applies no matter how old you are and even if you are already getting social security or medicare benefits. May be required if an unemployment claimant was employed by a school and has a reasonable assurance of returning to that employment in the next term. Web why should i keep records?.

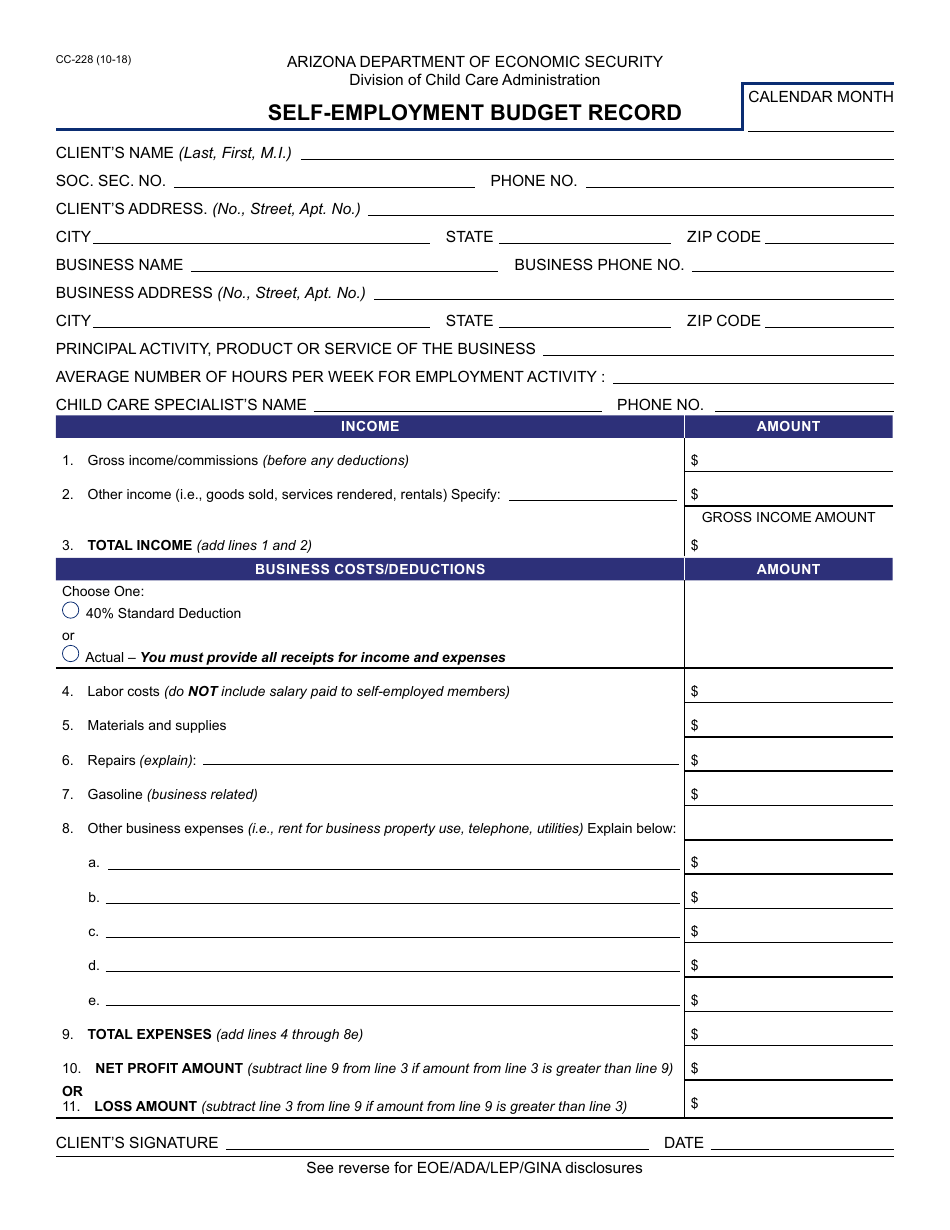

Form CC228 Download Fillable PDF or Fill Online Selfemployment Budget

Amounts of tips reported to you by your employees. Amounts and dates of all wage, annuity, and pension payments. Month # 1 month # 2 month # 3 $0 $0 $0 > expenses may only be deducted from income if a copy of the receipt is included. Please make only one entry per calendar period employed. These should be available.

FREE 11+ Sample Self Employment Forms in PDF MS Word

Amounts of tips reported to you by your employees. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. How it works browse for the illinois self employment form customize and esign all kids self employment records form The forms are available for free download. The social security administration uses the information from schedule.

Self Employment Ledger Template Fill Out and Sign Printable PDF

Web print below in date order your employment only for year(s) (or months) you believe our records are not correct. A means for calculating income for qualifying households with a farm loss. If you need more space, attach a separate sheet. Use of form 2790 is not required. A client uses her home phone to run a business.

Fillable Form Il 4442790 State Of Illinois Department Of Human

The social security administration uses the information from schedule se to figure your benefits under the social security program. Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. Show quarterly wage periods and amounts for years prior to 1978; A means for calculating income for qualifying households with a farm.

SelfEmployment Ledger 40 FREE Templates & Examples

Month # 1 month # 2 month # 3 $0 $0 $0 > expenses may only be deducted from income if a copy of the receipt is included. > the low income home energy assistance program (liheap) does not allow the same business deductions as the irs federal income tax. If you are applying for disability benefits, the information you.

This Tax Applies No Matter How Old You Are And Even If You Are Already Getting Social Security Or Medicare Benefits.

Amounts of tips reported to you by your employees. A client uses her home phone to run a business. Browse by state alabama al alaska ak arizona az arkansas ar california ca colorado co connecticut ct delaware de. The forms are available for free download.

May Be Required If An Unemployment Claimant Was Employed By A School And Has A Reasonable Assurance Of Returning To That Employment In The Next Term.

This information is to be supplied with your ei rede application. Show quarterly wage periods and amounts for years prior to 1978; Some common irs deductions not allowed for these purposes are: Web why should i keep records?

A Means For Calculating Income For Qualifying Households With A Farm Loss.

Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Amounts and dates of all wage, annuity, and pension payments. Web use a illinois self employment record form template to make your document workflow more streamlined. How it works browse for the illinois self employment form customize and esign all kids self employment records form

Month # 1 Month # 2 Month # 3 $0 $0 $0 > Expenses May Only Be Deducted From Income If A Copy Of The Receipt Is Included.

The following list of documents, are used to verify earned income. What documents will i need? If you need more space, attach a separate sheet. Use of form 2790 is not required.