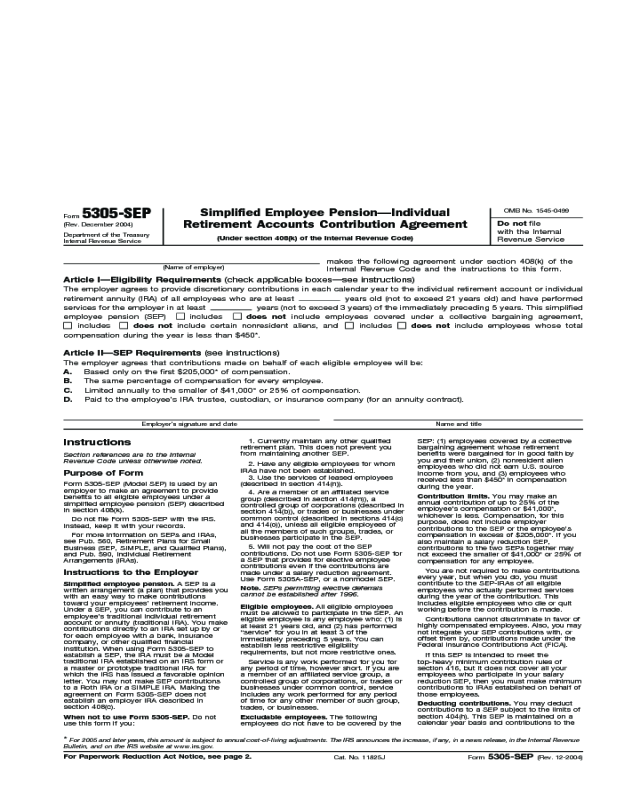

Sep Form 5305

Sep Form 5305 - Web there are three document format options for sep plans: Keep a copy for your files. Instead, keep it with your records. Don’t file it with the irs. Forms and publications from the internal revenue service by u.s. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Web form 5500 schedules and instructions; Why not consider a sep? A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.

Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Web form 5500 schedules and instructions; Instead, keep it with your records. Keep a copy for your files. Do not file this form with the irs. Forms and publications from the internal revenue service by u.s. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Web there are three document format options for sep plans: Why not consider a sep? Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.

Instead, keep it with your records. Do not file this form with the irs. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Keep a copy for your files. Choosing a financial institution to maintain your sep is one of the most important decisions. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Web there are three document format options for sep plans: Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Forms and publications from the internal revenue service by u.s. Web form 5500 schedules and instructions;

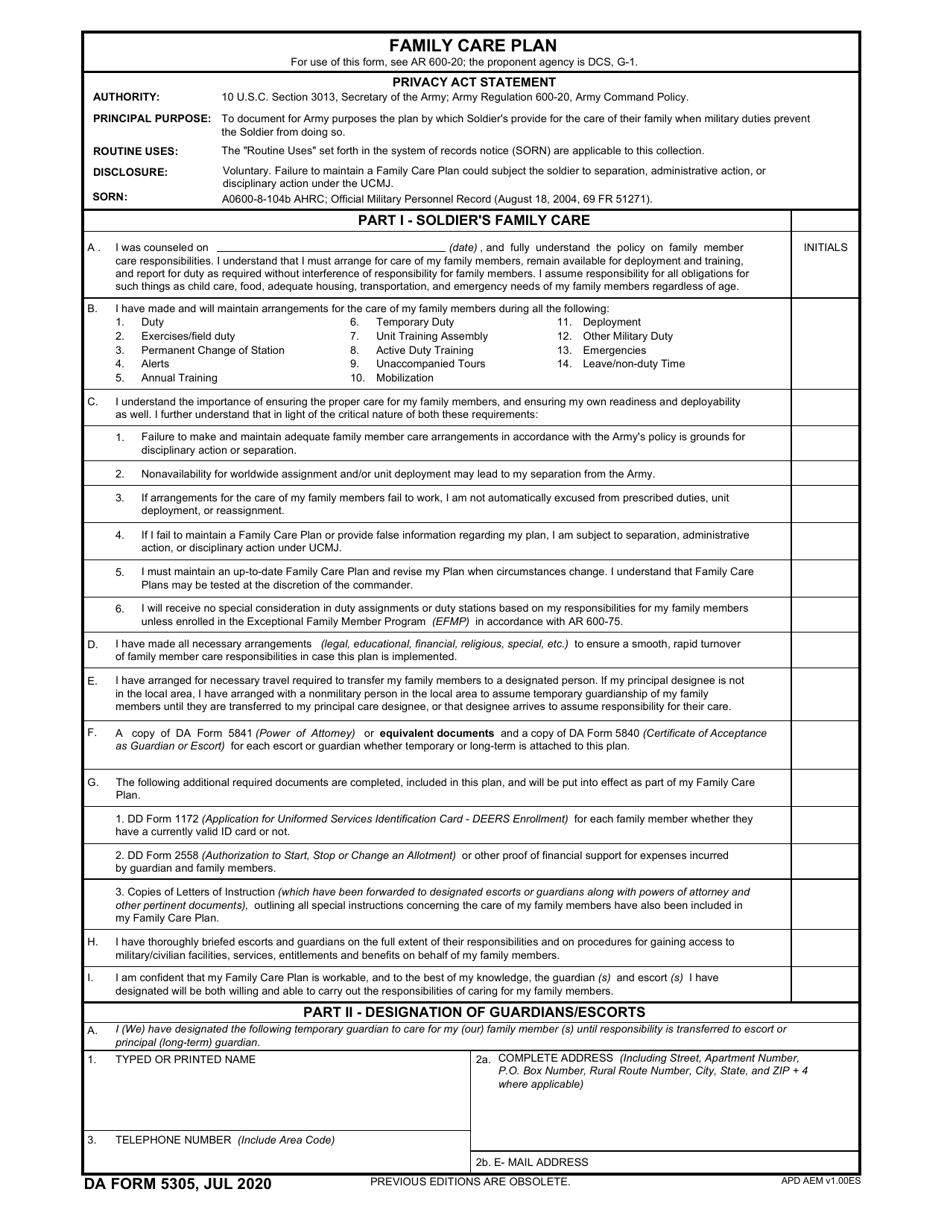

DA Form 5305 Download Fillable PDF or Fill Online Family Care Plan

Web form 5500 schedules and instructions; Why not consider a sep? Do not file this form with the irs. Web there are three document format options for sep plans: A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms.

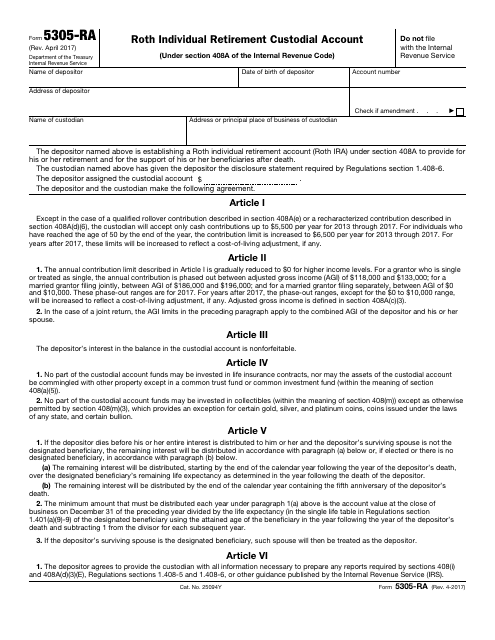

IRS Form 5305RA Download Fillable PDF or Fill Online Roth Individual

Keep a copy for your files. Forms and publications from the internal revenue service by u.s. Instead, keep it with your records. Do not file this form with the irs. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

Do not file this form with the irs. Forms and publications from the internal revenue service by u.s. Web there are three document format options for sep plans: Don’t file it with the irs. Instead, keep it with your records.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Do not file this form with the irs. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Web there are three document format options for sep plans: Forms and publications from the internal revenue service by u.s. Why not consider a sep?

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Web there are three document format options for sep plans: Choosing a financial institution to maintain your sep is one of the most important decisions. Keep a copy for your files. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. A prototype document offered by banks, insurance.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Instead, keep it with your records. Web there are three document format options for sep plans: Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Choosing a financial institution to maintain your sep is one of the most important decisions. Keep a copy for.

Form 5305ASEP Individual Retirement Accounts Contribution Agreement

Why not consider a sep? Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Web form 5500 schedules and instructions; Do not file this form with the irs. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set.

Form 5305SEP Simplified Employee PensionIndividual Retirement

Forms and publications from the internal revenue service by u.s. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Don’t file it with the irs. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for. Web.

Form 5305SEP Edit, Fill, Sign Online Handypdf

Do not file this form with the irs. Why not consider a sep? Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Web form 5500 schedules and instructions; Forms and publications from the internal revenue service by u.s.

Form 5305E Coverdell Education Savings Trust Account (2012) Free

Choosing a financial institution to maintain your sep is one of the most important decisions. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. A prototype document offered by banks, insurance companies, mutual fund companies and other qualified financial institutions or forms. Simplified employee pension (sep) plans.

Forms And Publications From The Internal Revenue Service By U.s.

Why not consider a sep? Do not file this form with the irs. Web there are three document format options for sep plans: Instead, keep it with your records.

A Prototype Document Offered By Banks, Insurance Companies, Mutual Fund Companies And Other Qualified Financial Institutions Or Forms.

Don’t file it with the irs. Web the annual reporting required for qualified plans (form 5500, annual return/report of employee benefit plan) is normally not required for seps. Choosing a financial institution to maintain your sep is one of the most important decisions. Simplified employee pension (sep) plans can provide a significant source of income at retirement by allowing employers to set aside money in retirement accounts for.

Web Form 5500 Schedules And Instructions;

Keep a copy for your files.