Should I Form My Llc In Delaware

Should I Form My Llc In Delaware - Web faqs steps to form an llc in delaware 1 name your llc before you can formally create your llc, you need to have a name that you can use for your llc. Drug deaths nationwide hit a record 109,680 in 2022, according to. You must use an llc designator (ie. Currently, llcs account for over 70% of business entity formations in delaware. Incorporate your business with us for less! We make it simple to register your new llc. File your llc paperwork in just 3 easy steps! However, it is important for every llc to have an operating agreement, establishing the rules and structure of the business. Web relative to new york, starting an llc in delaware is simpler and less expensive. The operating agreement is a private agreement and is not filed with the state.

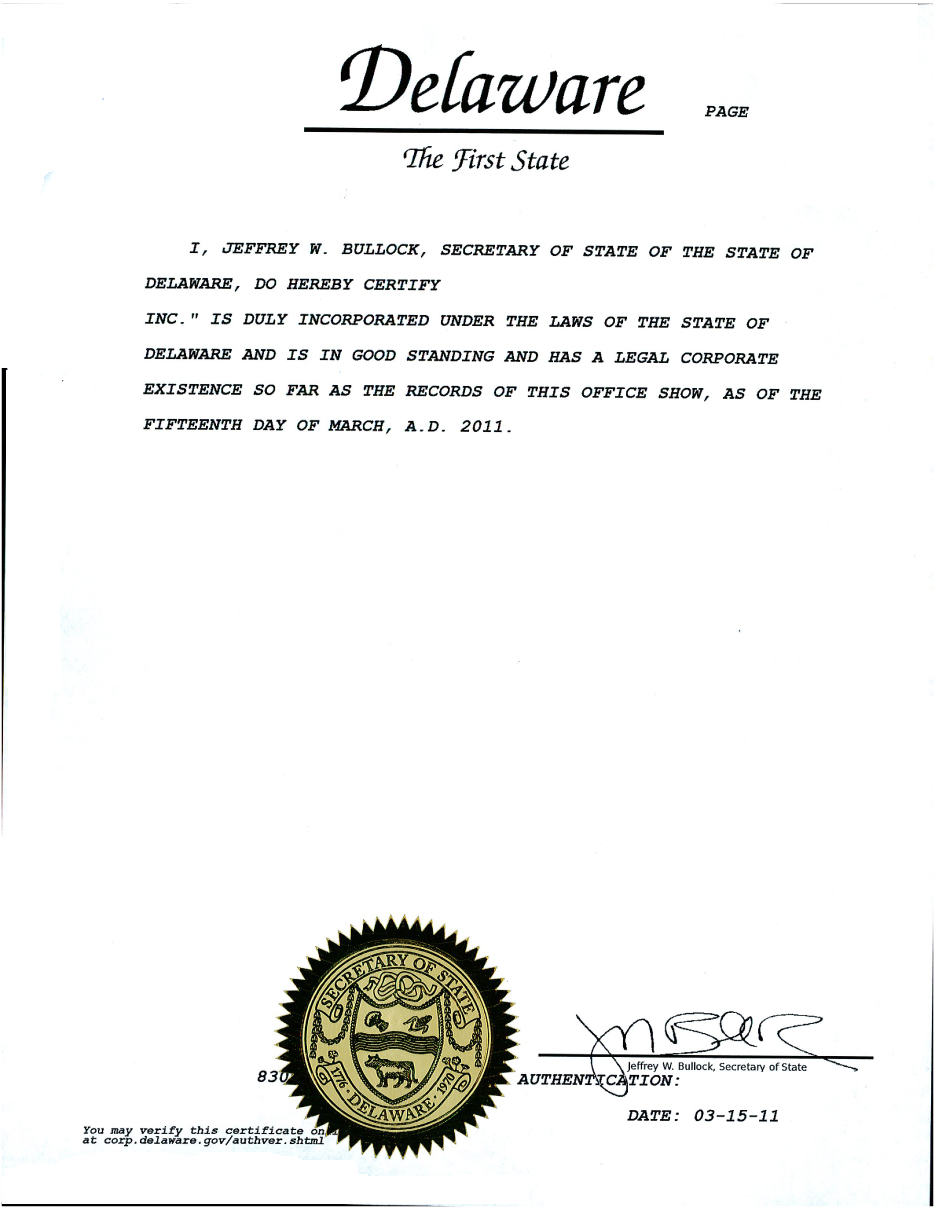

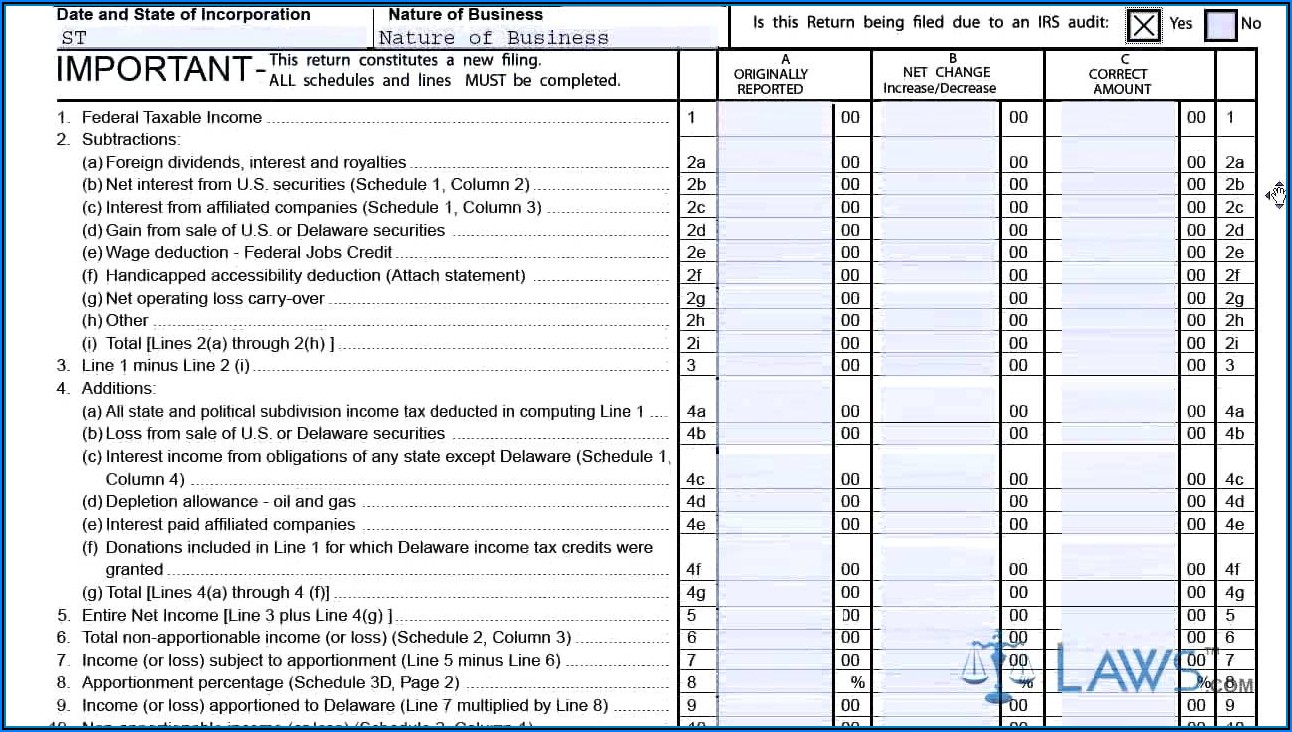

Web a llc is always classified in the same manner for delaware income tax as it is for federal income tax purposes. Ad our local experts know the ins & outs of forming a delaware llc. According to the delaware limited liability company act, your delaware llc name must: Delaware has no state or local sales tax for consumers. The tax, which recently increased, is a flat $300 and is payable to the dos. Currently, llcs account for over 70% of business entity formations in delaware. We give you more because we're a delaware registered agent. No one else offers a more complete delaware llc package at a more competitive price We'll do the legwork so you can set aside more time & money for your business. Web delaware has long been considered the preferred state to form a limited liability company (llc).

There is a $200 penalty for late payments. Nationwide incorporation and filing service. Web relative to new york, starting an llc in delaware is simpler and less expensive. We make it simple to register your new llc. Web the hearing was particularly timely, because the u.s. Ad protect your personal assets with a $0 llc—just pay state filing fees. Web corporations, public benefit corporations effective august 1, 2013, limited liability companies (llc), limited partnerships (lp), statutory trusts and many general partnerships (gp) are required to file with the delaware division of corporations. We give you more because we're a delaware registered agent. Web up to 25% cash back delaware, however, imposes an annual tax on llcs. Corporations had an average annual growth rate of 13.6%.

Delaware Llc Certificate Master of Documents

Web a llc is always classified in the same manner for delaware income tax as it is for federal income tax purposes. Web by incnow | published october 19, 2018. No one else offers a more complete delaware llc package at a more competitive price Web delaware has long been considered the preferred state to form a limited liability company.

How to Register an LLC in Delaware (in Only 3 Steps)

You can pay the tax online at the dos website. Web faqs steps to form an llc in delaware 1 name your llc before you can formally create your llc, you need to have a name that you can use for your llc. Ad we offer a $50 fixed registered agent fee. Ad quickly & easily form your new business,.

What Business Type Is Right for You? LLC versus Corporation Lawyer

The courts in delaware are efficient and quick when it comes to cases involving business entities. Delaware does not require llcs to file an annual report, but. Web why should i incorporate or form an llc in delaware? Web delaware has long been considered the preferred state to form a limited liability company (llc). We give you more because we're.

How To Form An LLC In Delaware In 10 Minutes! YouTube

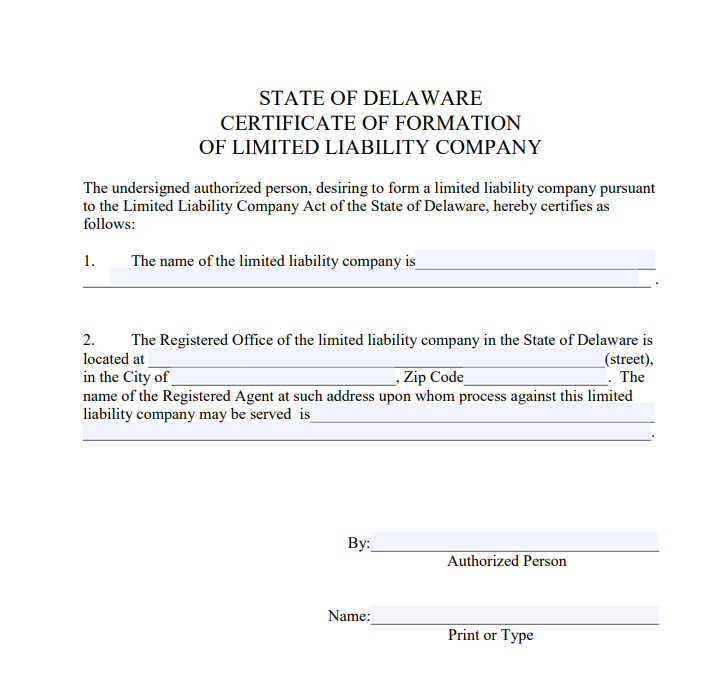

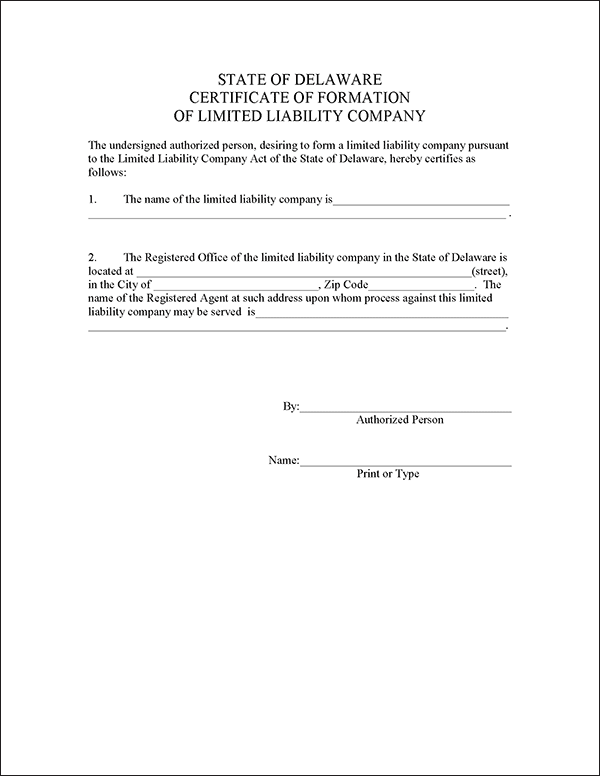

To have access to the gold standard of business laws, you should form an llc in delaware. * how to form a delaware llc Name check service, to confirm that your preferred business name is valid and available to be reserved. Delaware does not require llcs to file an annual report, but. You must simply file your certificate of formation.

Llc In Delaware >

We give you more because we're a delaware registered agent. You can apply online or by mail. You can pay the tax online at the dos website. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Web the hearing was particularly timely, because the u.s.

Delaware LLC How to Start an LLC in Delaware TRUiC

$0 + state filing fees. You must simply file your certificate of formation and pay a $90 filing fee. Web to form a delaware llc, you'll need to file a certificate of formation with the delaware department of state, which costs $90. Limited liability companies classified as partnerships must file delaware form 300. However, it is important for every llc.

Gold Delaware LLC Package Order Form

The name must differ from any other business name registered with the. We give you more because we're a delaware registered agent. Ad protect your personal assets with a $0 llc—just pay state filing fees. The tax, which recently increased, is a flat $300 and is payable to the dos. Web the hearing was particularly timely, because the u.s.

Delaware LLC Everything You Need to Know Business Formations

The operating agreement is a private agreement and is not filed with the state. Nationwide incorporation and filing service. Web by incnow | published october 19, 2018. No one else offers a more complete delaware llc package at a more competitive price Currently, llcs account for over 70% of business entity formations in delaware.

Should You Form an LLC in Delaware? How to Decide Where to Register an

Delaware does not require llcs to file an annual report, but. Web why should i incorporate or form an llc in delaware? The name must differ from any other business name registered with the. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. The tax is due on or before june 1.

Delaware Llc Tax Forms Form Resume Examples 1ZV8ABR23X

Name check service, to confirm that your preferred business name is valid and available to be reserved. Drug deaths nationwide hit a record 109,680 in 2022, according to. Articles of organization, the document needed to officially register your llc with the state. Web in delaware, llcs have grown by an average rate of 8.8% from 2016 to 2020. We make.

Web To Form A Delaware Llc, You'll Need To File A Certificate Of Formation With The Delaware Department Of State, Which Costs $90.

Limited liability companies classified as partnerships must file delaware form 300. Drug deaths nationwide hit a record 109,680 in 2022, according to. The registration process can be done online; In 2021, 72.3% of all businesses were formed in delaware.

Web A Llc Is Always Classified In The Same Manner For Delaware Income Tax As It Is For Federal Income Tax Purposes.

Ad our local experts know the ins & outs of forming a delaware llc. Web why should i incorporate or form an llc in delaware? Web by incnow | published october 19, 2018. You can apply online or by mail.

Web Up To 25% Cash Back Delaware, However, Imposes An Annual Tax On Llcs.

Delaware does not require llcs to file an annual report, but. The name must differ from any other business name registered with the. We give you more because we're a delaware registered agent. We make it simple to register your new llc.

To Have Access To The Gold Standard Of Business Laws, You Should Form An Llc In Delaware.

Delaware is an easy and reliable state in which to incorporate or form llcs, plus the annual cost is low and the owners of the llc as individuals are given the strongest legal protection available by any state. Corporations had an average annual growth rate of 13.6%. Ad quickly & easily form your new business, in any state, for as little as $0 + state fees. The tax is due on or before june 1.