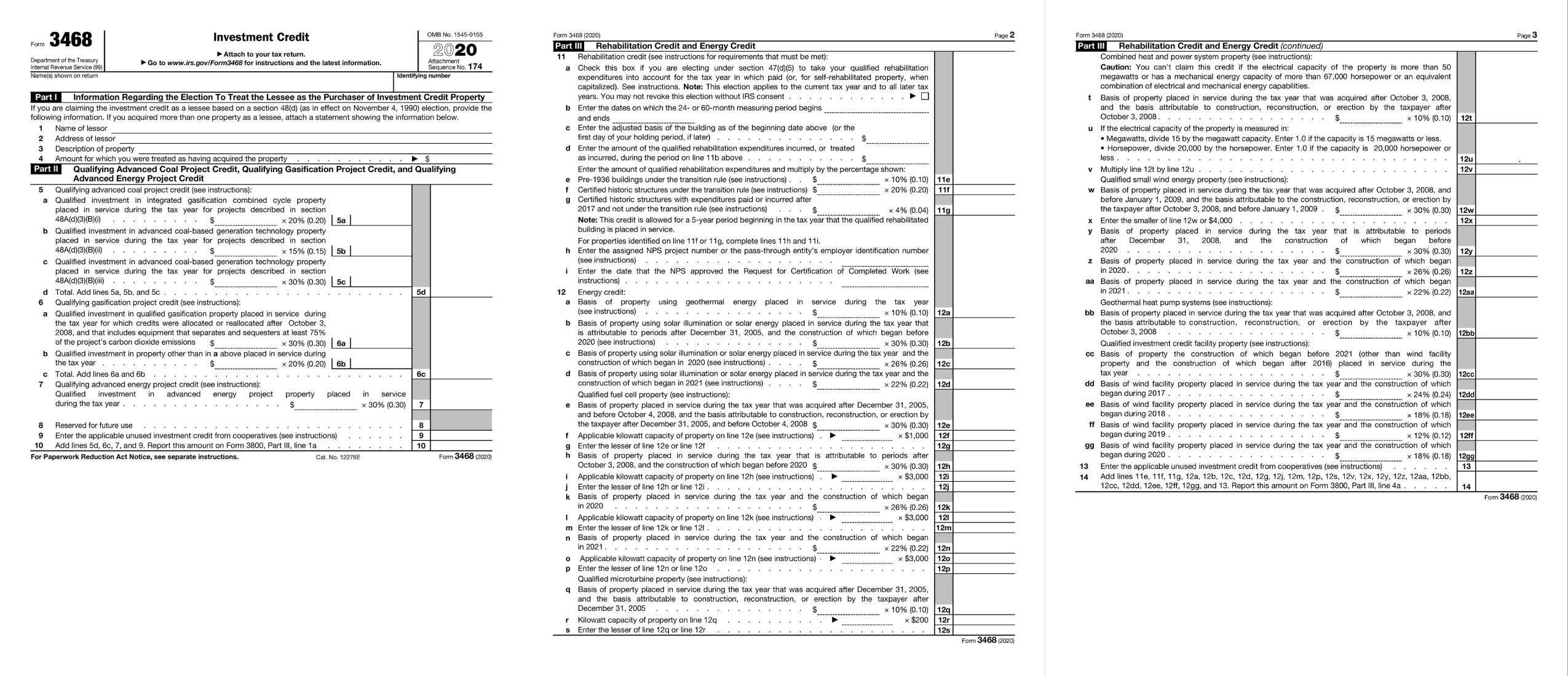

Solar Tax Credit Form 3468

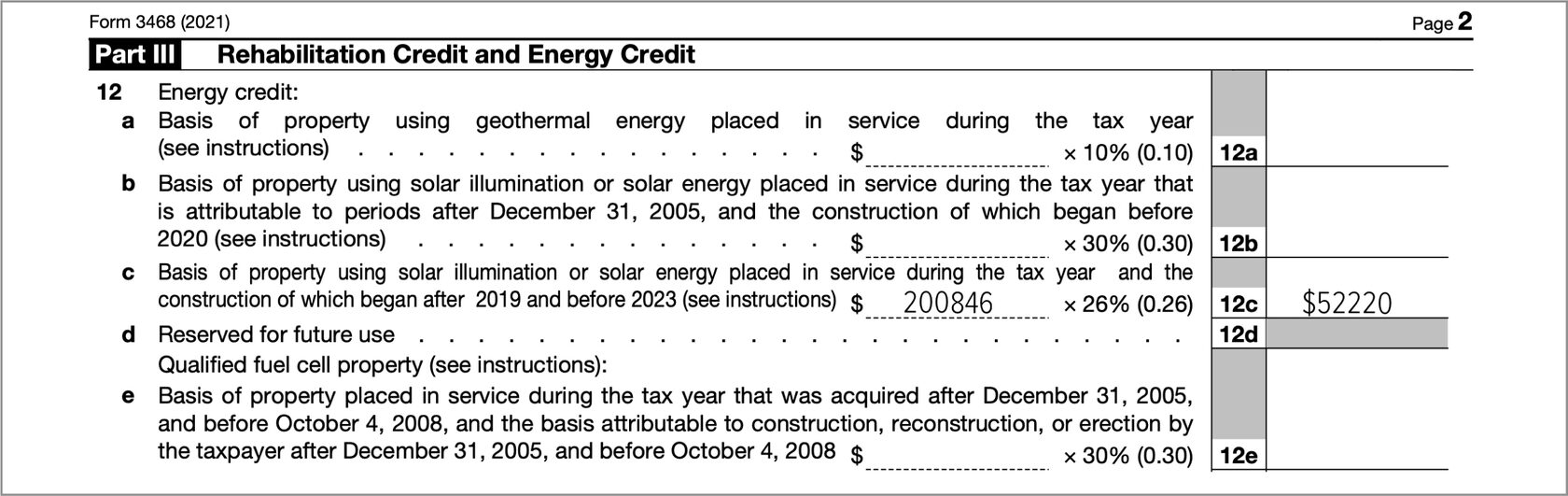

Solar Tax Credit Form 3468 - Web internal revenue code (irc) sections 48 (a) (3) (i) and 48 (a) (3) (ii) grant businesses a tax credit for solar equipment as part of the energy credit. Federal solar investment tax credit (itc). If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. The total gross cost of your solar energy system after any cash rebates. • established new credits for energy storage technology, qualified biogas property, and microgrid controllers. Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. Go to screen 26, credits. If depreciable, enter the asset in screen 16, depreciation (4562). Estimated dollar amount you can save: Web the solar investment tax credit (itc) is a tax credit that can be claimed on federal corporate income taxes for 30% of the cost of a solar photovoltaic (pv) system.

Web form 3468 is used to compute the investment credit; Web the total gross cost of your solar energy system after any cash rebates. Generally, (a) an estate or trust whose entire qualified. After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to. Insert any additional energy improvements to line 2 4. Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information. Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. Web these credits for periods in 2023. Get competing solar quotes online how it.

Ad go solar with sunnova! The specific instructions section of the instructions for form 3468 state the following: Federal solar investment tax credit (itc). Custom, efficient solar panels tailored to your needs. Ad with the right expertise, federal tax credits and incentives could benefit your business. After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to. Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. Take control of home energy costs & produce your own solar energy. Web internal revenue code (irc) sections 48 (a) (3) (i) and 48 (a) (3) (ii) grant businesses a tax credit for solar equipment as part of the energy credit. Web the total gross cost of your solar energy system after any cash rebates.

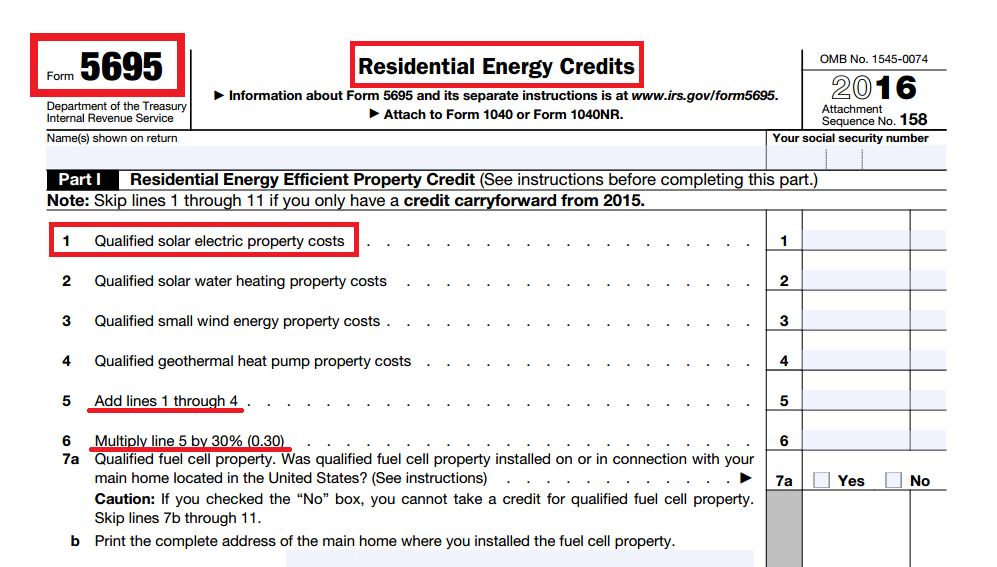

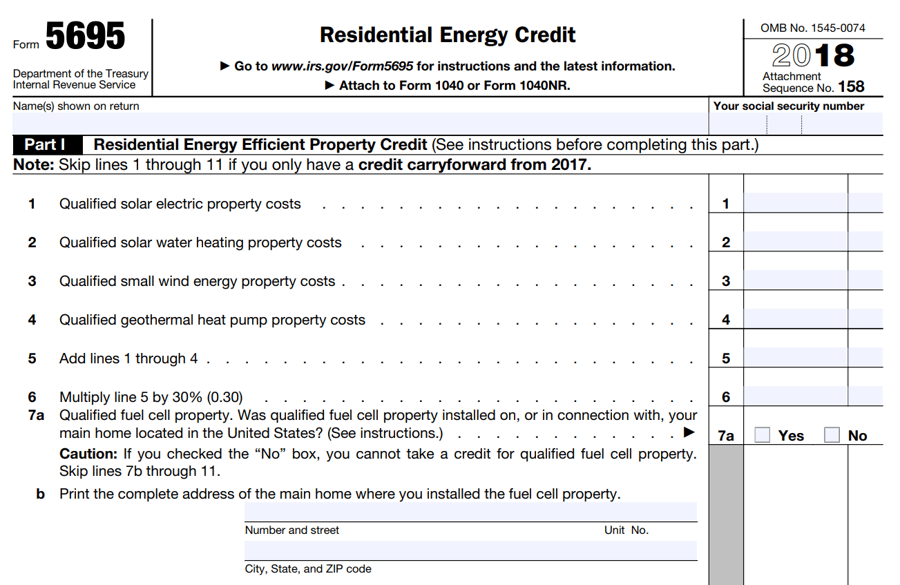

Nonbusiness Energy Credit Form Armando Friend's Template

Insert any additional energy improvements to line 2 4. Home solar built just for you. Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. Web there are two options for entering the solar credit. Get competing solar quotes online how it.

How Does the Federal Solar Tax Credit Work?

Home solar built just for you. Ad go solar with sunnova! After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to. Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Web form 3468 calculates tax credits for a number.

How to Get FREE Solar Panels How To Build It

Ad go solar with sunnova! Ira 2022 enacted the following. Web the total gross cost of your solar energy system after any cash rebates. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. Federal solar investment tax credit (itc).

How to File the Federal Solar Tax Credit A Step by Step Guide

Web form 3468 is used to compute the investment credit; If depreciable, enter the asset in screen 16, depreciation (4562). Get competing solar quotes online how it. After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to. Web to claim the itc, a taxpayer must complete and attach.

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Get competing solar quotes online how it. Web commercial entities will follow this guidance and complete irs form 3468. Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. Ad with the right expertise, federal tax credits and incentives could benefit your business. Web how do i claim the federal solar tax credit?

Federal Investment Tax Credit (ITC) Form 3468/3468i, Eligible

Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information. Custom, efficient solar panels tailored to your needs. The total gross cost of your solar energy system after any cash rebates. The specific instructions section of the instructions for form 3468 state the following: Insert any additional energy.

2020 Solar Tax Forms Solar Energy Solutions

Work with federal tax credits and incentives specialists who have decades of experience. Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Insert any additional energy improvements to line 2 4. Web to claim the itc, a taxpayer must complete and attach irs form 3468 to their tax return. Ira 2022.

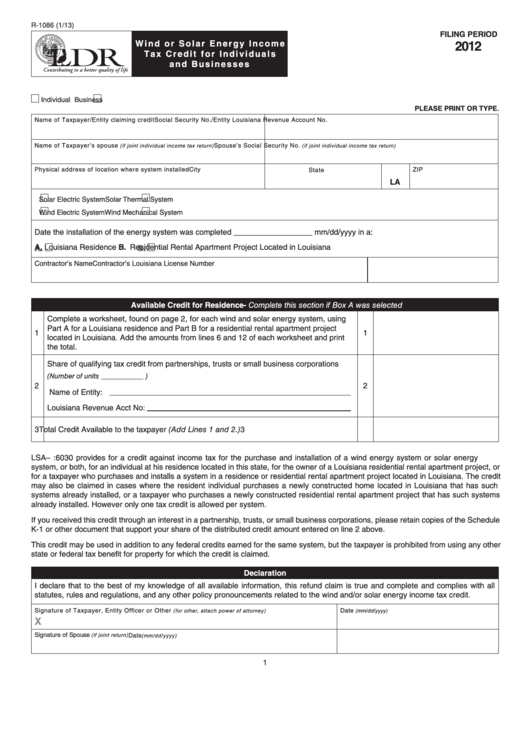

Fillable Form R1086 Wind Or Solar Energy Tax Credit For

Federal solar investment tax credit (itc). Web form 3468 is used to compute the investment credit; Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. The total gross cost of your solar energy system after any cash rebates. Estimated dollar amount you can save:

How do I claim the solar tax credit? A1 Solar Store

Web these credits for periods in 2023. Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Take control of home energy costs & produce your own solar energy. Web the total gross cost of your solar energy system after any cash rebates. Web form 3468 calculates tax credits for a number.

How To Claim The Solar Tax Credit Alba Solar Energy

The federal tax credit falls to 26% starting in 2033. Work with federal tax credits and incentives specialists who have decades of experience. Federal solar investment tax credit (itc). Go to screen 26, credits. After seeking professional tax advice and ensuring you are eligible for the credit, you can complete and attach irs form 5695 to.

Web Follow These Steps To Enter A Solar Energy Credit:

The total gross cost of your solar energy system after any cash rebates. Go to screen 26, credits. Add qualified solar electricity costs to line 1. Insert any additional energy improvements to line 2 4.

Web Form 3468 Calculates Tax Credits For A Number Of Qualified Commercial Energy Improvements, Including Solar Systems.

Web the federal tax code includes a variety of tax credits designed to promote different types of investment. Web solar incentives in missouri: Now, pv magazine usa is not a tax advisor, so seek professional advice before filling out. Ira 2022 enacted the following.

Web Internal Revenue Code (Irc) Sections 48 (A) (3) (I) And 48 (A) (3) (Ii) Grant Businesses A Tax Credit For Solar Equipment As Part Of The Energy Credit.

• established new credits for energy storage technology, qualified biogas property, and microgrid controllers. The investment credit is composed of various credits including the business energy credit. Web form 3468 is used to compute the investment credit; Web you must attach a statement to form 3468 to claim section 48d advanced manufacturing investment credit that includes the following information.

Custom, Efficient Solar Panels Tailored To Your Needs.

Web these credits for periods in 2023. Home solar built just for you. Estimated dollar amount you can save: Web the total gross cost of your solar energy system after any cash rebates.