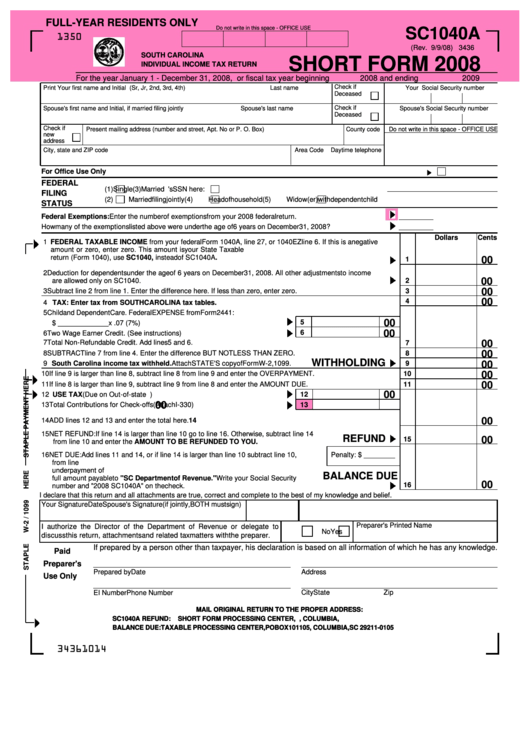

South Carolina Withholding Form 2023

South Carolina Withholding Form 2023 - Fica wage and tax adjustment request waiver The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Manage your tax accounts online for free! 11/1/22) 3478 employers must calculate taxable income for each employee. Form namesc withholding tax information guide: 14 by the state revenue department. You can print other south carolina tax forms here. South carolina’s 2023 withholding methods were released nov. Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld.

Web state of south carolina department of revenue wh1603 (rev. The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table 14 by the state revenue department. Visit dor.sc.gov/withholding what’s new for withholding tax? Form namesc withholding tax information guide: Web want more information about withholding taxes? You can print other south carolina tax forms here. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages.

11/1/22) 3478 employers must calculate taxable income for each employee. Fica wage and tax adjustment request waiver 14 by the state revenue department. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Manage your tax accounts online for free! Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Visit dor.sc.gov/withholding what’s new for withholding tax? Then, compute the amount of tax to be withheld using the subtraction method or the addition method. The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%.

South Carolina State Tax Withholding Form

The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Form namesc withholding tax information guide: Web want more information about withholding taxes? 14 by the.

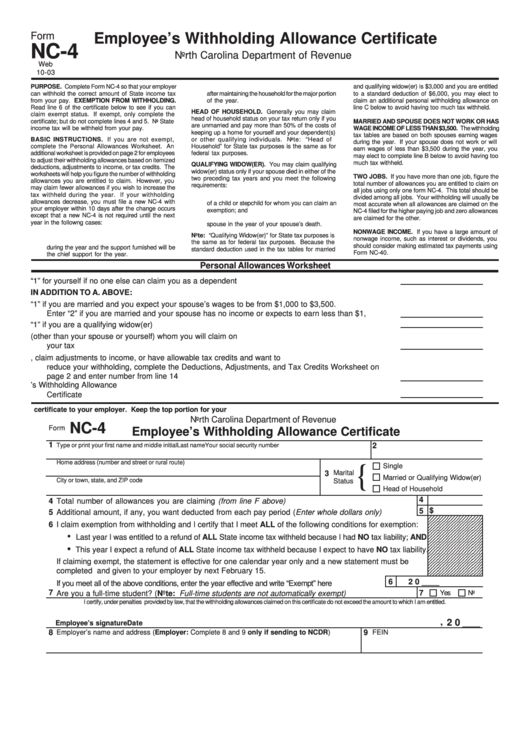

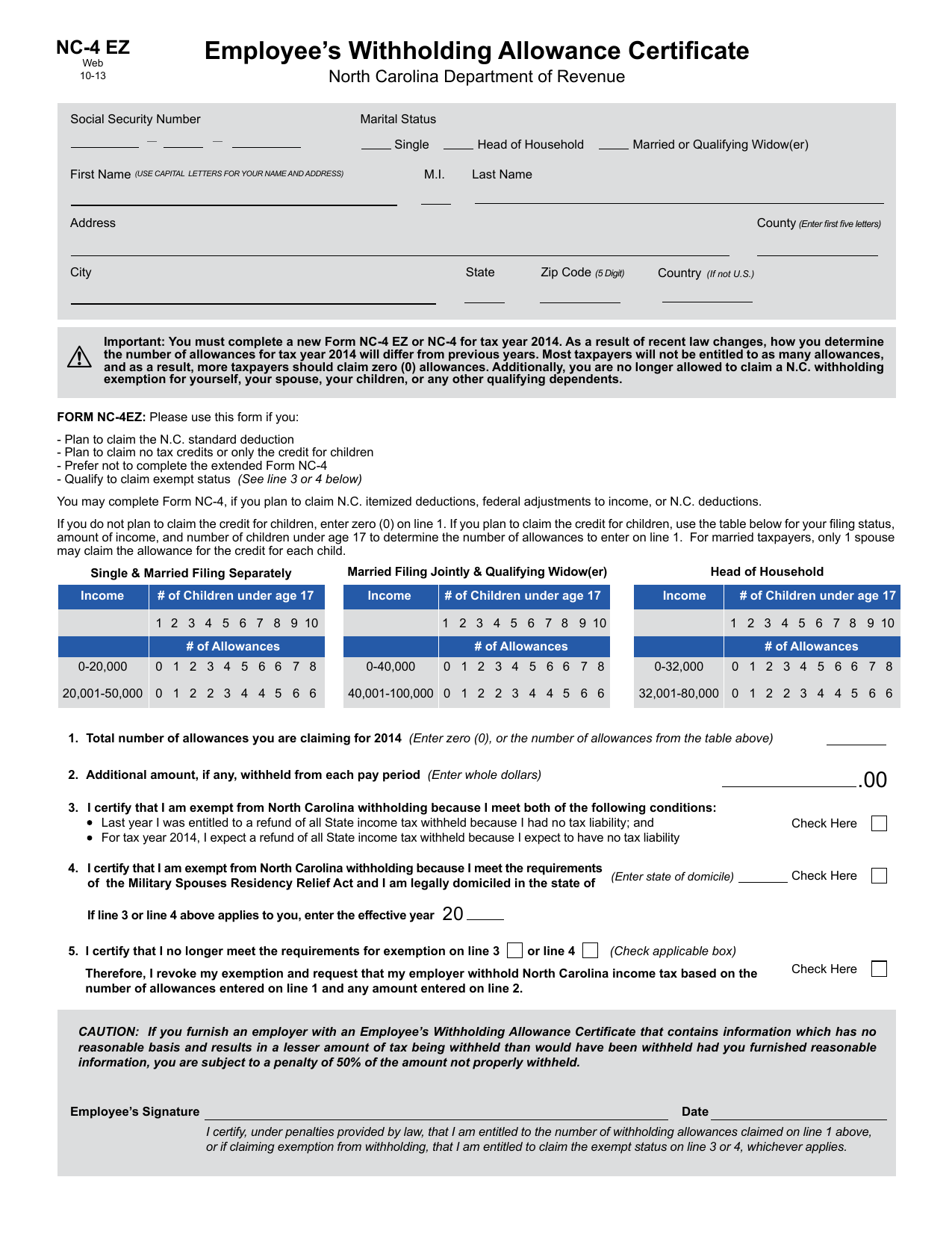

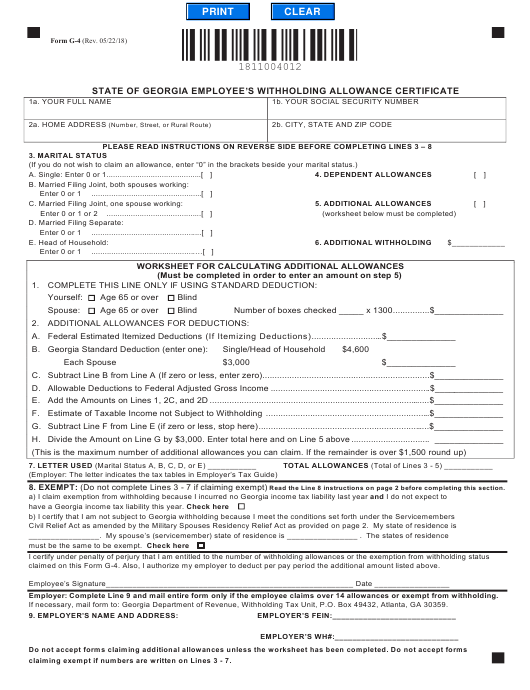

Employee’s Withholding Allowance Certificate NC4 EZ

Form namesc withholding tax information guide: Manage your tax accounts online for free! Web want more information about withholding taxes? For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and.

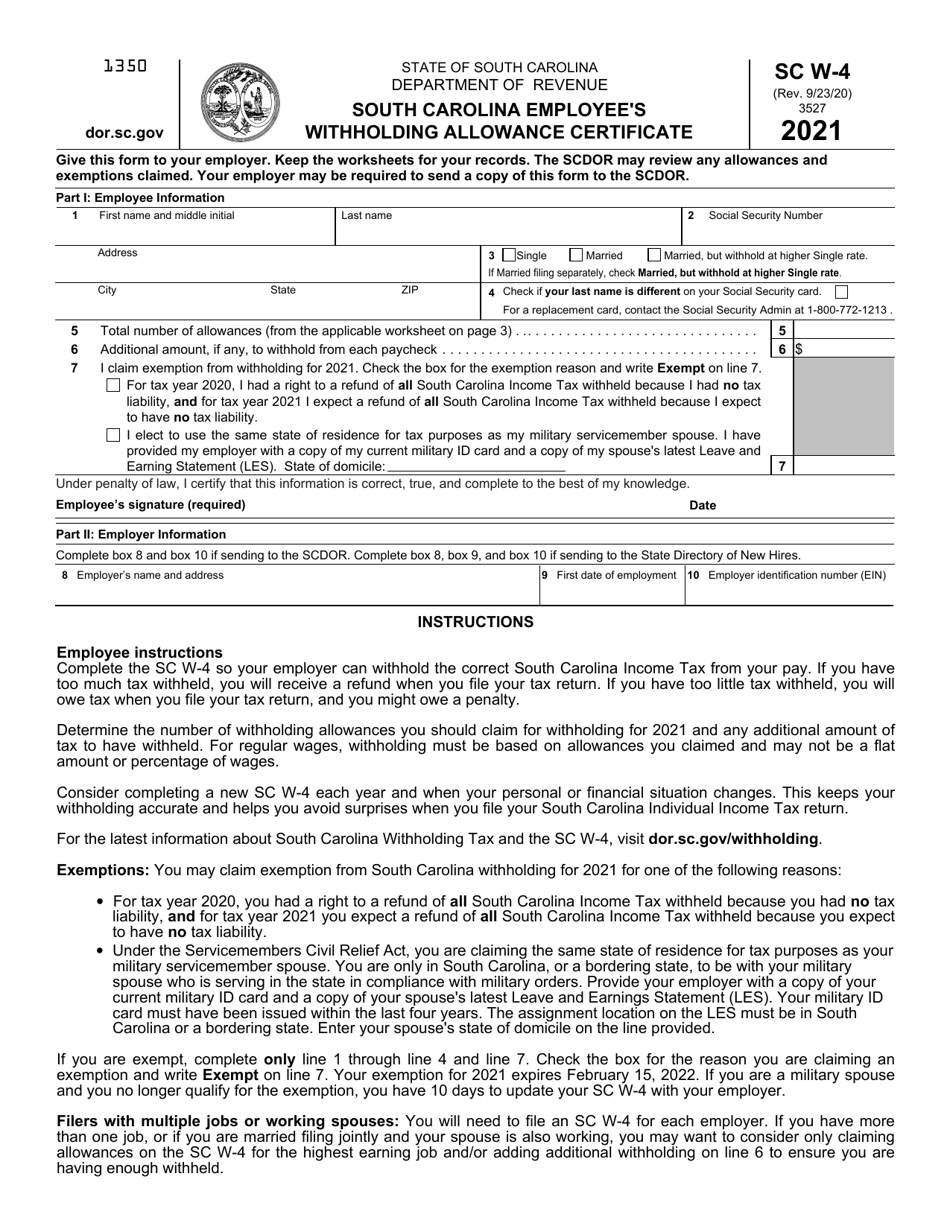

Form SC W4 Download Fillable PDF or Fill Online South Carolina

You can print other south carolina tax forms here. 11/1/22) 3478 employers must calculate taxable income for each employee. Web determine the number of withholding allowances you should claim for withholding for 2023 and any additional amount of tax to have withheld. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Web state of south carolina.

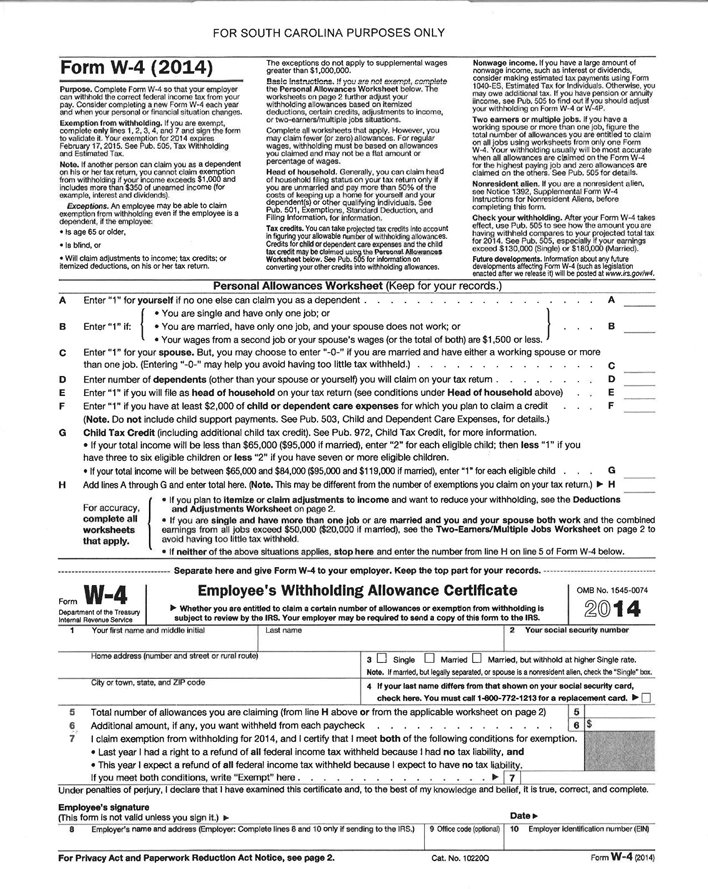

State Tax Withholding Forms Template Free Download Speedy Template

Manage your tax accounts online for free! For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. Sign up for email reminder s You can print other south carolina tax forms here. South carolina’s 2023 withholding methods were released nov.

South Carolina Tax Withholding Form

The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. Then, compute the amount of tax to be withheld using the subtraction method or the addition method. Fica wage and tax adjustment request waiver Manage your tax accounts online.

State Employee Withholding Form 2023

14 by the state revenue department. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Form namesc withholding tax information guide: Web state of south carolina department of revenue wh1603 (rev. Manage your tax accounts online for free!

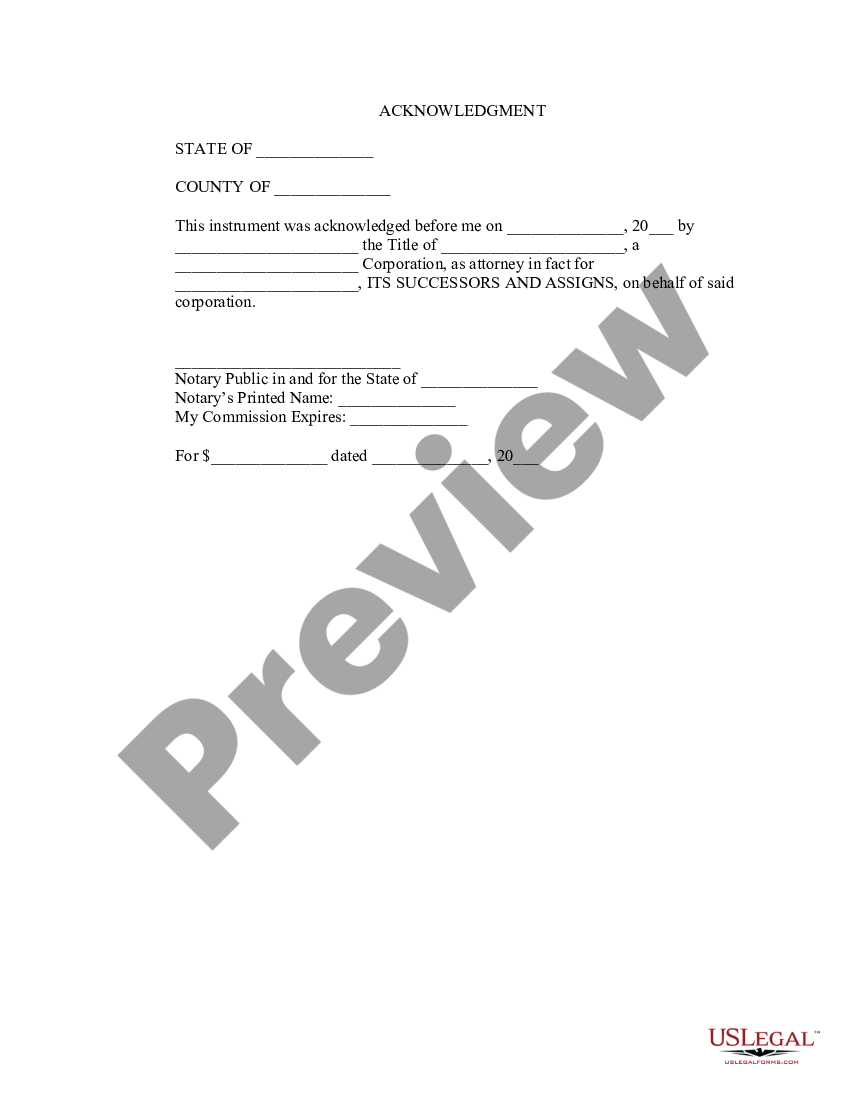

South Carolina Assignment Withholding US Legal Forms

I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. Web want more information about withholding taxes? 11/1/22) 3478 employers must calculate taxable income for each employee. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table Web state of south carolina department of revenue wh1603 (rev.

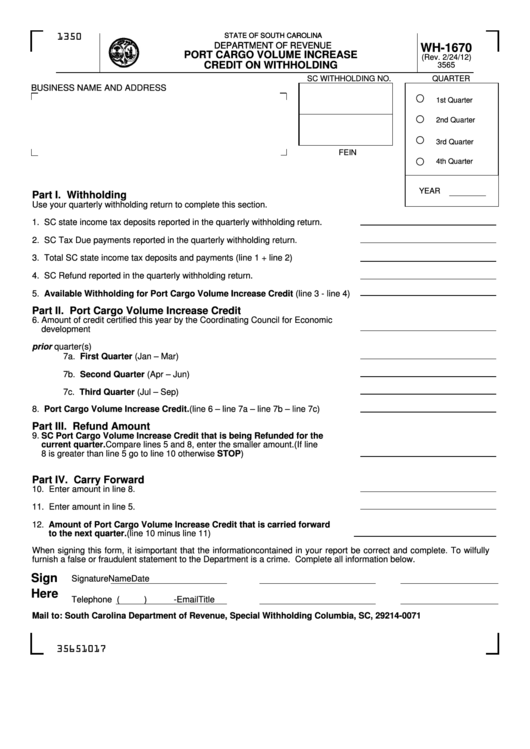

Form Wh1670 Port Cargo Volume Increase Credit On Withholding South

The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. You can print other south carolina tax forms here. Sign up for email reminder s Manage your.

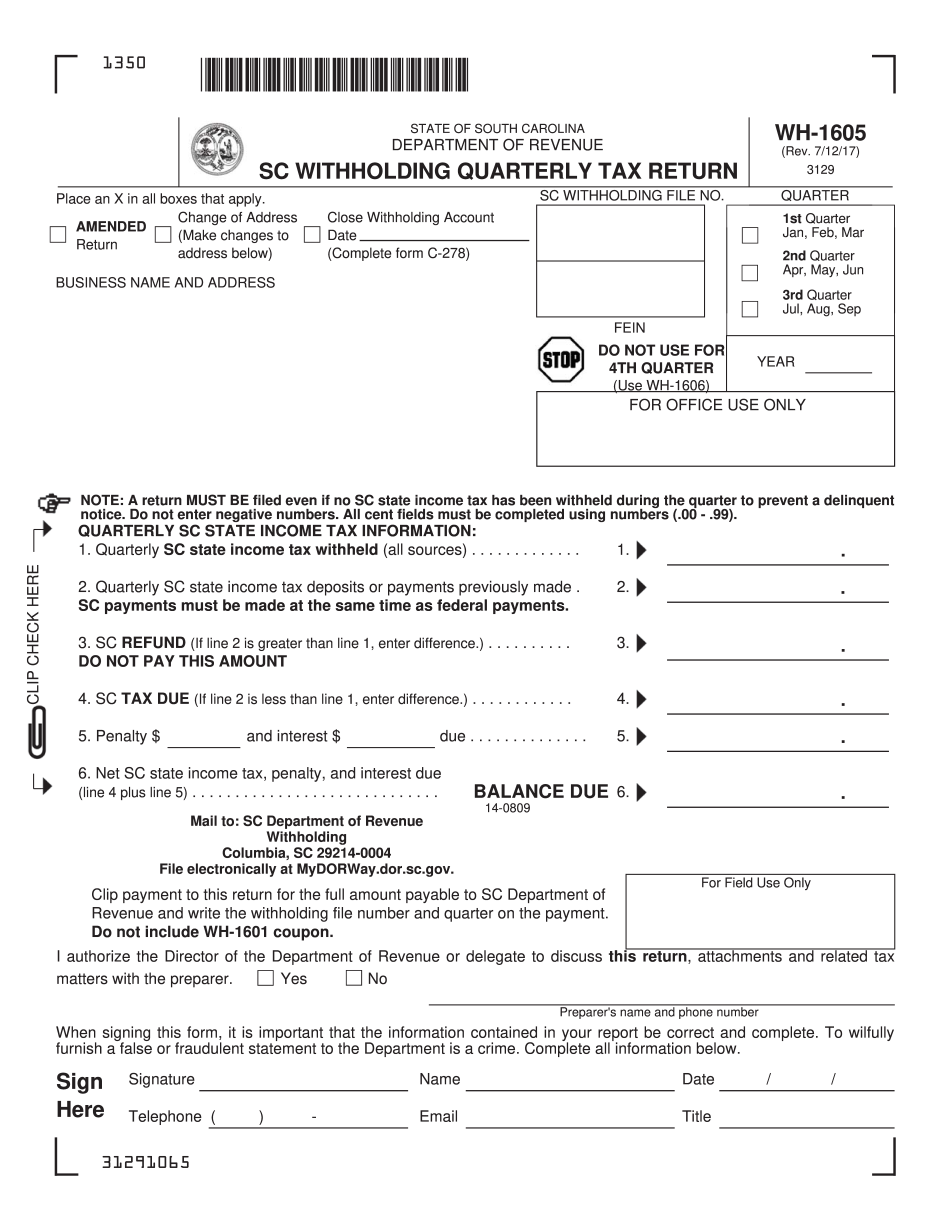

South Carolina Form WH1605 Printable SC Withholding Quarterly Tax Return

Manage your tax accounts online for free! The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. You can print other south carolina tax forms here. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table.

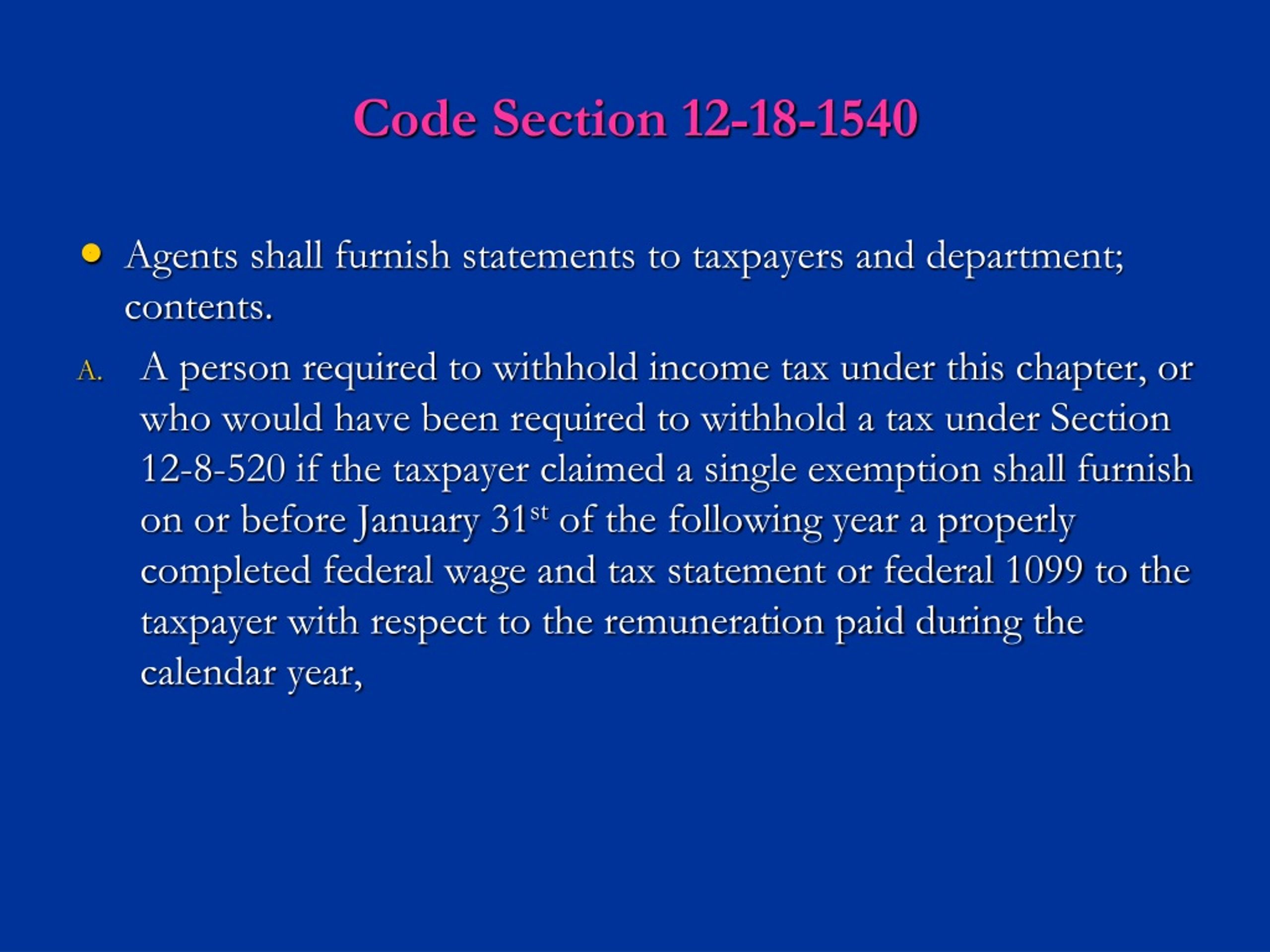

PPT South Carolina Withholding and Forms W2 PowerPoint Presentation

You can print other south carolina tax forms here. Then, compute the amount of tax to be withheld using the subtraction method or the addition method. South carolina’s 2023 withholding methods were released nov. Sign up for email reminder s Form namesc withholding tax information guide:

You Can Print Other South Carolina Tax Forms Here.

Form namesc withholding tax information guide: Manage your tax accounts online for free! Web want more information about withholding taxes? Web state of south carolina department of revenue wh1603 (rev.

Fica Wage And Tax Adjustment Request Waiver

I.compute annualized salary multiply weekly salary by 52 weeks to calculate the. Sign up for email reminder s The number of tax brackets used in the formula decreased to three, with rates of zero, 3%, and 6.5%, instead of the previous six, with rates ranging from 0.2% to 7%. South carolina’s 2023 withholding methods were released nov.

Web Determine The Number Of Withholding Allowances You Should Claim For Withholding For 2023 And Any Additional Amount Of Tax To Have Withheld.

Then, compute the amount of tax to be withheld using the subtraction method or the addition method. 10/31/22) 3268 1350 dor.sc.gov withholding tax tables number of allowances 2023 daily table 11/1/22) 3478 employers must calculate taxable income for each employee. Visit dor.sc.gov/withholding what’s new for withholding tax?

For Regular Wages, Withholding Must Be Based On Allowances You Claimed And May Not Be A Flat Amount Or Percentage Of Wages.

14 by the state revenue department.