Tax Form 763

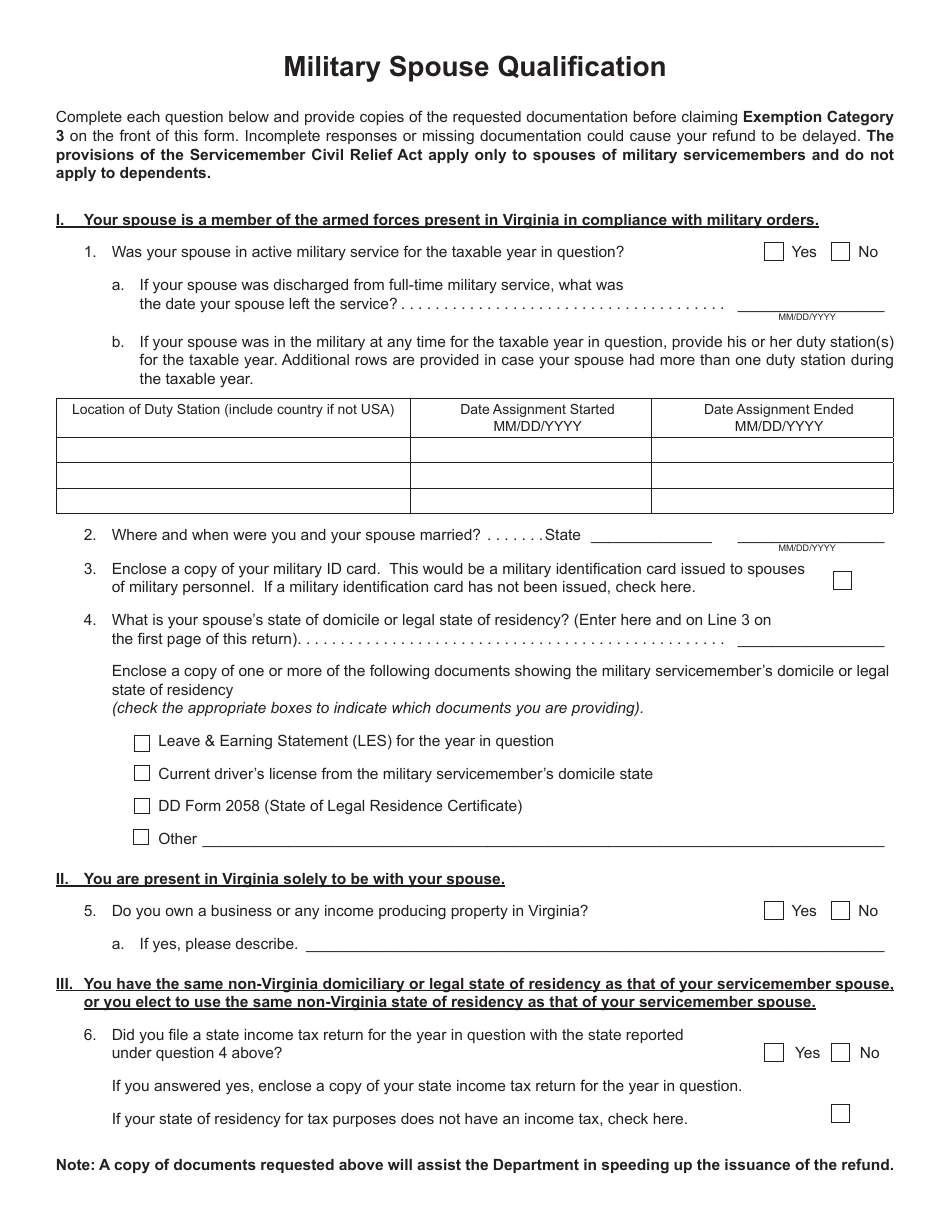

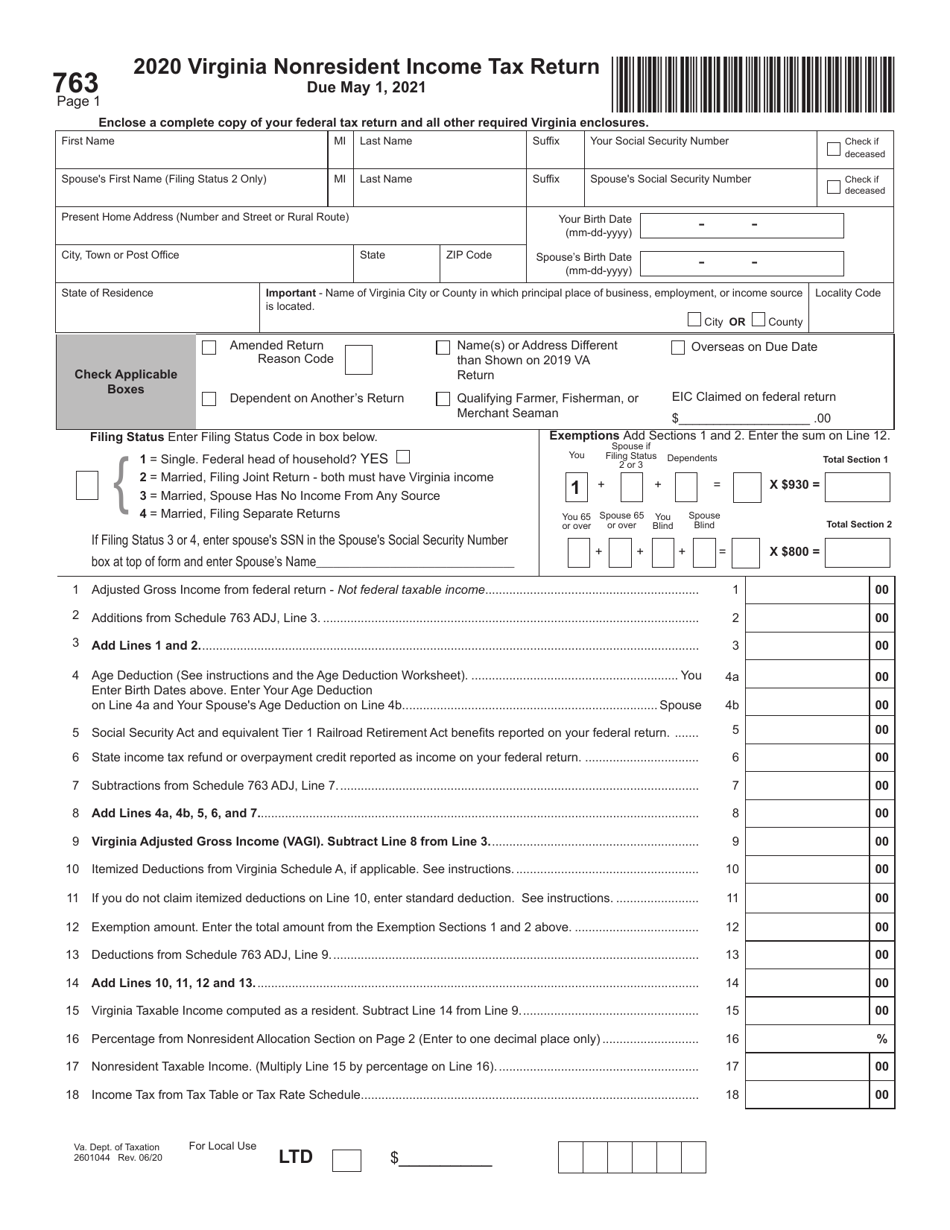

Tax Form 763 - Nonresidents of virginia need to file form 763 for their virginia income taxes. Taxpayers who are not able to file electronically should mail a paper tax return along. 763 = (7 * 10 2) + (6 * 10 1) + (3 * 10 0) 763 = (7 * 100) + (6 * 10) + (3 * 1) 763 = 700 + 60 + 3. In admissible form, sufficient to require a trial of material factual issues. The solution above and other expanded form solutions were. Web the lease includes a tax escalation provision: Private delivery services should not deliver returns to irs offices other than. Generally, you are required to make payments. Refer to the form 763 instructions for other. If the corporation's principal business, office, or agency is located in.

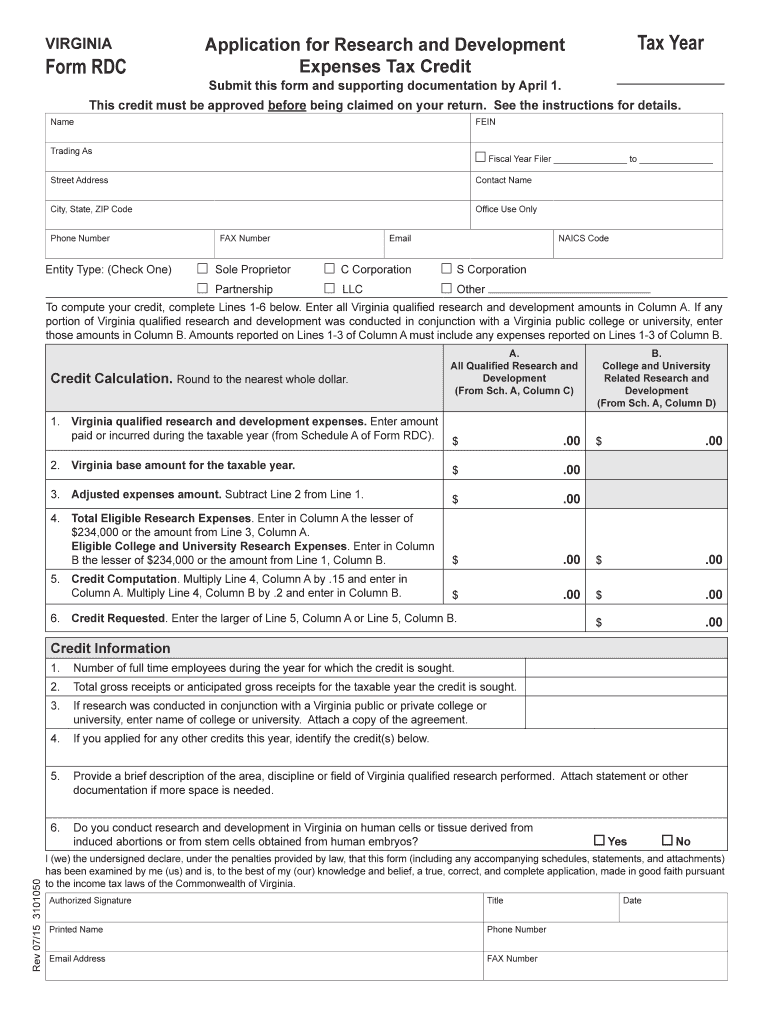

763 = (7 * 10 2) + (6 * 10 1) + (3 * 10 0) 763 = (7 * 100) + (6 * 10) + (3 * 1) 763 = 700 + 60 + 3. Of taxation 763s f 2601046 rev. The solution above and other expanded form solutions were. Nonresidents of virginia need to file form 763 for their virginia income taxes. Generally, you are required to make payments. Web if you live in another state and have rental property and/or business income from virginia, file virginia form 763, a nonresident tax return. Enclose a complete copy of. Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. 06/21 virginia special nonresident claim *va763s121888* for individual income tax withheld date of birth your birthday. Web the lease includes a tax escalation provision:

Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. Refer to the form 763 instructions for other. Web if you live in another state and have rental property and/or business income from virginia, file virginia form 763, a nonresident tax return. 2022 virginia nonresident income tax return. Web in that event, follow the steps outlined in the taxpayer guide to identity theft. Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. 763 = (7 * 10 2) + (6 * 10 1) + (3 * 10 0) 763 = (7 * 100) + (6 * 10) + (3 * 1) 763 = 700 + 60 + 3. Web what form should i file | 763s. Make use of the tips about how to fill out the va. Of taxation 763s f 2601046 rev.

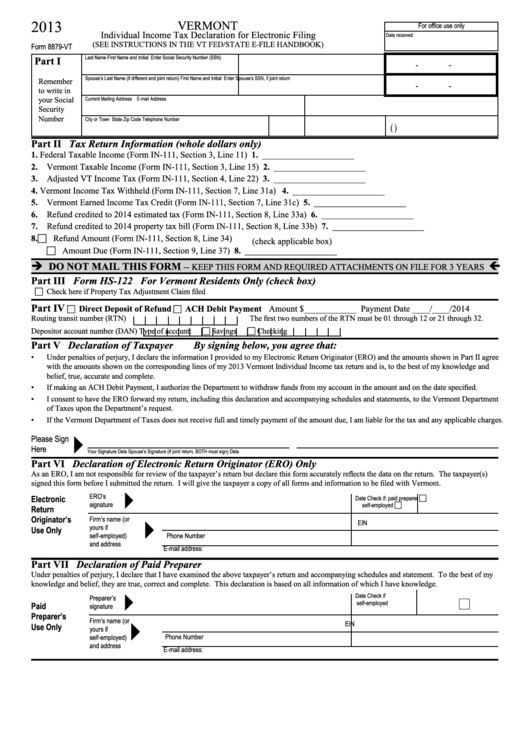

Form 8879Vt Individual Tax Declaration For Electronic Filing

Nonresidents of virginia need to file form 763 for their virginia income taxes. Private delivery services should not deliver returns to irs offices other than. Web find mailing addresses by state and date for filing form 2553. Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. 763 = (7 * 10.

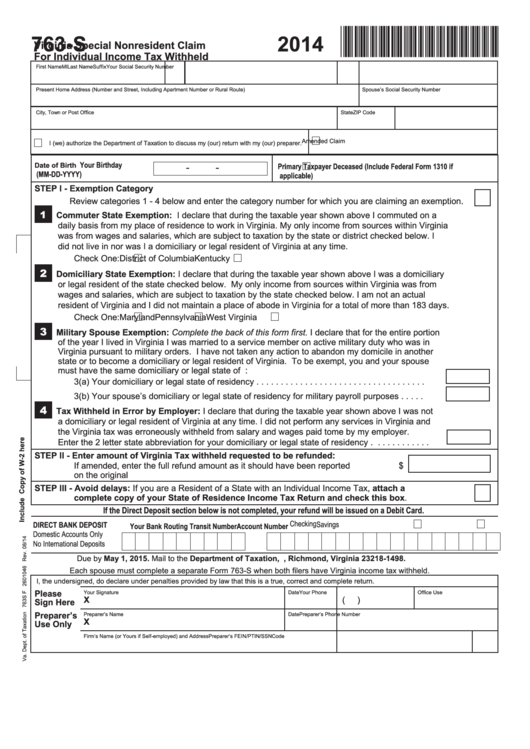

Virginia Fillable Form 763 Form Resume Examples 7NYAzbRVpv

Nonresidents of virginia need to file form 763 for their virginia income taxes. Web expanded form of 763: Filing electronically is the easiest. If you moved into or out of virginia six. In admissible form, sufficient to require a trial of material factual issues.

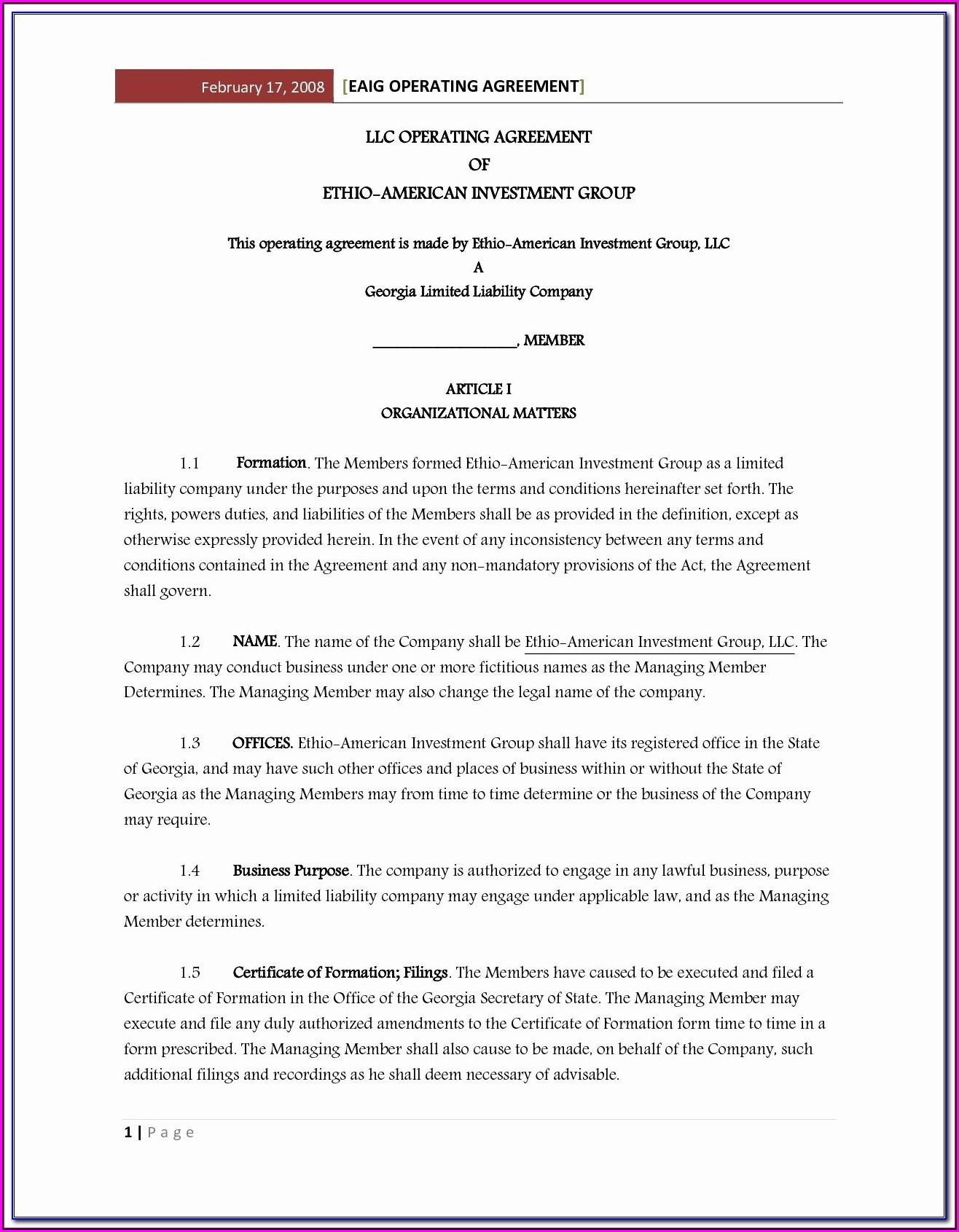

VA Form RDC 2015 Fill out Tax Template Online US Legal Forms

Web expanded form of 763: Filing electronically is the easiest. Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. Web estimated income tax filing if you did not have enough income tax withheld, you may need to pay estimated income tax..

Electronic Filing for Software Developers VA1346

The solution above and other expanded form solutions were. Web we last updated the nonresident income tax instructions in march 2023, so this is the latest version of form 763 instructions, fully updated for tax year 2022. If you moved into or out of virginia six. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose.

Fillable Online ww2 anokacounty form 763 Fax Email Print pdfFiller

Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. In admissible form, sufficient to require a trial of material factual issues. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Private delivery services.

Fillable Form 763S Virginia Special Nonresident Claim For Individual

Generally, you are required to make payments. If the corporation's principal business, office, or agency is located in. Web we last updated the nonresident income tax instructions in march 2023, so this is the latest version of form 763 instructions, fully updated for tax year 2022. In admissible form, sufficient to require a trial of material factual issues. Web if.

Form 763S Download Fillable PDF or Fill Online Virginia Special

2022 virginia nonresident income tax return. Web draft 2022 form 763, virginia nonresident income tax return. Make use of the tips about how to fill out the va. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Web the lease includes a.

Form TC763C Download Fillable PDF or Fill Online Cigarette Tax Surety

06/21 virginia special nonresident claim *va763s121888* for individual income tax withheld date of birth your birthday. Web the data in your state of virginia return is populated by the data you enter for your federal return. Web estimated income tax filing if you did not have enough income tax withheld, you may need to pay estimated income tax. The solution.

Form 763 Download Fillable PDF or Fill Online Virginia Nonresident

Enclose a complete copy of. Web in that event, follow the steps outlined in the taxpayer guide to identity theft. Web estimated income tax filing if you did not have enough income tax withheld, you may need to pay estimated income tax. Web what form should i file | 763s. If you moved into or out of virginia six.

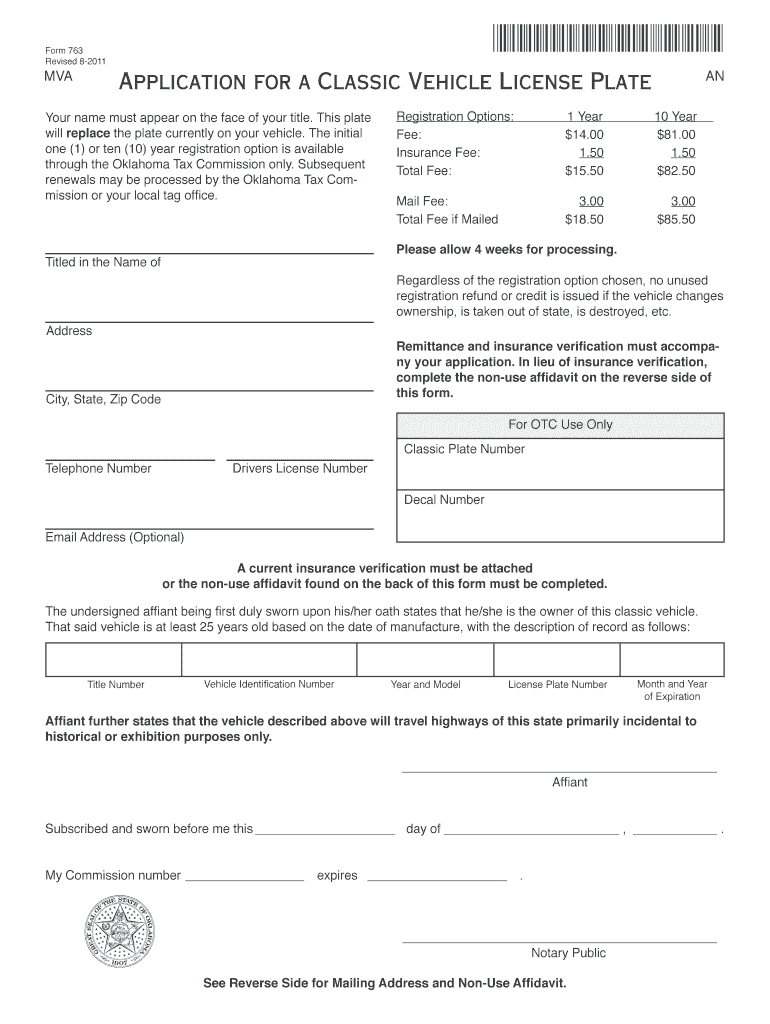

Tax Ok Gov Online Services Fill Out and Sign Printable PDF Template

Of taxation 763s f 2601046 rev. Stein law firm, p.c., 35 ny3d at 179; Private delivery services should not deliver returns to irs offices other than. Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763. Generally, you are required to make payments.

Taxpayers Who Are Not Able To File Electronically Should Mail A Paper Tax Return Along.

Web what form should i file | 763s. Web estimated income tax filing if you did not have enough income tax withheld, you may need to pay estimated income tax. If you moved into or out of virginia six. Web nonresidents of virginia, who need to file income taxes in virginia state, need to file form 763.

06/21 Virginia Special Nonresident Claim *Va763S121888* For Individual Income Tax Withheld Date Of Birth Your Birthday.

Web find irs addresses for private delivery of tax returns, extensions and payments. Web 2021 virginia nonresident income tax return 763 due may 1, 2022 *va0763121888* enclose a complete copy of your federal tax return and all other required virginia. Web if you live in another state and have rental property and/or business income from virginia, file virginia form 763, a nonresident tax return. Private delivery services should not deliver returns to irs offices other than.

Stein Law Firm, P.c., 35 Ny3D At 179;

Based on the information you have provided, it appears you should file form 763s claim for individual income tax withheld. Web draft 2022 form 763, virginia nonresident income tax return. Web the lease includes a tax escalation provision: Filing electronically is the easiest.

Web Expanded Form Of 763:

If the corporation's principal business, office, or agency is located in. Refer to the form 763 instructions for other. Web in the 'nonresident income allocation' section of the overall 'income' section, be sure to fill out the virginia column with the correct values, even if it's $0. Web we last updated the nonresident income tax instructions in march 2023, so this is the latest version of form 763 instructions, fully updated for tax year 2022.