Tax Form 8332 Printable

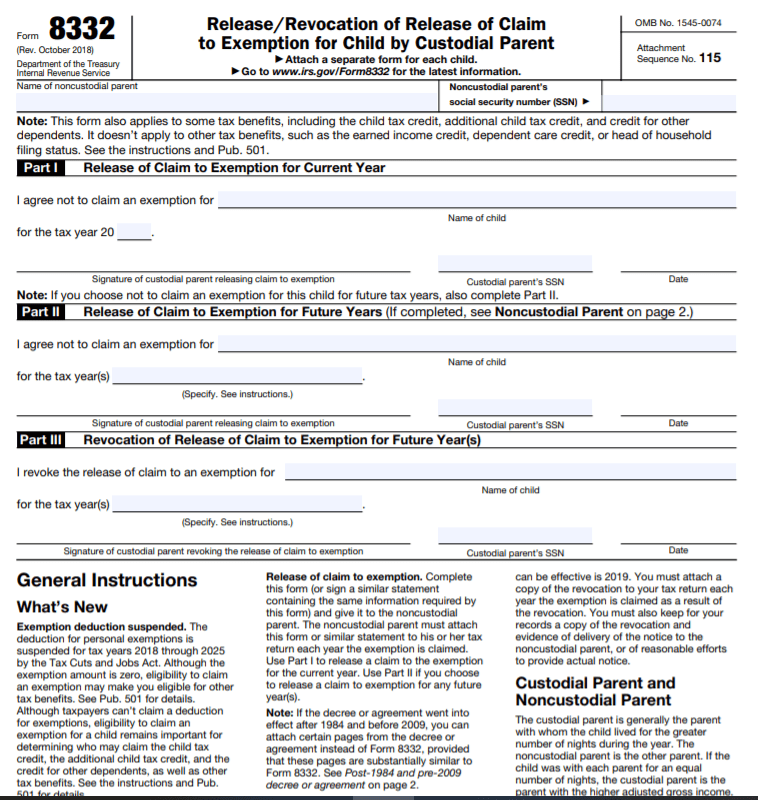

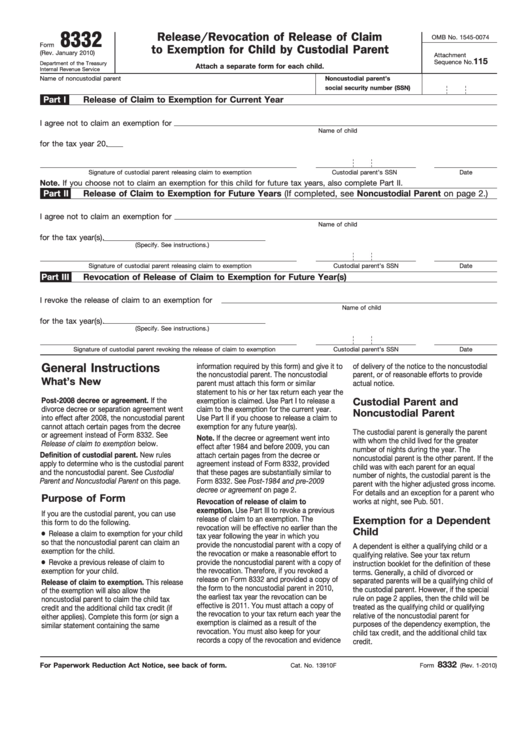

Tax Form 8332 Printable - If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. Additionally, custodial parents can use tax form 8332 to revoke the release of this same right. On the releasing an exemption screen, select yes and follow the onscreen instructions to. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service Although the exemption amount is zero, eligibility to claim an exemption may make you eligible for other tax benefits. If you are the custodial parent, you can use form 8332 to do the following. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to exemption for child by custodial parent, or a similar statement. Search for revocation of release of claim to exemption for child of divorced or separated parents and select the jump to link in the search results; Web what is form 8332: The release of the dependency exemption will also release to the noncustodial parent the child tax credit and the additional child tax credit (if either applies).

The release of the dependency exemption will also release to the noncustodial parent the child tax credit and the additional child tax credit (if either applies). If you are the custodial parent, you can use form 8332 to do the following. Web to find and fill out form 8332: All noncustodial parents must attach form 8332 or a similar statement to their return On the releasing an exemption screen, select yes and follow the onscreen instructions to. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to exemption for child by custodial parent, or a similar statement. Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 08:59 am overview having custody of your child usually means you can claim that child as a dependent on your taxes. Complete this form (or a similar statement. Additionally, custodial parents can use tax form 8332 to revoke the release of this same right. Web form 8332 is used by custodial parents to release their claim to their child's exemption.

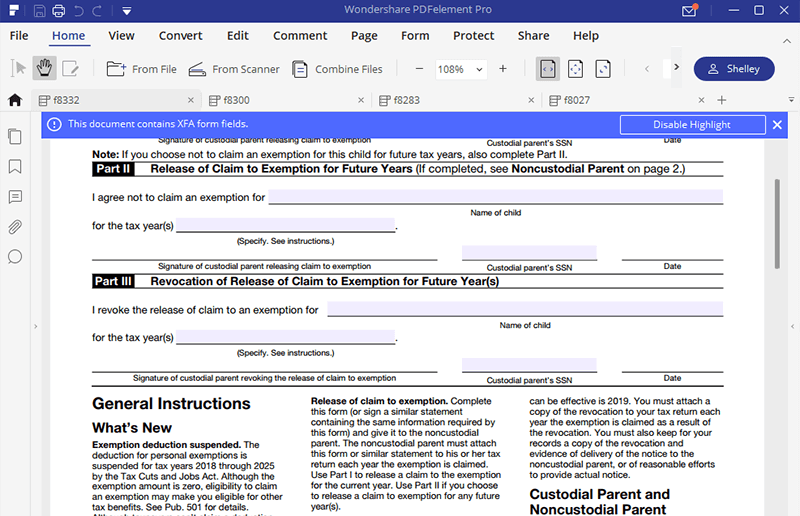

If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. If you are the custodial parent, you can use form 8332 to do the following. Web general instructions purpose of form. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service Web general instructions what’s new exemption deduction suspended. Although the exemption amount is zero, eligibility to claim an exemption may make you eligible for other tax benefits. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. On the releasing an exemption screen, select yes and follow the onscreen instructions to. Web what is form 8332: Web to find and fill out form 8332:

What is Form 8332 Release/Revocation of Release of Claim to Exemption

If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. The form can be used for current or future tax years. Web form 8332 is used by custodial parents to release their claim to their child's exemption. On the releasing an exemption screen, select yes and follow the.

Is IRS tax form 8332 available online for printing? mccnsulting.web

Web form 8332 is used by custodial parents to release their claim to their child's exemption. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service On the releasing an exemption screen, select yes and follow the onscreen instructions to. Although the exemption amount is zero, eligibility to claim an exemption.

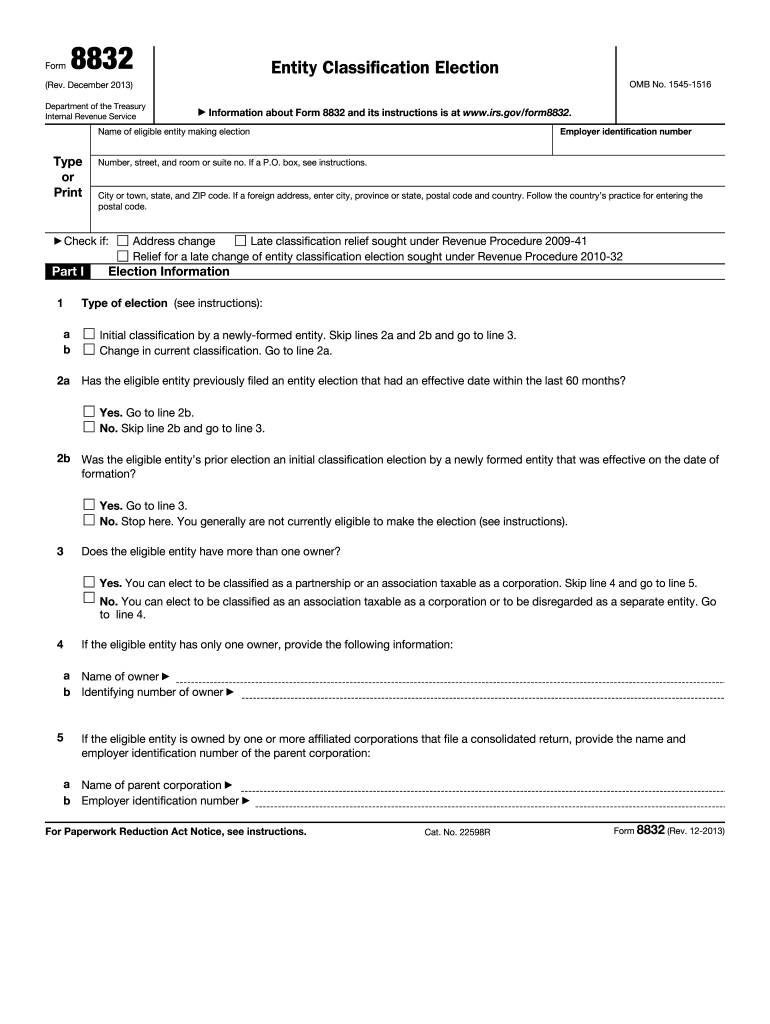

IRS 8832 20132021 Fill and Sign Printable Template Online US Legal

Web what is form 8332: If you are a custodial parent, you can use this form to release your claim to a dependency exemption for your child. The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the tax cuts and jobs act. About form 8332, release/revocation of release of claim to exemption for child by.

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

On the releasing an exemption screen, select yes and follow the onscreen instructions to. Open or continue your return in turbotax if you aren't already in it; The form can be used for current or future tax years. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service Web general instructions.

Tax Form 8332 Printable Master of Documents

Open or continue your return in turbotax if you aren't already in it; The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the tax cuts and jobs act. Search for revocation of release of claim to exemption for child of divorced or separated parents and select the jump to link in the search results; Release/revocation.

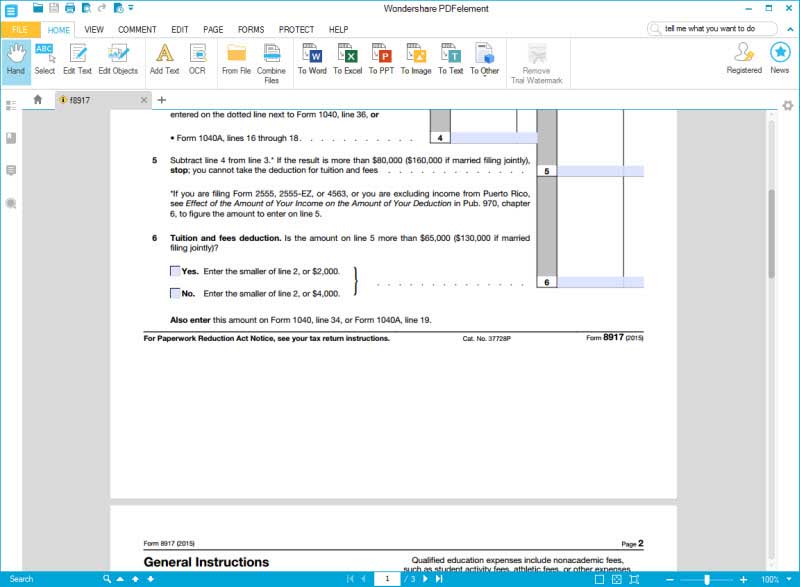

IRS Form 8332 Fill it with the Best PDF Form Filler

All noncustodial parents must attach form 8332 or a similar statement to their return Web to find and fill out form 8332: Permission can also be granted for future tax years so. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent. Additionally, custodial parents.

Checklist old — MG Tax

If you are the custodial parent, you can use form 8332 to do the following. On the releasing an exemption screen, select yes and follow the onscreen instructions to. If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Web claim.

Tax Form 8332 Printable Printable Form 2022

Web form 8332 is used by custodial parents to release their claim to their child's exemption. Web to find and fill out form 8332: The form can be used for current or future tax years. Web general instructions purpose of form. Permission can also be granted for future tax years so.

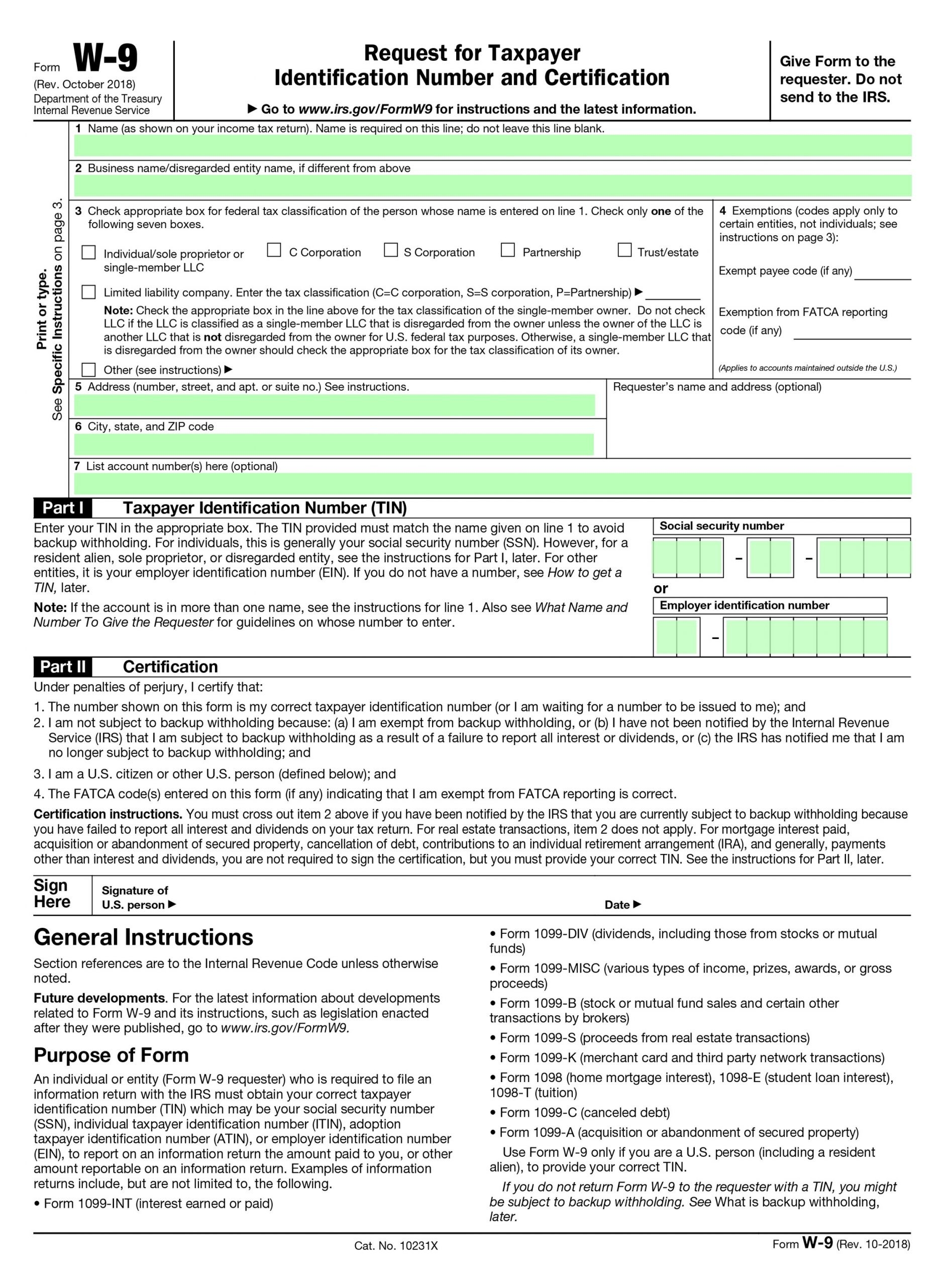

2020 W9 Blank Tax Form Calendar Template Printable

Search for revocation of release of claim to exemption for child of divorced or separated parents and select the jump to link in the search results; The deduction for personal exemptions is suspended for tax years 2018 through 2025 by the tax cuts and jobs act. Although the exemption amount is zero, eligibility to claim an exemption may make you.

Fillable Form 8332 Release/revocation Of Release Of Claim To

Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 08:59 am overview having custody of your child usually means you can claim that child as a dependent on your taxes. On the releasing an exemption screen, select.

Additionally, Custodial Parents Can Use Tax Form 8332 To Revoke The Release Of This Same Right.

The form can be used for current or future tax years. Release/revocation of release of claim to exemption for child by custodial parent written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 08:59 am overview having custody of your child usually means you can claim that child as a dependent on your taxes. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax years. All noncustodial parents must attach form 8332 or a similar statement to their return

Web Form 8332 Is Used By Custodial Parents To Release Their Claim To Their Child's Exemption.

Web what is form 8332: Permission can also be granted for future tax years so. About form 8332, release/revocation of release of claim to exemption for child by custodial parent | internal revenue service Web to find and fill out form 8332:

Web General Instructions Purpose Of Form.

If you are a custodial parent and you were ever married to the child’s noncustodial parent, you may use this form to release your claim to your child’s exemption. Web claim the child tax credit and additional child tax credit for the qualifying child if the custodial parent provides them with form 8332, release/revocation of release of claim to exemption for child by custodial parent, or a similar statement. On the releasing an exemption screen, select yes and follow the onscreen instructions to. Web form 8332 is the form custodial parents can use to release their right to claim a child as a dependent to the noncustodial parent.

Complete This Form (Or A Similar Statement.

If you are the custodial parent, you can use form 8332 to do the following. Search for revocation of release of claim to exemption for child of divorced or separated parents and select the jump to link in the search results; Web general instructions what’s new exemption deduction suspended. Open or continue your return in turbotax if you aren't already in it;

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)