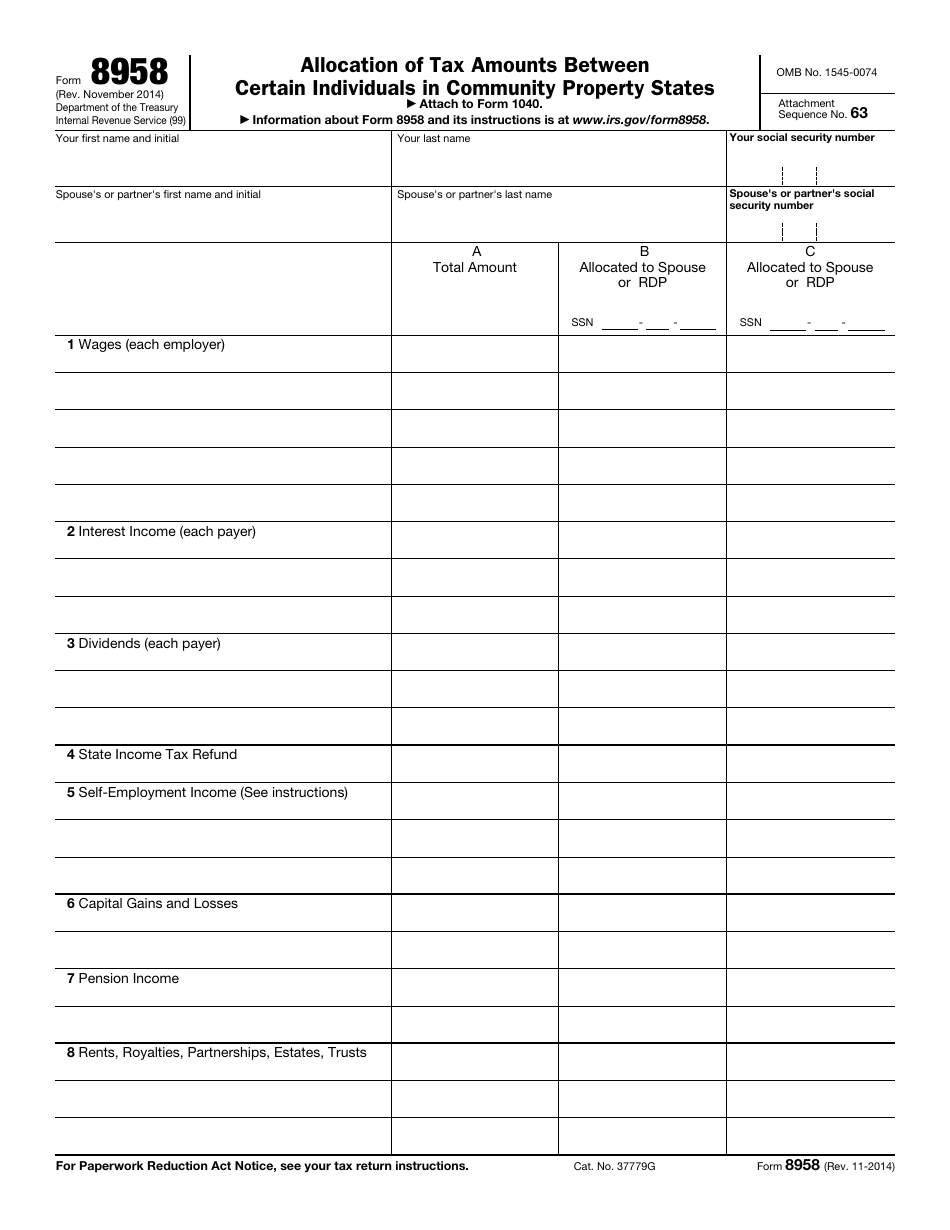

Tax Form 8958

Tax Form 8958 - Web up to $40 cash back select add new on your dashboard and transfer a file into the system in one of the following ways: Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Web publication 555 (03/2020), community property revised: Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web water bills can be paid online or in person at city hall (414 e. Web 1973 rulon white blvd. 63rd st.) using cash, check or credit card. Department of the treasury internal revenue service center kansas. My wife and i are filing married, filing. Income allocation information is required when electronically filing a return with.

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web 1973 rulon white blvd. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Department of the treasury internal revenue service center kansas. Web common questions about entering form 8958 income for community property allocation in lacerte. 63rd st.) using cash, check or credit card. Web forms 706 ‐ a, 706 ‐ gs(d), 706 ‐ gs(t), 706 ‐ na, 706 ‐ qdt, 8612, 8725, 8831, 8842, 8892, 8924, 8928: Yes, loved it could be better no one. Web water bills can be paid online or in person at city hall (414 e. If using a private delivery service, send your returns to the street address above for the submission processing center.

Web publication 555 (03/2020), community property revised: Income allocation information is required when electronically filing a return with. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. By uploading it from your device or importing from the cloud, web, or. You will be mailing your returns to specific addresses based on the type of. Web forms 706 ‐ a, 706 ‐ gs(d), 706 ‐ gs(t), 706 ‐ na, 706 ‐ qdt, 8612, 8725, 8831, 8842, 8892, 8924, 8928: Department of the treasury internal revenue service center kansas. Web water bills can be paid online or in person at city hall (414 e. 12th st.) or at the water services department (4800 e.

Form Steps to Fill out Digital 8959 Fill online, Printable, Fillable

Yes, loved it could be better no one. My wife and i are filing married, filing. Income allocation information is required when electronically filing a return with. By uploading it from your device or importing from the cloud, web, or. Web irs mailing addresses by residence & form.

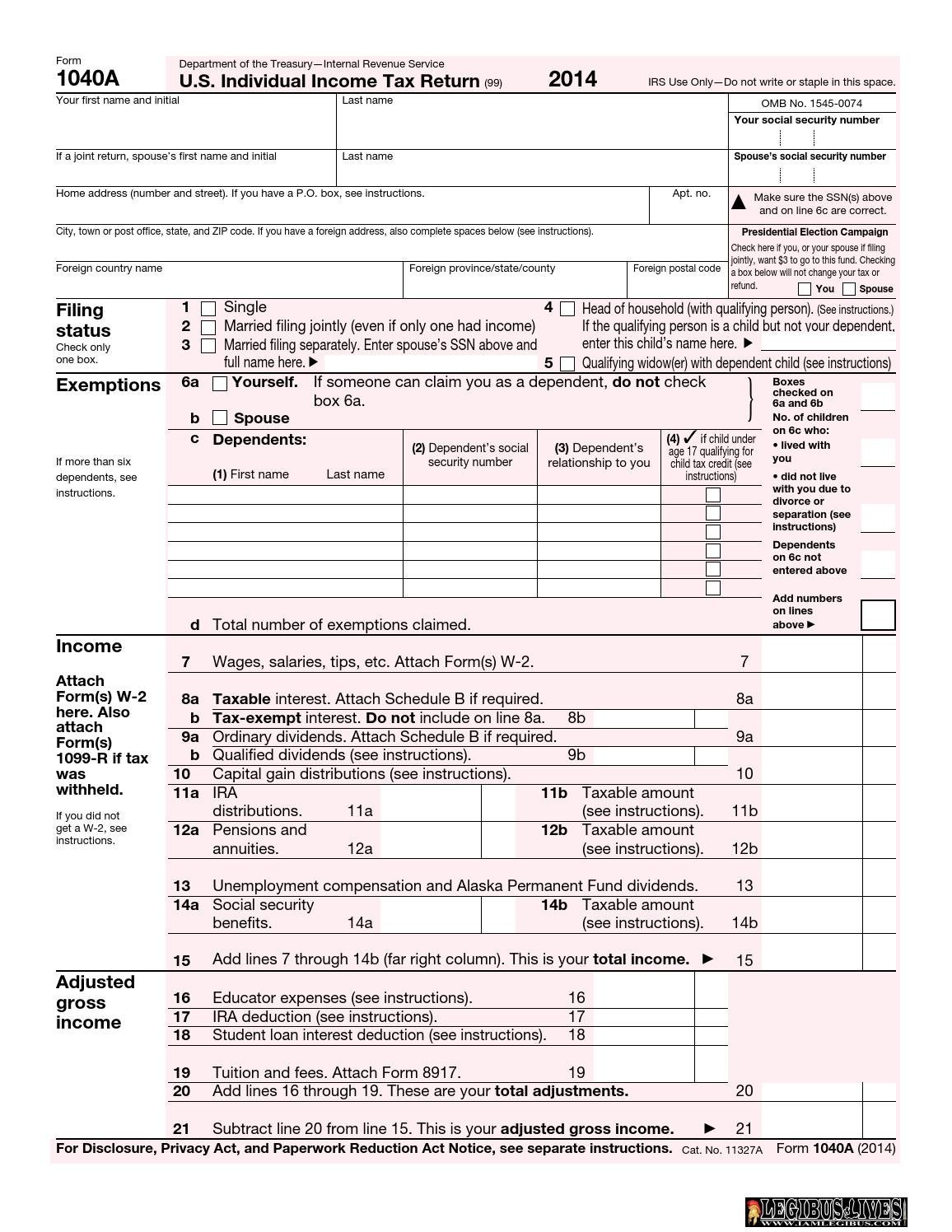

3.11.3 Individual Tax Returns Internal Revenue Service

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of. Web forms 706 ‐ a, 706 ‐ gs(d), 706 ‐ gs(t), 706 ‐ na, 706 ‐ qdt, 8612, 8725, 8831, 8842, 8892, 8924, 8928: By uploading it from your device or.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Web publication 555 (03/2020), community property revised: Web irs mailing addresses by residence & form. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are.

Tax preparation Stock Photos, Royalty Free Tax preparation Images

Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web you only need to complete form 8958 allocation of tax amounts between certain individuals.

SelfEmployed Borrower Case Study Part I Completing the Form 91 wit…

You will be mailing your returns to specific addresses based on the type of. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web 1973 rulon white blvd. Yes, loved it could be better no one. Web publication 555 discusses community property laws that affect.

U s individual tax return forms instructions & tax table (f1040a

I got married in nov 2021. 63rd st.) using cash, check or credit card. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner,.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

12th st.) or at the water services department (4800 e. Web 1973 rulon white blvd. Web up to $40 cash back select add new on your dashboard and transfer a file into the system in one of the following ways: Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so.

Form 8958 Fill Out and Sign Printable PDF Template signNow

By uploading it from your device or importing from the cloud, web, or. I got married in nov 2021. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web 1973 rulon white blvd. Web if your resident state is a community property state, and you file a federal tax return separately.

De 2501 Part B Printable

12th st.) or at the water services department (4800 e. Web water bills can be paid online or in person at city hall (414 e. Below, find tables with addresses by residency. Web publication 555 (03/2020), community property revised: Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web forms 706 ‐ a, 706 ‐ gs(d), 706 ‐ gs(t), 706 ‐ na, 706 ‐ qdt, 8612, 8725, 8831, 8842, 8892, 8924, 8928: My wife and i are filing married, filing. I got married in nov 2021. 12th st.) or at the water services department (4800 e. Income allocation information is required when electronically filing a return with.

Web Use This Form To Determine The Allocation Of Tax Amounts Between Married Filing Separate Spouses Or Registered Domestic Partners (Rdps) With Community Property.

Department of the treasury internal revenue service center kansas. Web publication 555 (03/2020), community property revised: Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web 1973 rulon white blvd.

Web Form 8958 Is Also Needed For The Two Separately Filed Tax Returns Of Registered Domestic Partners In A Community Property State Who Are Filing As Single, Head Of.

I got married in nov 2021. Web water bills can be paid online or in person at city hall (414 e. Web common questions about entering form 8958 income for community property allocation in lacerte. Web publication 555 discusses community property laws that affect how you figure your income on your federal income tax return if you are married, live in a community.

Web Up To $40 Cash Back Select Add New On Your Dashboard And Transfer A File Into The System In One Of The Following Ways:

Yes, loved it could be better no one. 63rd st.) using cash, check or credit card. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web irs mailing addresses by residence & form.

Income Allocation Information Is Required When Electronically Filing A Return With.

12th st.) or at the water services department (4800 e. My wife and i are filing married, filing. Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return.