Tax Form For Us Citizen Living Abroad

Tax Form For Us Citizen Living Abroad - Resident, you must report all interest, dividends, wages, or other. If you qualify as an american citizen residing. Citizen living abroad may be responsible for paying taxes. Citizens and green card holders may still have to file u.s. What special tax credits and deductions you may qualify for based on: How does living abroad mitigate your us tax? Web irs filing dates for us citizens living abroad. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the answer is, it depends. Tax information for foreign persons with income in the u.s. File your return using the appropriate address for your.

Web this means that as an american living abroad, you will need to file a us federal tax return this year if your total income in 2022—regardless of where the income was earned (and. If you are a u.s. Tax purposes unless you meet one of two tests. Web a common question you may have is “does a us citizen living abroad file a 1040 or 1040nr?” the answer is, it depends. Citizens and resident aliens with income outside the u.s. What special tax credits and deductions you may qualify for based on: Ad our international tax services can be customized to fit your specific business needs. Web learn from the irs about filing a u.s. Citizen and resident aliens living abroad should know their tax obligations. Tax return if you live abroad, including:

Resident, you must report all interest, dividends, wages, or other. How does living abroad mitigate your us tax? Web learn from the irs about filing a u.s. Web irs filing dates for us citizens living abroad. Web internal revenue code section 7701 (a) (30) for the definition of a u.s. If you are a nonresident alien, you will file. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web fortunately or unfortunately, u.s. Citizen living abroad may be responsible for paying taxes. Citizens and resident aliens with income outside the u.s.

Irs citizen living abroad tax instructions

Web october 25, 2022 resource center filing the u.s. Ad our international tax services can be customized to fit your specific business needs. Resident, you must report all interest, dividends, wages, or other. If you qualify as an american citizen residing. Citizens and resident aliens with income outside the u.s.

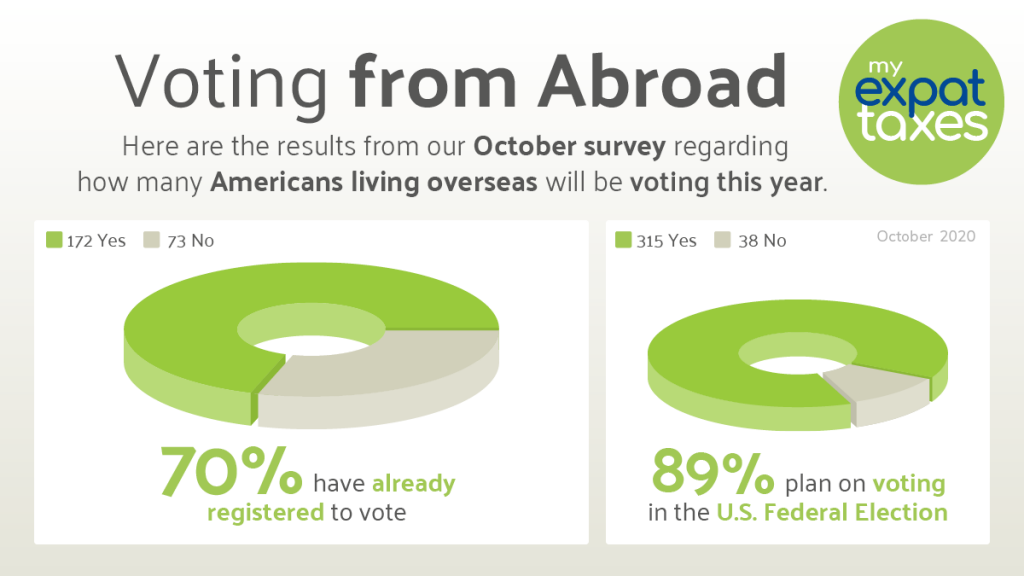

Voting As a US Citizen Abroad Survey Results 2020 MyExpatTaxes

Web you have to file a u.s. December 1, 2022 tax responsibilities of u.s. Citizen and resident aliens living abroad should know their tax obligations. Even though you no longer reside in the. Web internal revenue code section 7701 (a) (30) for the definition of a u.s.

Senior Citizen Tax Benefits Piggy Blog

Citizens and resident aliens with income outside the u.s. How does living abroad mitigate your us tax? Citizens and resident aliens living abroad if you’re a u.s. Citizen and resident aliens living abroad should know their tax obligations. Us citizens living abroad receive an extra two months to file their irs tax return, until june 15.

husband us citizen living abroad how to file for a divorce

December 1, 2022 tax responsibilities of u.s. How does living abroad mitigate your us tax? Web october 25, 2022 resource center filing the u.s. Web learn from the irs about filing a u.s. Citizen, you are considered a nonresident of the united states for u.s.

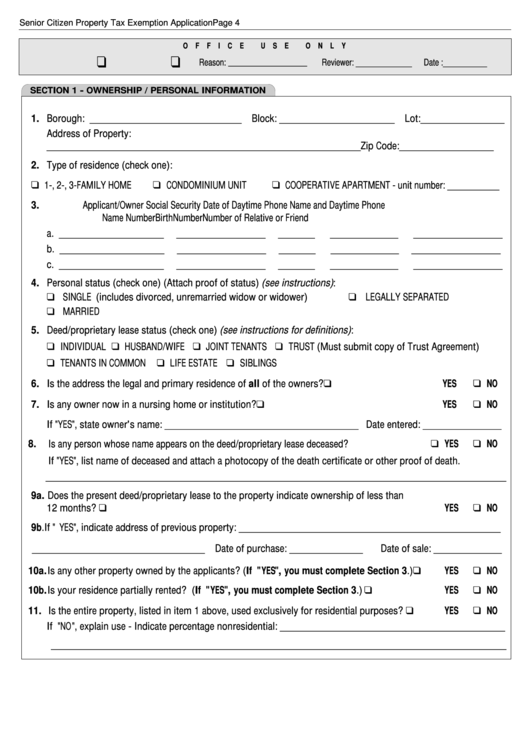

Senior Citizen Property Tax Exemption Application Form printable pdf

File your return using the appropriate address for your. Citizen or resident living or traveling outside the united states, you generally are. Ad our international tax services can be customized to fit your specific business needs. Web this means that as an american living abroad, you will need to file a us federal tax return this year if your total.

The Complete Guide to Filing US Taxes from Abroad

Web this means that as an american living abroad, you will need to file a us federal tax return this year if your total income in 2022—regardless of where the income was earned (and. Resident, you must report all interest, dividends, wages, or other. Citizen and resident aliens living abroad should know their tax obligations. Tax return if you live.

Six Ways the US Can and Will Tax American Citizens Living Abroad…If

Web if you are not a u.s. Tax return if you live abroad, including: Citizens and resident aliens living abroad if you’re a u.s. Web to use the feie, you must be: Resident, you must report all interest, dividends, wages, or other.

Tax Benefits for Senior Citizens Budget 2018 proposes tax, other

Citizen, you are considered a nonresident of the united states for u.s. Ad our international tax services can be customized to fit your specific business needs. File your return using the appropriate address for your. December 1, 2022 tax responsibilities of u.s. Citizen and resident aliens living abroad should know their tax obligations.

Irs citizen living abroad tax instructions

Web if you are not a u.s. Citizen or resident living or traveling outside the united states, you generally are. Turbotax will figure out if you’re eligible for this exclusion or you can use the feie allows you to exclude a significant part of your. Tax purposes unless you meet one of two tests. And foreign payment of a u.s.

Web This Means That As An American Living Abroad, You Will Need To File A Us Federal Tax Return This Year If Your Total Income In 2022—Regardless Of Where The Income Was Earned (And.

December 1, 2022 tax responsibilities of u.s. Citizens and resident aliens living abroad if you’re a u.s. If you are a u.s. Citizens and resident aliens with income outside the u.s.

How Does Living Abroad Mitigate Your Us Tax?

Web you can request an additional extension by filing form 4868. Web learn from the irs about filing a u.s. Web you have to file a u.s. Web fortunately or unfortunately, u.s.

Expat’s Guide To State Taxes While Living Abroad At A Glance Do Expats Pay State Taxes?

If you are a u.s. Web if you are not a u.s. Citizen living abroad may be responsible for paying taxes. Us citizens living abroad receive an extra two months to file their irs tax return, until june 15.

January 26, 2022 | Last Updated:

Web to use the feie, you must be: Tax purposes unless you meet one of two tests. Web taxes generally, united states citizens get taxed on their worldwide income regardless of where they reside, so a u.s. What special tax credits and deductions you may qualify for based on: