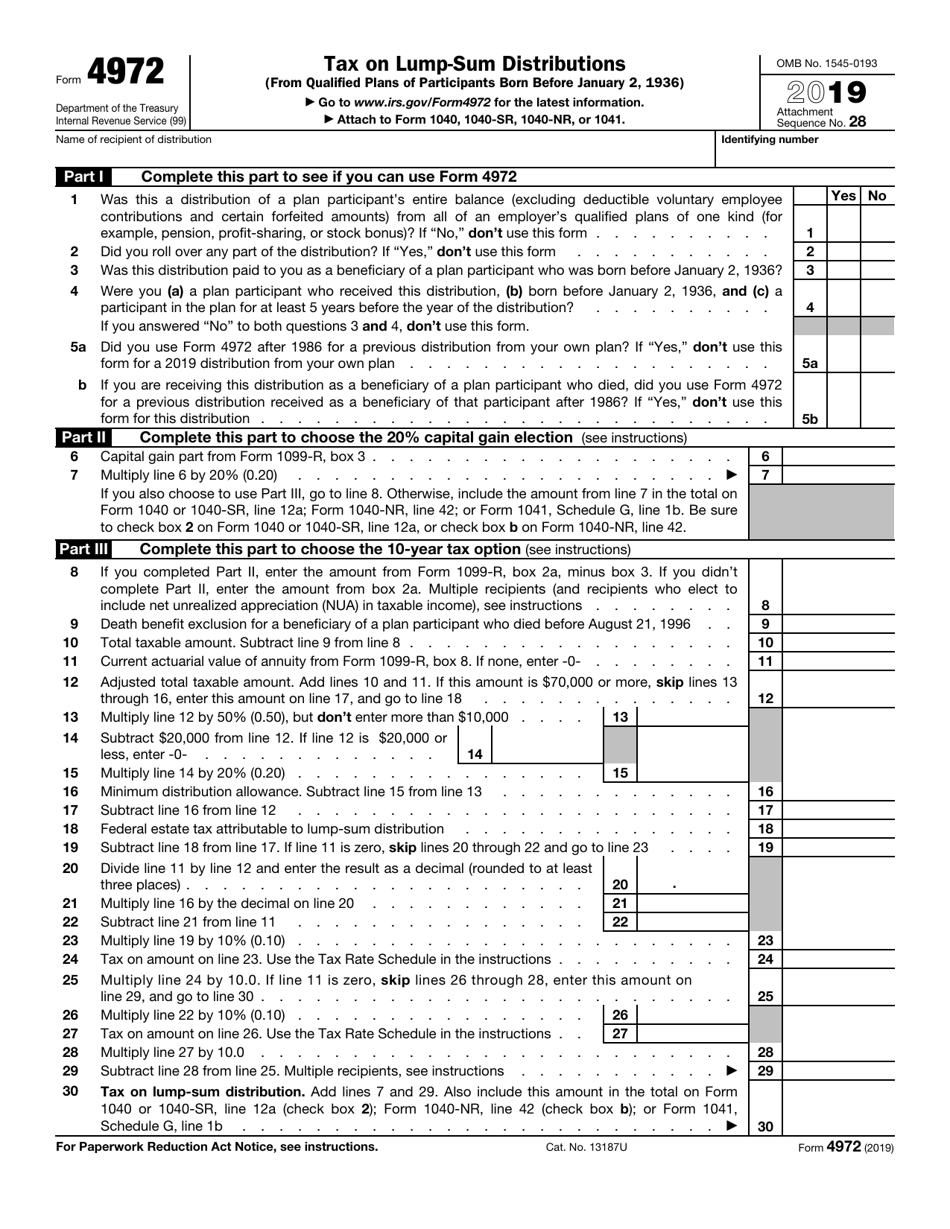

Taxpayer Form 4972

Taxpayer Form 4972 - In turbotax desktop, click on forms in the. The following choices are available. Download or email irs 4972 & more fillable forms, register and subscribe now! Part i—qualifications—an individual who qualifies to file federal form 4972 qualifies to file. Born before january 2, 1936) enter name of recipient of distribution. This form is usually required when:. You can download or print current. Use this form to figure the. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Complete, edit or print tax forms instantly.

In turbotax desktop, click on forms in the. You can download or print current. Complete, edit or print tax forms instantly. Click this link for info on how to delete a form in turbotax online. Web you could try to delete form 4972 from your return. Download or email irs 4972 & more fillable forms, register and subscribe now! Part i—qualifications—an individual who qualifies to file federal form 4972 qualifies to file. It allows beneficiaries to receive their entire benefit in. Born before january 2, 1936) enter name of recipient of distribution. Multiply line 17 by 10%.21.

In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. The following choices are available. This form is usually required when:. Multiply line 17 by 10%.21. It allows beneficiaries to receive their entire benefit in. Use this form to figure the. In turbotax desktop, click on forms in the. Ad edit, fill, sign 4972 2017 create & more fillable forms. Web you could try to delete form 4972 from your return. Click this link for info on how to delete a form in turbotax online.

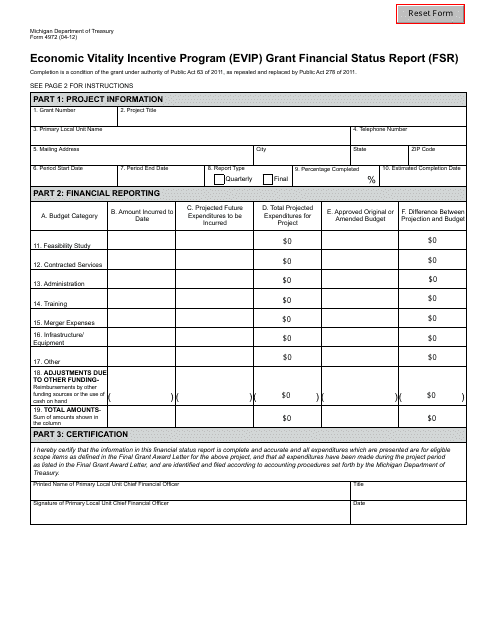

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Born before january 2, 1936) enter name of recipient of distribution. Download or email irs 4972 & more fillable forms, register and subscribe now! Ad edit, fill, sign 4972 2017 create & more fillable forms. Part i—qualifications—an individual who qualifies to file federal form 4972 qualifies to file. Web you could try to delete form 4972 from your return.

GST Registration of Normal Taxpayer (FORM GST REG01)

To claim these benefits, you must file irs. In turbotax desktop, click on forms in the. Born before january 2, 1936) enter name of recipient of distribution. Click this link for info on how to delete a form in turbotax online. This form is usually required when:.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

In turbotax desktop, click on forms in the. Use this form to figure the. It allows beneficiaries to receive their entire benefit in. To claim these benefits, you must file irs. Part i—qualifications—an individual who qualifies to file federal form 4972 qualifies to file.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

It allows beneficiaries to receive their entire benefit in. Click this link for info on how to delete a form in turbotax online. In turbotax desktop, click on forms in the. This form is usually required when:. Use this form to figure the.

GST Registration of Normal Taxpayer (FORM GST REG01)

You can download or print current. Web you could try to delete form 4972 from your return. In turbotax desktop, click on forms in the. Download or email irs 4972 & more fillable forms, register and subscribe now! Multiply line 17 by 10%.21.

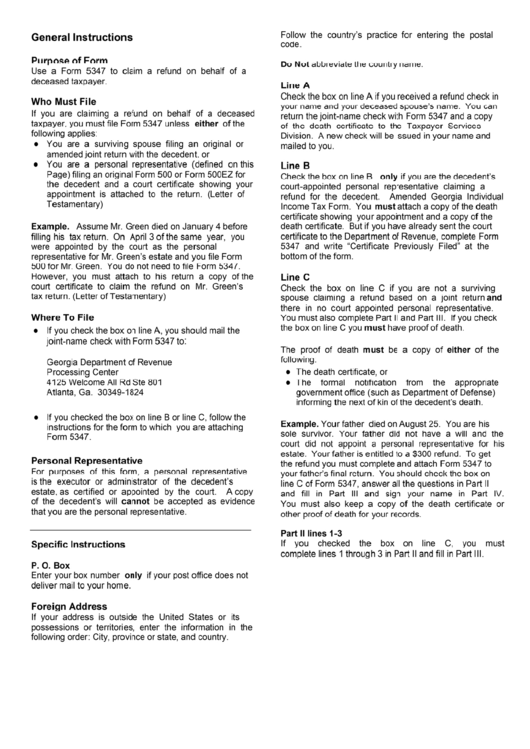

Form 5347 General Instruction To Refund On Behalf Of A Deceased

In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Complete, edit or print tax forms instantly. Part i—qualifications—an individual who qualifies to file federal form 4972 qualifies to file. To claim these benefits, you must file irs. It allows beneficiaries to receive their entire benefit in.

IRS Form 15107 Download Fillable PDF or Fill Online Information Request

Complete, edit or print tax forms instantly. Download or email irs 4972 & more fillable forms, register and subscribe now! Web you could try to delete form 4972 from your return. Click this link for info on how to delete a form in turbotax online. Click add to create a new copy of the form or click review to review.

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

In turbotax desktop, click on forms in the. Ad edit, fill, sign 4972 2017 create & more fillable forms. Download or email irs 4972 & more fillable forms, register and subscribe now! This form is usually required when:. Click this link for info on how to delete a form in turbotax online.

Obama S IRS Unveils New 1040 Tax Form International Liberty 2021 Tax

You can download or print current. To claim these benefits, you must file irs. Multiply line 17 by 10%.21. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10. Click add to create a new copy of the form or click review to review a form already created.

Form 4972 Tax on LumpSum Distributions (2015) Free Download

It allows beneficiaries to receive their entire benefit in. This form is usually required when:. Web you could try to delete form 4972 from your return. Click add to create a new copy of the form or click review to review a form already created. Complete, edit or print tax forms instantly.

Multiply Line 17 By 10%.21.

It allows beneficiaries to receive their entire benefit in. To claim these benefits, you must file irs. Click this link for info on how to delete a form in turbotax online. You can download or print current.

Born Before January 2, 1936) Enter Name Of Recipient Of Distribution.

Complete, edit or print tax forms instantly. Part i—qualifications—an individual who qualifies to file federal form 4972 qualifies to file. In turbotax desktop, click on forms in the. In the case of any qualified employer plan, there is hereby imposed a tax equal to 10.

The Following Choices Are Available.

Click add to create a new copy of the form or click review to review a form already created. Ad edit, fill, sign 4972 2017 create & more fillable forms. Web you could try to delete form 4972 from your return. Use this form to figure the.

This Form Is Usually Required When:.

Download or email irs 4972 & more fillable forms, register and subscribe now!