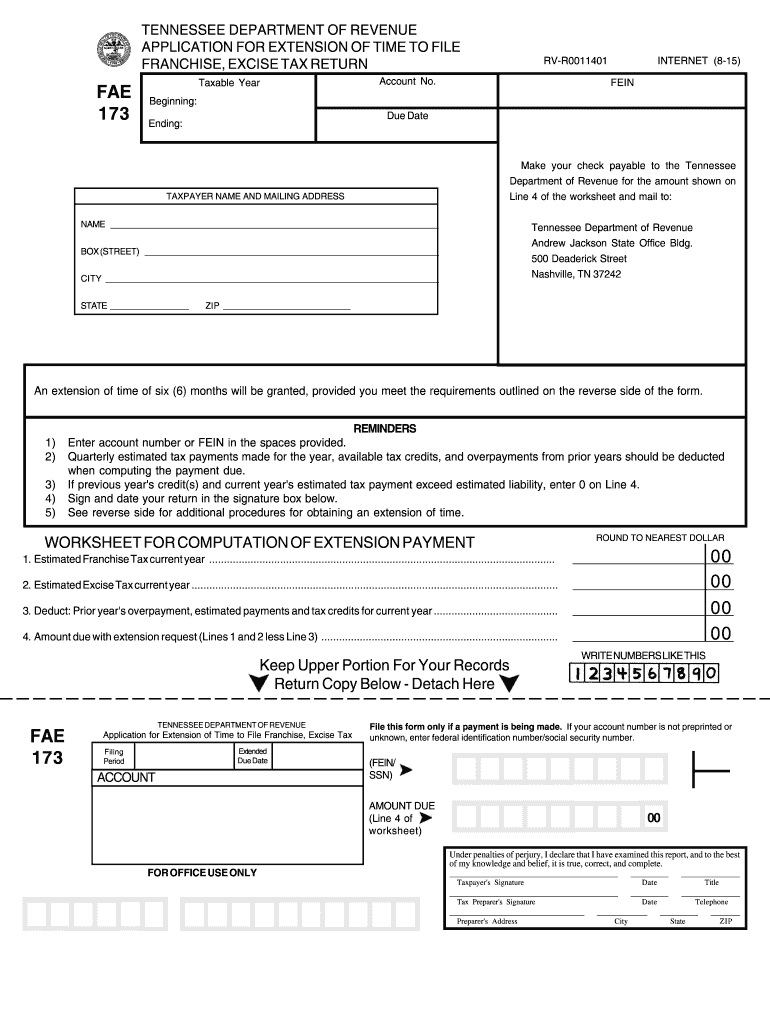

Tennessee Form Fae 173

Tennessee Form Fae 173 - Save or instantly send your ready documents. Deadline to file an extension with the. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. The application for exemption should be completed by. This form is for income earned in tax year 2022, with tax. Does tennessee support tax extension for business income tax returns? Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Use get form or simply click on the template preview to open it in the editor. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web how do i generate the fae 173 for a tennessee corporation using worksheet view?

Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: This form is for income earned in tax year 2022, with tax. Go to the other > extensions worksheet. The application for exemption should be completed by. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax. In taxslayer pro, this form is on the main menu of the tennessee franchise & excise tax return. Deadline to file an extension with the. Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Easily fill out pdf blank, edit, and sign them. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets.

What form does the state require to file an extension? Select the right tennessee franchise excise version from the list and start editing it straight away! Go to the other > extensions worksheet. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax. Web date tennessee operations began, whichever occurred first. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or through a mail service to meet the payment. This form is for income earned in tax year 2022, with tax. Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Web using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at:

Tennessee Fae 172 Form ≡ Fill Out Printable PDF Forms Online

Web the extension request is filed on form fae 173. Use get form or simply click on the template preview to open it in the editor. Save or instantly send your ready documents. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax..

Top 56 Tennessee Tax Exempt Form Templates free to download in PDF format

Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount shown on line 4 of the. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Save or instantly send your ready documents. What form does the state require to file.

2015 Form TN DoR FAE 173 Fill Online, Printable, Fillable, Blank

Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. Web we've got more versions of the tennessee franchise excise form. Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount.

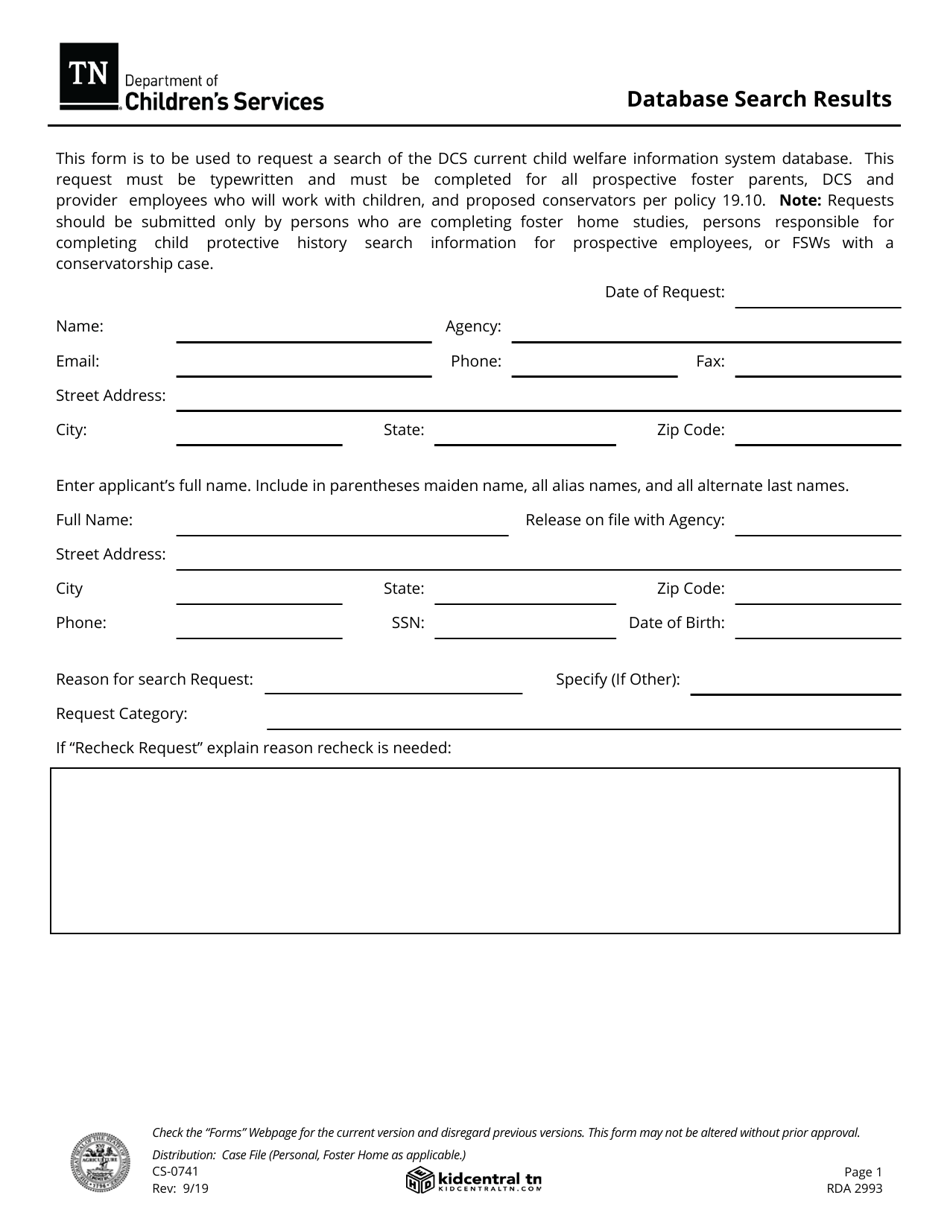

Form CS0741 Download Fillable PDF or Fill Online Database Search

Does tennessee support tax extension for business income tax returns? This form is for income earned in tax year 2022, with tax. Go to the other > extensions worksheet. Easily fill out pdf blank, edit, and sign them. Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax.

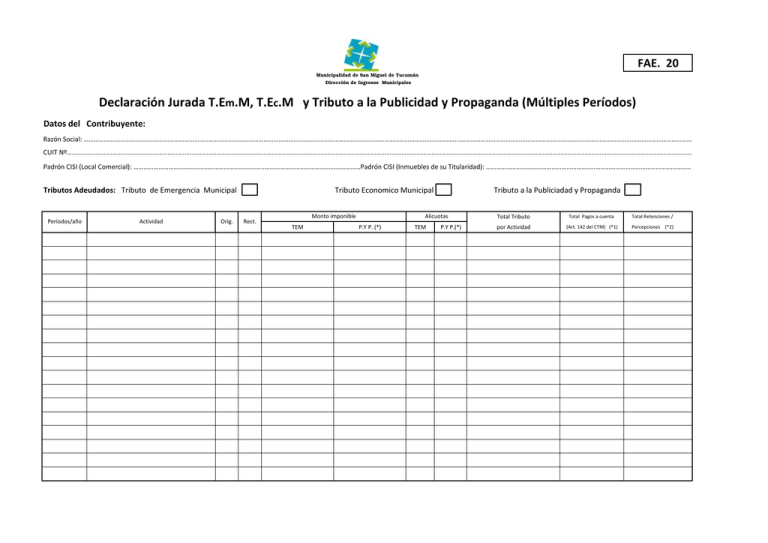

FORM. FAE.20.xlsx

Web the extension request is filed on form fae 173. Application for extension of time to file franchise and excise tax return you may file this extension along with your payment electronically at: Web how do i generate the fae 173 for a tennessee corporation using worksheet view? Deadline to file an extension with the. Web tennessee fae 173 form.

Dibujo digital de Lefty FNaF Amino [ Español ] Amino

Go to the other > extensions worksheet. Save or instantly send your ready documents. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Web i have received and read copies of portions of the tennessee code annotated.

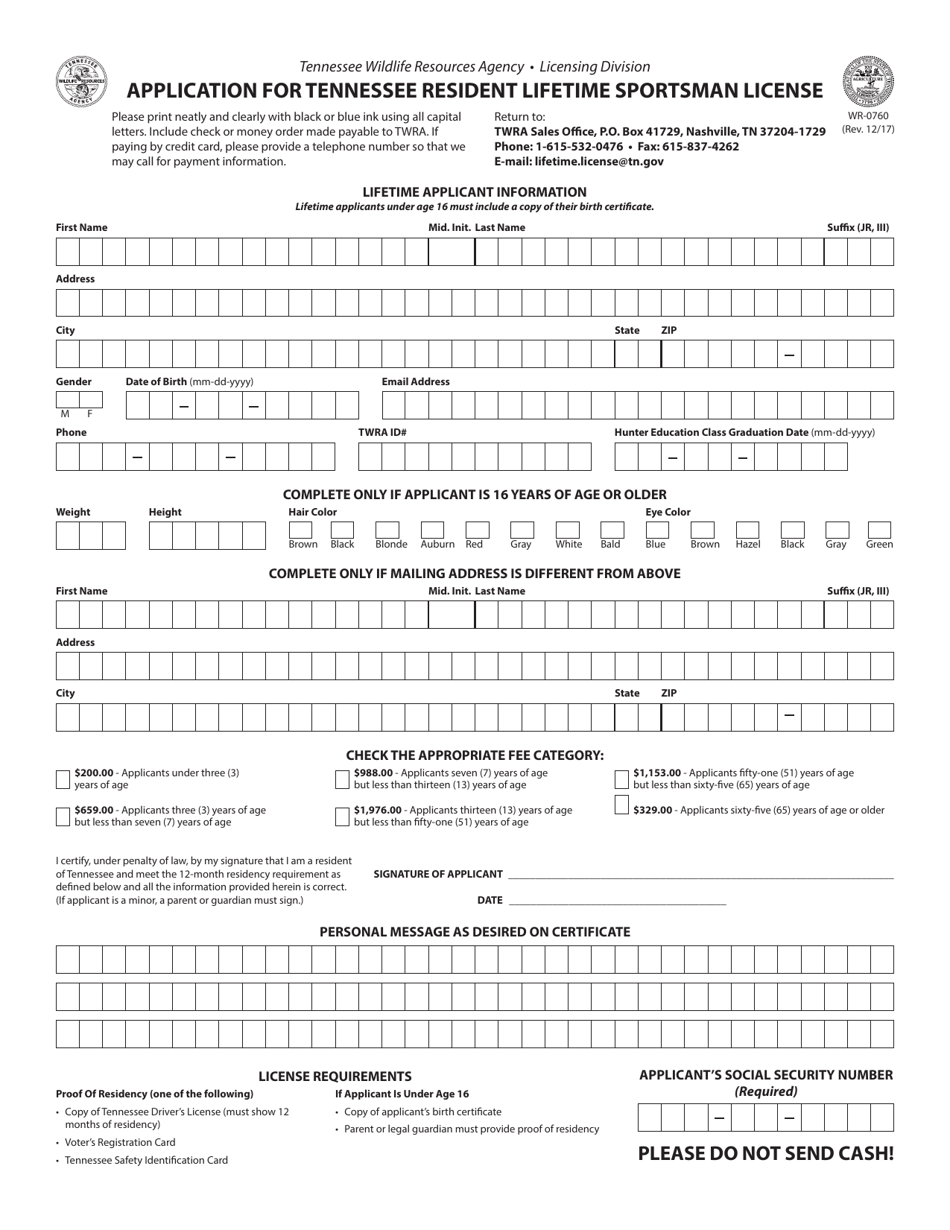

Form WR0760 Download Printable PDF or Fill Online Application for

Deadline to file an extension with the. Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount shown on line 4 of the. Easily fill out pdf blank, edit, and sign them. Web fae 173 tennessee department of revenue filing period account fae 173 application for extension.

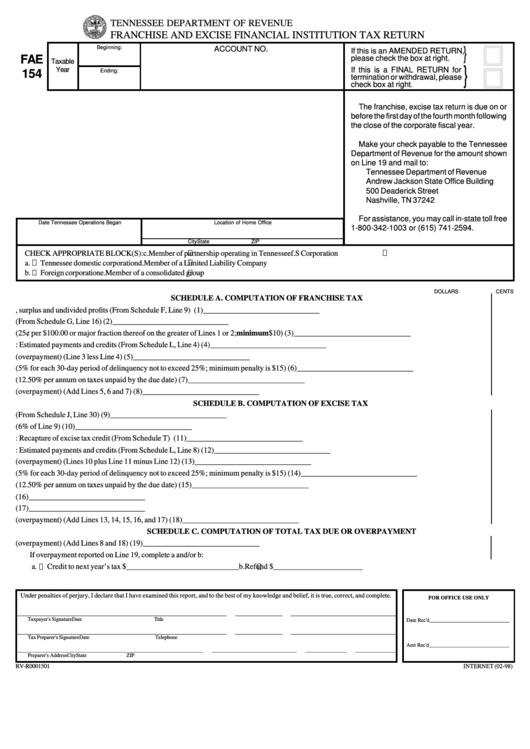

Fillable Form Fae 154 Franchise And Excise Financial Institution Tax

Web fae 173 tennessee department of revenue filing period account fae 173 application for extension of time to file franchise, excise tax an extension of time of. Deadline to file an extension with the. Web date tennessee operations began, whichever occurred first. Use get form or simply click on the template preview to open it in the editor. Save or.

411 Tennessee Department Of Revenue Forms And Templates free to

Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. Web tennessee fae 173 form is a.

TN DoR FAE 173 2017 Fill out Tax Template Online US Legal Forms

Easily fill out pdf blank, edit, and sign them. Taxpayers incorporated or otherwise formed outside tennessee must prorate the franchise tax on the initial return. Web using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: Form fae 173, application for extension of time to. Web how do i generate the.

Application For Extension Of Time To File Franchise And Excise Tax Return You May File This Extension Along With Your Payment Electronically At:

Use get form or simply click on the template preview to open it in the editor. Deadline to file an extension with the. This form is for income earned in tax year 2022, with tax. The application for exemption should be completed by.

In Taxslayer Pro, This Form Is On The Main Menu Of The Tennessee Franchise & Excise Tax Return.

Save or instantly send your ready documents. Web 173 taxpayer name and mailing address fein or ssn make your check payable to the tennessee department of revenue for the amount shown on line 4 of the. What form does the state require to file an extension? Get form now download pdf tennessee fae.

Web Fae 173 Tennessee Department Of Revenue Filing Period Account Fae 173 Application For Extension Of Time To File Franchise, Excise Tax An Extension Of Time Of.

Web we've got more versions of the tennessee franchise excise form. Web the paper form fae173 is for taxpayers that meet an exception for filing electronically to remit a payment in person or through a mail service to meet the payment requirements to. Unless otherwise specified, the below schedules are prepared for either form fae 170 or form fae 174 based on the information provided on the tennessee worksheets. • the paper form fae173 is for taxpayers that meet an exception for f iling electronically to remit a payment in person or through a mail service to meet the payment.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Web tennessee fae 173 form is a standardized test required to become licensed as a psychologist in the state of tennessee. Go to the other > extensions worksheet. Web using entries from the federal tax return and tennessee input, the following forms are prepared for the tennessee return: Web i have received and read copies of portions of the tennessee code annotated which pertain to unauthorized disclosure of state tax returns, tax information, and tax.

![Dibujo digital de Lefty FNaF Amino [ Español ] Amino](https://pm1.narvii.com/7048/865ef5d5163cdb851d55b169ef1a2a08eed66828r1-800-1280v2_hq.jpg)