Texas Affidavit Of Heirship Form

Texas Affidavit Of Heirship Form - An affidavit of heirship alone does not transfer property title. An affidavit of heirship is a document used to give property to the heirs of a person who has died. It identifies the heirs of the property. When one passes without a will (intestate), the texas estates code outlines who will receive assets (i.e., the decedent's heirs). Web some of the deceased's (decedent's) property may pass without the need for a formal probate process. No valid will, or if beneficiaries and/or heirs agree to disregard the will. Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile homes, applications to determine heirship, and transfer on death deeds. Web here, learn how to draft an affidavit of heirship. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court. Nonjudicial evidence of heirship § 203.002.

Web an affidavit of heirship is an affidavit that describes the family history of a decedent with the end result of outlining the heirs of decedent. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court. It identifies the heirs of the property. Web some of the deceased's (decedent's) property may pass without the need for a formal probate process. Texas defines “small estates” as those valuing $75,000 or less. An affidavit of heirship alone does not transfer property title. Identify all heirs of the estate your legal name and address list your relationship with the decedent timeline of relationship name of any/all spouses including date(s) or marriage, divorce, and death (if any) Nonjudicial evidence of heirship § 203.002. Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile homes, applications to determine heirship, and transfer on death deeds. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

It may be needed if the person did not have a will, or if the will was not approved within four years of their death. Identify all heirs of the estate your legal name and address list your relationship with the decedent timeline of relationship name of any/all spouses including date(s) or marriage, divorce, and death (if any) Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile homes, applications to determine heirship, and transfer on death deeds. Texas defines “small estates” as those valuing $75,000 or less. No valid will, or if beneficiaries and/or heirs agree to disregard the will. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court. Web an affidavit of heirship is an affidavit that describes the family history of a decedent with the end result of outlining the heirs of decedent. When one passes without a will (intestate), the texas estates code outlines who will receive assets (i.e., the decedent's heirs). Web here, learn how to draft an affidavit of heirship. General parameters for a texas affidavit of heirship document:

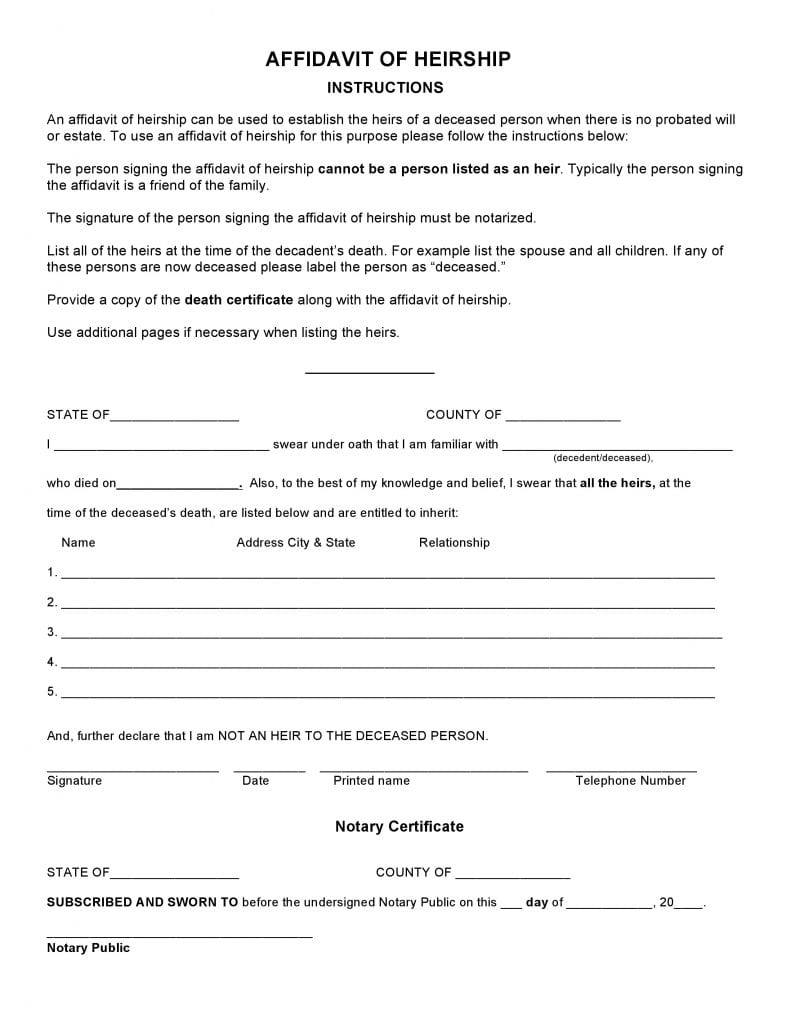

Download Free Arkansas Affidavit of Heirship Form Form Download

Web here, learn how to draft an affidavit of heirship. When one passes without a will (intestate), the texas estates code outlines who will receive assets (i.e., the decedent's heirs). Web some of the deceased's (decedent's) property may pass without the need for a formal probate process. Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile.

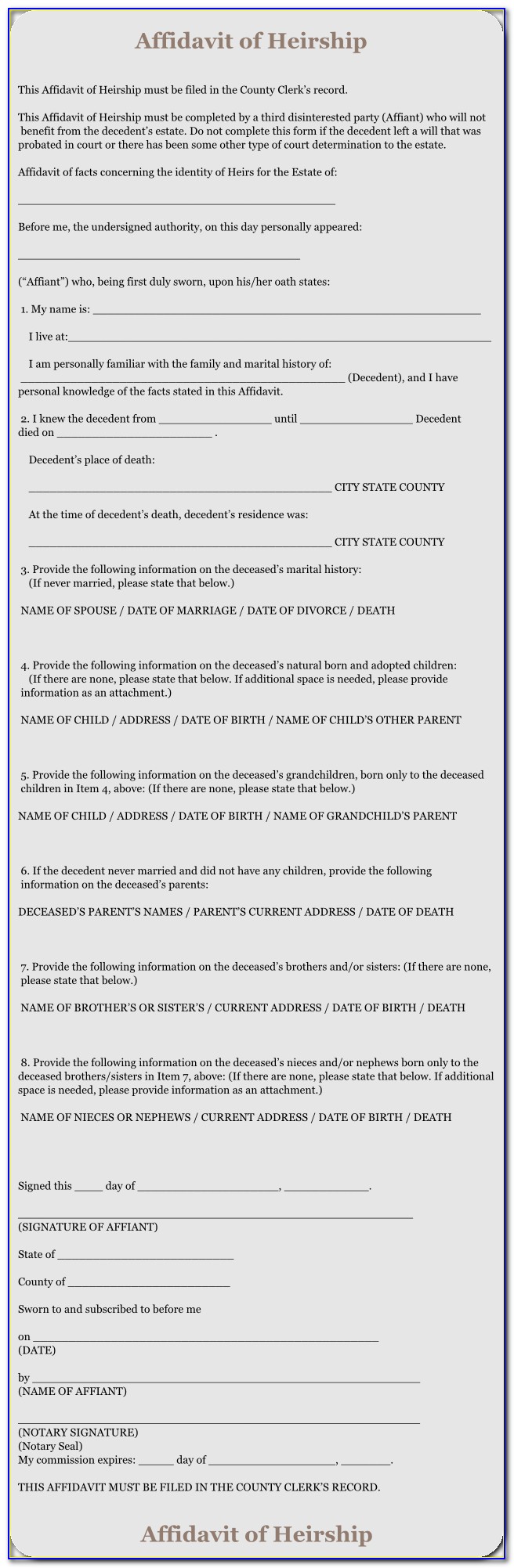

Affidavit Of Heirship Form Louisiana Form Resume Examples oXY1qXj8mZ

Web some of the deceased's (decedent's) property may pass without the need for a formal probate process. Web an affidavit of heirship is an affidavit that describes the family history of a decedent with the end result of outlining the heirs of decedent. It identifies the heirs of the property. It may be needed if the person did not have.

Affidavit of Heirship 15 Free Templates in PDF, Word, Excel Download

When one passes without a will (intestate), the texas estates code outlines who will receive assets (i.e., the decedent's heirs). Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile homes, applications to determine heirship, and transfer on death deeds. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a.

Affidavit Of Heirship Form California Form Resume Examples YqlkmrxDaj

When one passes without a will (intestate), the texas estates code outlines who will receive assets (i.e., the decedent's heirs). To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court. Methods include small estate affidavits, affidavits of heirship, statements of.

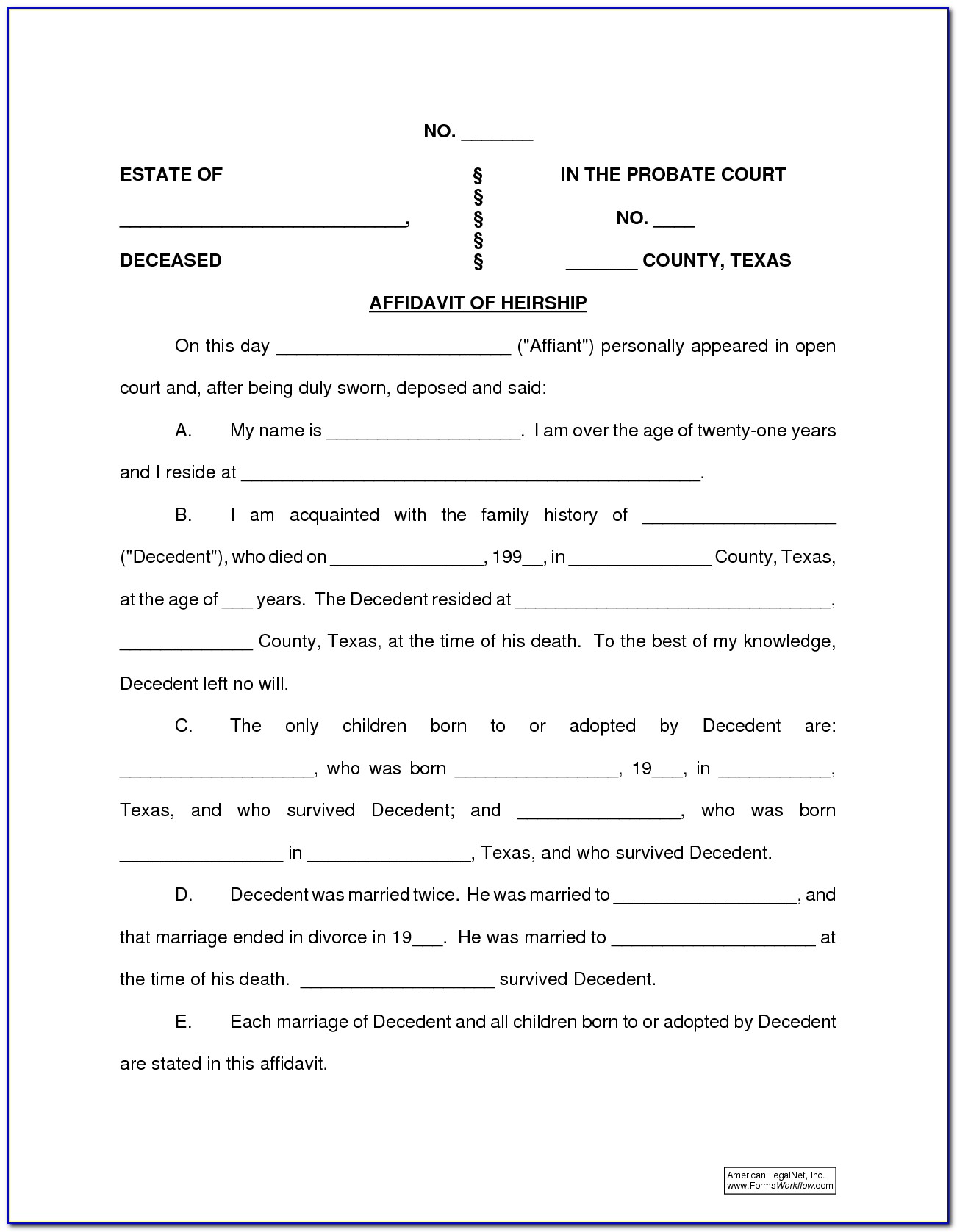

Affidavit Of Heirship Form Texas Form Resume Examples Nvq1P768kR

Nonjudicial evidence of heirship § 203.002. An affidavit of heirship alone does not transfer property title. To make an affidavit of heirship, it needs to be signed and notarized by. Web an affidavit of heirship can be filed anytime. No valid will, or if beneficiaries and/or heirs agree to disregard the will.

Affidavit of Heirship Texas Free Download

It identifies the heirs of the property. Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile homes, applications to determine heirship, and transfer on death deeds. Form of affidavit concerning identity of heirs nonjudicial evidence of heirship Identify all heirs of the estate your legal name and address list your relationship with the decedent timeline of.

Affidavit Of Heirship Form Harris County Texas Form Resume Examples

An affidavit of heirship alone does not transfer property title. Web an affidavit of heirship is an affidavit that describes the family history of a decedent with the end result of outlining the heirs of decedent. Web some of the deceased's (decedent's) property may pass without the need for a formal probate process. An affidavit of heirship is a document.

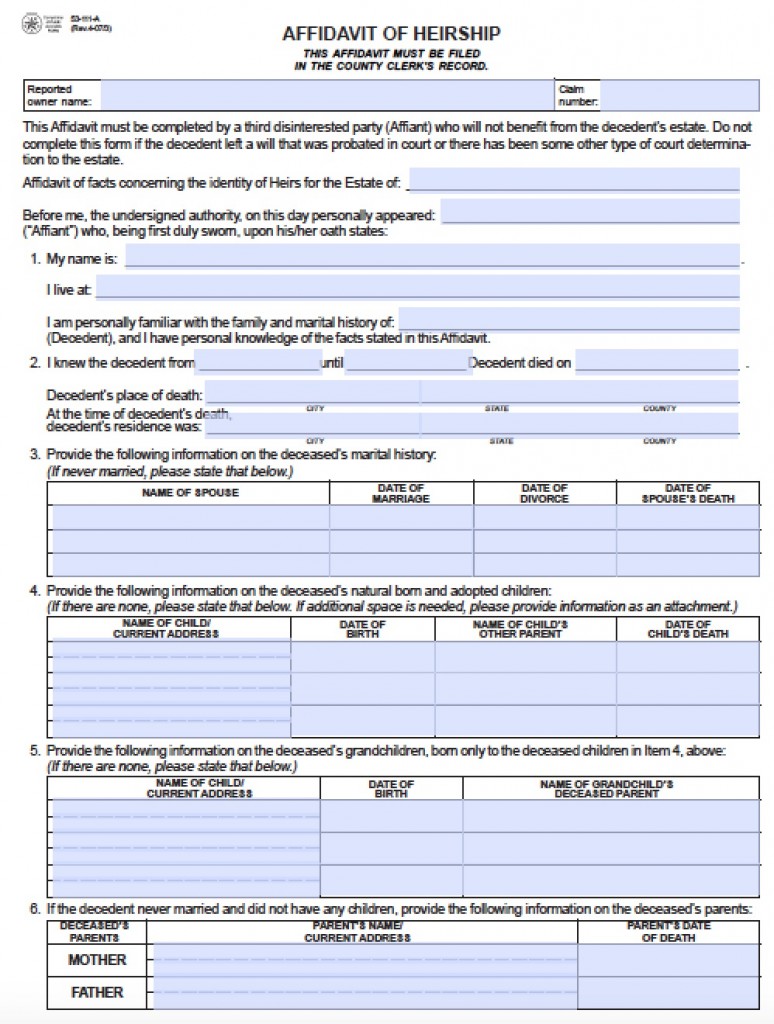

Free Texas Affidavit of Heirship 53111a Form PDF Word

No valid will, or if beneficiaries and/or heirs agree to disregard the will. Identify all heirs of the estate your legal name and address list your relationship with the decedent timeline of relationship name of any/all spouses including date(s) or marriage, divorce, and death (if any) It identifies the heirs of the property. It may be needed if the person.

Free Affidavit Of Heirship Form Texas Universal Network

Web here, learn how to draft an affidavit of heirship. It identifies the heirs of the property. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court. When one passes without a will (intestate), the texas estates code outlines who.

Ny Affidavit Of Heirship Form Form Resume Examples Mj1vG5NKwy

Web affidavit of heirship for a motor vehicle heir 1 (if a signature of affiant (heir 1) ☐ vehicle/decedent information vehicle identification number year make body style model title/document number (if unknown, leave blank) license plate state and number (if any) date of death location of death (county and state) Methods include small estate affidavits, affidavits of heirship, statements of.

Web Affidavit Of Heirship For A Motor Vehicle Heir 1 (If A Signature Of Affiant (Heir 1) ☐ Vehicle/Decedent Information Vehicle Identification Number Year Make Body Style Model Title/Document Number (If Unknown, Leave Blank) License Plate State And Number (If Any) Date Of Death Location Of Death (County And State)

No valid will, or if beneficiaries and/or heirs agree to disregard the will. Methods include small estate affidavits, affidavits of heirship, statements of inheritance for mobile homes, applications to determine heirship, and transfer on death deeds. General parameters for a texas affidavit of heirship document: An affidavit of heirship alone does not transfer property title.

Nonjudicial Evidence Of Heirship § 203.002.

Form of affidavit concerning identity of heirs nonjudicial evidence of heirship To make an affidavit of heirship, it needs to be signed and notarized by. Identify all heirs of the estate your legal name and address list your relationship with the decedent timeline of relationship name of any/all spouses including date(s) or marriage, divorce, and death (if any) Durable powers of attorney subtitle e.

Web Some Of The Deceased's (Decedent's) Property May Pass Without The Need For A Formal Probate Process.

Web an affidavit of heirship can be filed anytime. It identifies the heirs of the property. Web here, learn how to draft an affidavit of heirship. To claim bank accounts, trusts, heirlooms, and other personal property not including motor vehicles owned by a decedent, interested parties may file the affidavit of heirship to avoid probate court.

When One Passes Without A Will (Intestate), The Texas Estates Code Outlines Who Will Receive Assets (I.e., The Decedent's Heirs).

Web an affidavit of heirship is an affidavit that describes the family history of a decedent with the end result of outlining the heirs of decedent. An affidavit of heirship is a document used to give property to the heirs of a person who has died. Texas defines “small estates” as those valuing $75,000 or less. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.