Turbotax Form 982

Turbotax Form 982 - (if not already open.) once you are. Ad finding it harder than ever to file efficiently without risking costly errors? Web in turbotax online there is no way to complete form 982 for insolvency. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web irs form 982 is supported in turbotax versions deluxe and above. Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. Web 1 best answer doninga level 15 irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) the form 982. This is because you received a benefit from.

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Import your tax forms and file for your max refund today. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Ad finding it harder than ever to file efficiently without risking costly errors? Enter '982' in the magnifying glass in the upper right hand corner of the screen. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. March 2018) department of the treasury internal revenue service. Web if you qualify for an exception or exclusion, you don’t report your canceled debt on your tax return. This form is for income earned in tax year 2022, with tax returns due in april.

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Get a jumpstart on your taxes. According to irs publication 4681: Following the reasoning and steps below will. Web 1 best answer doninga level 15 irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) the form 982. Ad get ready for tax season deadlines by completing any required tax forms today. Web if you qualify for an exception or exclusion, you don’t report your canceled debt on your tax return. Web we last updated federal form 982 in february 2023 from the federal internal revenue service. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. But if you used turbotax deluxe or higher to file.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Generally, if you owe a debt to. If you had debt cancelled and are no longer obligated to repay the. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). However, when using an exception and it relates.

Form 982 Insolvency Worksheet

Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. Web 1 best answer doninga level 15 irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) the form 982. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Ad free online tax filing with turbotax® free edition. According to irs publication 4681: This form is for income earned in tax year 2022, with tax returns due in april. Ad finding it harder than ever to file efficiently without risking costly errors? This is because you received a benefit from.

Form 982 turbotax home and business lanthgolfsi

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. Web irs form 982 is supported in turbotax versions deluxe and above. Web the easiest way to find/file form 982 in turbotax online is to go to: Web.

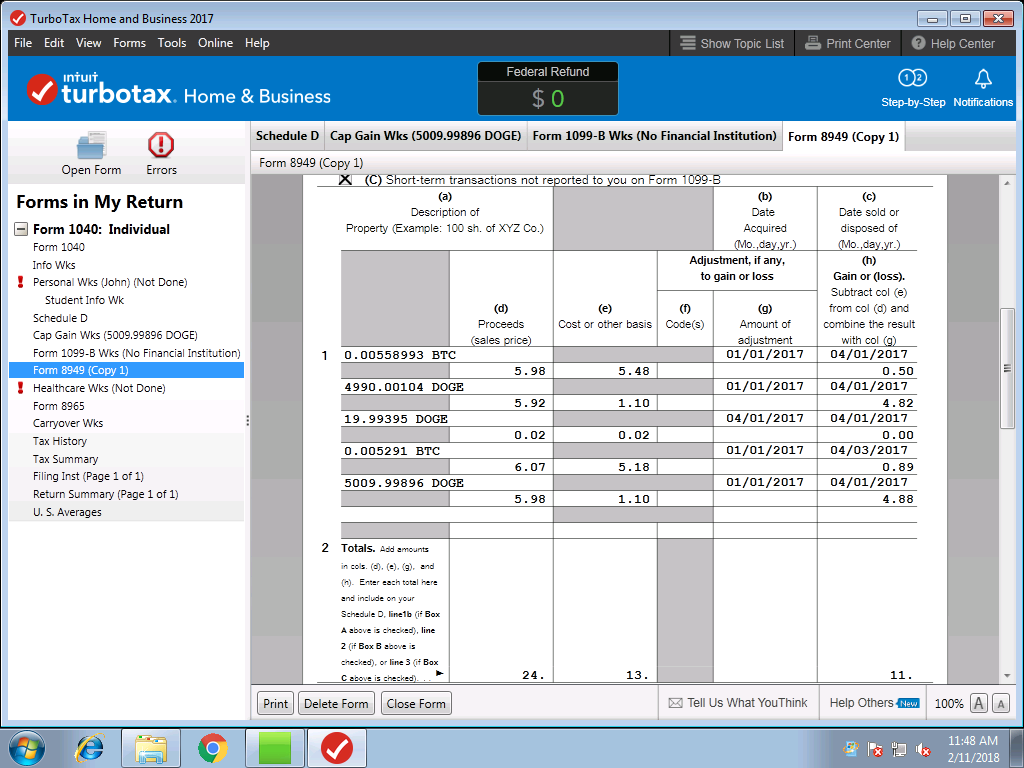

Import TXF from Bitcoin.Tax into TurboTax

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Sign into turbotax online and click take me to my return. According to irs publication 4681: Following the reasoning and steps below will. Ad free online tax filing with turbotax® free edition. March 2018) department of the treasury internal revenue service.

turbotax work from home

Our tax preparers will ensure that your tax returns are complete, accurate and on time. Web the easiest way to find/file form 982 in turbotax online is to go to: Complete, edit or print tax forms instantly. However, when using an exception and it relates to property that. Web form 982 (reduction of tax attributes due to discharge of indebtedness).

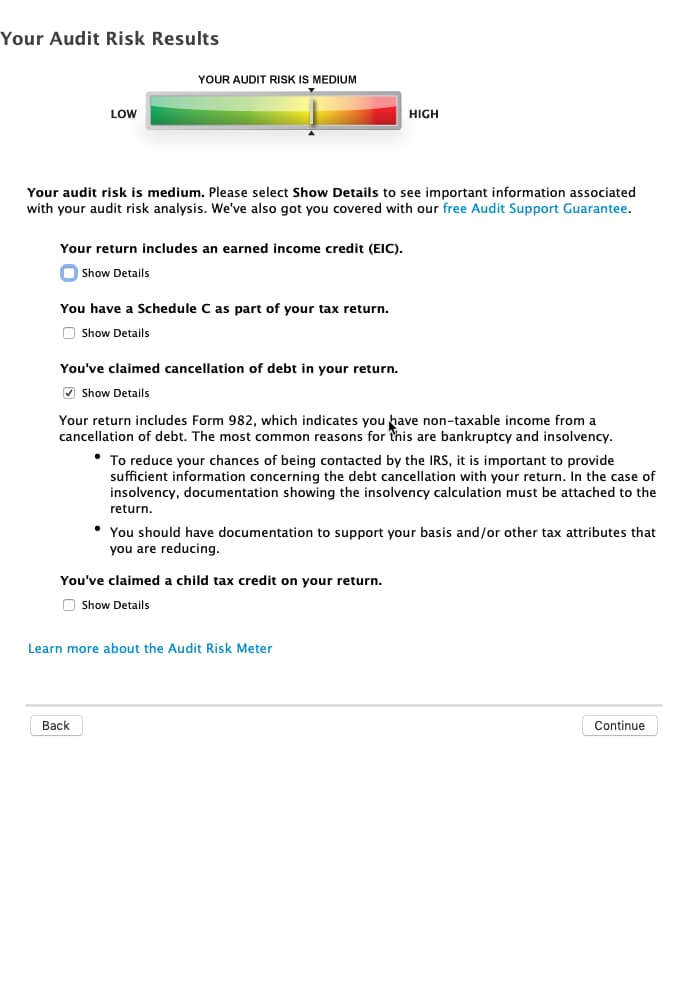

When I run the audit risk, it lists a concern for form 982 debt

According to irs publication 4681: Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Our tax preparers will ensure that your tax returns are complete, accurate and on time. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes.

TurboTax makes filing (almost) fun Inside Design Blog Turbotax

Web what is form 982? Generally, if you owe a debt to. But if you used turbotax deluxe or higher to file. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. See if you qualify today.

TurboTax 2016 Deluxe Home and Business + All States Fix Free Download

What is a discharge of indebtedness to the extent insolvent? Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. According to irs publication.

Web In Turbotax Online There Is No Way To Complete Form 982 For Insolvency.

Web if you qualify for an exception or exclusion, you don’t report your canceled debt on your tax return. Web the easiest way to find/file form 982 in turbotax online is to go to: However, when using an exception and it relates to property that. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income.

(If Not Already Open.) Once You Are.

If you had debt cancelled and are no longer obligated to repay the. Complete, edit or print tax forms instantly. Get a jumpstart on your taxes. But if you used turbotax deluxe or higher to file.

Following The Reasoning And Steps Below Will.

Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Ad finding it harder than ever to file efficiently without risking costly errors? Our tax preparers will ensure that your tax returns are complete, accurate and on time.

According To Irs Publication 4681:

What is a discharge of indebtedness to the extent insolvent? Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web 1 best answer michaeldc new member cancellation of debt and insolvency are a little complex but not complicated. Web 1 best answer doninga level 15 irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) the form 982.