Vat100 Form Pdf

Vat100 Form Pdf - Web vat1 pdf, 392 kb, 14 pages this file may not be suitable for users of assistive technology. Web the vat 100 report is used to prepare vat returns for submission to hmrc. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. A default folder is provided. Web up to $40 cash back vat100 is an online form from hm revenue & customs (hmrc) in the uk. Finding a authorized expert, creating an appointment and coming to the workplace for a private meeting makes completing a blank vat 100. With scribd, you can take your ebooks and audibooks anywhere, even offline. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: Web generate a vat 100 report.

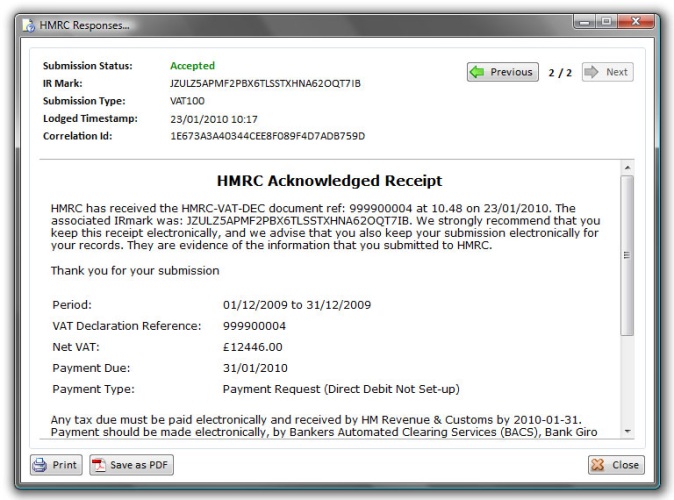

Go to tax > declarations > sales tax > report sales tax for. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web to view the pdf of a submitted vat100 return, see viewing the submitted vat100 in the file cabinet. Get everything done in minutes. With scribd, you can take your ebooks and audibooks anywhere, even offline. A submission receipt reference number is displayed on the vat online. Web up to $40 cash back vat100 is an online form from hm revenue & customs (hmrc) in the uk. Web up to $40 cash back the purpose of the blank vat 100 form is to report and pay value added tax (vat) due to the tax authorities. Web to clear your credentials simply submit the form with no data. Save or instantly send your ready documents.

A submission receipt reference number is displayed on the vat online. This topic is for netsuite accounts that use the country tax report page to generate the united kingdom vat. It is only applicable if your organisation is vat registered with hmrc. Edit your vat100 form pdf online type text, add images, blackout confidential details, add comments, highlights and more. Go to tax > declarations > sales tax > report sales tax for. Find out how accessible our forms. Overview 1.1 what this notice is about. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web generate a vat 100 report. Web 1 february 2021.

PDF Full Form pdf क्या है? PDF के बारे में पूरी जानकारी GyaniBox

A submission receipt reference number is displayed on the vat online. Get everything done in minutes. Find out how accessible our forms. Web complete vat100 form pdf online with us legal forms. Scribd is the world's largest social reading and publishing site.

Making Tax Digital Bransom Retail Systems

Overview 1.1 what this notice is about. Web up to $40 cash back vat100 is an online form from hm revenue & customs (hmrc) in the uk. Web follow the simple instructions below: When the particular vat period is finished and the vat data has been inspected and is complete,. Web to clear your credentials simply submit the form with.

Vorschau VAT 0240XBA24CAV1/0004, XVAT10040512

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web to view the pdf of a submitted vat100 return, see viewing the submitted vat100 in the file cabinet. With scribd, you can take your ebooks and audibooks anywhere, even offline. When the particular vat period is finished and the vat.

DC Software VAT Submission Pro

Web up to $40 cash back vat100 is an online form from hm revenue & customs (hmrc) in the uk. Web generate a vat 100 report. Try scribd free for 30 days. Scribd is the world's largest social reading and publishing site. Edit your vat100 form pdf online type text, add images, blackout confidential details, add comments, highlights and more.

VAT100 Reverse charge VAT for services not appearing in BOX 1 (UKVAT

Try scribd free for 30 days. This topic is for netsuite accounts that use the country tax report page to generate the united kingdom vat. Web the vat 100 report is used to prepare vat returns for submission to hmrc. 1 month and seven days after the reporting quarter: Web up to $40 cash back the purpose of the blank.

Vorschau VAT 0240XBA24CAV1/0004, XVAT10040512

It is used by businesses registered for vat in the. Follow these steps to generate a paper format of the vat 100 report. Go to tax > declarations > sales tax > report sales tax for. When the particular vat period is finished and the vat data has been inspected and is complete,. Find out how accessible our forms.

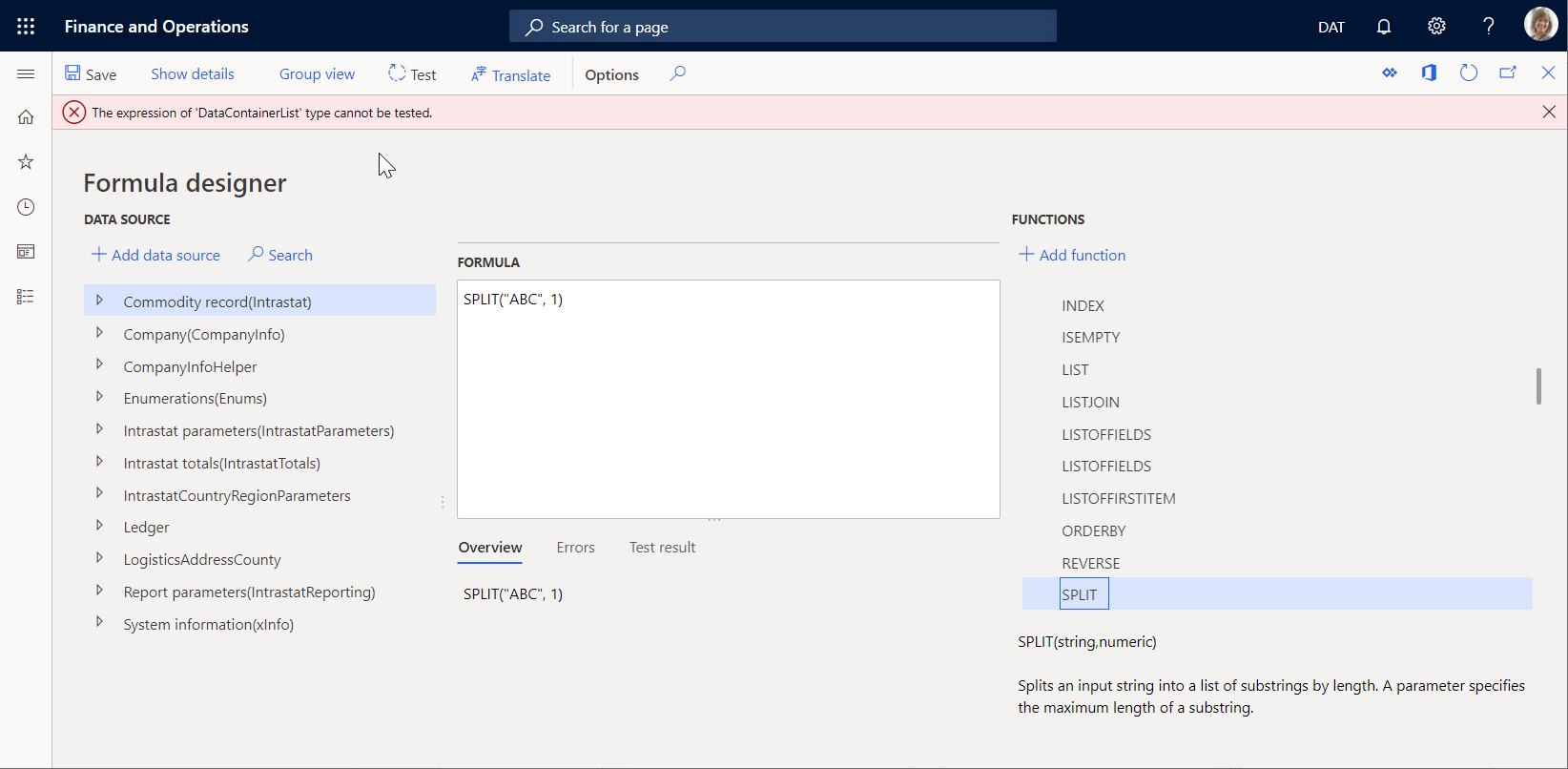

Formula designer in Electronic reporting (ER) Finance & Operations

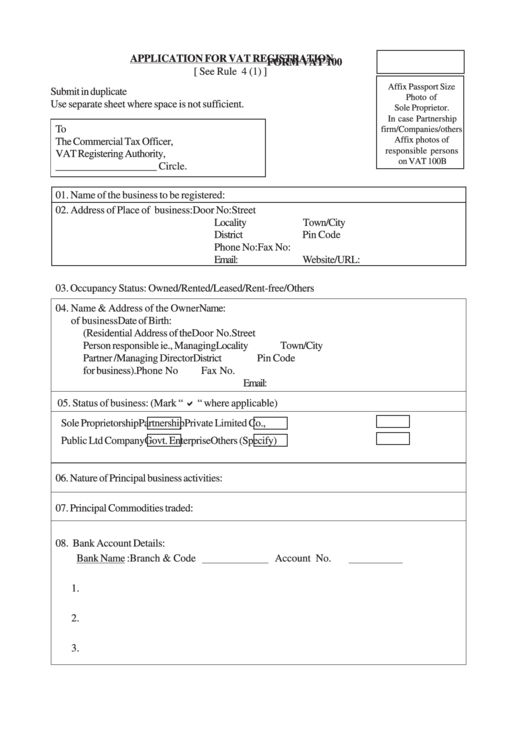

Provide partnership details when you register for vat. Overview 1.1 what this notice is about. Ad access millions of ebooks, audiobooks, podcasts, and more. Web the vat 100 report is used to prepare vat returns for submission to hmrc. Web 1 february 2021.

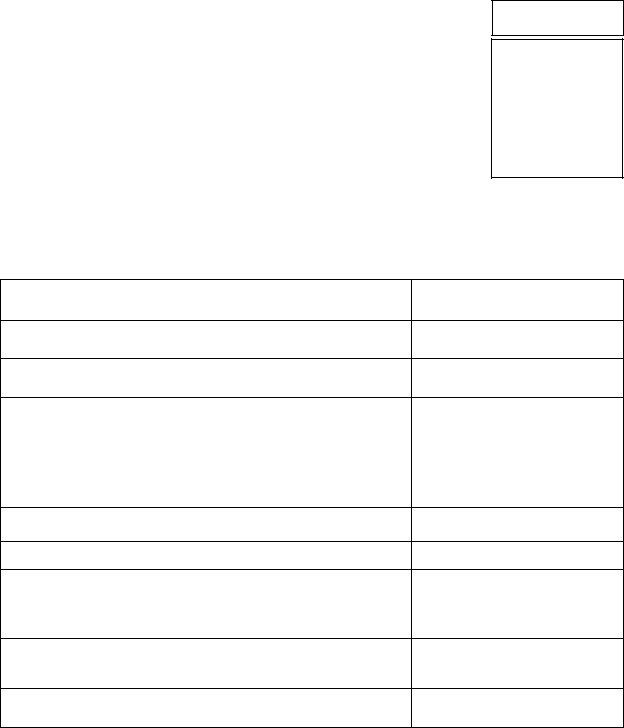

Form Vat 100 Application For Vat Registration printable pdf download

Web follow the simple instructions below: Edit your vat100 form pdf online type text, add images, blackout confidential details, add comments, highlights and more. 1 month and seven days after the reporting quarter: With scribd, you can take your ebooks and audibooks anywhere, even offline. Web to clear your credentials simply submit the form with no data.

Form Vat 100B ≡ Fill Out Printable PDF Forms Online

It’s used to declare value added tax (vat) on goods and services. A submission receipt reference number is displayed on the vat online. Web up to $40 cash back vat100 is an online form from hm revenue & customs (hmrc) in the uk. This notice helps you complete the vat return and provides information on how to submit your completed.

VAT 100 Print Tax Credit Value Added Tax

Finding a authorized expert, creating an appointment and coming to the workplace for a private meeting makes completing a blank vat 100. Follow these steps to generate a paper format of the vat 100 report. Web complete vat100 form pdf online with us legal forms. Overview 1.1 what this notice is about. Web up to $40 cash back vat100 is.

Register For Vat If Supplying Goods Under Certain Directives.

Web to view the pdf of a submitted vat100 return, see viewing the submitted vat100 in the file cabinet. This notice helps you complete the vat return and provides information on how to submit your completed return to hmrc. Save or instantly send your ready documents. Only required for arrivals reverse.

Find Out How Accessible Our Forms.

Web complete vat100 form pdf online with us legal forms. This topic is for netsuite accounts that use the country tax report page to generate the united kingdom vat. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. When the particular vat period is finished and the vat data has been inspected and is complete,.

Try Scribd Free For 30 Days.

Scribd is the world's largest social reading and publishing site. Web up to $40 cash back the purpose of the blank vat 100 form is to report and pay value added tax (vat) due to the tax authorities. It is used by businesses registered for vat in the. Ad access millions of ebooks, audiobooks, podcasts, and more.

Web Follow The Simple Instructions Below:

Edit your vat100 form pdf online type text, add images, blackout confidential details, add comments, highlights and more. Overview 1.1 what this notice is about. A default folder is provided. A submission receipt reference number is displayed on the vat online.