Virginia Form 760 Instructions 2022

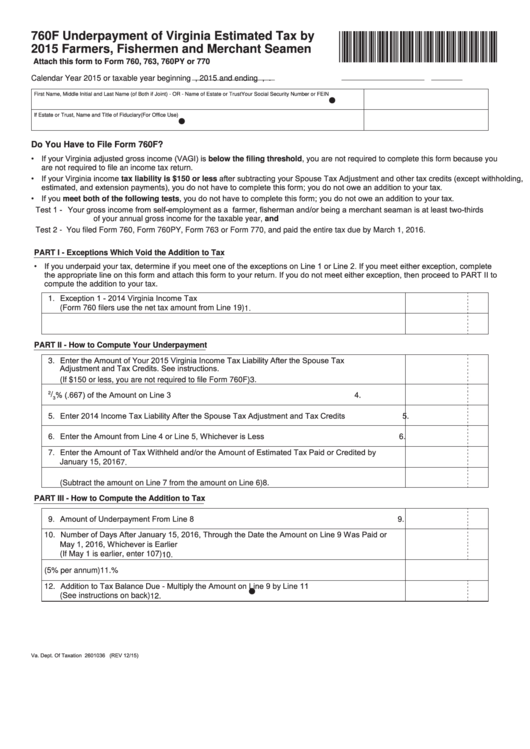

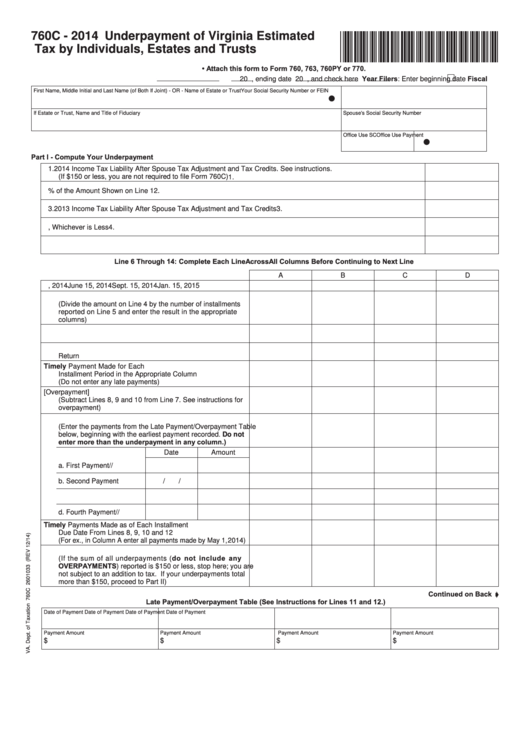

Virginia Form 760 Instructions 2022 - If your tax is underpaid as of any installment due date, you must file form 760c. Web we last updated the resident individual income tax return in january 2023, so this is the latest. Virginia form 760 *va0760122888* resident income tax return. Enter 66 2/3% (.667) of the amount on line 3 4. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Here are 6 advantages of filing electronically: Web find forms & instructions by category. Corporation and pass through entity tax. Since underpayments are determined as of each installment due date, Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits.

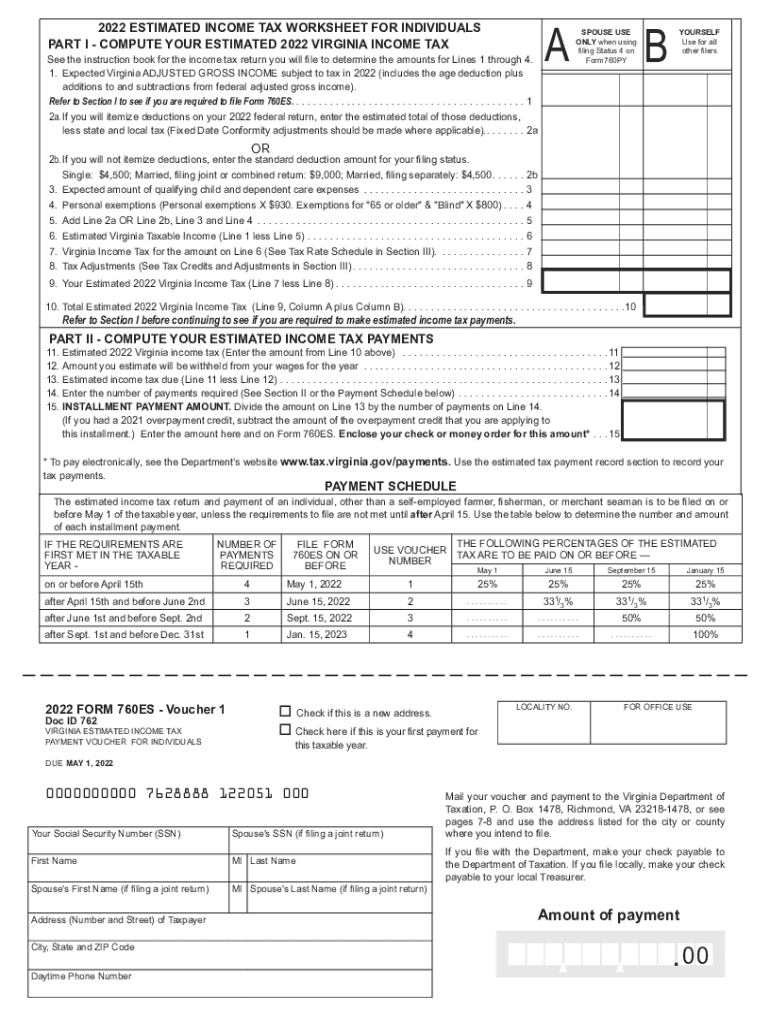

(if $150 or less, you are not required to file form 760f) 3. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Virginia fiduciary income tax return instructions 760es: Web home | virginia tax Since underpayments are determined as of each installment due date, Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Here are 6 advantages of filing electronically: Enter 66 2/3% (.667) of the amount on line 3 4. If your tax is underpaid as of any installment due date, you must file form 760c. Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits.

Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits. If your tax is underpaid as of any installment due date, you must file form 760c. Corporation and pass through entity tax. Web we last updated the resident individual income tax return in january 2023, so this is the latest. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Virginia form 760 *va0760122888* resident income tax return. Web find forms & instructions by category. Web this booklet includes instructions for filling out and filing your form 760 income tax return. Since underpayments are determined as of each installment due date, Web home | virginia tax

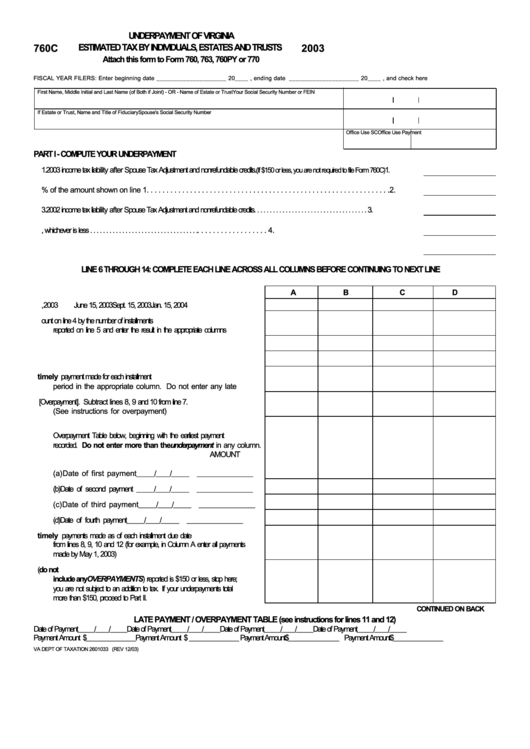

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Here are 6 advantages of filing electronically: (if $150 or less, you are not required to file form 760f) 3. Since underpayments are determined as of each installment due date, Virginia fiduciary income tax return instructions 760es: Web home | virginia tax

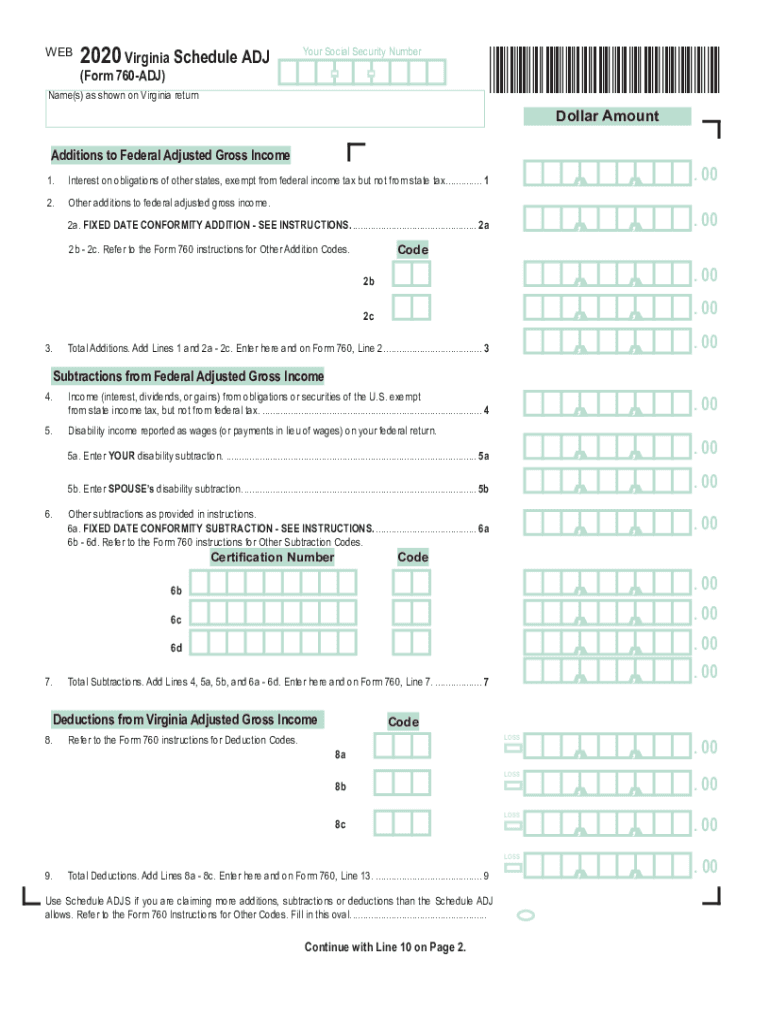

Va760 Form Fill Out and Sign Printable PDF Template signNow

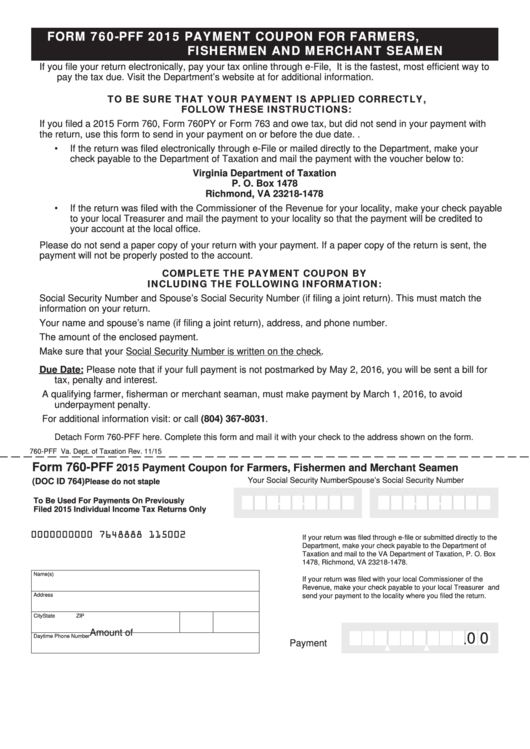

If your tax is underpaid as of any installment due date, you must file form 760c. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. The form must be filed even if you are due a refund when you file your tax return. Corporation and pass through entity tax. Enter 66 2/3% (.667) of the amount.

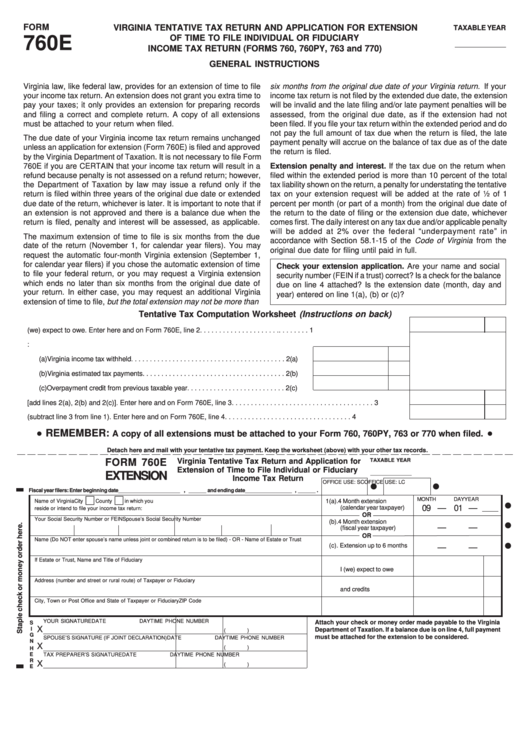

Form 760e Virginia Tentative Tax Return And Application For Extension

If your tax is underpaid as of any installment due date, you must file form 760c. Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits. Web 2022 form 760 resident individual income tax booklet uplease file electronically!u filing on paper means waiting longer for your refund. Web free printable 2022.

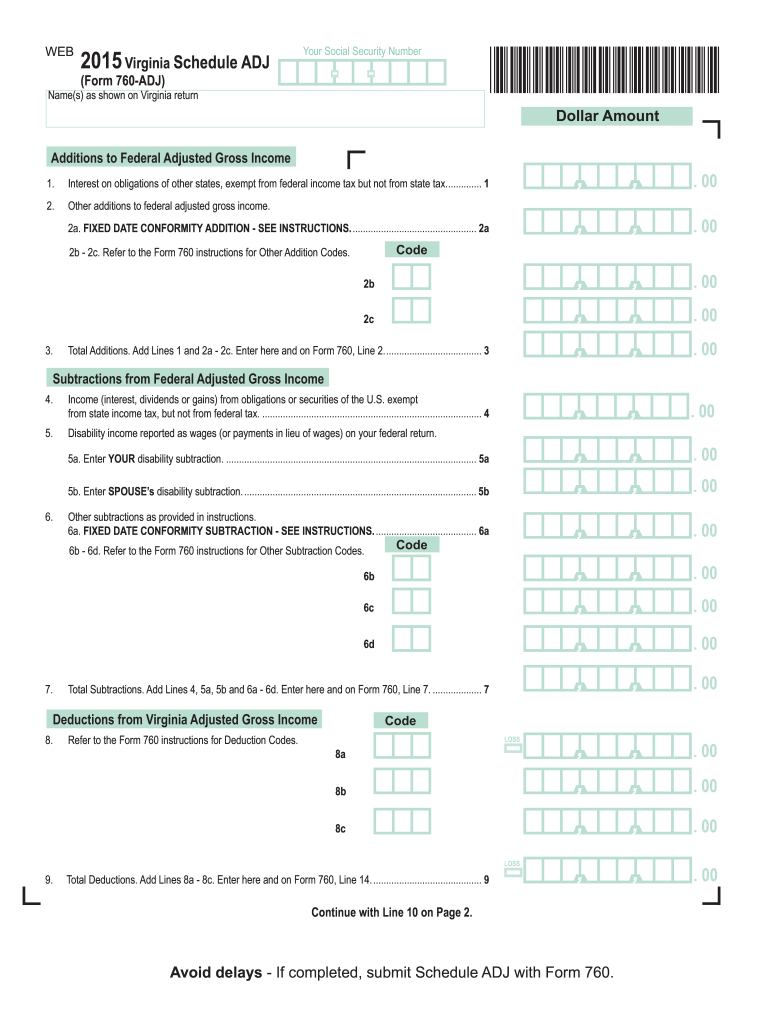

2015 Form VA 760ADJ Fill Online, Printable, Fillable, Blank pdfFiller

Web find forms & instructions by category. Web home | virginia tax (if $150 or less, you are not required to file form 760f) 3. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Here are 6 advantages of filing electronically:

Virginia Tax Instructions Form Fill Out and Sign Printable PDF

Web home | virginia tax Virginia fiduciary income tax return instructions 760es: Virginia form 760 *va0760122888* resident income tax return. Web find forms & instructions by category. Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates.

Top 22 Virginia Form 760 Templates free to download in PDF format

Web fiscal year filers should refer to virginia form 760es and the instructions to determine their installment due dates. Here are 6 advantages of filing electronically: If your tax is underpaid as of any installment due date, you must file form 760c. Web home | virginia tax Virginia fiduciary income tax return instructions 760es:

Top 22 Virginia Form 760 Templates free to download in PDF format

(if $150 or less, you are not required to file form 760f) 3. Web this booklet includes instructions for filling out and filing your form 760 income tax return. If your tax is underpaid as of any installment due date, you must file form 760c. Here are 6 advantages of filing electronically: Web free printable 2022 virginia form 760 and.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Web this booklet includes instructions for filling out and filing your form 760 income tax return. The form must be filed even if you are due a refund when you file your tax return. Web home | virginia tax Since underpayments are determined as of each installment due date, Virginia form 760 *va0760122888* resident income tax return.

VA 760 Instructions 20212022 Fill and Sign Printable Template Online

Since underpayments are determined as of each installment due date, Virginia form 760 *va0760122888* resident income tax return. Web home | virginia tax Web we last updated the resident individual income tax return in january 2023, so this is the latest. Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions.

2022 Form VA DoT 760ES Fill Online, Printable, Fillable, Blank pdfFiller

Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. The form must be filed even if you are due a refund when you file your tax return. Enter 66 2/3% (.667) of the amount on line 3 4. Web home | virginia tax Web fiscal year filers should refer to virginia form 760es and the instructions.

Web Fiscal Year Filers Should Refer To Virginia Form 760Es And The Instructions To Determine Their Installment Due Dates.

Web find forms & instructions by category. Web we last updated the resident individual income tax return in january 2023, so this is the latest. The form must be filed even if you are due a refund when you file your tax return. Since underpayments are determined as of each installment due date,

Web Home | Virginia Tax

Web free printable 2022 virginia form 760 and 2022 virginia form 760 instructions. Web enter the amount of your 2022 virginia income tax liability after the spouse tax adjustment and tax credits. Virginia form 760 *va0760122888* resident income tax return. Web this booklet includes instructions for filling out and filing your form 760 income tax return.

Web 2022 Form 760 Resident Individual Income Tax Booklet Uplease File Electronically!U Filing On Paper Means Waiting Longer For Your Refund.

If your tax is underpaid as of any installment due date, you must file form 760c. (if $150 or less, you are not required to file form 760f) 3. Corporation and pass through entity tax. Here are 6 advantages of filing electronically:

Enter 66 2/3% (.667) Of The Amount On Line 3 4.

Virginia fiduciary income tax return instructions 760es: