Virginia Military Spouse Tax Exemption Form

Virginia Military Spouse Tax Exemption Form - Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. You will not qualify for exemption from the local vehicle tax if: Personal exemption worksheet you may not claim more. Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web the virginia state income tax is administered by the virginia department of taxation (tax), po box 760, richmond, va 23206. During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. A copy of your state income tax return b.

Web under the servicemember civil relief act, as amended by the military spouses residency relief act, a spouse of a military servicemember may be exempt from virginia income. If you have questions relating to any of our personal property forms, please contact the. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web the virginia state income tax is administered by the virginia department of taxation (tax), po box 760, richmond, va 23206. Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web what form should i file | military spouse va. Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal.

Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt from taxation. A copy of your state income tax return b. If you have questions relating to any of our personal property forms, please contact the. Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. Web to apply for exemption, the following documentation is required: Web what form should i file | military spouse va. You will not qualify for exemption from the local vehicle tax if: Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Personal exemption worksheet you may not claim more.

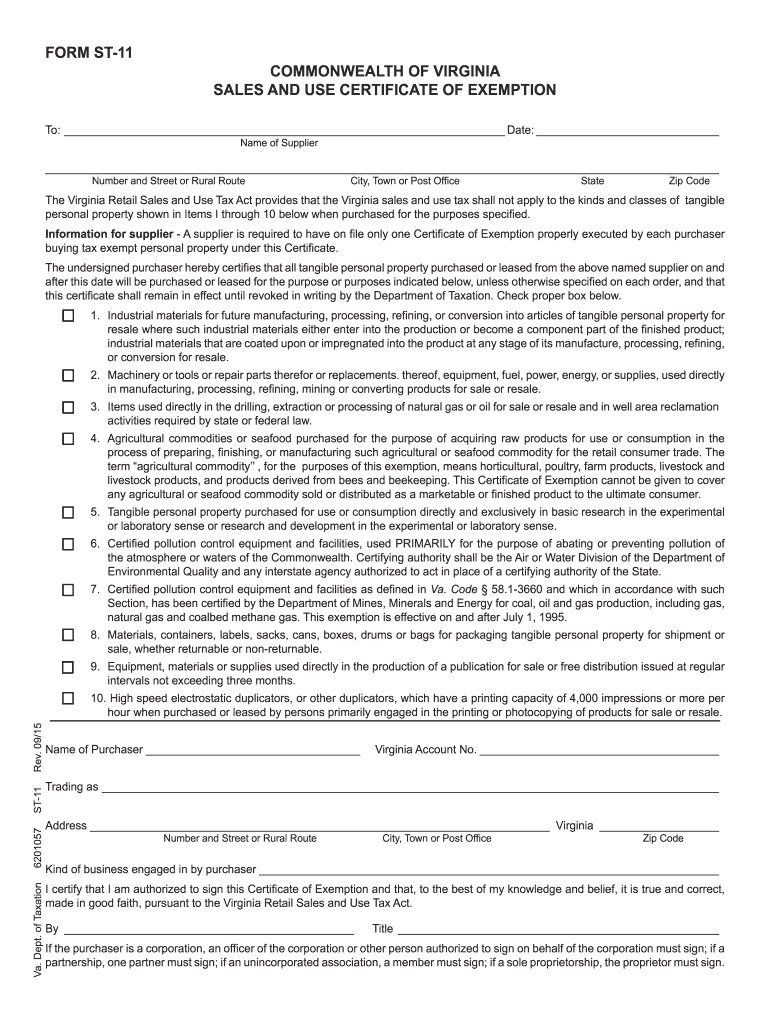

Virginia Sales Tax Exemption Form St 11 Fill Out and Sign Printable

Personal exemption worksheet you may not claim more. Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web what form should i file | military spouse va. If you have questions relating to any of our personal property forms, please contact.

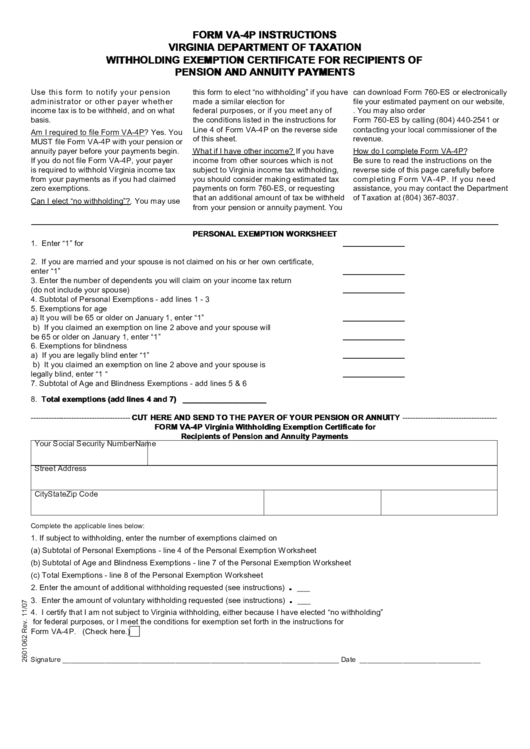

Fillable Form Va4p Virginia Withholding Exemption Certificate For

Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web pursuant to the.

Tax Checklist For The SelfEmployed Military Spouse NextGen MilSpouse

During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Web online forms provide the option of submitting the form electronically to our office. Web.

Real Estate Tax Exemption In Virginia For 100 P&T Veterans Page 2 VBN

Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. Web dependent military id you must attach at least one of the following: Web what form should i file | military spouse va. Web under the servicemember civil relief act,.

√ Military Spouse Residency Relief Act Tax Form Navy Docs

Web what form should i file | military spouse va. Personal exemption worksheet you may not claim more. Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. During the taxable year, were you a military spouse covered under the.

√ Military Spouse Residency Relief Act Tax Form Navy Docs

If you have questions relating to any of our personal property forms, please contact the. Web to apply for exemption, the following documentation is required: Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. During the taxable year,.

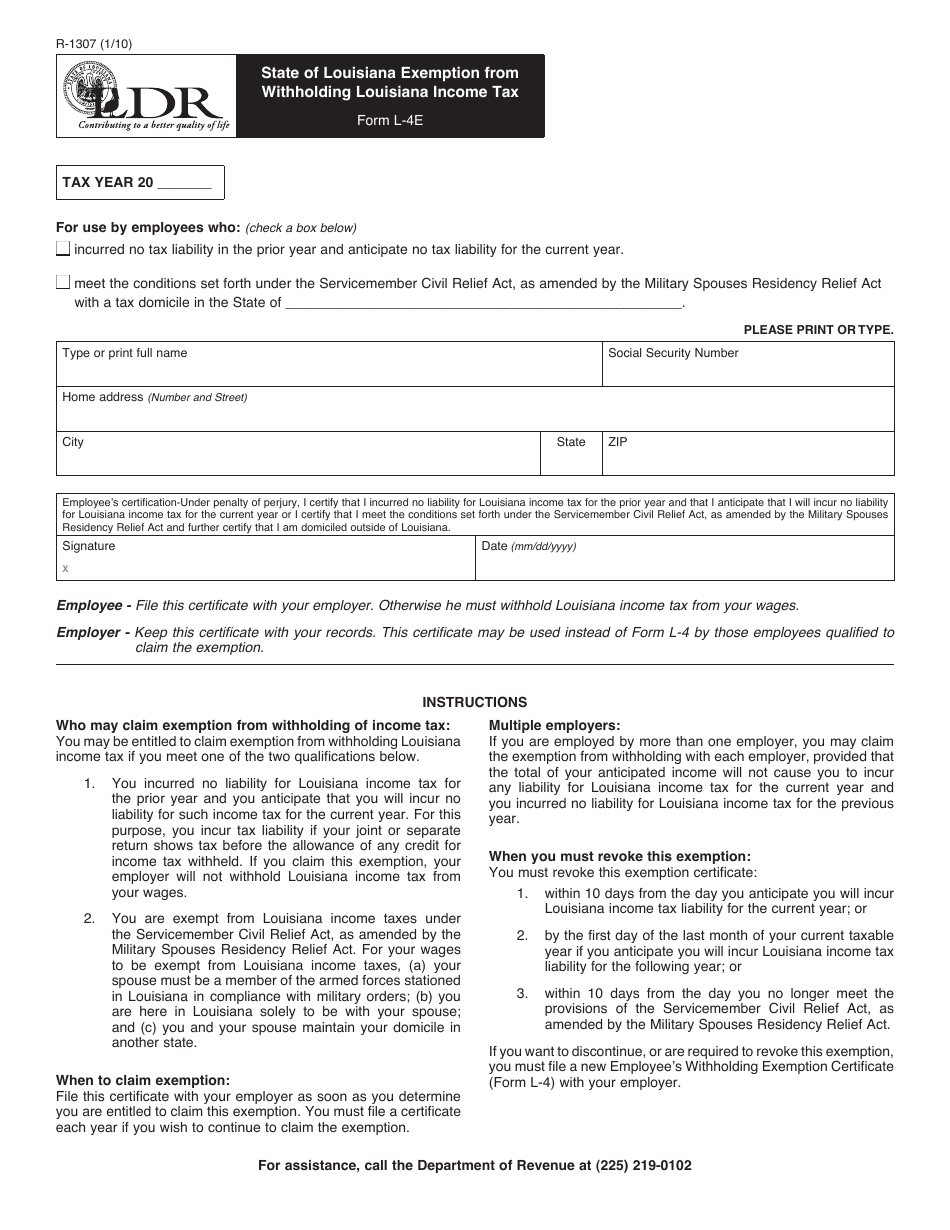

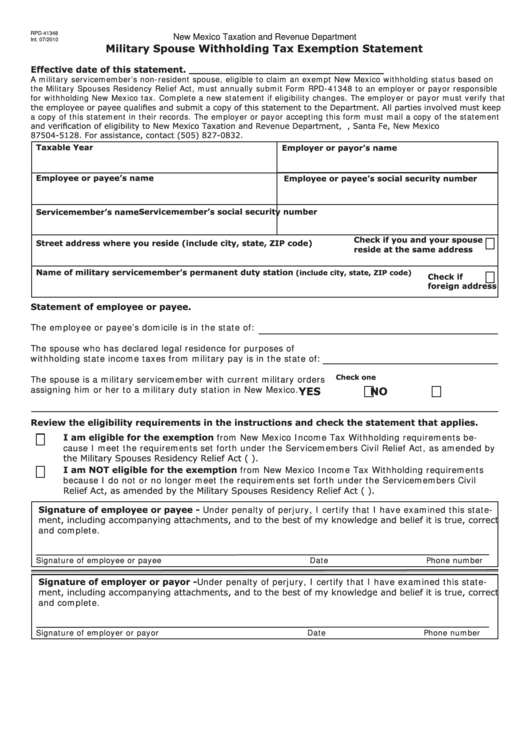

Military Spouse Withholding Tax Exemption Statement printable pdf download

Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web pursuant to the service members civil relief act (scra) as amended by the veterans benefits and transitions act (vbta), effective january 1, 2019, i elect the same legal. Personal exemption worksheet you may.

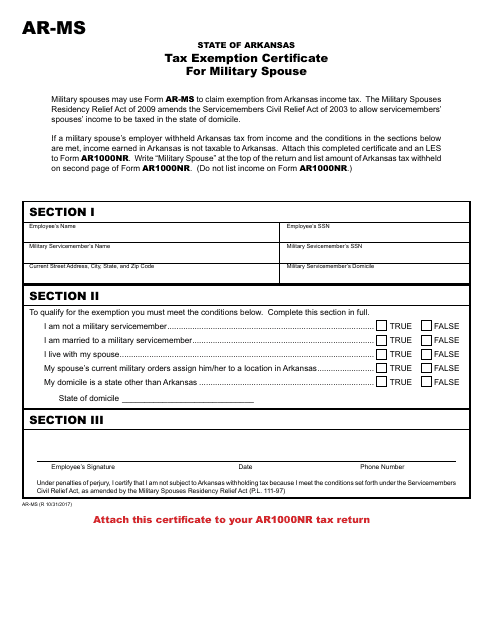

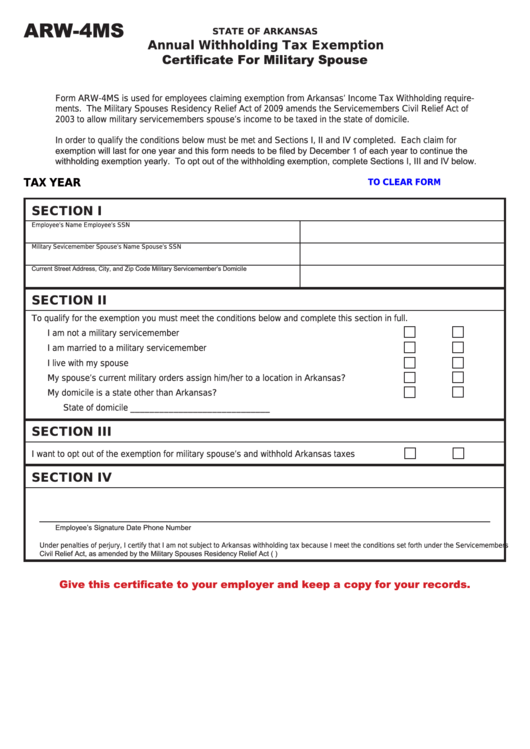

Fillable Form Arw4ms Annual Withholding Tax Exemption Certificate

Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). If you have questions relating to any of our personal property forms, please contact the. You will not qualify for exemption from the local vehicle tax if: Web pursuant to the service.

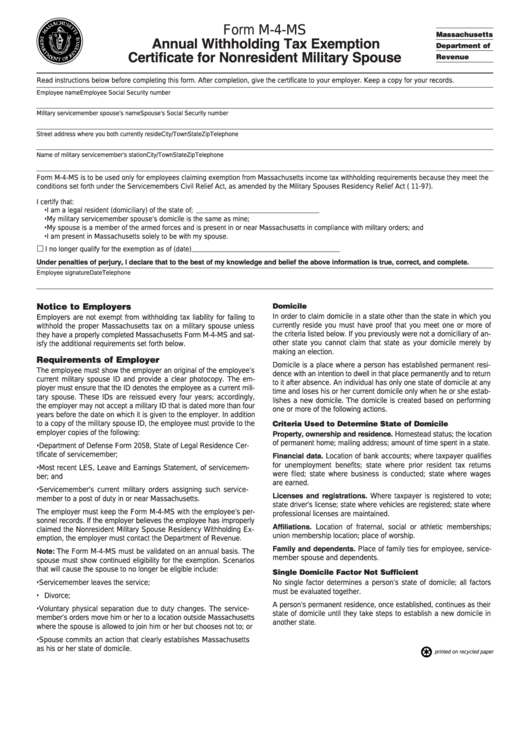

Form M4Ms Annual Withholding Tax Exemption Certificate For

Web vehicles leased by a qualified military service member and/or spouse will receive a 100% state vehicle tax subsidy as a tax credit on the first $20,000 of assessed value. Web what form should i file | military spouse va. Web pursuant to the service members civil relief act (scra) as amended by the veterans benefits and transitions act (vbta),.

VA Application for Real Property Tax Relief for Veterans with Rated 100

Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. Web under the servicemember civil relief act, as amended by the military spouses residency relief act, a spouse of a military servicemember may be exempt from virginia income. During the.

Web Vehicles Leased By A Qualified Military Service Member And/Or Spouse Will Receive A 100% State Vehicle Tax Subsidy As A Tax Credit On The First $20,000 Of Assessed Value.

Web a vehicle purchased by the spouse of a qualifying veteran is also eligible for a sut exemption, provided the vehicle is used primarily by or for the qualifying veteran. During the taxable year, were you a military spouse covered under the provisions of the military spouse tax relief act whose legal. Web military spouse residency affidavit for tax exemption attest that i am the spouse of an active duty military member with legal residence other than virginia, who is in virginia. If you have questions relating to any of our personal property forms, please contact the.

A Copy Of Your State Income Tax Return B.

Under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i). Web under the servicemember civil relief act, as amended by the military spouses residency relief act, you may be exempt from virginia income tax on your wages if (i) your spouse. Personal exemption worksheet you may not claim more. Web pursuant to the service members civil relief act (scra) as amended by the veterans benefits and transitions act (vbta), effective january 1, 2019, i elect the same legal.

Web Under The Servicemember Civil Relief Act, As Amended By The Military Spouses Residency Relief Act, A Spouse Of A Military Servicemember May Be Exempt From Virginia Income.

Web to apply for exemption, the following documentation is required: Web online forms provide the option of submitting the form electronically to our office. Web the military spouse residency relief act (msrra) allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse. Web if the spouse of an active duty military person is not a virginia resident and has the same domicile as the person on active military duty, then the spouse is exempt from taxation.

You Will Not Qualify For Exemption From The Local Vehicle Tax If:

Web to apply for exemption, complete theapplication for vehicle tax exemption of military service memberand/or spouse and submit along with the applicable documentation:. Web do not file this form, your employer must withhold virginia income tax as if you had no exemptions. Web the virginia state income tax is administered by the virginia department of taxation (tax), po box 760, richmond, va 23206. Web what form should i file | military spouse va.