W4 Form Colorado

W4 Form Colorado - Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. For example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. An employee with federal withholding could have. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. This will change how both. If too little is withheld, you will generally owe tax when you file your tax return. That calculation is designed to withhold the required colorado income tax due on your wages throughout. Web to add the 2023 colorado withholding certificate calculations to your employee profiles, select your product below. All out of state employees, please.

Web to add the 2023 colorado withholding certificate calculations to your employee profiles, select your product below. If too little is withheld, you will generally owe tax when you file your tax return. For example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter. An employee with federal withholding could have. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. That calculation is designed to withhold the required colorado income tax due on your wages throughout. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. This will change how both. All out of state employees, please.

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web to add the 2023 colorado withholding certificate calculations to your employee profiles, select your product below. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. That calculation is designed to withhold the required colorado income tax due on your wages throughout. An employee with federal withholding could have. If too little is withheld, you will generally owe tax when you file your tax return. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. This will change how both. For example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter. All out of state employees, please.

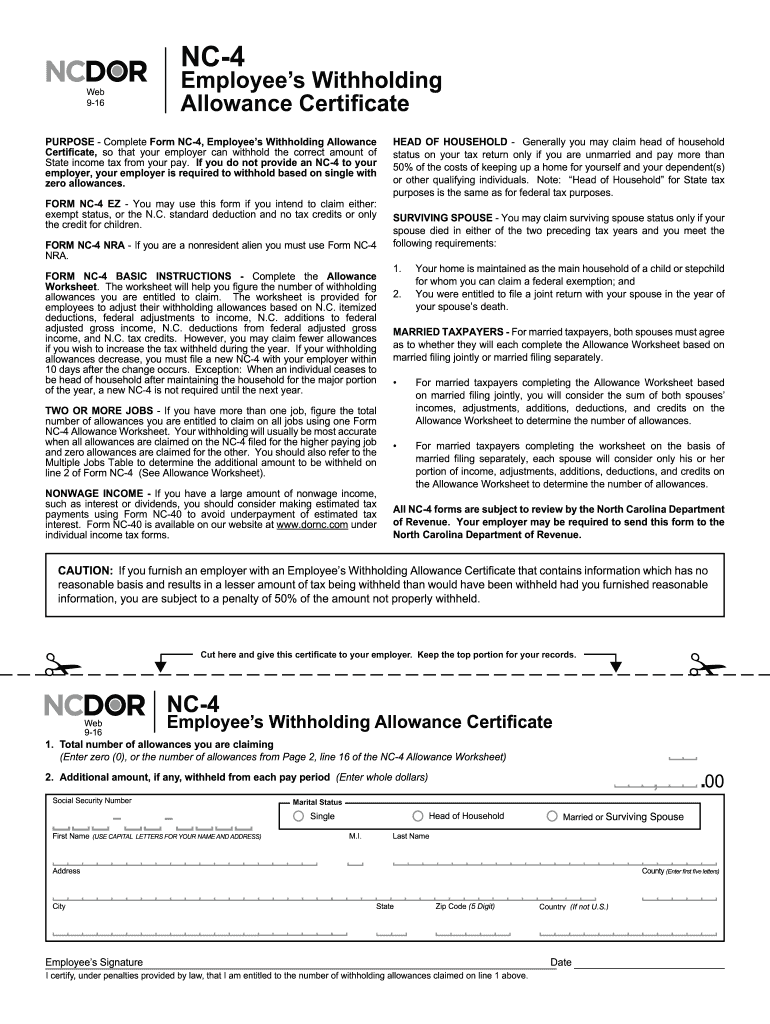

NC DoR NC4 2016 Fill out Tax Template Online US Legal Forms

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. All out of state employees, please. This will change how both. If too little is withheld, you will generally owe tax when you file your tax return. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022.

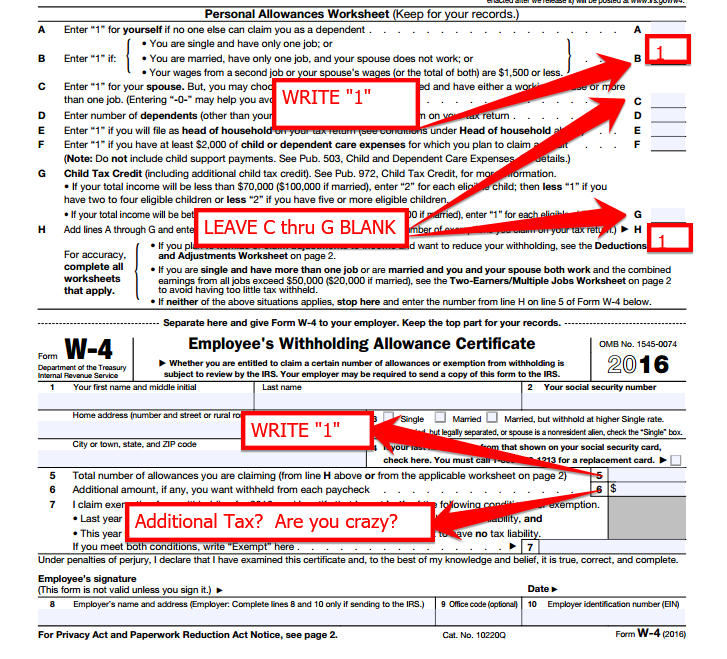

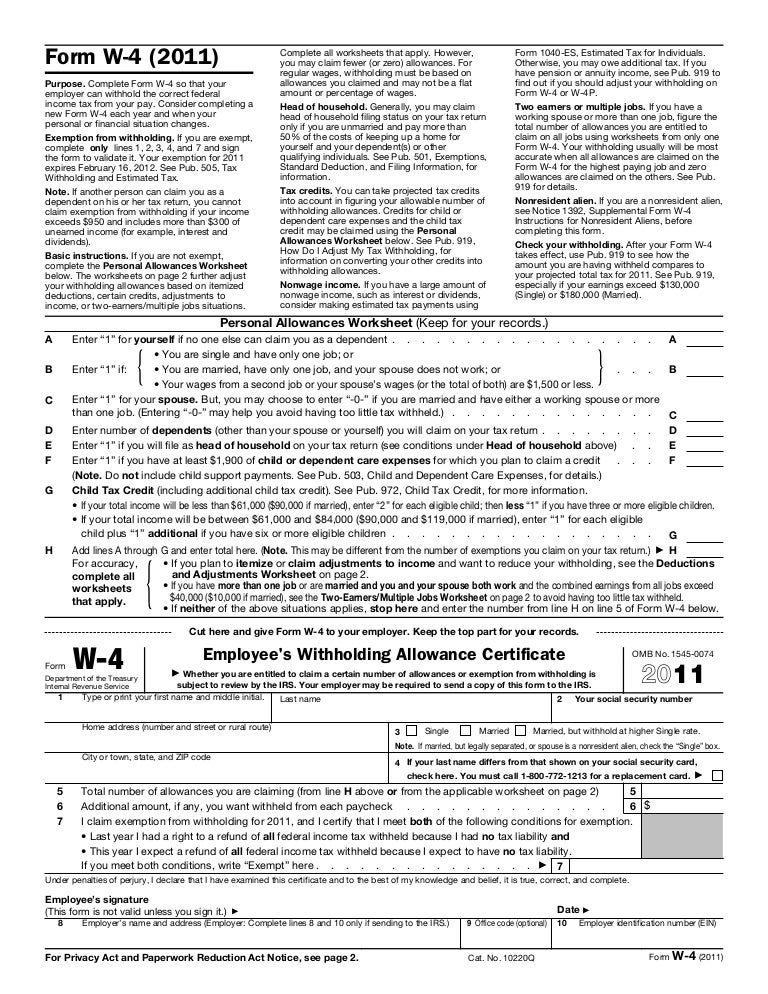

How to do Stuff Simple way to fill out a W4

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. For example, if you earn $60,000 per year.

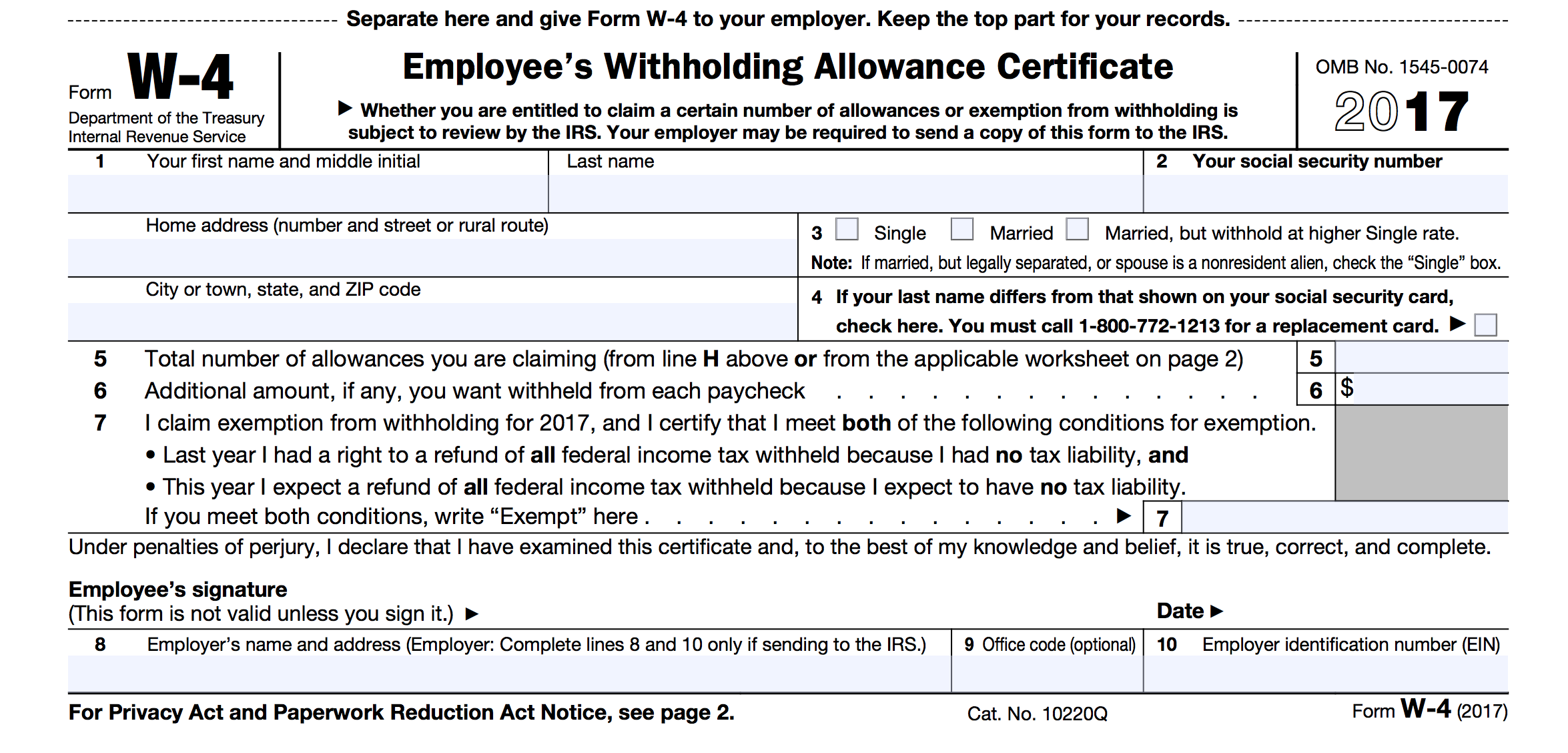

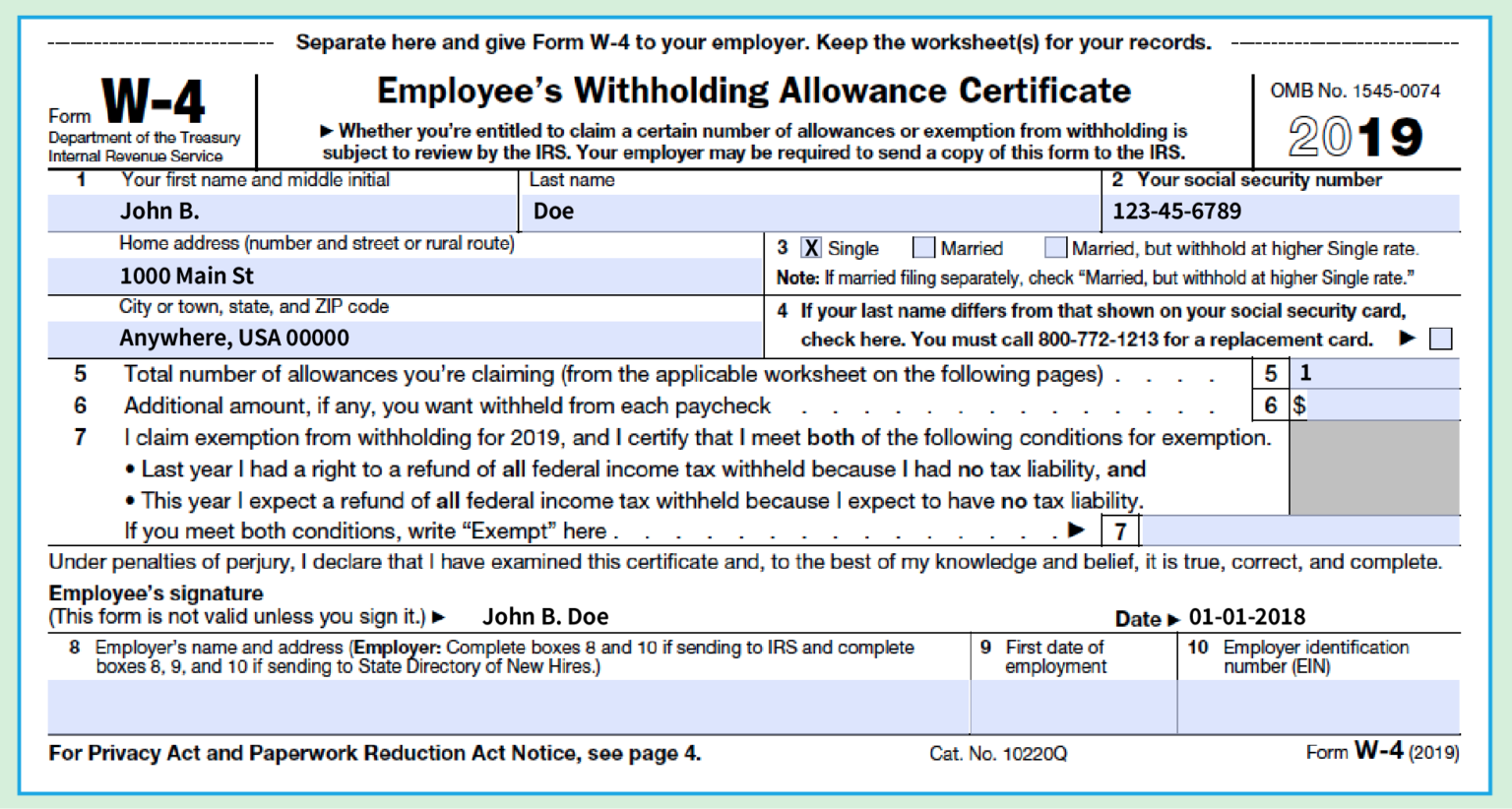

Employee W 4 Forms Printable 2022 W4 Form

An employee with federal withholding could have. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. If too little is withheld, you will generally owe tax when you file your tax return. That calculation is designed to withhold the required colorado income tax due on your wages throughout. All.

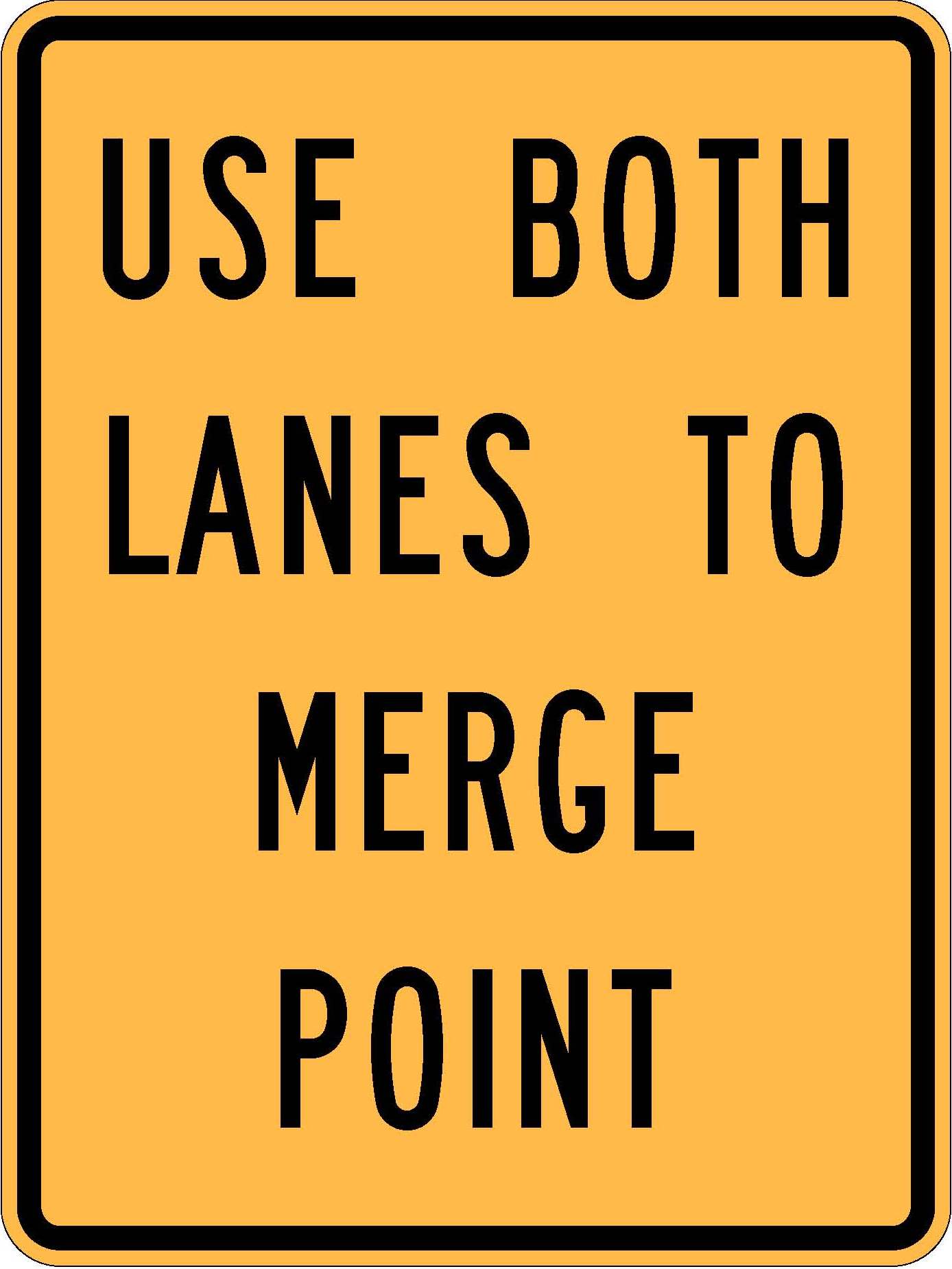

W451 Use Both Lanes To Merge Point.JPEG — Colorado Department of

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. This will change how both. All out of state employees, please. Web to add the 2023 colorado withholding certificate calculations to your employee profiles, select your product below. If too little is withheld, you will generally owe tax when you file your tax return.

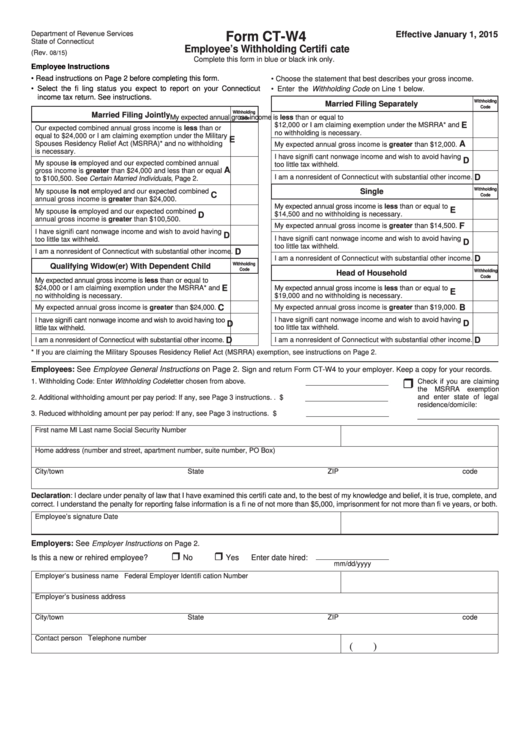

Ct Withholding W4 W4 Form 2021

All out of state employees, please. An employee with federal withholding could have. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. For example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter. Web form dr 0004.

2022 W4 Form IRS W4 Form 2022 Printable

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. All out of state employees, please. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. If too little is withheld, you will generally owe tax when you file your tax return. For example,.

Treasury and IRS unveil new Form W4 for 2020 Tax Pro Today

This will change how both. An employee with federal withholding could have. If too little is withheld, you will generally owe tax when you file your tax return. For example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter. Web form dr 0004 is the new colorado employee.

Form w4

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. If too little is withheld, you will generally owe tax when you file your tax return. This will change how both. That calculation is designed to withhold the required colorado income tax due on your wages throughout. Starting in 2022, an employee may complete.

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. An employee with federal withholding could have. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. This will change how both. All out of state employees, please.

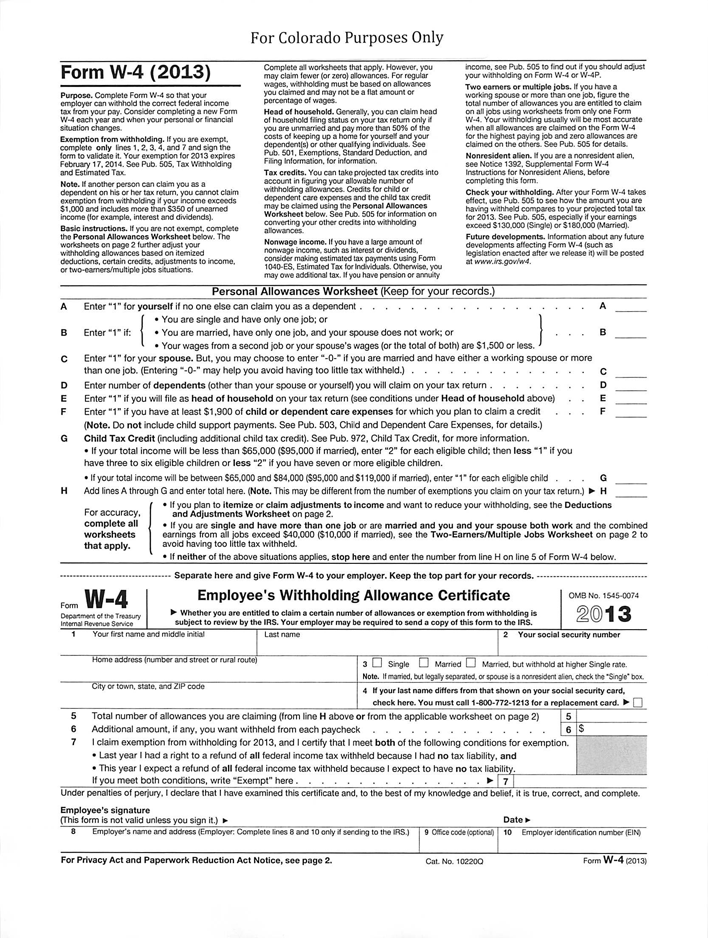

Free Colorado Form w4 (2013) PDF 545KB 1 Page(s)

This will change how both. An employee with federal withholding could have. If too little is withheld, you will generally owe tax when you file your tax return. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. For example, if you earn $60,000 per year and your spouse earns.

Web Form Dr 0004 Is The New Colorado Employee Withholding Certificate That Is Available For 2022.

For example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter. Starting in 2022, an employee may complete a colorado employee withholding certificate (form dr 0004), but it is not required. An employee with federal withholding could have. If too little is withheld, you will generally owe tax when you file your tax return.

This Will Change How Both.

Web to add the 2023 colorado withholding certificate calculations to your employee profiles, select your product below. All out of state employees, please. That calculation is designed to withhold the required colorado income tax due on your wages throughout. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022.