Washington State Chapter 7 Exemptions

Washington State Chapter 7 Exemptions - Web under washington law, the maximum homestead exemption is $125,000 (since july 2007). What are the downsides of chapter 7… The chapter 7 trustee will sell sonya's harley and, after deducting sales costs, recoup $9,250. Web you can find the washington state chapter 7 bankruptcy exemptions which are codified in the washington revised code under: If you are filing independently and you want to keep your car in chapter 7 then you may exempt up to $3,250 of equity in your vehicle, and if you are filing jointly with your spouse the amount is doubled to $6,500. I’m still paying for my car or furniture. (1) wages, salary, or other compensation regularly paid for personal services rendered by the debtor claiming the exemption shall not be claimed as exempt under rcw 6.15.010, but the same may be claimed as exempt. However, the exemptions you claim in. However, exemptions can play a large role in chapter 7 cases because much of your. Sonya owns a harley worth $15,000 free and clear.

Child support obligations and earnings of nonobligated spouse or domestic partner: Sonya owns a harley worth $15,000 free and clear. (see washington exemptions) the trustee sells the assets and pays you, the debtor, any. Web under washington law, the maximum homestead exemption is $125,000 (since july 2007). But her state's motor vehicle exemption is $5,350, leaving $9,650 in unprotected equity. When a bankruptcy exemption doesn't cover the property, you'll either lose it in chapter 7 or have to pay for it in the chapter 13 repayment plan. (these figures will adjust on april 1, 2025.) for comparison purposes, you'll find more federal bankruptcy exemptions here. I’m still paying for my car or furniture. However, the exemptions you claim in. Web by richard symmes | jul 3, 2023 | bankruptcy, blog, chapter 13 bankruptcy, chapter 7 bankruptcy, media & press, seattle debt settlement.

The trustee will give sonya the $5,350 exemption. When do i not need bankruptcy? But her state's motor vehicle exemption is $5,350, leaving $9,650 in unprotected equity. Web if you use the federal homestead exemption, you can protect $27,900 of equity in your personal residence if you file individually. Web while chapter 7 bankruptcy exemptions differ depending on the state or federal exemption system applied, typical exemptions include: Web washington bankruptcy exemptions. When a bankruptcy exemption doesn't cover the property, you'll either lose it in chapter 7 or have to pay for it in the chapter 13 repayment plan. It is also commonly known as the “fresh start” type. Otherwise, the law of the state. Web so what are the vehicle exemption laws for chapter 7 bankruptcy in washington state?

Washington state bill limits measles vaccine exemptions Fox News

The trustee will give sonya the $5,350 exemption. Child support obligations and earnings of nonobligated spouse or domestic partner: If you are filing independently and you want to keep your car in chapter 7 then you may exempt up to $3,250 of equity in your vehicle, and if you are filing jointly with your spouse the amount is doubled to.

Home Washington State Chapter

The trustee will give sonya the $5,350 exemption. Sonya owns a harley worth $15,000 free and clear. Web if you pass the bankruptcy means test in washington, you may qualify to file a chapter 7 bankruptcy, which is preferable to many people in washington as it’s often less expensive than a chapter 13. When a bankruptcy exemption doesn't cover the.

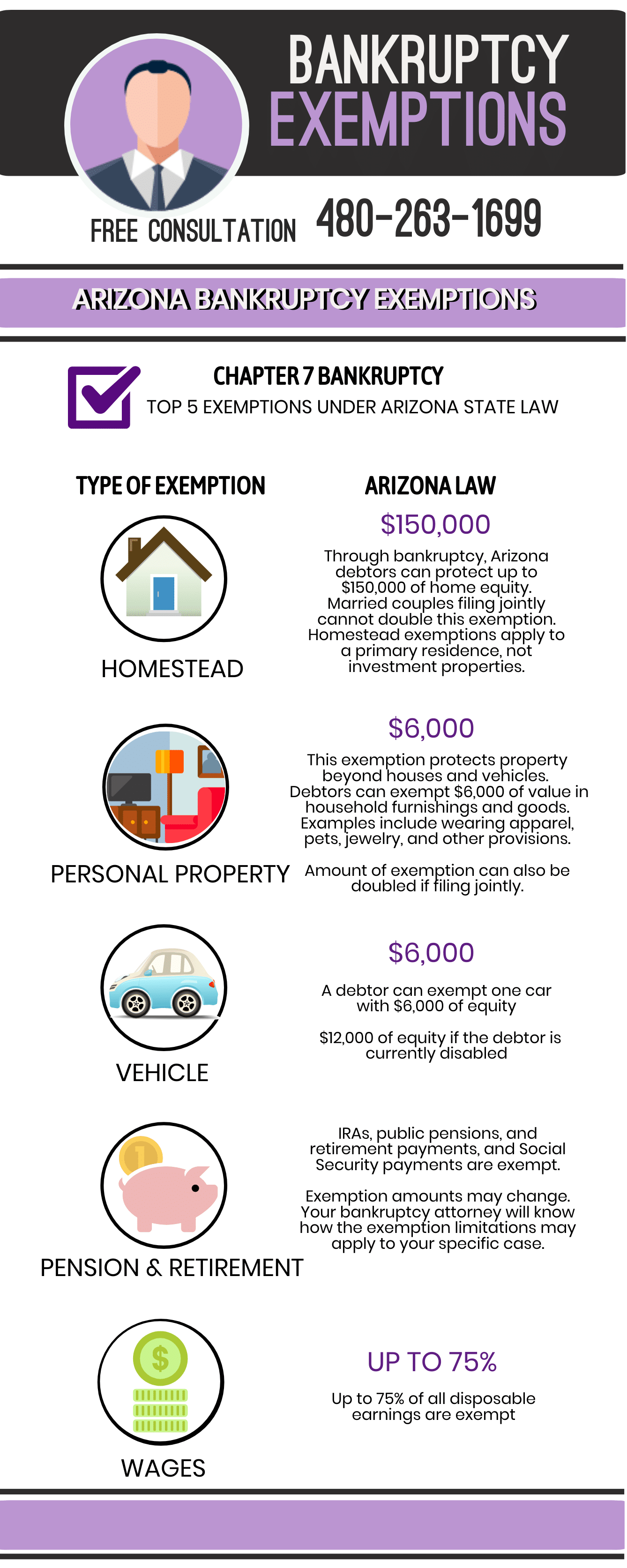

Chapter 7 Bankruptcy Exemptions in Arizona Judge Law Firm

Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. If you are filing independently and you want to keep your car in chapter 7 then you may exempt up to $3,250 of equity in your vehicle, and if you are filing jointly with your spouse the.

How to use Exemptions when Filing for Chapter 13 Bankruptcy Rosenblum Law

Web under washington law, the maximum homestead exemption is $125,000 (since july 2007). Web if you use the federal homestead exemption, you can protect $27,900 of equity in your personal residence if you file individually. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. Does chapter.

New York Bankruptcy Exemption Michael H. Schwartz, P.C.

However, exemptions can play a large role in chapter 7 cases because much of your. However, the exemptions you claim in. Web under washington law, the maximum homestead exemption is $125,000 (since july 2007). What are the downsides of chapter 7… When do i not need bankruptcy?

Washington State University to end ‘personal or philosophical

The trustee will give sonya the $5,350 exemption. What are the downsides of chapter 7… Exemptions from execution, etc., generally: Web when it comes to exemptions in chapter 7 bankruptcy situations, washington legal counsel is essential. Rcw 6.13, rcw 6.15, rcw 6.27, rcw 51.32, rcw 50.40, rcw 48.18, rcw.

Homestead Act and Bankrupty Washington State Exemptions in Bankruptcy

Web if you use the federal homestead exemption, you can protect $27,900 of equity in your personal residence if you file individually. Exemptions from execution, etc., generally: Sonya owns a harley worth $15,000 free and clear. Washington state bankruptcy exemptions will increase on. Rcw 6.13, rcw 6.15, rcw 6.27, rcw 51.32, rcw 50.40, rcw 48.18, rcw.

Washington State Chapter P.E.O. General Info

When a bankruptcy exemption doesn't cover the property, you'll either lose it in chapter 7 or have to pay for it in the chapter 13 repayment plan. But her state's motor vehicle exemption is $5,350, leaving $9,650 in unprotected equity. Child support obligations and earnings of nonobligated spouse or domestic partner: The trustee will give sonya the $5,350 exemption. Web.

What Can Be Exempted in Bankruptcy Phoenix Bankruptcy Attorney

It is also commonly known as the “fresh start” type. Web by richard symmes | jul 3, 2023 | bankruptcy, blog, chapter 13 bankruptcy, chapter 7 bankruptcy, media & press, seattle debt settlement. Chapter 7 bankruptcy enables people or companies to get rid of their debt and start again. You can keep property protected by an exemption or exempt property..

Chapter 7 Exemptions in New York Law Offices of David Brodman

Web under washington law, the maximum homestead exemption is $125,000 (since july 2007). Web by richard symmes | jul 3, 2023 | bankruptcy, blog, chapter 13 bankruptcy, chapter 7 bankruptcy, media & press, seattle debt settlement. Web exemptions under rcw 6.15.010 — limitations on exemptions. Web exempt and nonexempt property. Web if you pass the bankruptcy means test in washington,.

§342(B) For Individuals Filing For.

Web exempt and nonexempt property. Web so what are the vehicle exemption laws for chapter 7 bankruptcy in washington state? I’m still paying for my car or furniture. However, exemptions can play a large role in chapter 7 cases because much of your.

(See Washington Exemptions) The Trustee Sells The Assets And Pays You, The Debtor, Any.

(these figures will adjust on april 1, 2025.) for comparison purposes, you'll find more federal bankruptcy exemptions here. In washington, you can choose to use either the washington bankruptcy exemptions or the federal bankruptcy exemptions. Bankruptcy exemptions allow you to protect your essential property and income like child support, social security, and alimony. A certain amount of home equity a certain amount of a car’s.

Web Under Washington Law, The Maximum Homestead Exemption Is $125,000 (Since July 2007).

When a bankruptcy exemption doesn't cover the property, you'll either lose it in chapter 7 or have to pay for it in the chapter 13 repayment plan. Web chapter 7 bankruptcy is a liquidation where the trustee collects all of your assets and sells any assets which are not exempt. But her state's motor vehicle exemption is $5,350, leaving $9,650 in unprotected equity. Web chapter 7, of the bankruptcy code provides for the “liquidation” or sale of a debtor’s nonexempt property and the distribution of the proceeds to creditors.

Choosing State Or Federal Exemptions.

Washington state bankruptcy exemptions will increase on. When do i not need bankruptcy? I need to file for chapter 7 bankruptcy. (1) wages, salary, or other compensation regularly paid for personal services rendered by the debtor claiming the exemption shall not be claimed as exempt under rcw 6.15.010, but the same may be claimed as exempt.