What Equation Is The Balance Sheet Structured Around

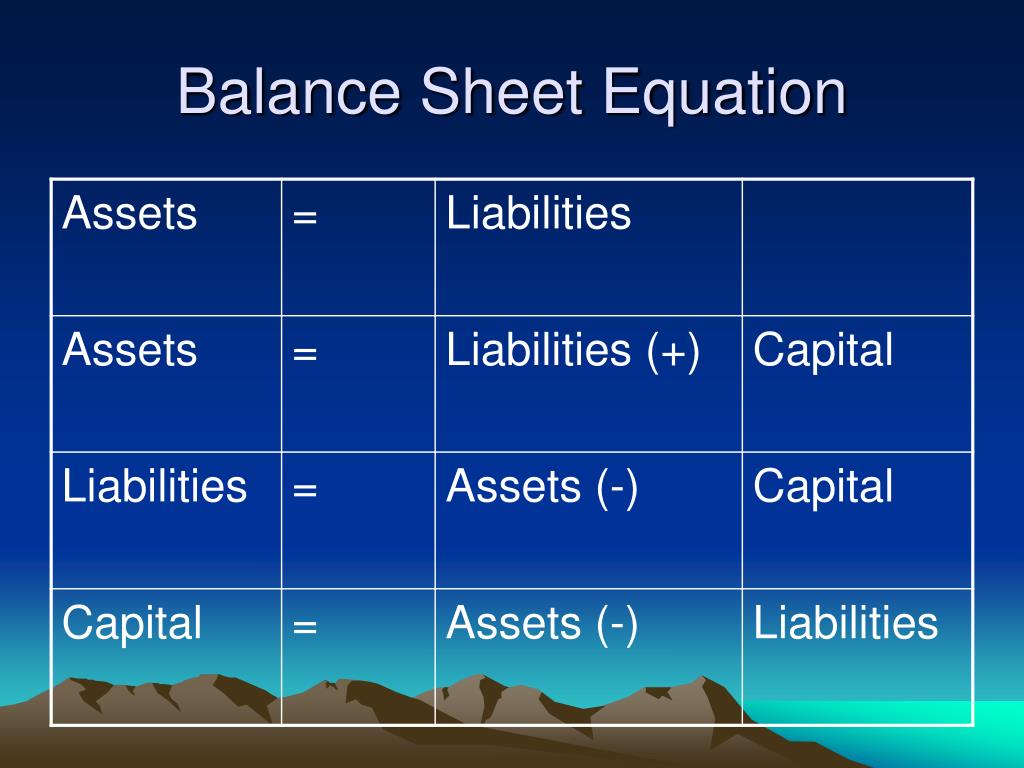

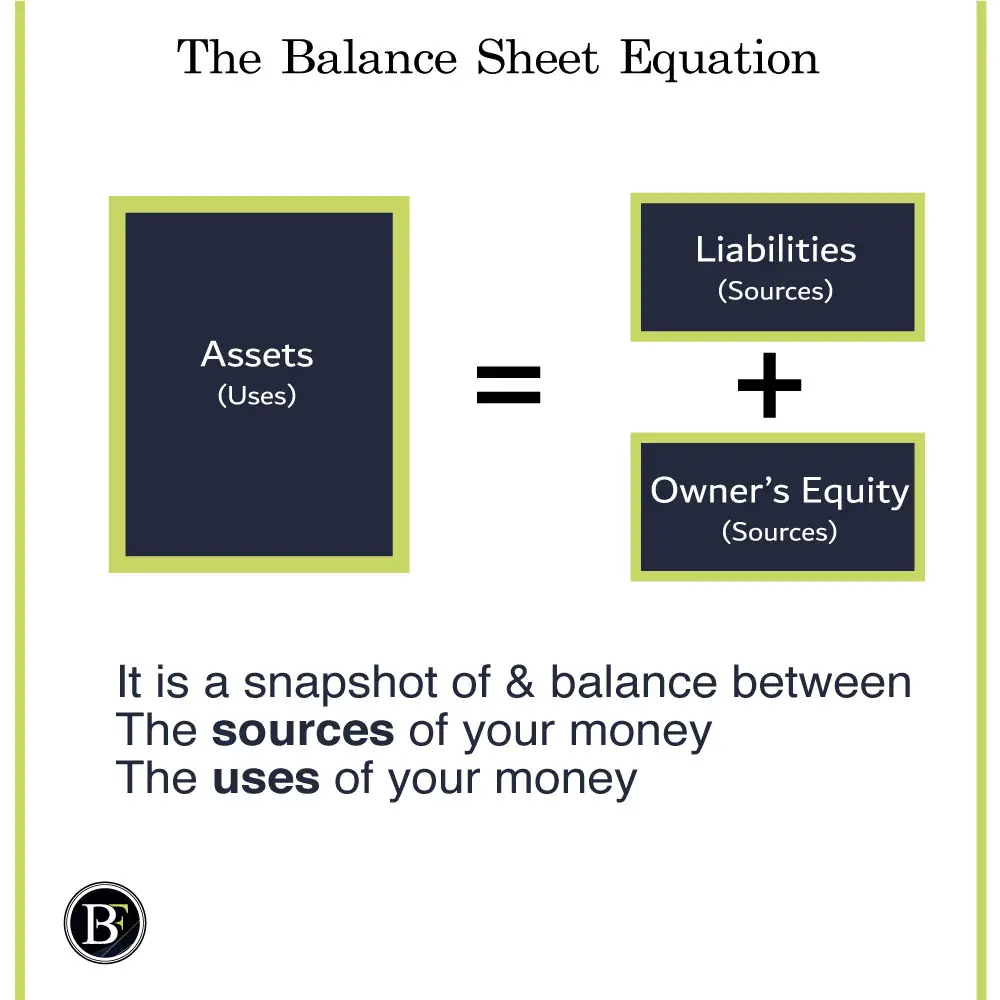

What Equation Is The Balance Sheet Structured Around - Assets = liabilities + owners’ equity. That's because a company has to pay for all the things it. The balance sheet — also ca Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). Assets = liabilities + equity. Web the balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its total assets, i.e., assets = equity + liabilities. The balance sheet formula remains important, and we should consider it this way. Web \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive. Assets = liabilities + equity. Web one type of accounting report is a balance sheet, which is based on the accounting equation:

Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). Assets = liabilities + equity. Assets = liabilities + equity. Web the balance sheet is based on the fundamental equation: Web one type of accounting report is a balance sheet, which is based on the accounting equation: Web the balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its total assets, i.e., assets = equity + liabilities. The balance sheet formula remains important, and we should consider it this way. Assets = liabilities + owners’ equity. Web we can best express the balance sheet as a formula. Web \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive.

Web \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive. That's because a company has to pay for all the things it. Web one type of accounting report is a balance sheet, which is based on the accounting equation: Web we can best express the balance sheet as a formula. The balance sheet formula remains important, and we should consider it this way. Web the balance sheet is based on the fundamental equation: Assets = liabilities + equity. Assets = liabilities + equity. Web the balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its total assets, i.e., assets = equity + liabilities. Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections).

PPT JAIIB PowerPoint Presentation, free download ID2728880

Web we can best express the balance sheet as a formula. The balance sheet formula remains important, and we should consider it this way. The balance sheet — also ca Web the balance sheet is based on the fundamental equation: Web one type of accounting report is a balance sheet, which is based on the accounting equation:

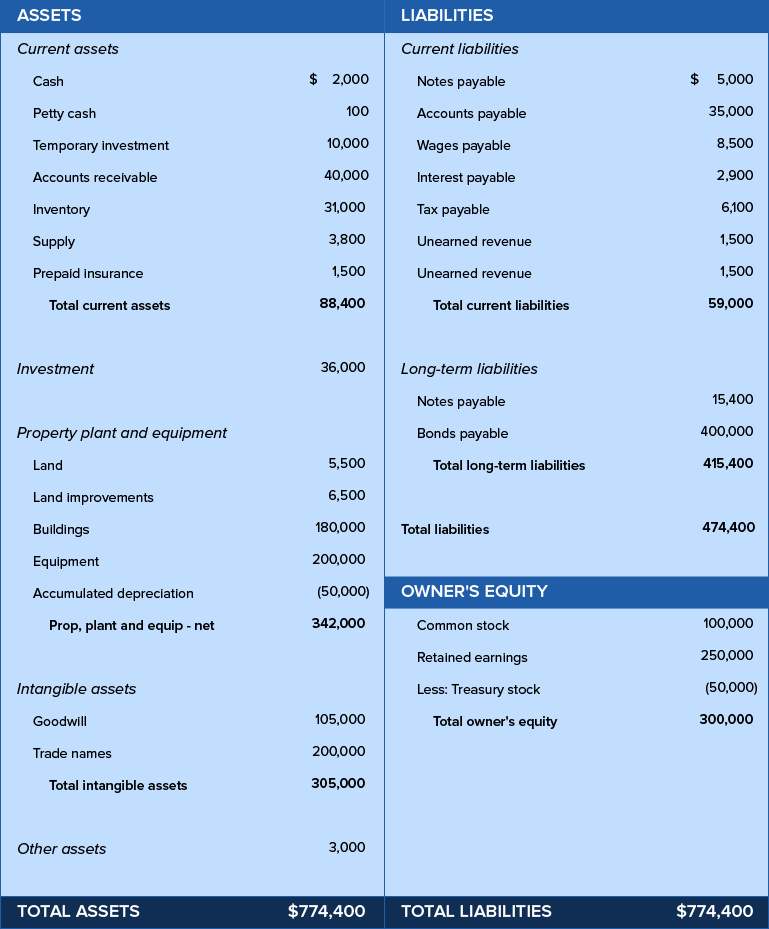

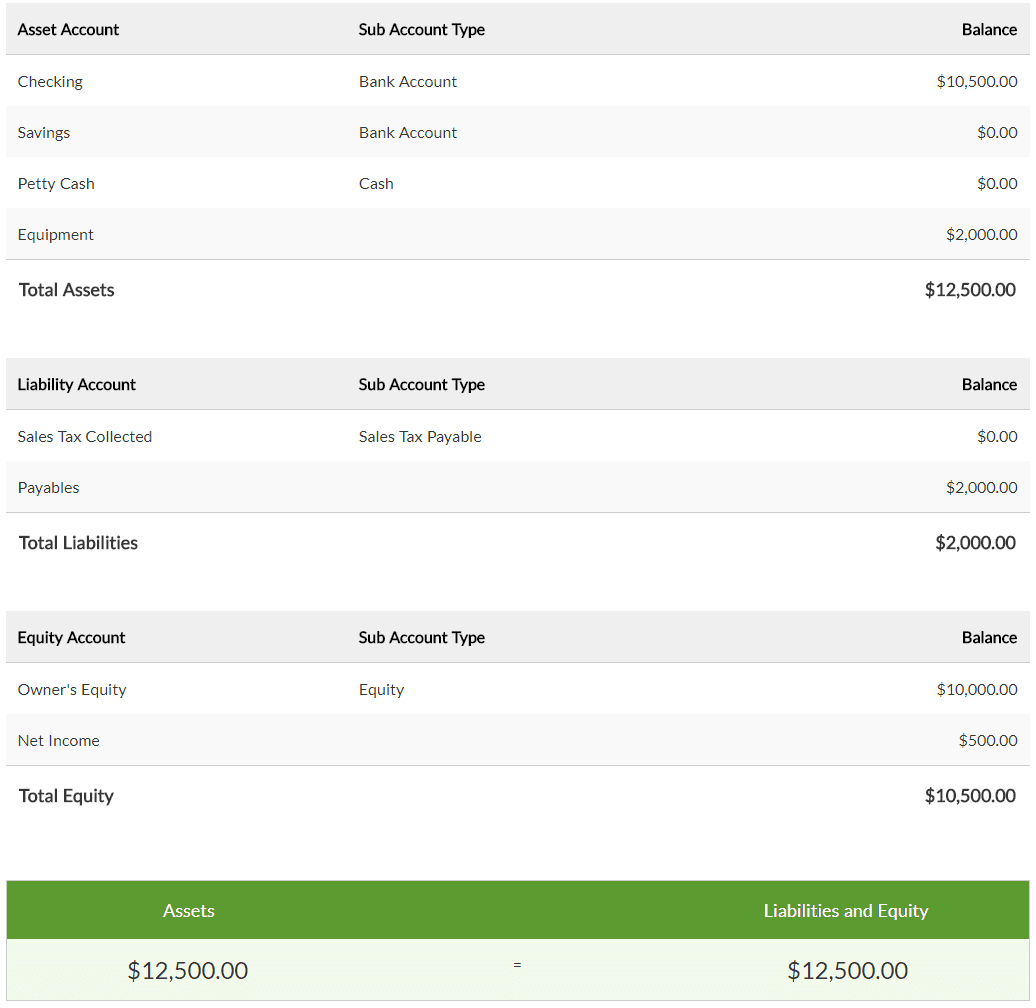

Balance Sheet Definition, Example, Elements of a Balance Sheet Zoho

The balance sheet — also ca Assets = liabilities + equity. Web \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive. That's because a company has to pay for all the things it. Assets = liabilities + equity.

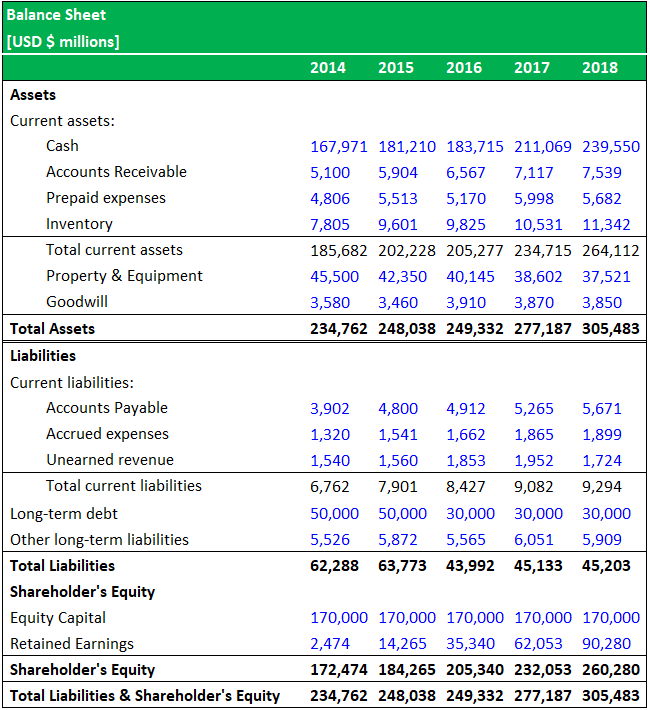

Balance Sheet Equation Explained Tessshebaylo

That's because a company has to pay for all the things it. Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). The balance sheet formula remains important, and we should consider it this way. Web the balance sheet is based on the fundamental equation: Assets = liabilities + owners’ equity.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Assets = liabilities + equity. Assets = liabilities + owners’ equity. The balance sheet — also ca The balance sheet formula remains important, and we should consider it this way. Web the balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its.

Balance Sheet Example Wise

Assets = liabilities + owners’ equity. Assets = liabilities + equity. Assets = liabilities + equity. Web the balance sheet formula is a fundamental accounting equation that mentions that, for a business, the sum of its owner’s equity & the total liabilities is equal to its total assets, i.e., assets = equity + liabilities. The balance sheet formula remains important,.

General 05/11/11

That's because a company has to pay for all the things it. Assets = liabilities + owners’ equity. The balance sheet — also ca Web we can best express the balance sheet as a formula. Web one type of accounting report is a balance sheet, which is based on the accounting equation:

balance sheet equation example

The balance sheet formula remains important, and we should consider it this way. Web we can best express the balance sheet as a formula. Assets = liabilities + owners’ equity. Assets = liabilities + equity. Web one type of accounting report is a balance sheet, which is based on the accounting equation:

The 3 Components of the Balance Sheet Explained

Assets = liabilities + equity. Assets = liabilities + owners’ equity. Web the balance sheet is based on the fundamental equation: The balance sheet formula remains important, and we should consider it this way. The balance sheet — also ca

Chapter 9 Accounting and Cash Flow Small Business Management

Web one type of accounting report is a balance sheet, which is based on the accounting equation: The balance sheet — also ca Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). The balance sheet formula remains important, and we should consider it this way. Web \text {assets} = \text {liabilities} + \text.

Pt. 2 Balance Sheet Equation and Ratios

Web we can best express the balance sheet as a formula. Assets = liabilities + owners’ equity. Web one type of accounting report is a balance sheet, which is based on the accounting equation: That's because a company has to pay for all the things it. Cfi’s financial analysis course as such, the balance sheet is divided into two sides.

Web \Text {Assets} = \Text {Liabilities} + \Text {Shareholders' Equity} Assets = Liabilities +Shareholders’ Equity This Formula Is Intuitive.

Assets = liabilities + owners’ equity. Cfi’s financial analysis course as such, the balance sheet is divided into two sides (or sections). That's because a company has to pay for all the things it. Assets = liabilities + equity.

Web We Can Best Express The Balance Sheet As A Formula.

The balance sheet formula remains important, and we should consider it this way. Assets = liabilities + equity. Web one type of accounting report is a balance sheet, which is based on the accounting equation: Web the balance sheet is based on the fundamental equation:

Web The Balance Sheet Formula Is A Fundamental Accounting Equation That Mentions That, For A Business, The Sum Of Its Owner’s Equity & The Total Liabilities Is Equal To Its Total Assets, I.e., Assets = Equity + Liabilities.

The balance sheet — also ca