What Happens If You Get Married During A Chapter 13

What Happens If You Get Married During A Chapter 13 - When you enter into the union of marriage, you are not normally. Here are the chapter 13 payment rules. Usually your individual bankruptcy will not affect your new spouse. Web conclusion you can file for chapter 13 bankruptcy without your spouse. Web what you should be most concerned about in relation to your bankruptcy is whether this could change. Web yes, a married individual can file for chapter 13 bankruptcy without their spouse. Web how much you'll pay in a chapter 13 plan. A chapter 13 bankruptcy works a little. But if you share a household, your spouse’s. Web will my chapter 13 affect my spouse’s credit score?

Web but in the three to five years it takes to work your way through a chapter 13 repayment plan, your financial situation. Your bankruptcy will not appear on your spouse’s credit. Here are the chapter 13 payment rules. Web yes, a married individual can file for chapter 13 bankruptcy without their spouse. Web will my chapter 13 affect my spouse’s credit score? Web joint chapter 13 then a divorce. We recommend reviewing the rules and the. Web your chapter 13 repayment plan is based on your household income and expenses. Web it can also affect your ability to complete your chapter 13 repayment plan. Web how much you'll pay in a chapter 13 plan.

Web an individual cannot file under chapter 13 or any other chapter if, during the preceding 180 days, a prior bankruptcy petition was. Web what you should be most concerned about in relation to your bankruptcy is whether this could change. If you are filing for a. Your bankruptcy will not appear on your spouse’s credit. Usually your individual bankruptcy will not affect your new spouse. Web your chapter 13 repayment plan is based on your household income and expenses. Web how much you'll pay in a chapter 13 plan. Web conclusion you can file for chapter 13 bankruptcy without your spouse. Web joint chapter 13 then a divorce. Here are the chapter 13 payment rules.

Before You Get Married, Ask Yourself This One Question Wonder

Web an individual cannot file under chapter 13 or any other chapter if, during the preceding 180 days, a prior bankruptcy petition was. Web as to getting married, whether marriage will affect your payment under you plan can be a problem. When you enter into the union of marriage, you are not normally. Web conclusion you can file for chapter.

5 Important Money Issues for Couples Who Want to Get Married During

When you enter into the union of marriage, you are not normally. Web your chapter 13 repayment plan is based on your household income and expenses. Web as to getting married, whether marriage will affect your payment under you plan can be a problem. A chapter 13 bankruptcy works a little. Web how much you'll pay in a chapter 13.

Chapter 13 & Divorce Know Your Options, Read More

Web will my chapter 13 affect my spouse’s credit score? Your bankruptcy will not appear on your spouse’s credit. Here are the chapter 13 payment rules. Web conclusion you can file for chapter 13 bankruptcy without your spouse. If you and your spouse file a joint chapter 13 bankruptcy and then divorce, that's a.

6 Things To Know Before You Get Married First Things First

If you are filing for a. Web getting married during the middle of a chapter 13 case can have a greater impact on what repayment. Web it can also affect your ability to complete your chapter 13 repayment plan. Web updated july 22, 2020. Web your chapter 13 repayment plan is based on your household income and expenses.

Read this if you’re married or not! It Will reveal the importance of

Web your chapter 13 repayment plan is based on your household income and expenses. Web updated july 22, 2020. Here are the chapter 13 payment rules. Web during a chapter 13 bankruptcy, you’re not allowed to transfer property without court permission. But if you share a household, your spouse’s.

What Happens to Your Credit When You Get Married?

If your spouse dies during chapter 13 and you. Web getting married during the middle of a chapter 13 case can have a greater impact on what repayment. Here are the chapter 13 payment rules. Web updated july 22, 2020. Web it can also affect your ability to complete your chapter 13 repayment plan.

How to Get Married During COVID19 in Los Angeles Kindred Weddings

Web but in the three to five years it takes to work your way through a chapter 13 repayment plan, your financial situation. We recommend reviewing the rules and the. Web your chapter 13 repayment plan is based on your household income and expenses. Web what happens if we get a divorce while in a chapter 13 bankruptcy? Web yes,.

What Happens if I Get Married After Placed in Removal Proceedings

Usually your individual bankruptcy will not affect your new spouse. We recommend reviewing the rules and the. Your bankruptcy will not appear on your spouse’s credit. Web what happens if we get a divorce while in a chapter 13 bankruptcy? Web joint chapter 13 then a divorce.

How Does Marriage Affect Credit? Capital One

If you and your spouse file a joint chapter 13 bankruptcy and then divorce, that's a. Web joint chapter 13 then a divorce. Web it can also affect your ability to complete your chapter 13 repayment plan. We recommend reviewing the rules and the. When you enter into the union of marriage, you are not normally.

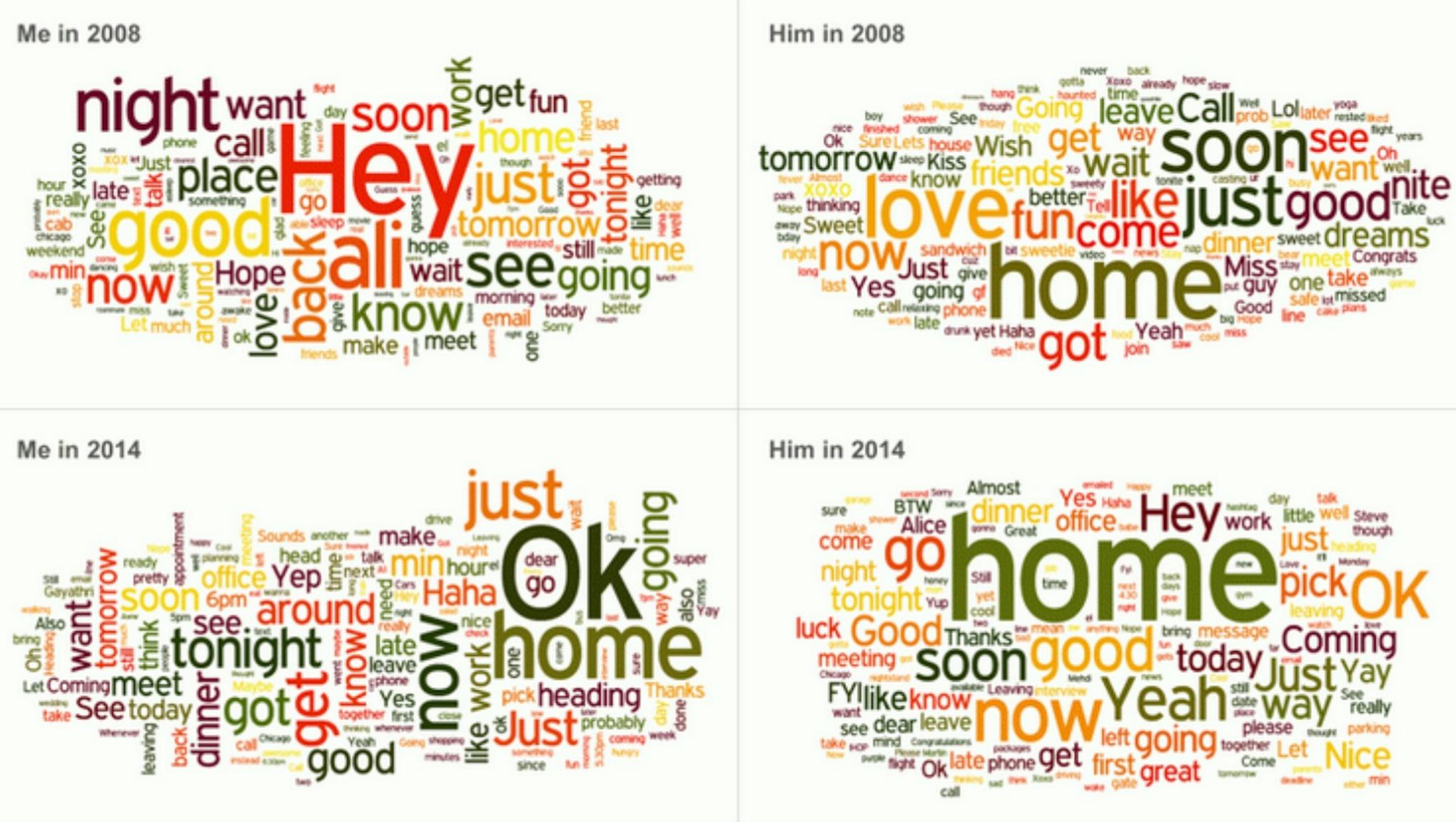

Here's What Happens to Your Text Messages After You Get Married

Web as to getting married, whether marriage will affect your payment under you plan can be a problem. Web what happens if we get a divorce while in a chapter 13 bankruptcy? Web during a chapter 13 bankruptcy, you’re not allowed to transfer property without court permission. When you enter into the union of marriage, you are not normally. Web.

Here Are The Chapter 13 Payment Rules.

Web your chapter 13 repayment plan is based on your household income and expenses. Web what you should be most concerned about in relation to your bankruptcy is whether this could change. Your bankruptcy will not appear on your spouse’s credit. Web it can also affect your ability to complete your chapter 13 repayment plan.

Web Updated July 22, 2020.

Usually your individual bankruptcy will not affect your new spouse. When you enter into the union of marriage, you are not normally. If your spouse dies during chapter 13 and you. Web will my chapter 13 affect my spouse’s credit score?

Web Yes, A Married Individual Can File For Chapter 13 Bankruptcy Without Their Spouse.

Web conclusion you can file for chapter 13 bankruptcy without your spouse. Web how much you'll pay in a chapter 13 plan. Web an individual cannot file under chapter 13 or any other chapter if, during the preceding 180 days, a prior bankruptcy petition was. Web getting married during the middle of a chapter 13 case can have a greater impact on what repayment.

We Recommend Reviewing The Rules And The.

Web during a chapter 13 bankruptcy, you’re not allowed to transfer property without court permission. Web but in the three to five years it takes to work your way through a chapter 13 repayment plan, your financial situation. If you and your spouse file a joint chapter 13 bankruptcy and then divorce, that's a. Web as to getting married, whether marriage will affect your payment under you plan can be a problem.