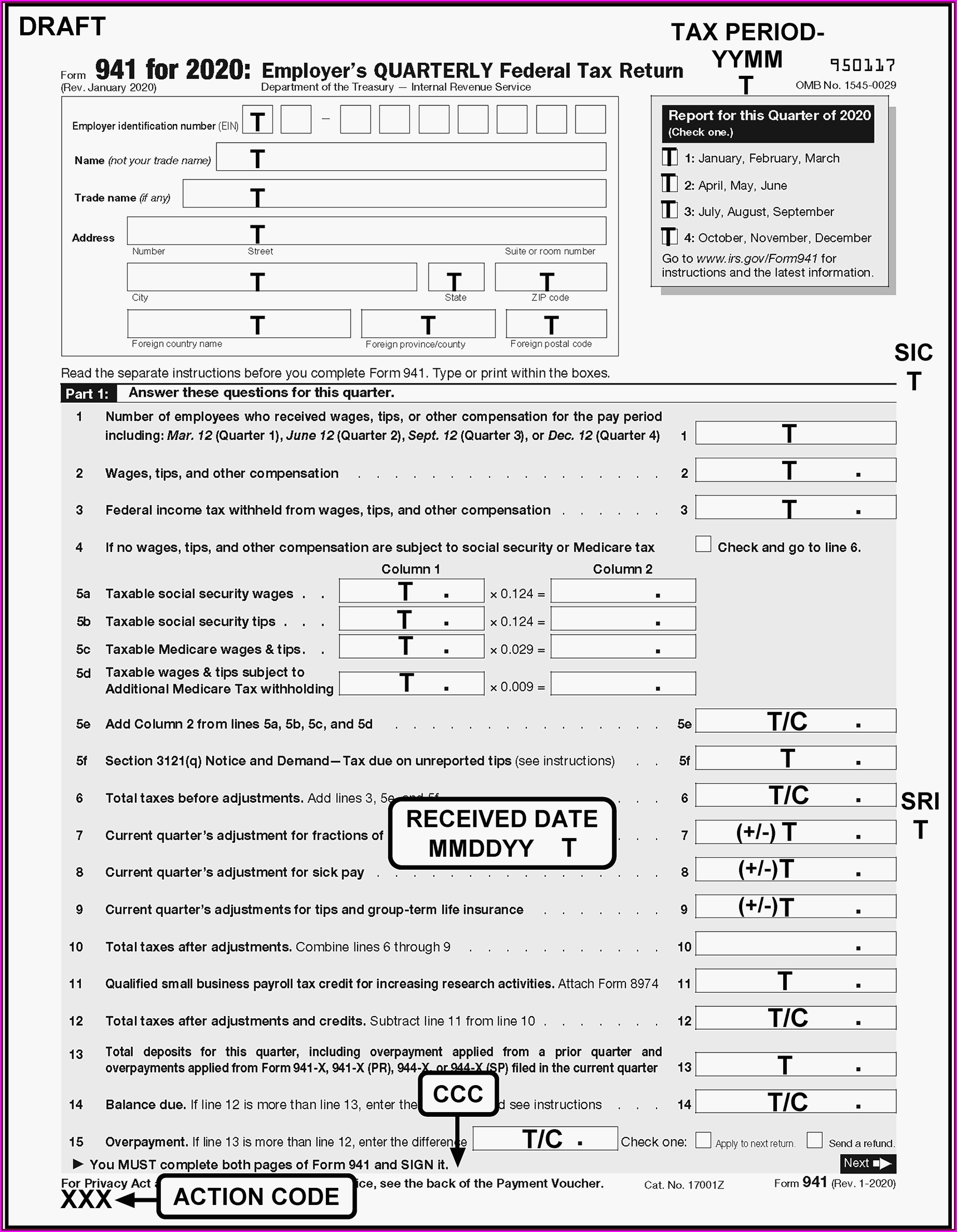

What Is A 941 X Form

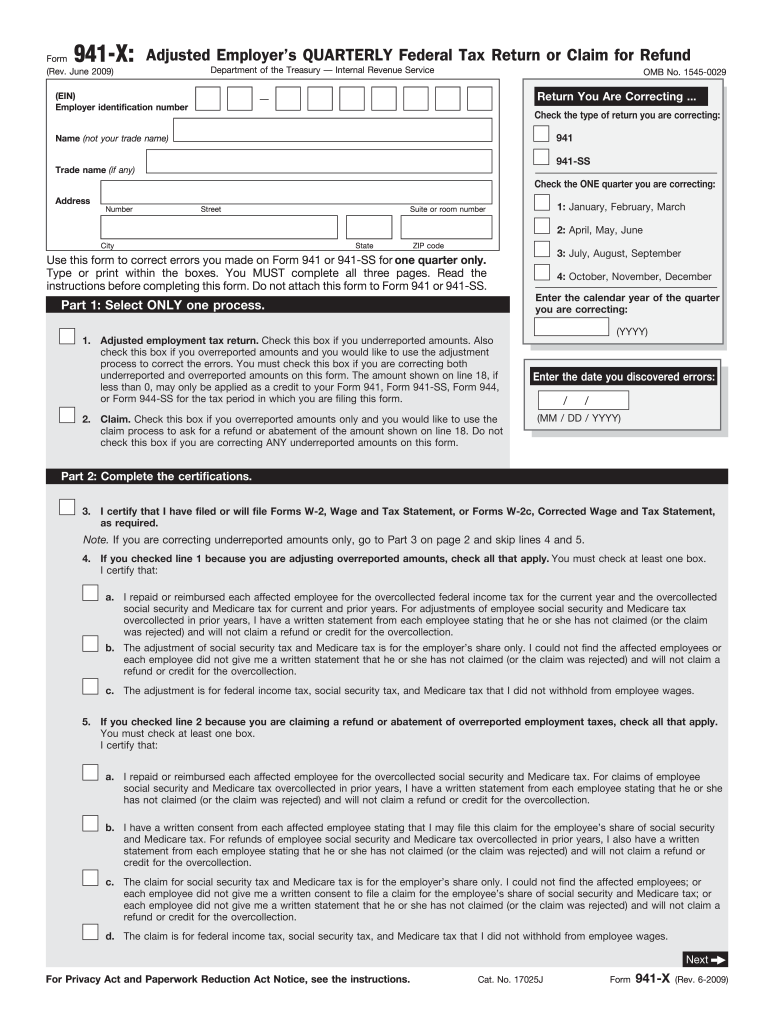

What Is A 941 X Form - Certain employers whose annual payroll tax and withholding. Ad get ready for tax season deadlines by completing any required tax forms today. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. If you have figured out. If you are located in. Web overview you must file irs form 941 if you operate a business and have employees working for you. File 941 x for employee retention credit is it possible to file both an erc and a.

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. If you are located in. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web hub taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. If you find an error on a. File 941 x for employee retention credit is it possible to file both an erc and a. Ad access irs tax forms. Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web hub taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Employers use this form to report. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Form 941 is used by employers. Get ready for tax season deadlines by completing any required tax forms today. Certain employers whose annual payroll tax and withholding.

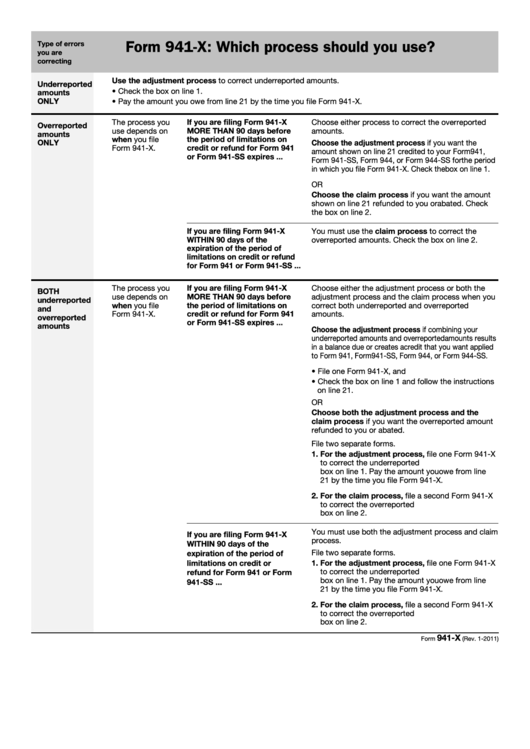

Instructions For Form 941X Adjusted Employer'S Quarterly Federal Tax

Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you have figured out. Ad access irs tax forms. Web hub taxes march 28, 2019 form 941 is a.

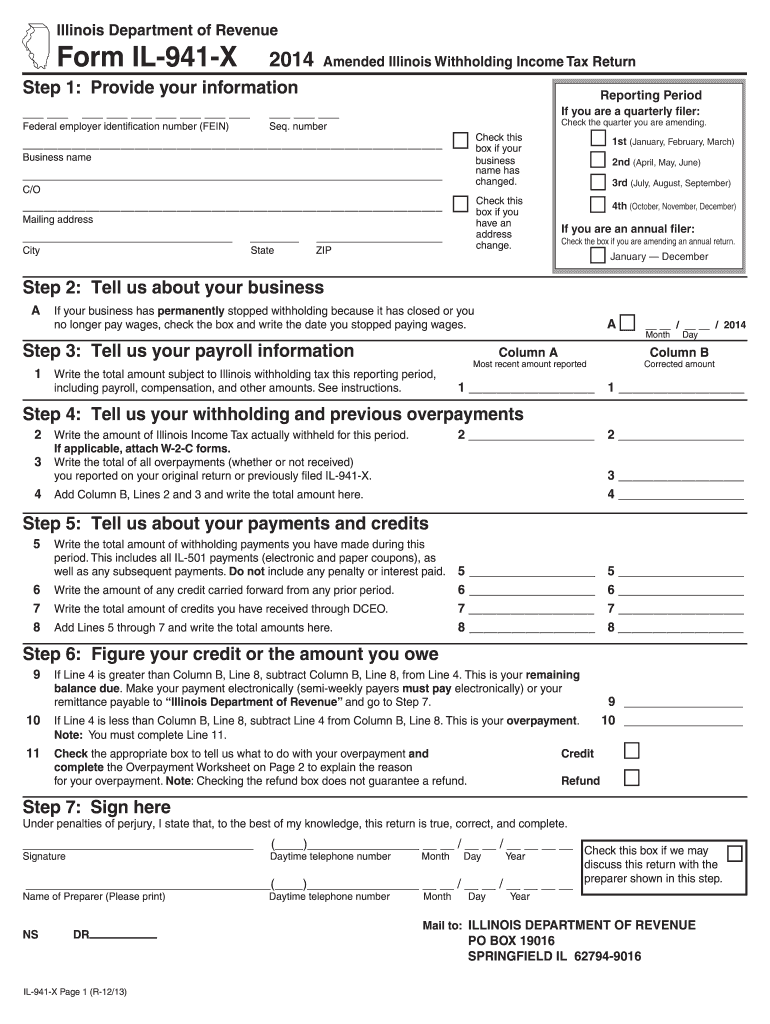

Il 941 X Form Fill Out and Sign Printable PDF Template signNow

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Filing deadlines are in april, july, october and january. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Employers use this form to report. Certain employers whose annual payroll tax and withholding.

How to fill out IRS Form 941 2019 PDF Expert

Web overview you must file irs form 941 if you operate a business and have employees working for you. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employers use this form to report. Web.

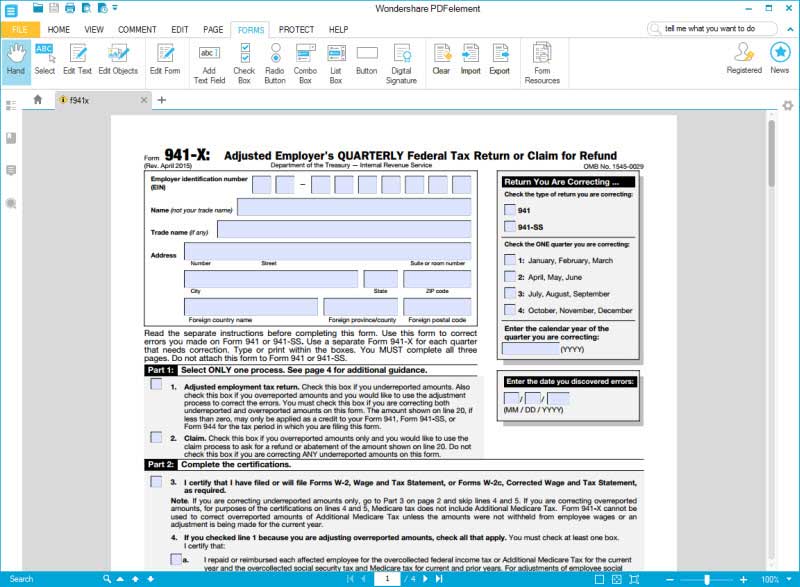

IRS Form 941X Learn How to Fill it Easily

Ad access irs tax forms. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Certain employers whose annual payroll tax and withholding. Employee wages, income tax withheld from wages,.

Form 941X Edit, Fill, Sign Online Handypdf

Web understanding tax credits and their impact on form 941. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Web overview you must file irs form 941 if you operate a business and have employees working for you. If you are located in. Complete, edit or print tax forms instantly.

Form 941 X mailing address Fill online, Printable, Fillable Blank

Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Filing deadlines are in april, july, october and january. The sum of line 30 and line 31 multiplied by.

What You Need to Know About Just Released IRS Form 941X Blog

Certain employers whose annual payroll tax and withholding. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. If you are located in. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Employers use this form to report. Ad access irs tax forms. If you find an error on a.

IRS Form 941X Complete & Print 941X for 2021

Employers use this form to report. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Get ready for tax season deadlines by completing any required tax forms today. July 2020) adjusted.

Form 941 X Fill Out and Sign Printable PDF Template signNow

Get ready for tax season deadlines by completing any required tax forms today. Employers use this form to report. Ad get ready for tax season deadlines by completing any required tax forms today. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Tax credits are powerful incentives.

Filing Deadlines Are In April, July, October And January.

Ad get ready for tax season deadlines by completing any required tax forms today. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Ad access irs tax forms. If you have figured out.

Form 941 Is Used By Employers.

The sum of line 30 and line 31 multiplied by the credit. File 941 x for employee retention credit is it possible to file both an erc and a. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Web overview you must file irs form 941 if you operate a business and have employees working for you.

Employee Wages, Income Tax Withheld From Wages, Taxable Social Security Wages, Taxable Social Security Tips, Taxable Medicare Wages And Tips,.

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web hub taxes march 28, 2019 form 941 is a internal revenue service (irs) tax form for employers in the u.s. If you find an error on a. Complete, edit or print tax forms instantly.

Connecticut, Delaware, District Of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine,.

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Complete, edit or print tax forms instantly. If you are located in. Web understanding tax credits and their impact on form 941.