What Is A Form 1099 Composite

What Is A Form 1099 Composite - Web your form 1099 composite is simply multiple forms in one document. Web if not, you're in the right place. Web how do i enter information from a 1099 composite? Web you'll receive a form 1099 if you earned money from a nonemployer source. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. It is one page with the 3 sections on it. Web bookmark icon johnw152 expert alumni it's fairly straightforward. A composite has more than one type of 1099. Web a 1099 form is used to document income received outside of a permanent salaried job. Depending on what’s happened in your financial life during.

Web the composite 1099 form is a consolidation of various forms 1099 and summarizes relevant account information for the past year. The document should contain three separate tax documents that. Depending on what’s happened in your financial life during. Upload, modify or create forms. You will take each form and enter it as if it were distributed on its own. You likely have a 1099. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web how do i enter information from a 1099 composite? Web in the united states, corporations, small businesses and other employers use a variety of forms to record the income earned by employees and independent. Please see this answer from richardg.

Please see this answer from richardg. There are many different types of 1099 forms. Web a 1099 form is used to document income received outside of a permanent salaried job. Substitute payments in lieu of dividends may be reported on a composite. Web bookmark icon johnw152 expert alumni it's fairly straightforward. This includes the associated cost basis. You will take each form and enter it as if it were distributed on its own. The document should contain three separate tax documents that. Here are some common types of 1099 forms: You likely have a 1099.

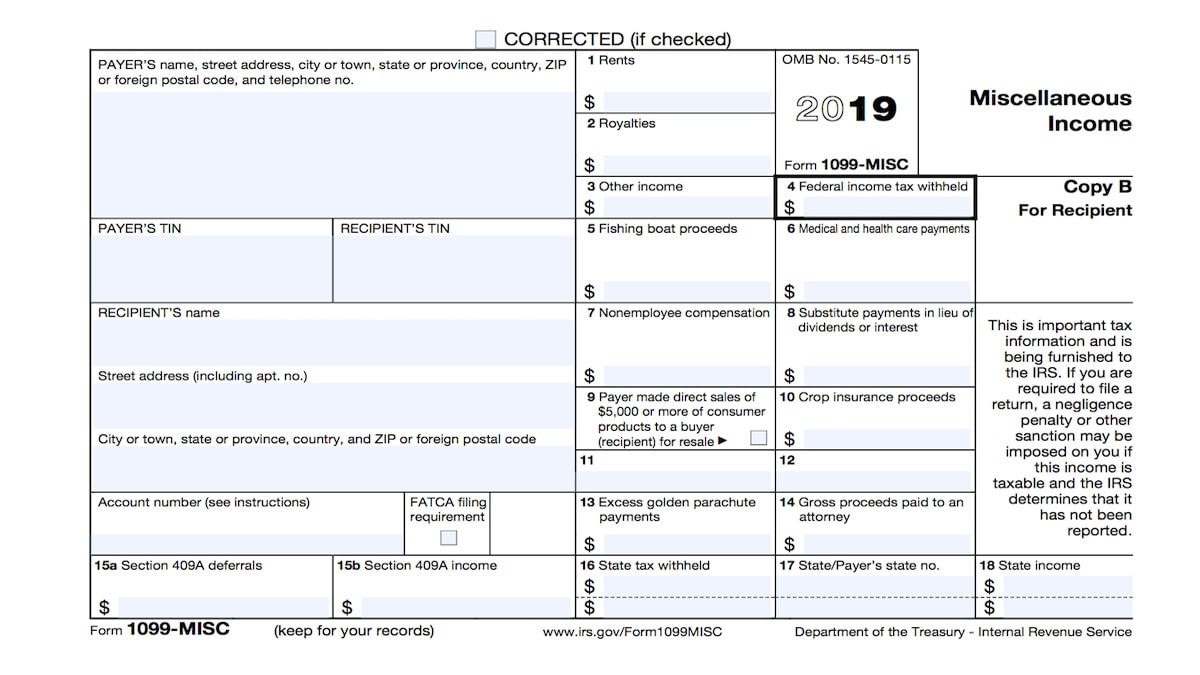

What is a 1099Misc Form? Financial Strategy Center

Web june 14, 2017 h&r block the 1099 form is a common one that covers several types of situations. It is one page with the 3 sections on it. Web raymond james | life well planned. Please see this answer from richardg. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by.

Information returns What You Should Know About Form1099

This includes the associated cost basis. Upload, modify or create forms. The document should contain three separate tax documents that you need to report: You likely have a 1099. Substitute payments in lieu of dividends may be reported on a composite.

united states Why no 1099 for short term capital gains from stocks

Web if not, you're in the right place. The document should contain three separate tax documents that you need to report: These letters are among the designations assigned to 1099s that you might see as part of a 1099 composite tax form—a tax form. Web in the united states, corporations, small businesses and other employers use a variety of forms.

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

The document should contain three separate tax documents that you need to report: There are many different types of 1099 forms. Here are some common types of 1099 forms: Web a 1099 form is used to document income received outside of a permanent salaried job. You likely have a 1099.

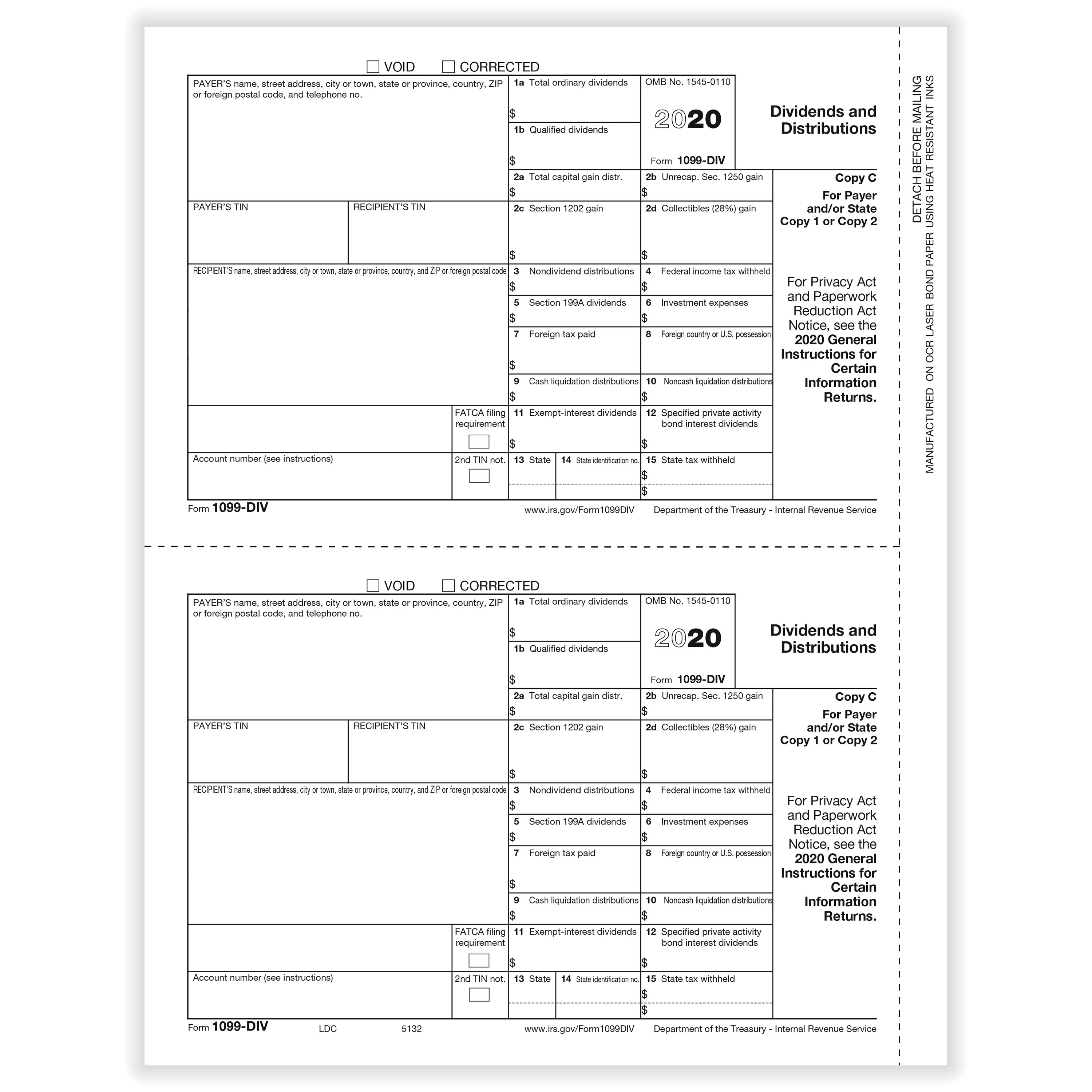

1099DIV Payer and State Copies Formstax

Try it for free now! It is one page with the 3 sections on it. Web a 1099 form is used to document income received outside of a permanent salaried job. Web bookmark icon johnw152 expert alumni it's fairly straightforward. You will take each form and enter it as if it were distributed on its own.

Form 1099

At least $10 in royalties or broker. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Here are some common types of 1099 forms: This includes the associated cost basis. Web june 14, 2017 h&r block the 1099 form is a.

Form 1099DIV, Dividends and Distributions, State Copy 1

Here are some common types of 1099 forms: Web bookmark icon johnw152 expert alumni it's fairly straightforward. You likely have a 1099. Web raymond james | life well planned. The document should contain three separate tax documents that.

【ベストコレクション】 1099 composite vs 1099 r 1985841099 composite vs 1099 r

Web if not, you're in the right place. It is one page with the 3 sections on it. You likely have a 1099. The document should contain three separate tax documents that. Depending on what’s happened in your financial life during.

united states Why no 1099 for short term capital gains from stocks

Web the composite 1099 will actually have the 3 main kinds of 1099 on it, 1099div, 1099int and 1099b for sales. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web the composite 1099 form is.

Form 1099MISC for independent consultants (6 step guide)

Web how do i enter information from a 1099 composite? This includes the associated cost basis. Web raymond james | life well planned. The document should contain three separate tax documents that. Web in the united states, corporations, small businesses and other employers use a variety of forms to record the income earned by employees and independent.

There Are Many Different Types Of 1099 Forms.

It is one page with the 3 sections on it. Web your form 1099 composite is simply multiple forms in one document. At least $10 in royalties or broker. Here are some common types of 1099 forms:

Web A 1099 Form Is Used To Document Income Received Outside Of A Permanent Salaried Job.

Web the composite 1099 form is a consolidation of various forms 1099 and summarizes relevant account information for the past year. Try it for free now! Web how do i enter information from a 1099 composite? This includes the associated cost basis.

The Document Should Contain Three Separate Tax Documents That.

Web bookmark icon johnw152 expert alumni it's fairly straightforward. Web you'll receive a form 1099 if you earned money from a nonemployer source. Depending on what’s happened in your financial life during. Substitute payments in lieu of dividends may be reported on a composite.

You Likely Have A 1099.

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. You will take each form and enter it as if it were distributed on its own. These letters are among the designations assigned to 1099s that you might see as part of a 1099 composite tax form—a tax form. Web if not, you're in the right place.

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)