What Is A Il 1040 Form

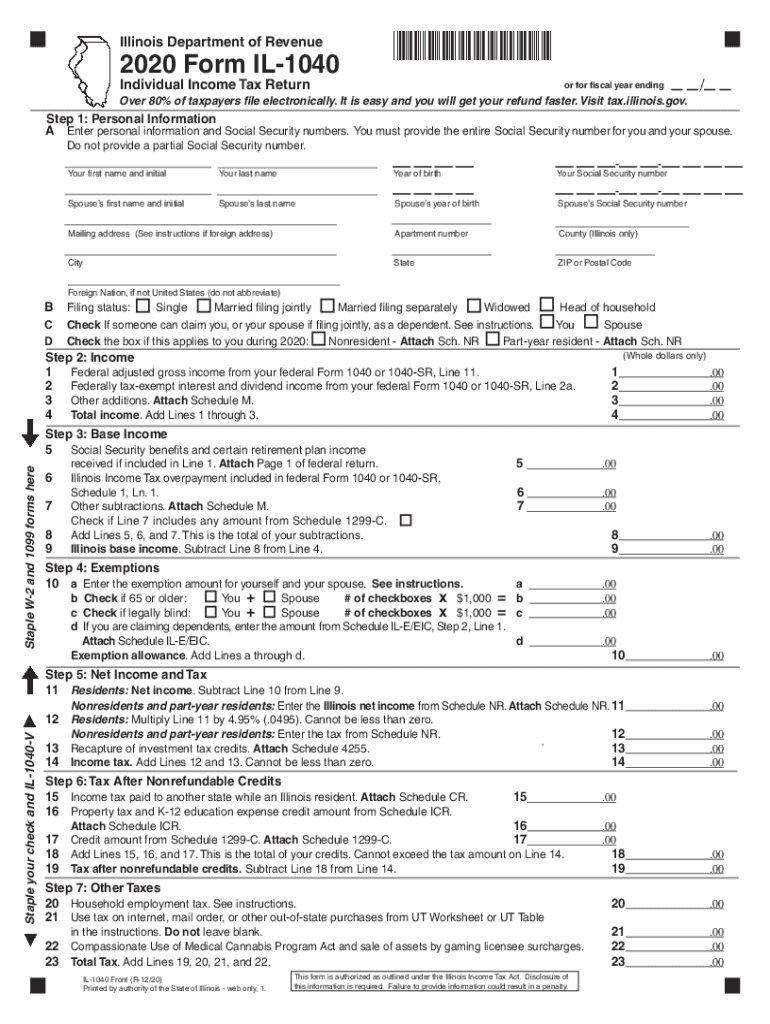

What Is A Il 1040 Form - Web form 1040 is what individual taxpayers use to file their taxes with the irs. It is free to file. The form is used to report an individual's annual income and calculate their tax liability. For more information about the illinois income tax, see the illinois income tax page. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web unlike the other tax forms, form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions and adjust income. Web form 1040 is the main tax form used to file a u.s. Before viewing these documents you may need to download adobe acrobat reader. The form determines if additional taxes are due or if the filer will receive a tax refund. The first page asks for general information about who you are, including your full legal name, date of birth, address, social security.

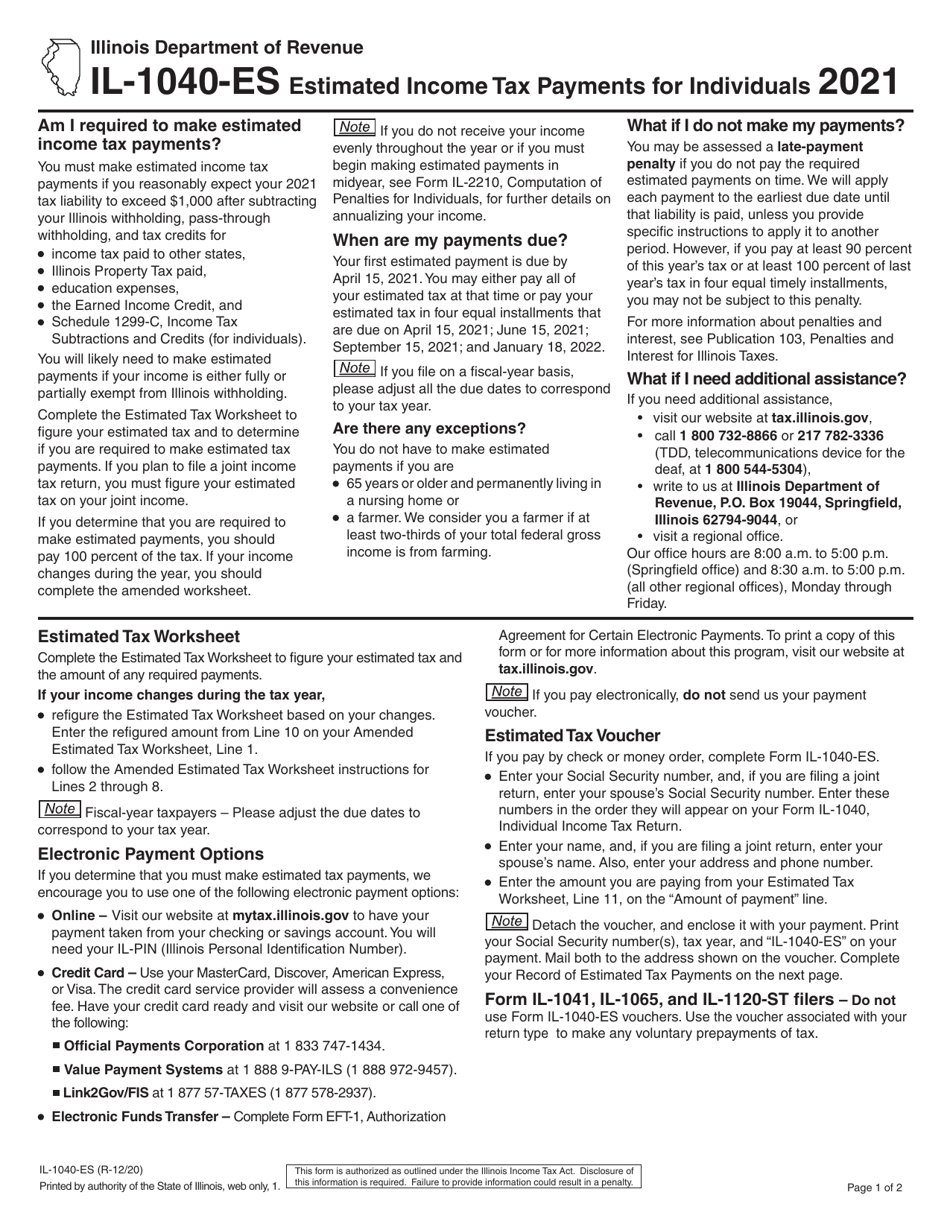

Web form 1040 is what individual taxpayers use to file their taxes with the irs. The first page asks for general information about who you are, including your full legal name, date of birth, address, social security. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Taxpayer answer center find an answer to your. The form is used to report an individual's annual income and calculate their tax liability. Documents are in adobe acrobat portable document format (pdf). You must file form 1040 if any of the. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web unlike the other tax forms, form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions and adjust income.

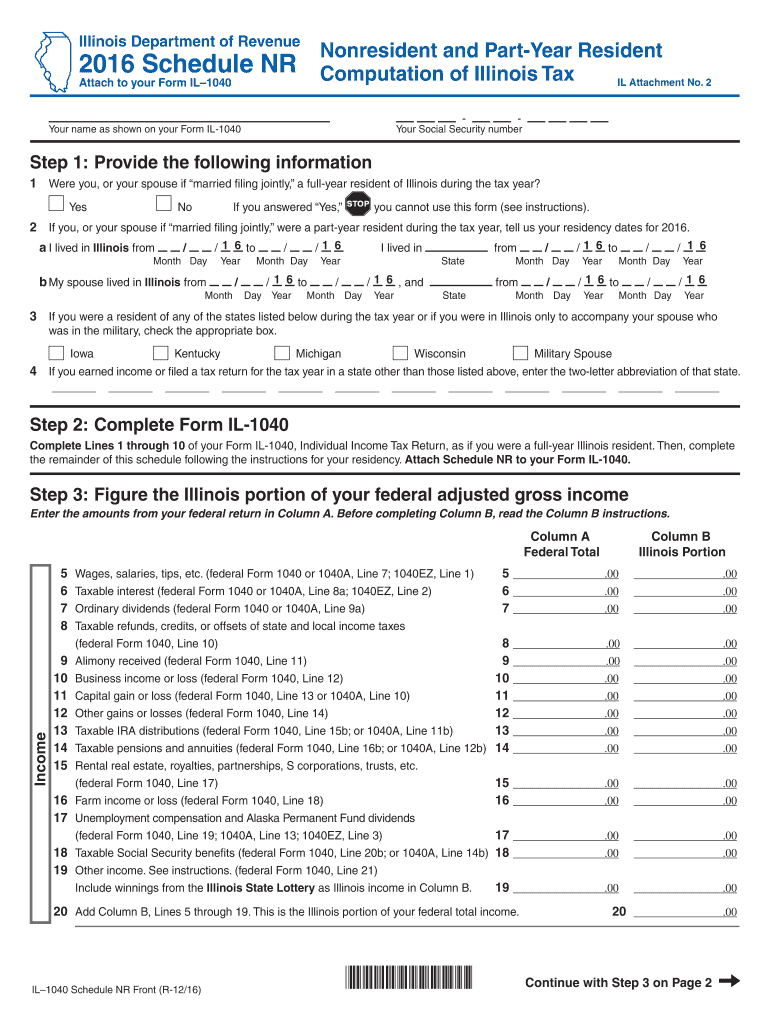

Here is a comprehensive list of illinois. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web form 1040 is the main tax form used to file a u.s. You must file form 1040 if any of the. The form is used to report an individual's annual income and calculate their tax liability. The first page asks for general information about who you are, including your full legal name, date of birth, address, social security. It is free to file. This form is used by illinois residents who file an individual income tax return. 2023 estimated income tax payments for individuals. Taxpayer answer center find an answer to your.

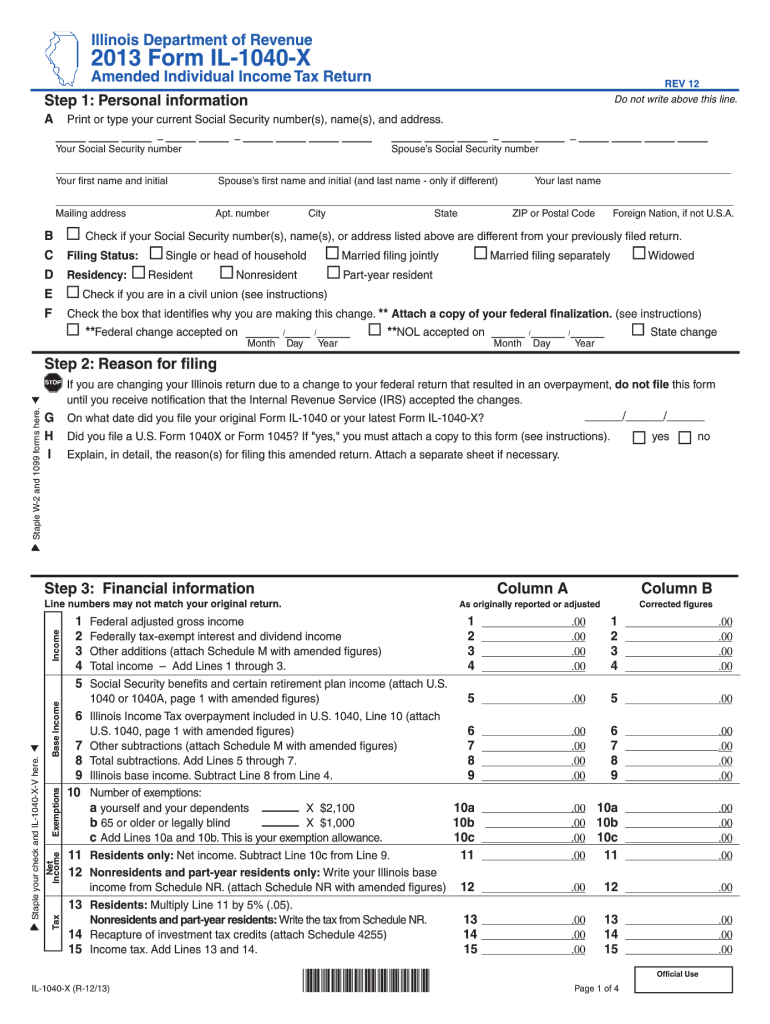

Illinois Form IL 1040 X Amended Individual Tax Fill Out and

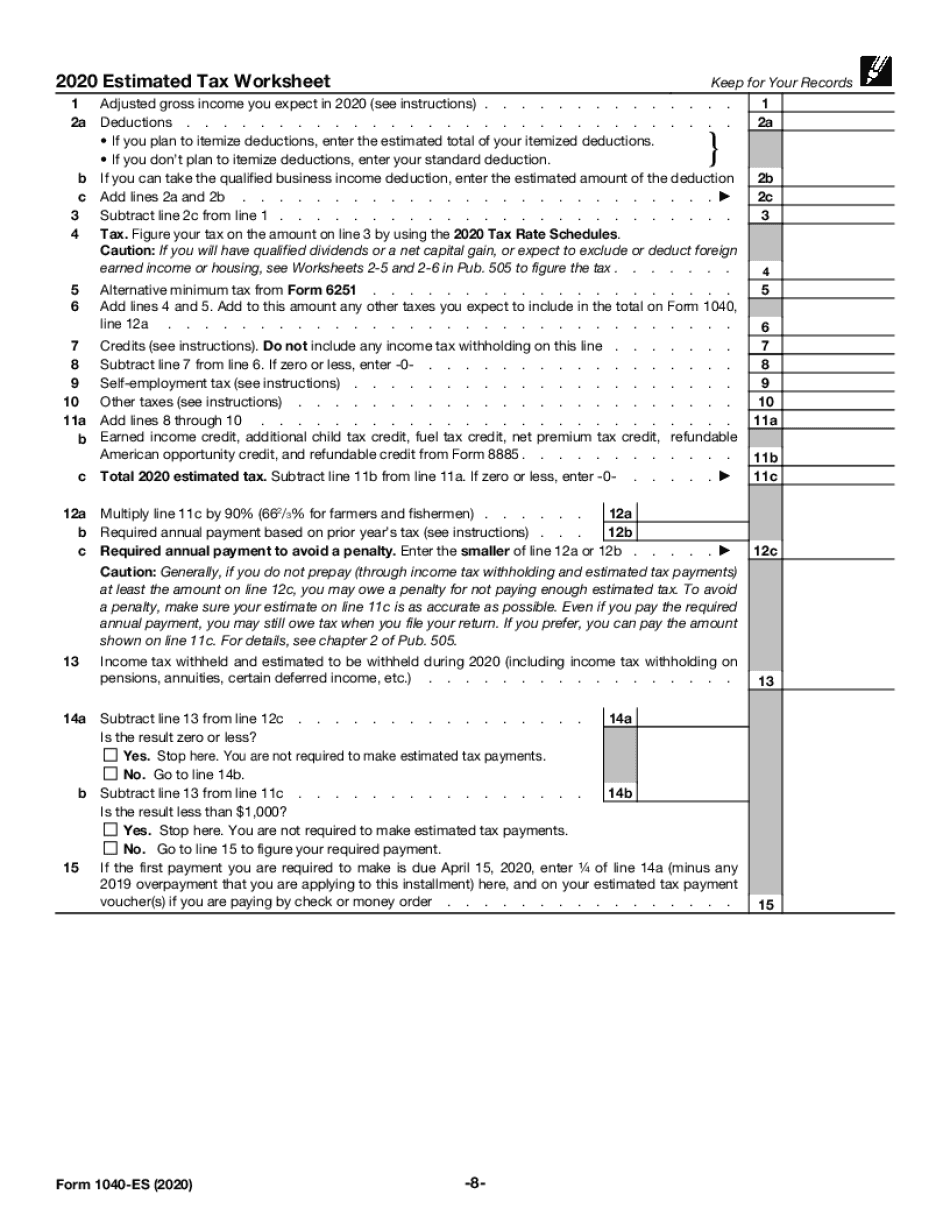

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web form 1040 is a federal tax form that us taxpayers use to report their annual income tax returns. Web the 1040 form is the official tax.

IL DoR IL1040V 20202022 Fill and Sign Printable Template Online

For more information about the illinois income tax, see the illinois income tax page. The form determines if additional taxes are due or if the filer will receive a tax refund. This form is used by illinois residents who file an individual income tax return. Web the irs form 1040 consists of two pages. Individual income tax return 2021 department.

Form IL1040X Download Fillable PDF or Fill Online Amended Individual

Here is a comprehensive list of illinois. The first page asks for general information about who you are, including your full legal name, date of birth, address, social security. This form is used by illinois residents who file an individual income tax return. You must file form 1040 if any of the. Web form 1040 is a federal tax form.

Form IL1040ES Download Fillable PDF or Fill Online Estimated

2023 estimated income tax payments for individuals. This form is used by illinois residents who file an individual income tax return. Web form 1040 is a federal tax form that us taxpayers use to report their annual income tax returns. It is free to file. Taxpayer answer center find an answer to your.

IL DoR IL1040X 2012 Fill out Tax Template Online US Legal Forms

Web form 1040 is a federal tax form that us taxpayers use to report their annual income tax returns. Here is a comprehensive list of illinois. The form is used to report an individual's annual income and calculate their tax liability. Web form 1040 is what individual taxpayers use to file their taxes with the irs. Then, complete the remainder.

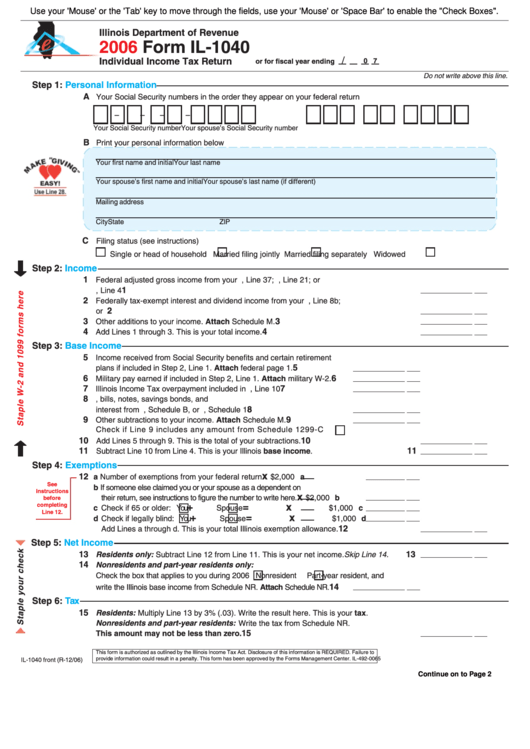

Fillable Form Il1040 Individual Tax Return 2006 printable

It is free to file. Web form 1040 is what individual taxpayers use to file their taxes with the irs. Web unlike the other tax forms, form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions and adjust income. Web form 1040 is a federal tax form that us taxpayers use to report their annual income tax.

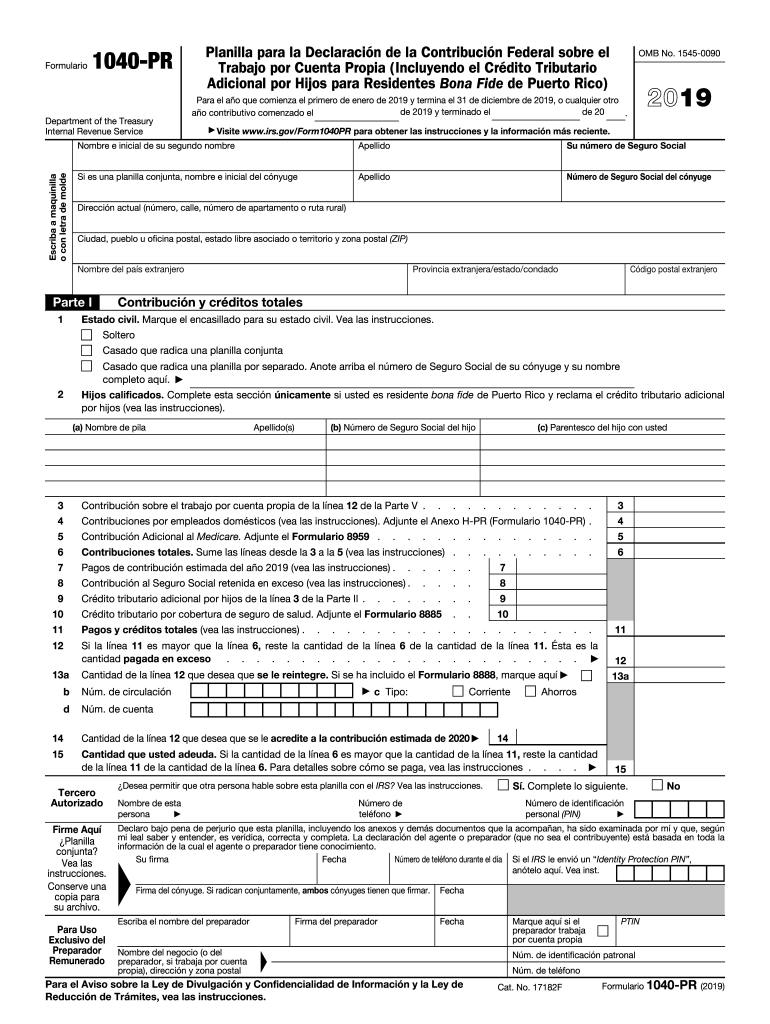

1040 Pr Fill Out and Sign Printable PDF Template signNow

Web unlike the other tax forms, form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions and adjust income. Then, complete the remainder of this schedule following the instructions for. The first page asks for general information about who you are, including your full legal name, date of birth, address, social security. The form is used to.

il1040es 2019 Fill Online, Printable, Fillable Blank

Web form 1040 is the main tax form used to file a u.s. Taxpayer answer center find an answer to your. For more information about the illinois income tax, see the illinois income tax page. Here is a comprehensive list of illinois. This form is used by illinois residents who file an individual income tax return.

Attach to Your Form IL 1040 Fill Out and Sign Printable PDF Template

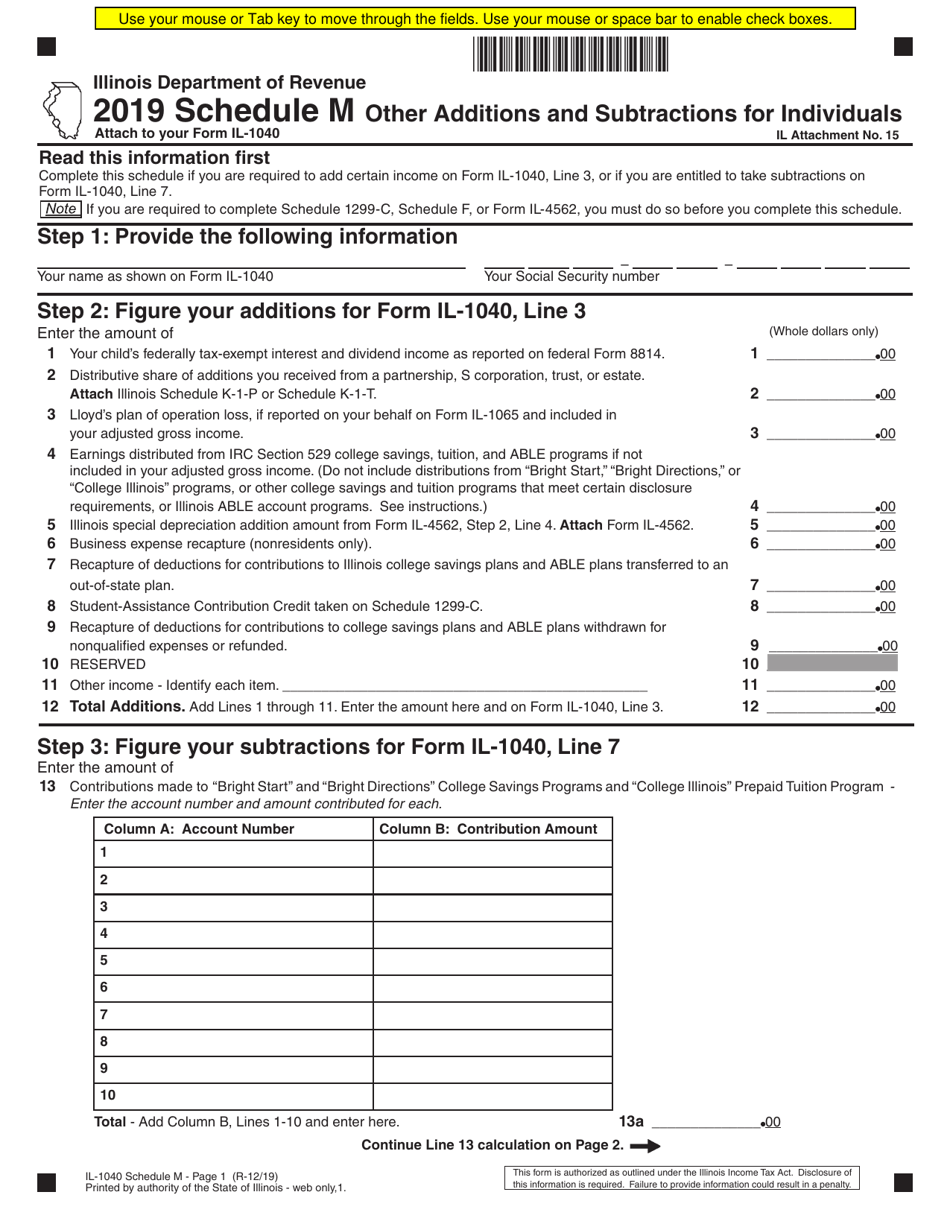

Then, complete the remainder of this schedule following the instructions for. We last updated the individual income tax return in january 2023, so this is the. Web unlike the other tax forms, form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions and adjust income. Web form 1040 is a federal tax form that us taxpayers use.

Form IL1040 Schedule M Download Fillable PDF or Fill Online Other

The form determines if additional taxes are due or if the filer will receive a tax refund. Then, complete the remainder of this schedule following the instructions for. Documents are in adobe acrobat portable document format (pdf). The form is used to report an individual's annual income and calculate their tax liability. Web form 1040 is the main tax form.

Here Is A Comprehensive List Of Illinois.

It determines how much you owe the irs or if you're due for a tax refund. It is easy and you will get your refund faster. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Documents are in adobe acrobat portable document format (pdf).

Web Form 1040 Is What Individual Taxpayers Use To File Their Taxes With The Irs.

The first page asks for general information about who you are, including your full legal name, date of birth, address, social security. Web form 1040 is a federal tax form that us taxpayers use to report their annual income tax returns. Web form 1040 is the main tax form used to file a u.s. Before viewing these documents you may need to download adobe acrobat reader.

It Is Free To File.

For more information about the illinois income tax, see the illinois income tax page. 2023 estimated income tax payments for individuals. The form determines if additional taxes are due or if the filer will receive a tax refund. This form is used by illinois residents who file an individual income tax return.

Use This Form For Payments That Are Due On April 18, 2023, June 15, 2023, September 15, 2023, And.

The form is used to report an individual's annual income and calculate their tax liability. Web unlike the other tax forms, form 1040 allows taxpayers to claim numerous expenses and tax credits, itemize deductions and adjust income. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Then, complete the remainder of this schedule following the instructions for.