What Is Form 2210

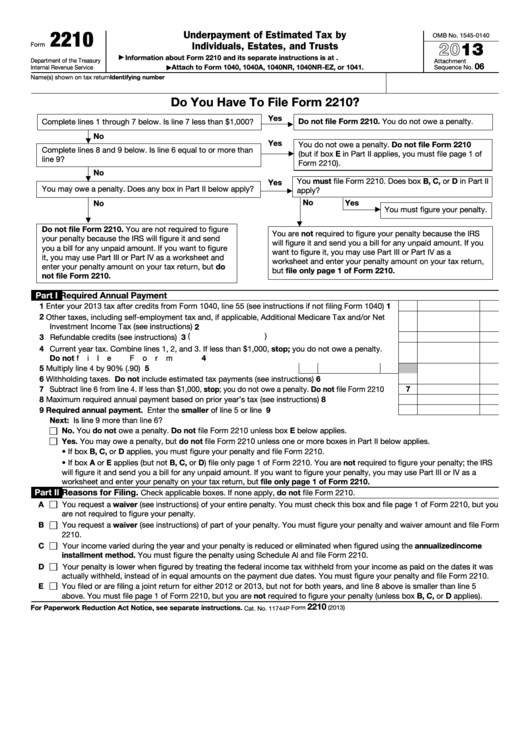

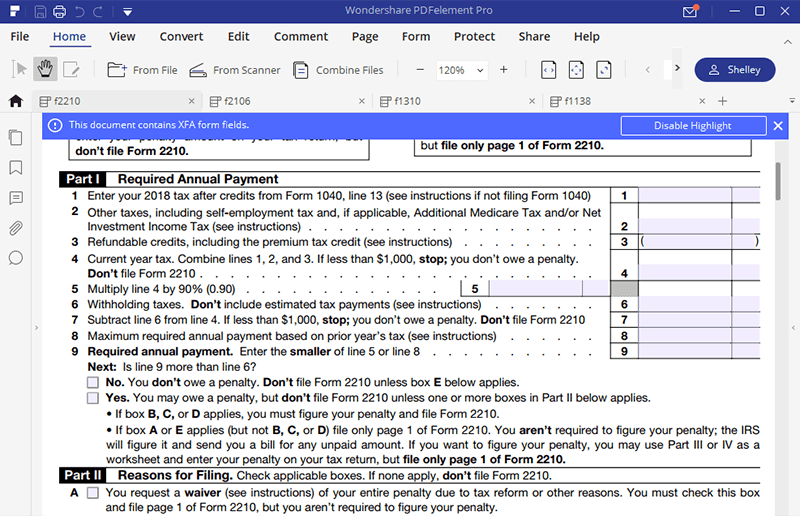

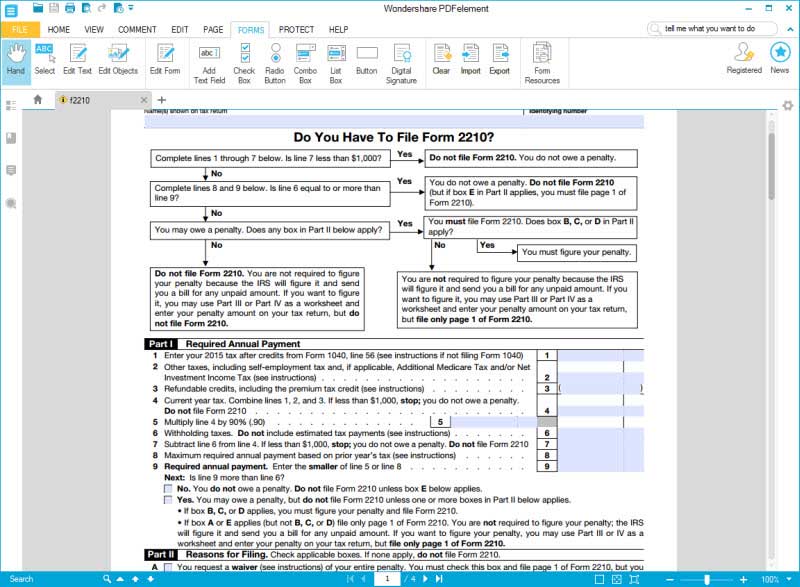

What Is Form 2210 - Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability. Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes during the tax year. If a taxpayer does not honor an irs installment agreement, the irs measures the tax deficiency by. Web form 2210 is a federal individual income tax form. Taxpayers don’t have to file form 2210 since the irs will determine the amount of penalty and will send a bill for it. Web why isn't form 2210 generating for a form 1041 estate return? Web form 2210 is irs form that relates to underpayment of estimated taxes. If neither of boxes b, c, or d is checked in part ii you do. For estates and trusts, no penalty applies if: Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form).

With the form, attach an explanation for why you didn’t pay estimated taxes in the specific time period that you’re. You only need to check the appropriate box in part ii and file page 1 of the form if you are. Here's how to delete a form: Web form 2210 is irs form that relates to underpayment of estimated taxes. By checking the box, irs to figure penalty, the program will bypass trying to calculate any penalty and allow filing the return without waiting for the 2210 to be. Web form 2210 is a federal individual income tax form. Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. Web what is irs form 2210? For estates and trusts, no penalty applies if:

Web form 2210 serves primarily as a personal guide on how much a taxpayer should expect to pay as a penalty for tax underpayment. You should figure out the amount of tax you have underpaid. Taxpayers don’t have to file form 2210 since the irs will determine the amount of penalty and will send a bill for it. For estates and trusts, no penalty applies if: For instructions and the latest information. You owe underpayment penalties and are requesting a penalty waiver. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. The irs will generally figure any penalty due and send the taxpayer a bill. Department of the treasury internal revenue service. The form doesn't always have to be completed;

Fillable Form 2210 Fill Online, Printable, Fillable, Blank pdfFiller

You are not required to complete it since the irs will figure the penalty, if any, and let you know if you owe anything additionally. Web form 2210 is irs form that relates to underpayment of estimated taxes. For estates and trusts, no penalty applies if: Web form 2210 is used to determine how much you owe in underpayment penalties.

IRS Form 2210Fill it with the Best Form Filler

Web why isn't form 2210 generating for a form 1041 estate return? Web complete form 2210, schedule ai, annualized income installment method pdf (found within the form). With the form, attach an explanation for why you didn’t pay estimated taxes in the specific time period that you’re. If neither of boxes b, c, or d is checked in part ii.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

By checking the box, irs to figure penalty, the program will bypass trying to calculate any penalty and allow filing the return without waiting for the 2210 to be. A decedent's estate for any tax year ending before the date that is 2 years after the. Web form 2210 is used by individuals (as well as estates and trusts) to.

Fillable Form 2210 Underpayment Of Estimated Tax By Individuals

If a taxpayer does not honor an irs installment agreement, the irs measures the tax deficiency by. Web level 1 form 2210 tt estimates that form 2210 will be available to the pc program on 3/17/22. To calculate the penalty yourself (other than. This form contains both a short and regular method for determining your penalty. Web why isn't form.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web irs form 2210 (underpayment of estimated tax by individuals, estates, and trusts) calculates the underpayment penalty if you didn't withhold or pay enough taxes during the tax year. Web what is irs form 2210? This means the irs requires you to pay estimated taxes throughout the year—either via withholding from paychecks or by making quarterly. For instructions and the.

IRS Form 2210Fill it with the Best Form Filler

Web why isn't form 2210 generating for a form 1041 estate return? If neither of boxes b, c, or d is checked in part ii you do. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. To calculate the penalty yourself (other than. The irs will generally figure your penalty for.

Form 2210Underpayment of Estimated Tax

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc). A decedent's estate for any tax year ending before the.

IRS Form 2210 Fill it with the Best Form Filler

Web why isn't form 2210 generating for a form 1041 estate return? With the form, attach an explanation for why you didn’t pay estimated taxes in the specific time period that you’re. You only need to check the appropriate box in part ii and file page 1 of the form if you are. While most taxpayers have income taxes automatically.

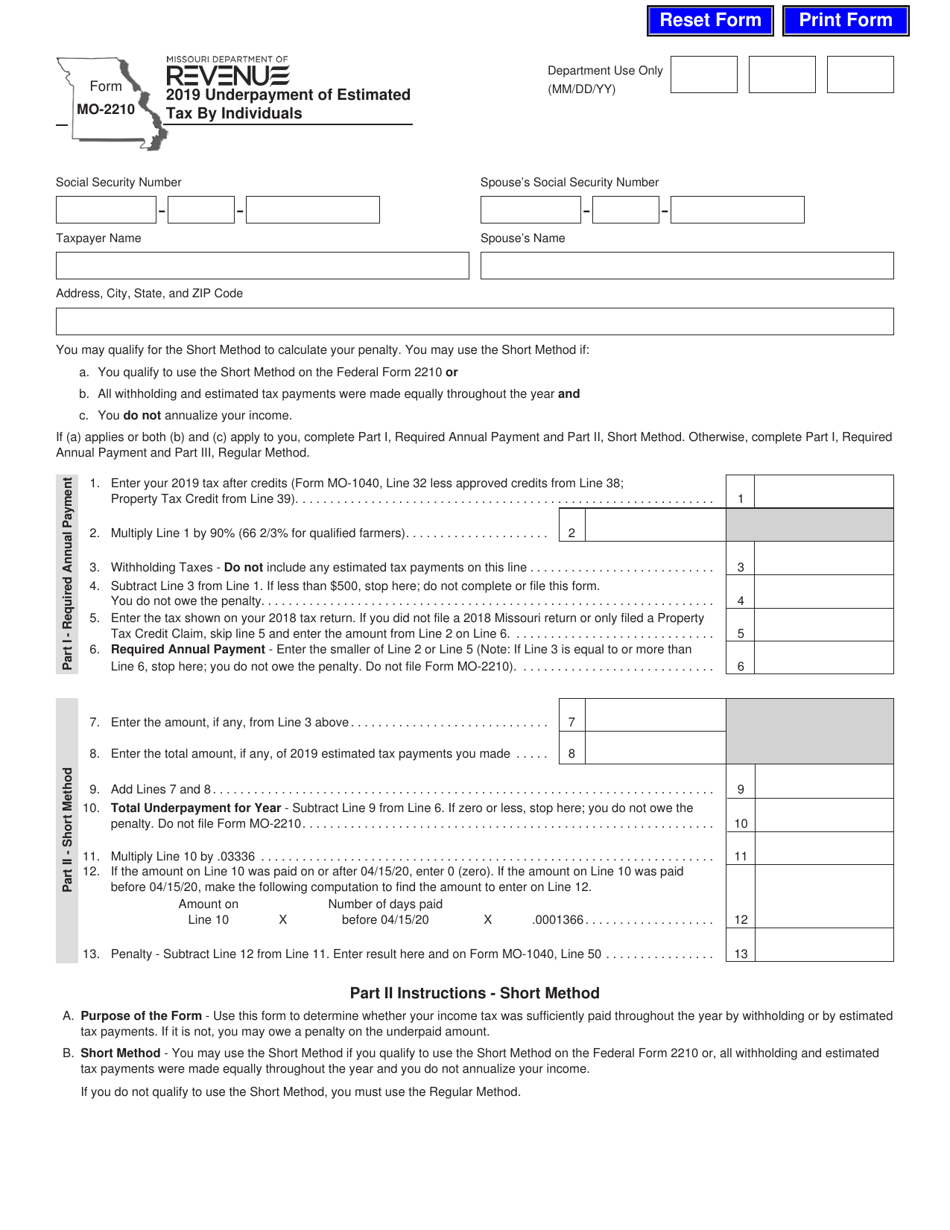

Form MO2210 Download Fillable PDF or Fill Online Underpayment of

Web complete form 2210 to request a waiver when you file. Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty. For estates and trusts, no penalty applies if: You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return. If.

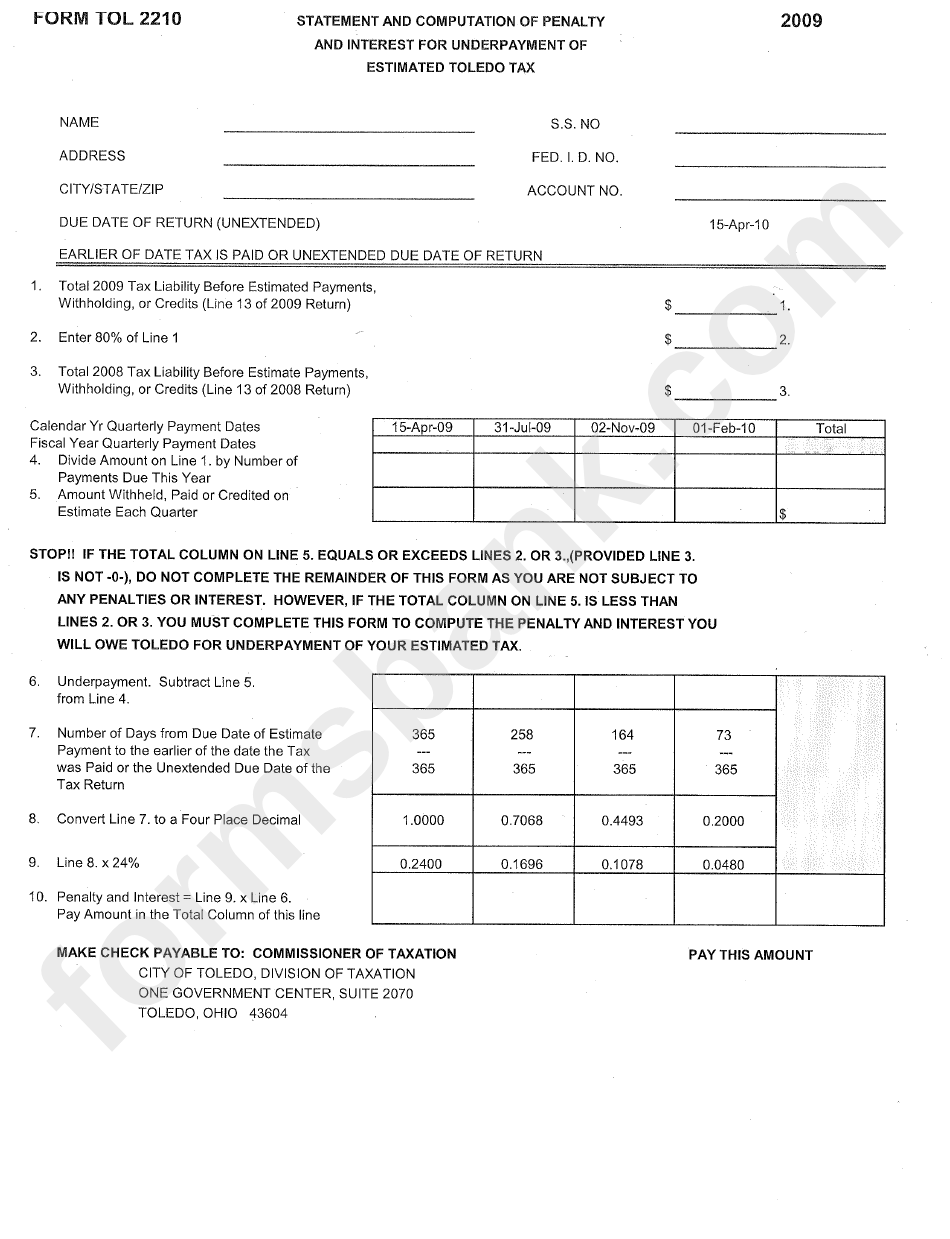

Form Tol 2210 Statement And Computation Of Penalty And Interest

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc). Web form 2210 is a federal individual income tax form. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some.

You Only Need To Check The Appropriate Box In Part Ii And File Page 1 Of The Form If You Are.

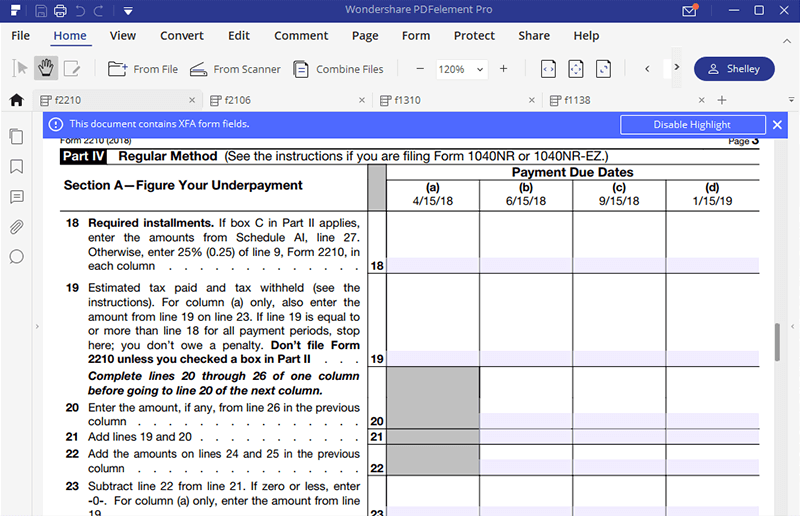

To calculate the penalty yourself (other than. Examine the form before completing it and use the flowchart at the top of the form. This means the irs requires you to pay estimated taxes throughout the year—either via withholding from paychecks or by making quarterly. This form contains both a short and regular method for determining your penalty.

You Owe Underpayment Penalties And Are Requesting A Penalty Waiver.

Underpayment of estimated tax by individuals, estates, and trusts. If a taxpayer does not honor an irs installment agreement, the irs measures the tax deficiency by. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability.

You Are Not Required To Complete It Since The Irs Will Figure The Penalty, If Any, And Let You Know If You Owe Anything Additionally.

You should figure out the amount of tax you have underpaid. Web go to www.irs.gov/form2210 for instructions and the latest information. Web the form instructions say not to file form 2210 for the sole purpose of including and calculating the penalty. Web form 2210 (or form 2220 for corporations) will help you determine the penalty amount.

The Irs Will Generally Figure Any Penalty Due And Send The Taxpayer A Bill.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is not subject to withholding (such as self employed income, investment returns, etc). For estates and trusts, no penalty applies if: Web form 2210 serves primarily as a personal guide on how much a taxpayer should expect to pay as a penalty for tax underpayment. You can, however, use form 2210 to figure your penalty if you wish and include the penalty on your return.