What Is Form 8453 Ol

What Is Form 8453 Ol - Web do not mail this form to the ftb. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web do not mail this form to the ftb. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. By signing this form, you. Web do not mail this form to the ftb. Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. Individual income tax transmittal for an irs. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: And 1099r, distributions from pensions, annuities,.

If you do not receive an acknowledgement, you must contact your intermediate service provider. If a joint return, or request for refund, your spouse must also sign. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Individual income tax transmittal for an irs. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web information about form 8453, u.s. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web do not mail this form to the ftb. By signing form ftb 8453. By signing this form, you.

Web do not mail this form to the ftb. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web information about form 8453, u.s. Web do not mail this form to the ftb. By signing this form, you. If a joint return, or request for refund, your spouse must also sign. And 1099r, distributions from pensions, annuities,. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. Individual income tax transmittal for an irs.

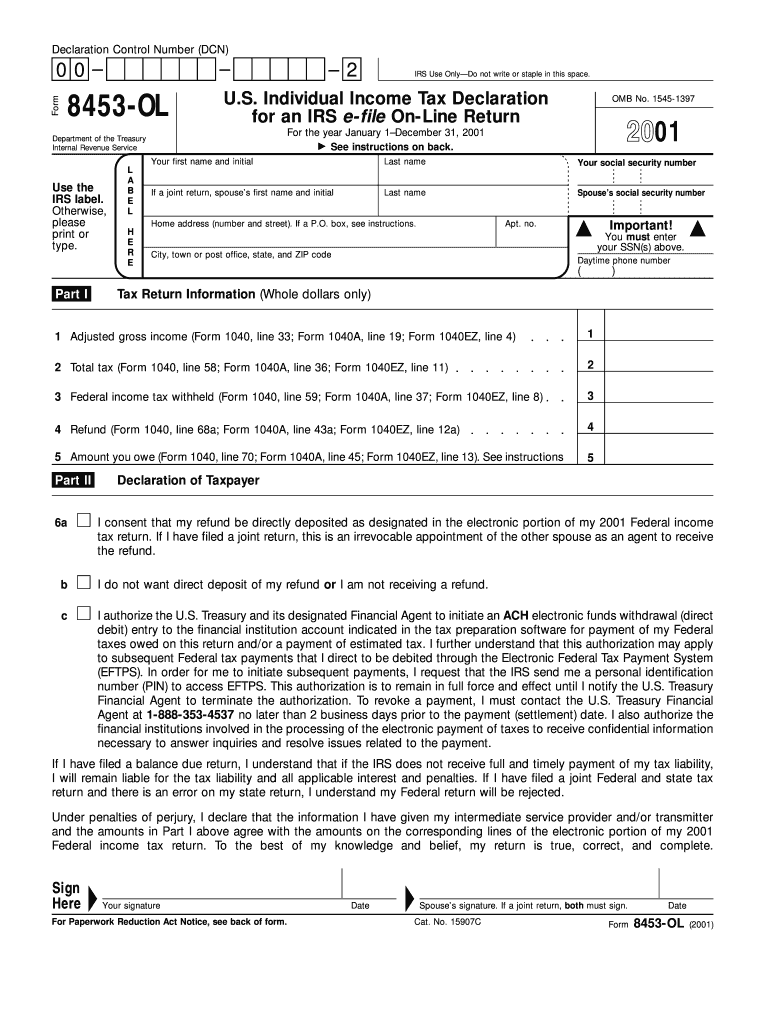

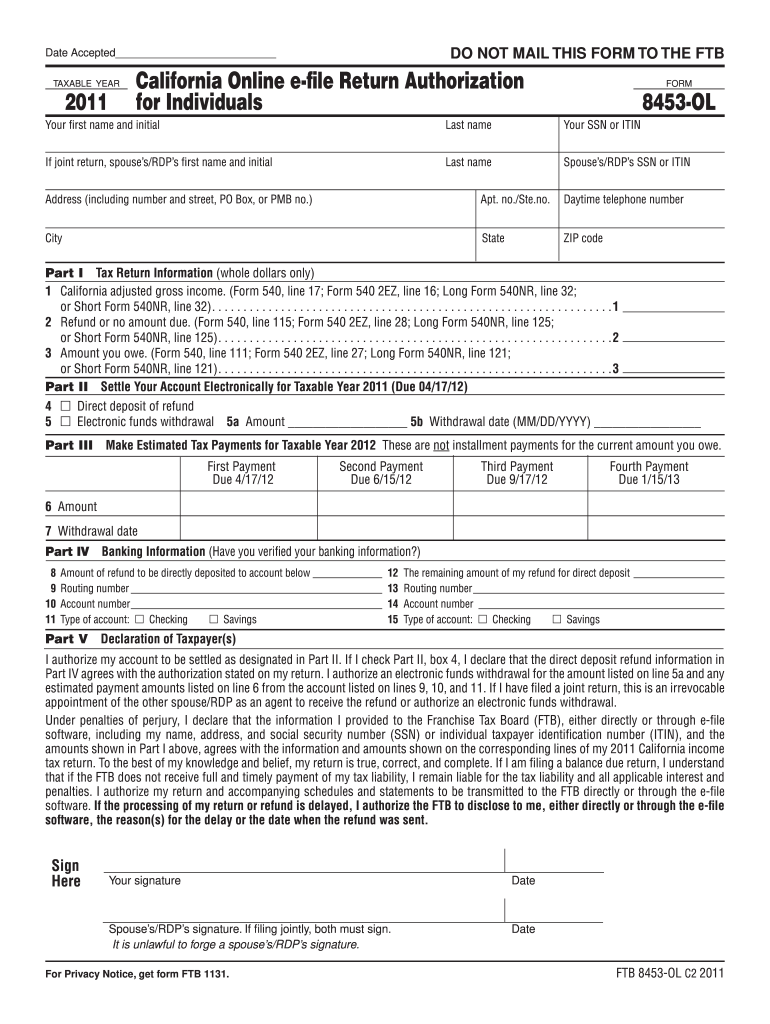

Form 8453OL Fill out & sign online DocHub

Web information about form 8453, u.s. Individual income tax transmittal for an irs. Web do not mail this form to the ftb. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web i will keep form ftb 8453 on file for four years from.

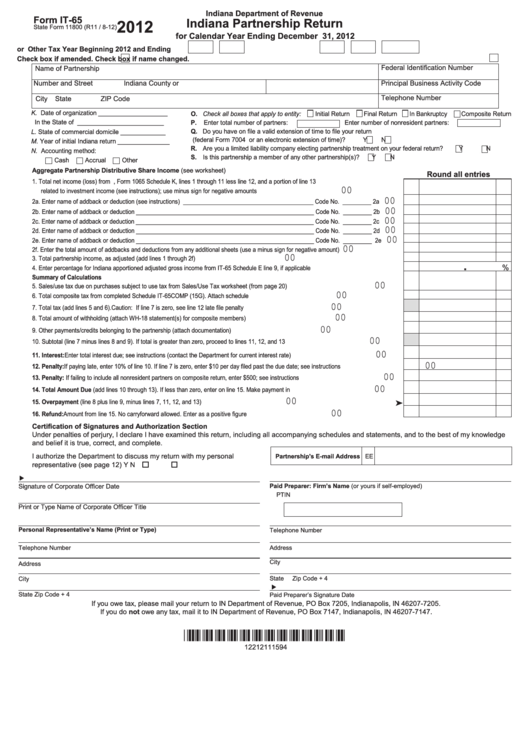

Fillable Form It65 Indiana Partnership Return 2012 printable pdf

Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Web do not mail this form to the ftb. Web do not mail this form to the ftb. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue.

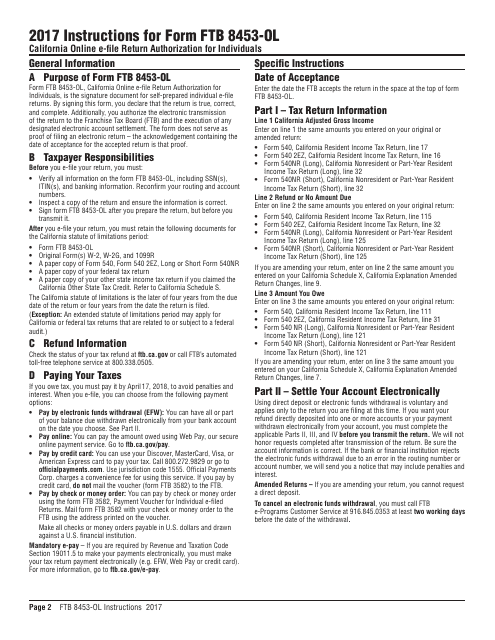

Instructions for Form Ftb 8453ol California Online EFile Return

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. And 1099r, distributions from pensions, annuities,. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this.

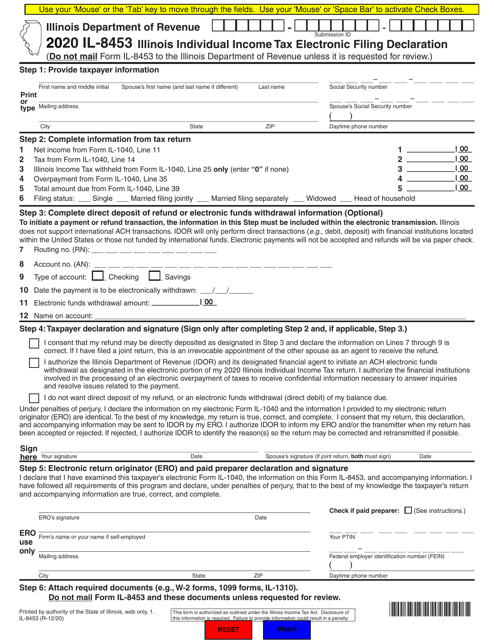

Form IL8453 Download Fillable PDF or Fill Online Illinois Individual

Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. Web information about form 8453, u.s. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: By signing form ftb 8453. Web most taxpayers are required.

8453 ol Fill out & sign online DocHub

Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web do not.

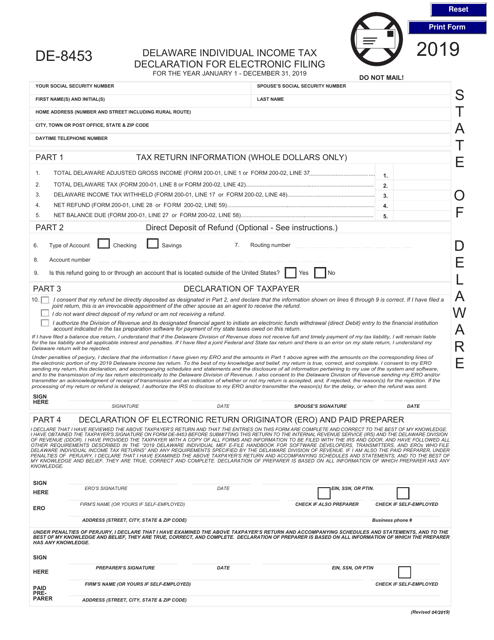

Form DE8453 Download Fillable PDF or Fill Online Delaware Individual

Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: And 1099r, distributions from pensions, annuities,. Individual income tax transmittal for an irs. If you do not receive an acknowledgement, you must contact your intermediate service provider. Web do not mail this form to the ftb.

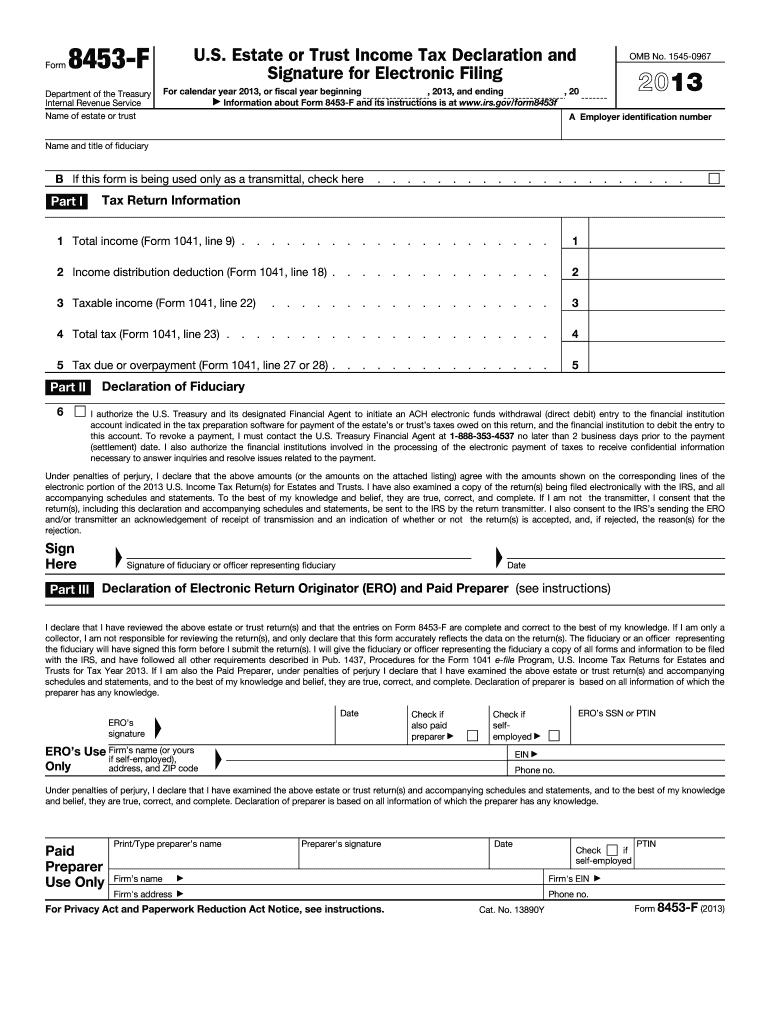

20132021 Form IRS 8453F Fill Online, Printable, Fillable, Blank

Web do not mail this form to the ftb. Web do not mail this form to the ftb. Individual income tax transmittal for an irs. If a joint return, or request for refund, your spouse must also sign. And 1099r, distributions from pensions, annuities,.

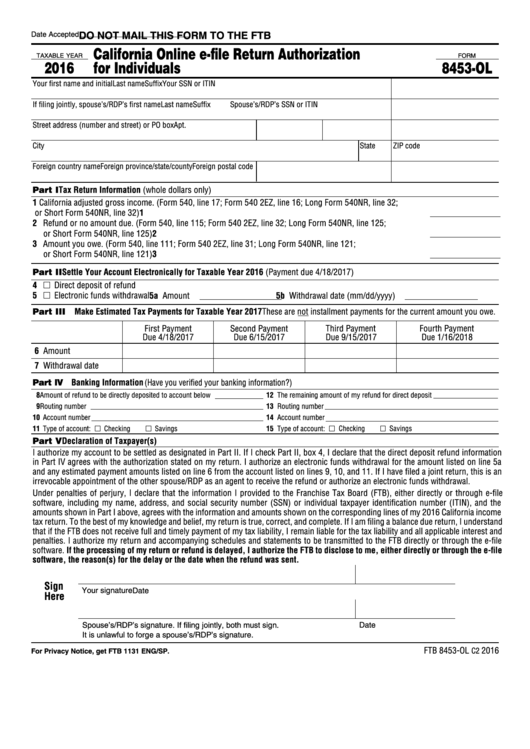

Fillable Form 8453Ol California Online EFile Return Authorization

Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. If a joint return, or request for refund, your spouse must also.

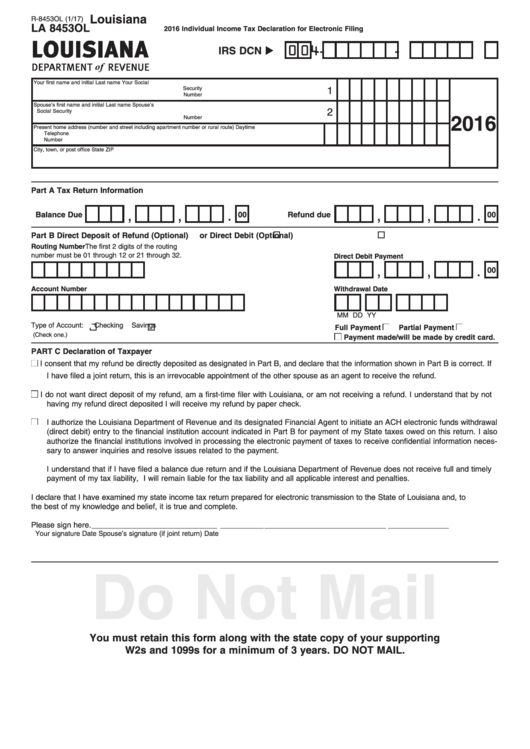

8453 Ol Form Louisiana Department Of Revenue Individual Tax

Individual income tax transmittal for an irs. Web information about form 8453, u.s. If you do not receive an acknowledgement, you must contact your intermediate service provider. Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and.

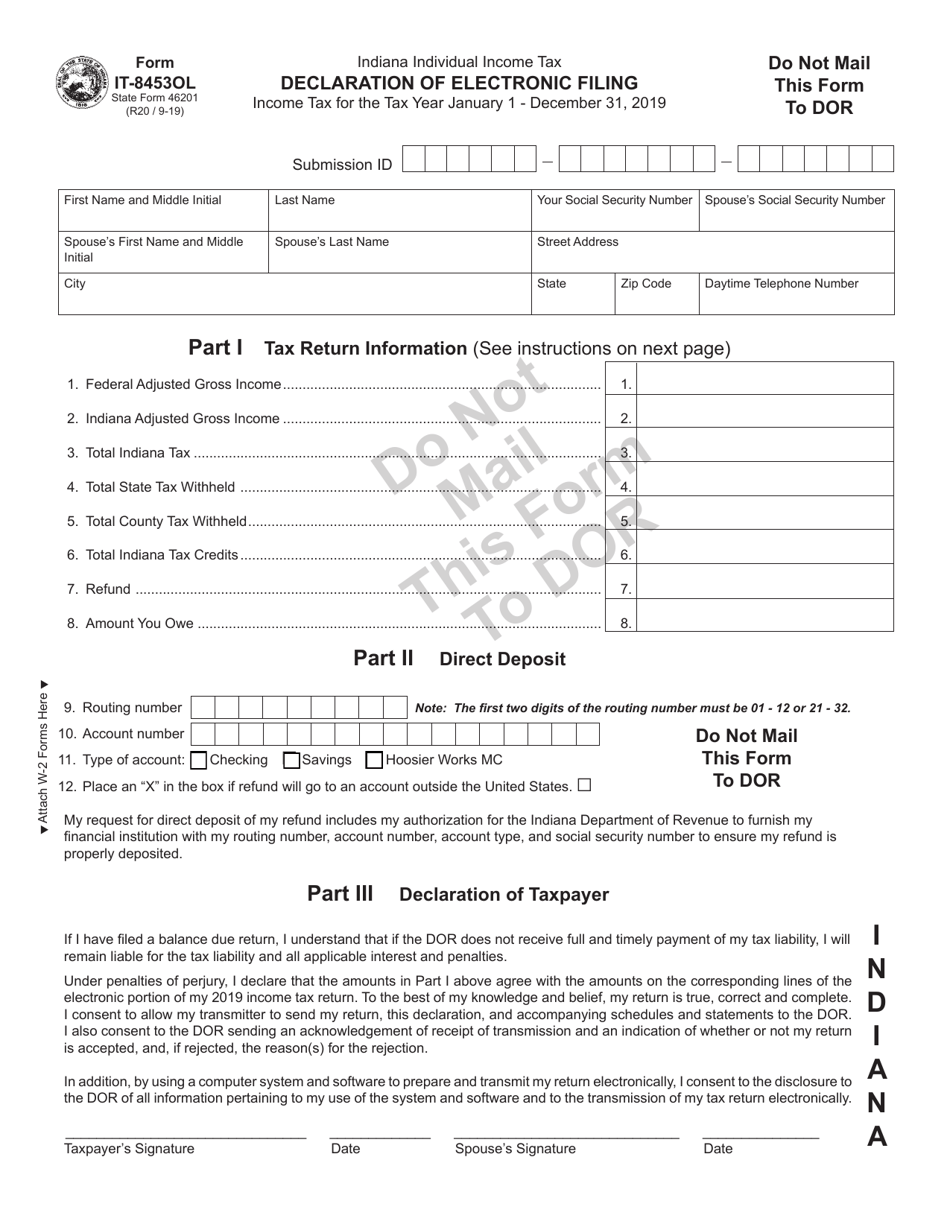

Form IT8453OL (State Form 46201) Download Fillable PDF or Fill Online

Web do not mail this form to the ftb. Web do not mail this form to the ftb. Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. Web.

If A Joint Return, Or Request For Refund, Your Spouse Must Also Sign.

Web this form is used to authenticate an electronic employment tax return or request for refund, authorize an electronic return originator (ero) or an intermediate. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Individual income tax transmittal for an irs. Individual income tax transmittal for an irs.

By Signing This Form, You.

Web i will keep form ftb 8453 on file for four years from the due date of the return or four years from the date the return is filed, whichever is later, and i will make a copy available to the. Web do not mail this form to the ftb. Web forms and publications about filing your indiana taxes electronically for individuals and corporations can be found in the table below. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address:

Web Do Not Mail This Form To The Ftb.

By signing form ftb 8453. Web information about form 8453, u.s. And 1099r, distributions from pensions, annuities,. If you do not receive an acknowledgement, you must contact your intermediate service provider.