What Is Form 8615 Turbotax

What Is Form 8615 Turbotax - How do i clear and. See who must file, later. When turbotax did the final checking on my child's return, it put out this complaint: Unearned income includes taxable interest, ordinary dividends, capital gains (including. I have also included additional information as it. To find form 8615 please follow the steps below. I complete the return and for the. While there have been other changes to the. Web if turbotax is adding form 8615 to your son's return, then he is being subject to kiddie tax. The child is required to file a tax return.

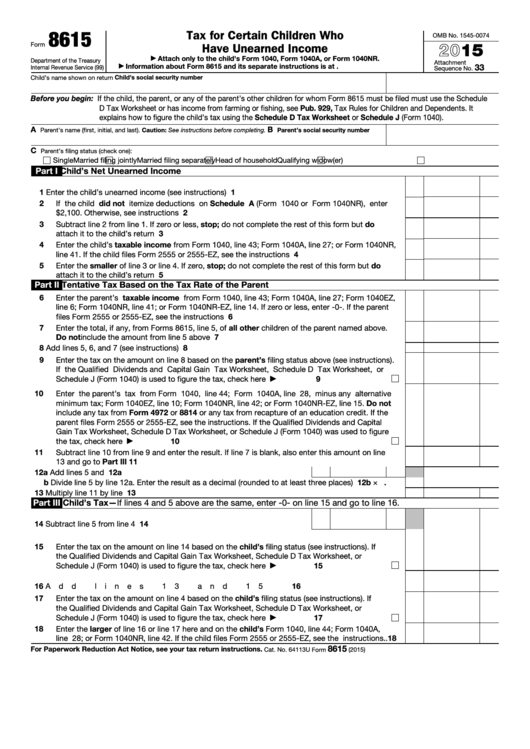

Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Reach out to learn how we can help you! Web if turbotax is adding form 8615 to your son's return, then he is being subject to kiddie tax. When turbotax did the final checking on my child's return, it put out this complaint: Unearned income includes taxable interest, ordinary dividends, capital gains (including. Web how do i file an irs extension (form 4868) in turbotax online? Under age 18, age 18 and did. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web form 8615 is tax for certain children who have unearned income. Web why does my tax return keep getting rejected?

I have also included additional information as it. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Web how do i file an irs extension (form 4868) in turbotax online? Web what is form 8615 used for. See who must file, later. Web what is form 8615, tax for children under age 18? Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. When turbotax did the final checking on my child's return, it put out this complaint: I complete the return and for the. Under age 18, age 18 and did.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

I have elected to calculate at the new tcja rules by answering no to the question. Web for form 8615, “unearned income” includes all taxable income other than earned income. Form 8615 must be filed with the child’s tax return if all of the following apply: See who must file, later. Turbo tax says it will walk you through fixing.

Don’t Miss Out On These Facts About the Form 8615 TurboTax by

Ad sovos combines tax automation with a human touch. Web what is form 8615, tax for children under age 18? I have elected to calculate at the new tcja rules by answering no to the question. Web if you have a child and any of the following apply turbotax will generate a form 8615. If the child doesn't qualify for.

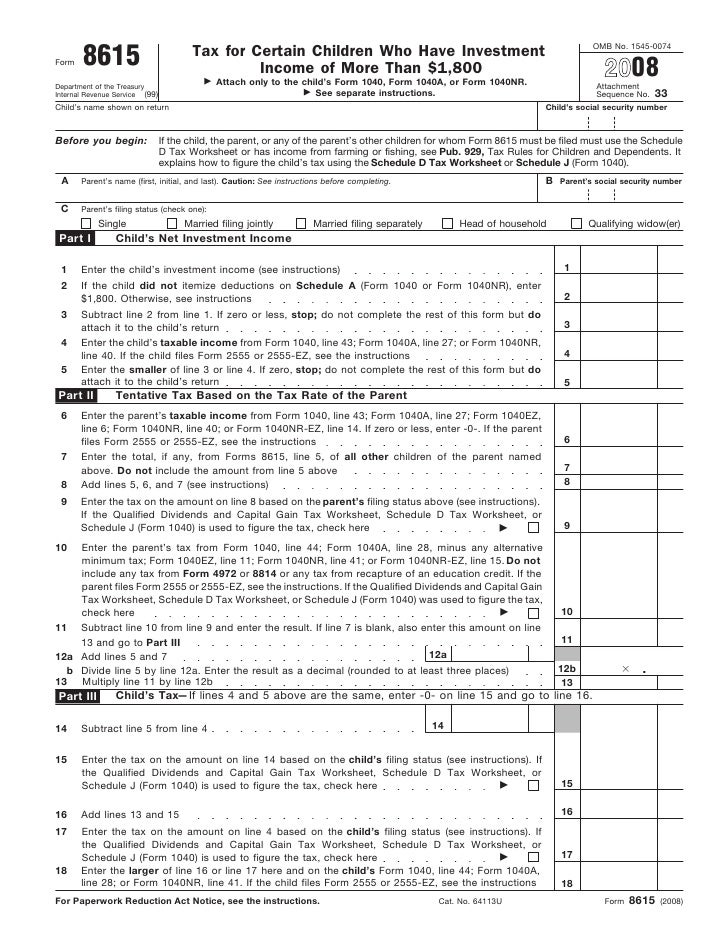

Form 8615Tax for Children Under Age 14 With Investment of Mor…

I have elected to calculate at the new tcja rules by answering no to the question. How do i clear and. Web form 8615 is tax for certain children who have unearned income. When turbotax did the final checking on my child's return, it put out this complaint: Unearned income includes taxable interest, ordinary dividends, capital gains (including.

Form 8615 Edit, Fill, Sign Online Handypdf

Web for form 8615, “unearned income” includes all taxable income other than earned income. The child had more than $2,300 of unearned income. Reach out to learn how we can help you! Web what is form 8615, tax for children under age 18? Turbo tax says it will walk you through fixing it.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

The child is required to file a tax return. Web if turbotax is adding form 8615 to your son's return, then he is being subject to kiddie tax. Parent's net lt gain shouldn't be less than or equal to zero. Ad sovos combines tax automation with a human touch. Web for form 8615, “unearned income” includes all taxable income other.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

Form 8615 must be filed with the child’s tax return if all of the following apply: This would mean that he would have had to have more than $2,200 of. Web what is form 8615, tax for children under age 18? Unearned income includes taxable interest, ordinary dividends, capital gains (including. File an extension in turbotax online before the deadline.

Gain proper advice to fix form 8615 in TurboTax — anpuhelp at

I have elected to calculate at the new tcja rules by answering no to the question. Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web if you have a child and any of the following apply turbotax will.

Form 8615 Office Depot

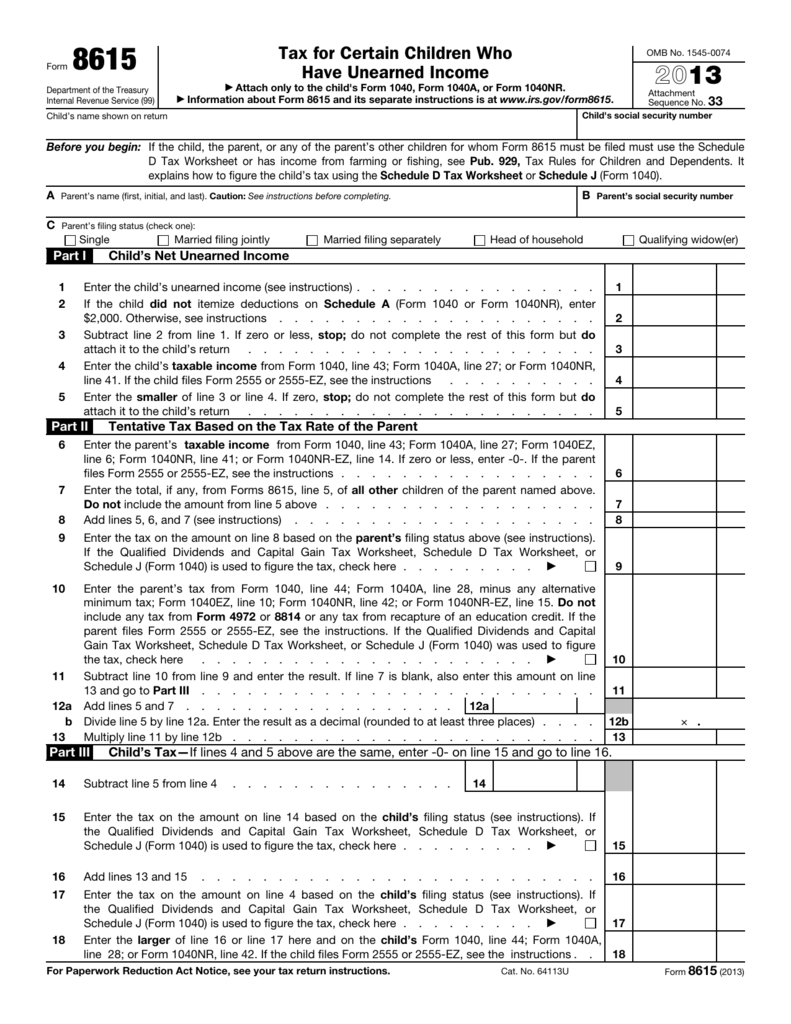

Web form 8615 must be filed for any child who meets all of the following conditions. Form 8615 is required to be used when a taxpayer’s child had unearned income over $2,300 and is: Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations.

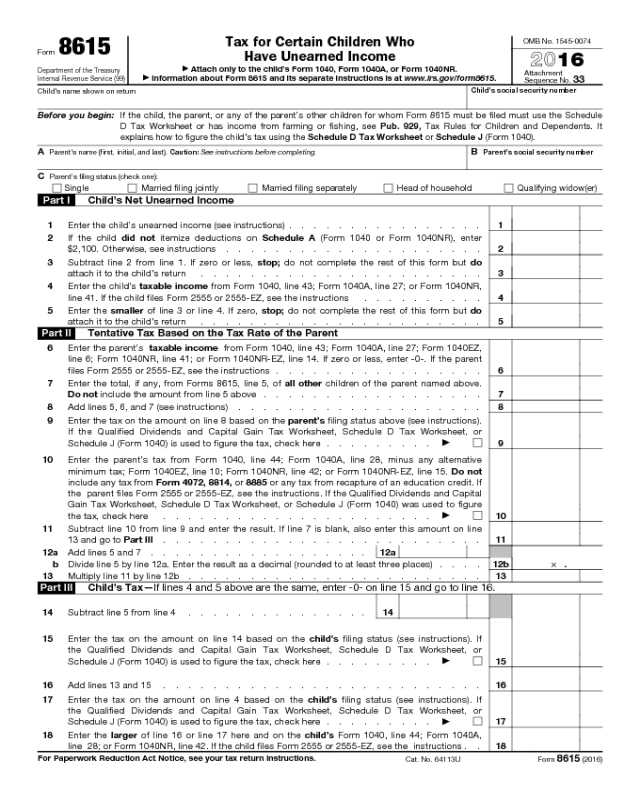

Fillable Form 8615 Tax For Certain Children Who Have Unearned

Web what is form 8615 used for. How do i clear and. File an extension in turbotax online before the deadline to avoid a late filing penalty. Under age 18, age 18 and did. Easily sort by irs forms to find the product that best fits your tax situation.

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

For children under age 18 and certain older children described below in who must file , unearned income over $2,300 is taxed at the parent's rate if the. Unearned income includes taxable interest, ordinary dividends, capital gains (including. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. Parent's net lt gain shouldn't.

Parent's Net Lt Gain Shouldn't Be Less Than Or Equal To Zero.

Turbo tax says it will walk you through fixing it. Web purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. If the child doesn't qualify for a form 8814 election, file form 8615 with a child's separate. When turbotax did the final checking on my child's return, it put out this complaint:

The Child Had More Than $2,300 Of Unearned Income.

While there have been other changes to the. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web for form 8615, “unearned income” includes all taxable income other than earned income. Easily sort by irs forms to find the product that best fits your tax situation.

See Who Must File, Later.

Ad sovos combines tax automation with a human touch. File an extension in turbotax online before the deadline to avoid a late filing penalty. I complete the return and for the. To find form 8615 please follow the steps below.

You Had More Than $2,300 Of Unearned.

Web what is form 8615 used for. I have elected to calculate at the new tcja rules by answering no to the question. I have also included additional information as it. Web why does my tax return keep getting rejected?