When Is Form 3115 Due

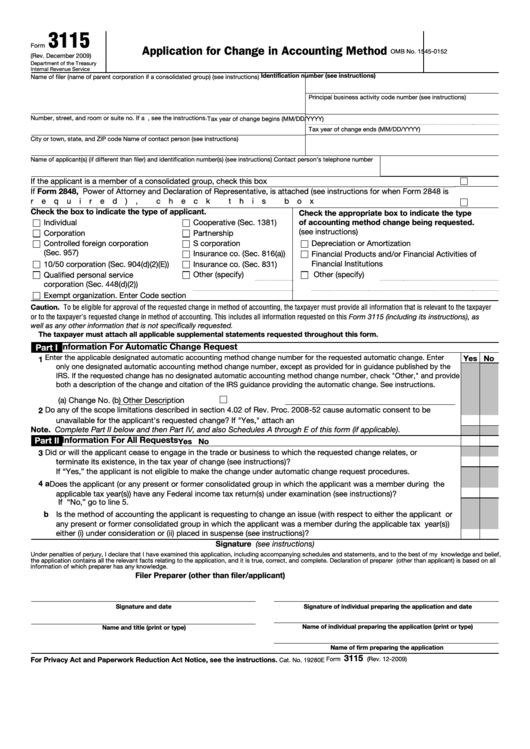

When Is Form 3115 Due - Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. 31, 2015, had until the due date of their timely filed federal income tax return. Web in some situations, the irs issues automatic consent procedures allowing taxpayers to voluntarily change their method of accounting without a user fee by simply. Web so, if your client can benefit from any of the tax saving opportunities from the new tprs, a 3115 should be filed in most cases. Web complete a 2022 mtm election filed by the april 18, 2022 deadline on form 3115 filed with your 2022 tax returns — by the due date of the return, including extensions. The excess repayment of $1,500 can be carried. Web in plr 202223011 [1] the irs denied the taxpayer’s request to file a form 3115 for an overall accounting method change from the cash to accrual basis it had. Web therefore taxpayers have until july 15, 2020 to file all forms 3115 and 1128 that are due on or after april 1, 2020, and before july 15, 2020. Web what is the penalty for not filing form 3115 by the due date? Additionally, form 3115 allows you.

Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. Web in plr 202223011 [1] the irs denied the taxpayer’s request to file a form 3115 for an overall accounting method change from the cash to accrual basis it had. 31, 2015, had until the due date of their timely filed federal income tax return. Web the irs will grant an extension of time to file an automatic form 3115 (i.e., beyond six months from the due date of the return for the year of change, excluding extensions) only. Web in some situations, the irs issues automatic consent procedures allowing taxpayers to voluntarily change their method of accounting without a user fee by simply. Application for change in accounting method. The calendar year is the most. Web in 2021, you made a repayment of $4,500. Additionally, form 3115 allows you. Web what is the penalty for not filing form 3115 by the due date?

Web therefore taxpayers have until july 15, 2020 to file all forms 3115 and 1128 that are due on or after april 1, 2020, and before july 15, 2020. The calendar year is the most. Web in 2021, you made a repayment of $4,500. Web so, if your client can benefit from any of the tax saving opportunities from the new tprs, a 3115 should be filed in most cases. December 2022) department of the treasury internal revenue service. Additionally, form 3115 allows you. Web in some situations, the irs issues automatic consent procedures allowing taxpayers to voluntarily change their method of accounting without a user fee by simply. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal. 22 nov 2006 hello roland, you should meet with a tax advisor.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Web complete a 2022 mtm election filed by the april 18, 2022 deadline on form 3115 filed with your 2022 tax returns — by the due date of the return, including extensions. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. The excess repayment of $1,500 can be.

Form 3115 Application for Change in Accounting Method

Web in 2021, you made a repayment of $4,500. Web with the issuance of the new guidance, the procedures for filing a form 3115, application for change in accounting method, for both automatic and nonautomatic method changes. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web in plr 202223011.

Fill Free fillable Form 3115 2018 Application for Change in

Web the irs will grant an extension of time to file an automatic form 3115 (i.e., beyond six months from the due date of the return for the year of change, excluding extensions) only. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. The excess repayment of $1,500.

Form 3115 Application for Change in Accounting Method(2015) Free Download

The calendar year is the most. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting under section 15.04 and a required change to an overall accrual method. Web complete a 2022 mtm election filed by the april 18, 2022 deadline on form 3115 filed with your 2022 tax returns — by.

Form 3115 App for change in acctg method Capstan Tax Strategies

Web in 2021, you made a repayment of $4,500. Web the irs will grant an extension of time to file an automatic form 3115 (i.e., beyond six months from the due date of the return for the year of change, excluding extensions) only. Web in some situations, the irs issues automatic consent procedures allowing taxpayers to voluntarily change their method.

Fillable Form 3115 Application For Change In Accounting Method

This applies only if you. Web what is the penalty for not filing form 3115 by the due date? December 2022) department of the treasury internal revenue service. The excess repayment of $1,500 can be carried. Web with the issuance of the new guidance, the procedures for filing a form 3115, application for change in accounting method, for both automatic.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Accounting treatment of certain credit card fees. Web in 2021, you made a repayment of $4,500. Web so, if your client can benefit from any of the tax saving opportunities from the new tprs, a 3115 should be filed in most cases. Web requires one form 3115 for an automatic change to, from or within an nae method of accounting.

Form 3115 for a Cash to Accrual Method Accounting Change

Web so, if your client can benefit from any of the tax saving opportunities from the new tprs, a 3115 should be filed in most cases. Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal. December 2022) department of the.

National Association of Tax Professionals Blog

22 nov 2006 hello roland, you should meet with a tax advisor. Web in some situations, the irs issues automatic consent procedures allowing taxpayers to voluntarily change their method of accounting without a user fee by simply. Application for change in accounting method. The excess repayment of $1,500 can be carried. Web with certain exceptions, the revenue procedure is effective.

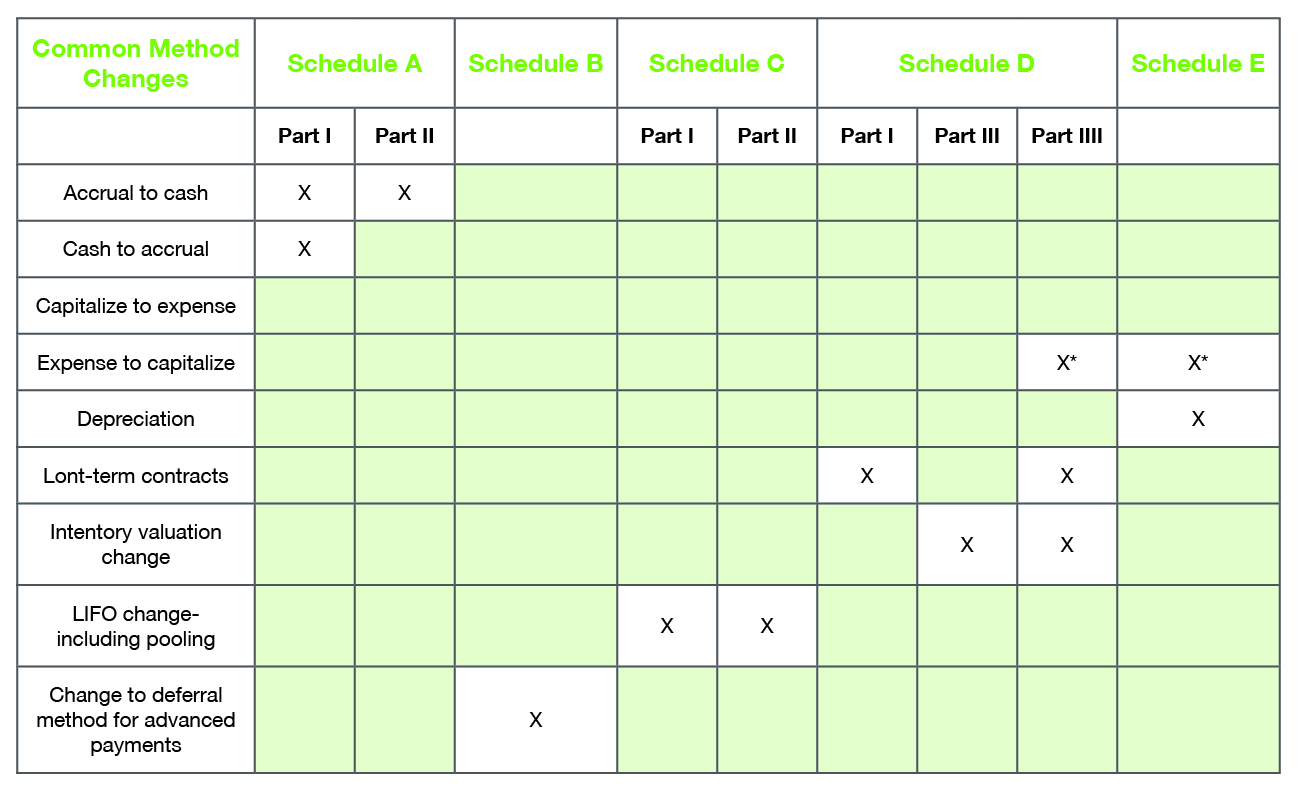

TPAT Form 3115 and New Tangible Property Regulations (TPR)

Accounting treatment of certain credit card fees. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods. Web with certain exceptions, the revenue procedure is effective for a form 3115 filed on or after aug. Web with the issuance of the new guidance, the procedures for filing a form 3115, application.

Web Complete A 2022 Mtm Election Filed By The April 18, 2022 Deadline On Form 3115 Filed With Your 2022 Tax Returns — By The Due Date Of The Return, Including Extensions.

Web introduction every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. Web in 2021, you made a repayment of $4,500. Web previously, taxpayers filing form 3115 in tax years ending on or after may 31, 2014, and on or before jan. Web february 09, 2021 purpose (1) this transmits revised irm 4.11.6, examining officers guide (eog), changes in accounting methods.

Web The Irs Will Grant An Extension Of Time To File An Automatic Form 3115 (I.e., Beyond Six Months From The Due Date Of The Return For The Year Of Change, Excluding Extensions) Only.

Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Accounting treatment of certain credit card fees. Web what is the penalty for not filing form 3115 by the due date? This applies only if you.

Web In Some Situations, The Irs Issues Automatic Consent Procedures Allowing Taxpayers To Voluntarily Change Their Method Of Accounting Without A User Fee By Simply.

December 2022) department of the treasury internal revenue service. Application for change in accounting method. Web therefore taxpayers have until july 15, 2020 to file all forms 3115 and 1128 that are due on or after april 1, 2020, and before july 15, 2020. Additionally, form 3115 allows you.

Web With Certain Exceptions, The Revenue Procedure Is Effective For A Form 3115 Filed On Or After Aug.

Web with the issuance of the new guidance, the procedures for filing a form 3115, application for change in accounting method, for both automatic and nonautomatic method changes. 31, 2015, had until the due date of their timely filed federal income tax return. 22 nov 2006 hello roland, you should meet with a tax advisor. Web the form 3115 for the taxpayer’s last tax year ending before january 31, 2022, may be submitted on or before the due date (including extensions) of the federal.