When To File Form 8606

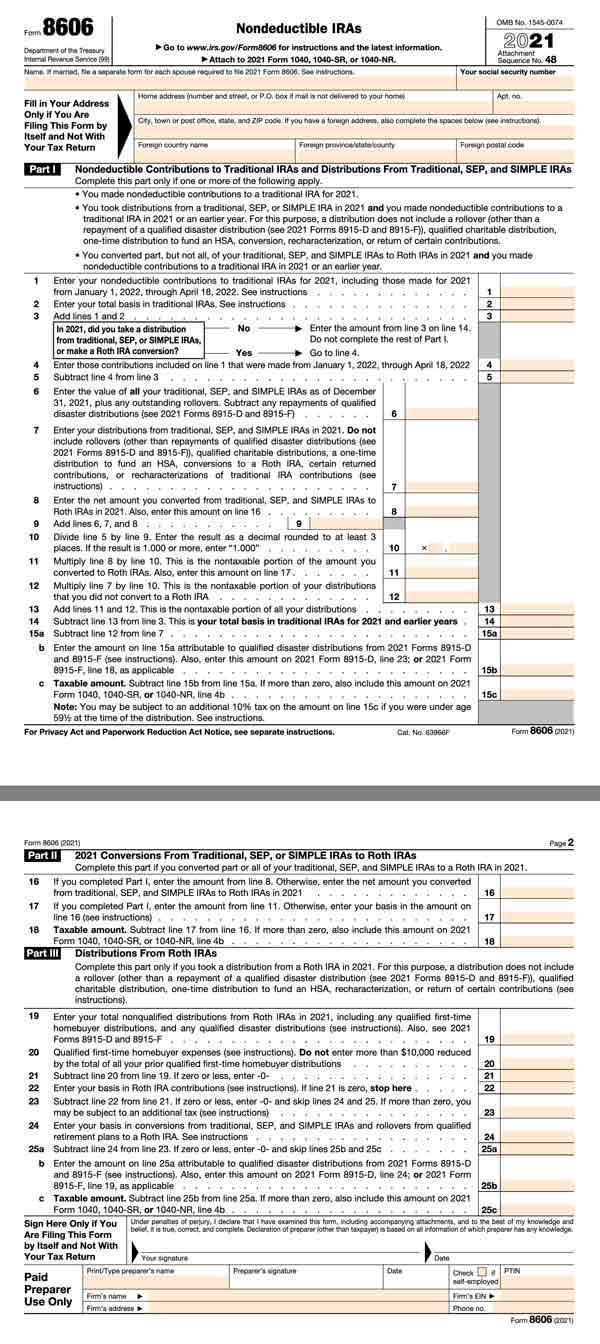

When To File Form 8606 - Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. If you're not required to file an income tax return but are required to. Web solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on. If you’re required to file form 8606 but. You will need to amend the 2021 return once the first. Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. If you aren’t required to. Form 8606 should be filed with your federal income tax return for the year you made nondeductible contributions or took. Speak to your advisor for specific guidance. Web file form 8606 when you convert a traditional ira to a roth ira.

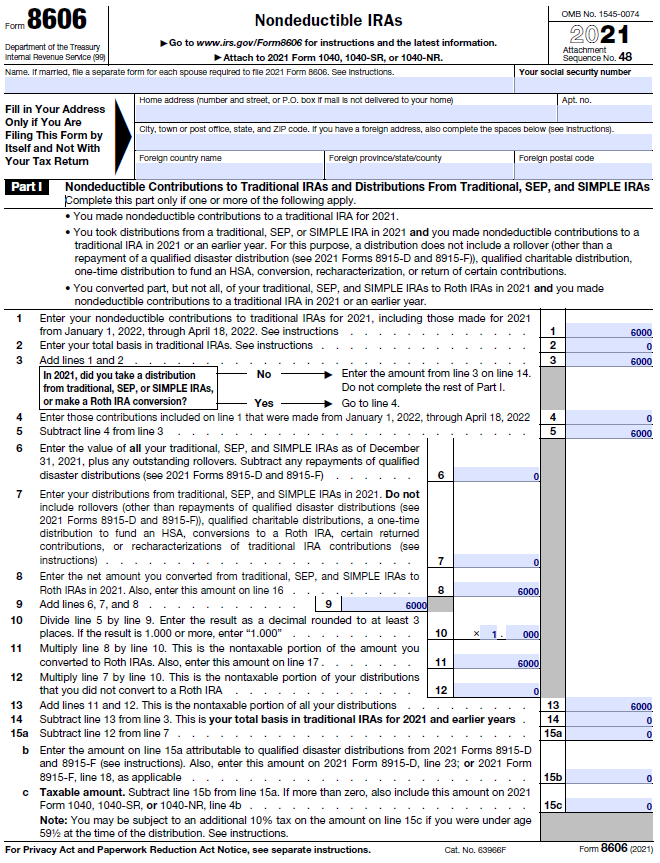

If you're not required to file an income tax return but are required to. If married, file a separate form for each spouse required to file. Web file form 8606 when you convert a traditional ira to a roth ira. If you aren’t required to. Web solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on. If you took a distribution from your traditional ira in 2021 then you will need to file form 8606. This will involve part ii: If married, file a separate form for each spouse required to file. Web file form 8606 with form 1040 or 1040nr by the due date, including due dates for extensions. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

If married, file a separate form for each spouse required to file. Web filing form 8606 with the irs when to file. Web file form 8606 with form 1040 or 1040nr by the due date, including due dates for extensions. Web solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on. If you aren’t required to. If you took a distribution from your traditional ira in 2021 then you will need to file form 8606. If you aren’t required to. Web when and where to file. Form 8606 should be filed with your federal income tax return for the year you made nondeductible contributions or took. If you're not required to file an income tax return but are required to.

united states How to file form 8606 when doing a recharacterization

Speak to your advisor for specific guidance. Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. If you took a distribution from your traditional ira in 2021 then you will need to file form 8606. Web when and where to file. Web file.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web there are several ways to submit form 4868. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. If you took a distribution from your traditional ira in 2021 then you will need to file form 8606. If you're not required to file an income tax return but are required.

Are Taxpayers Required to File Form 8606? Retirement Daily on

If you're not required to file an income tax return but are required to. “2020 conversions from traditional, sep, or simple iras to roth. This will involve part ii: Form 8606 should be filed with your federal income tax return for the year you made nondeductible contributions or took. Web file form 8606 when you convert a traditional ira to.

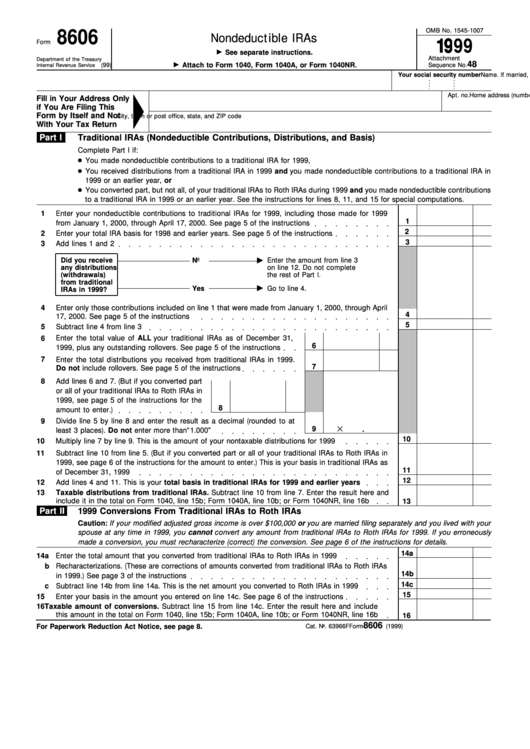

Form 8606 Nondeductible Iras 1999 printable pdf download

If you aren’t required to. If you’re required to file form 8606 but. If married, file a separate form for each spouse required to file. You will need to amend the 2021 return once the first. If you're not required to file an income tax return but are required to.

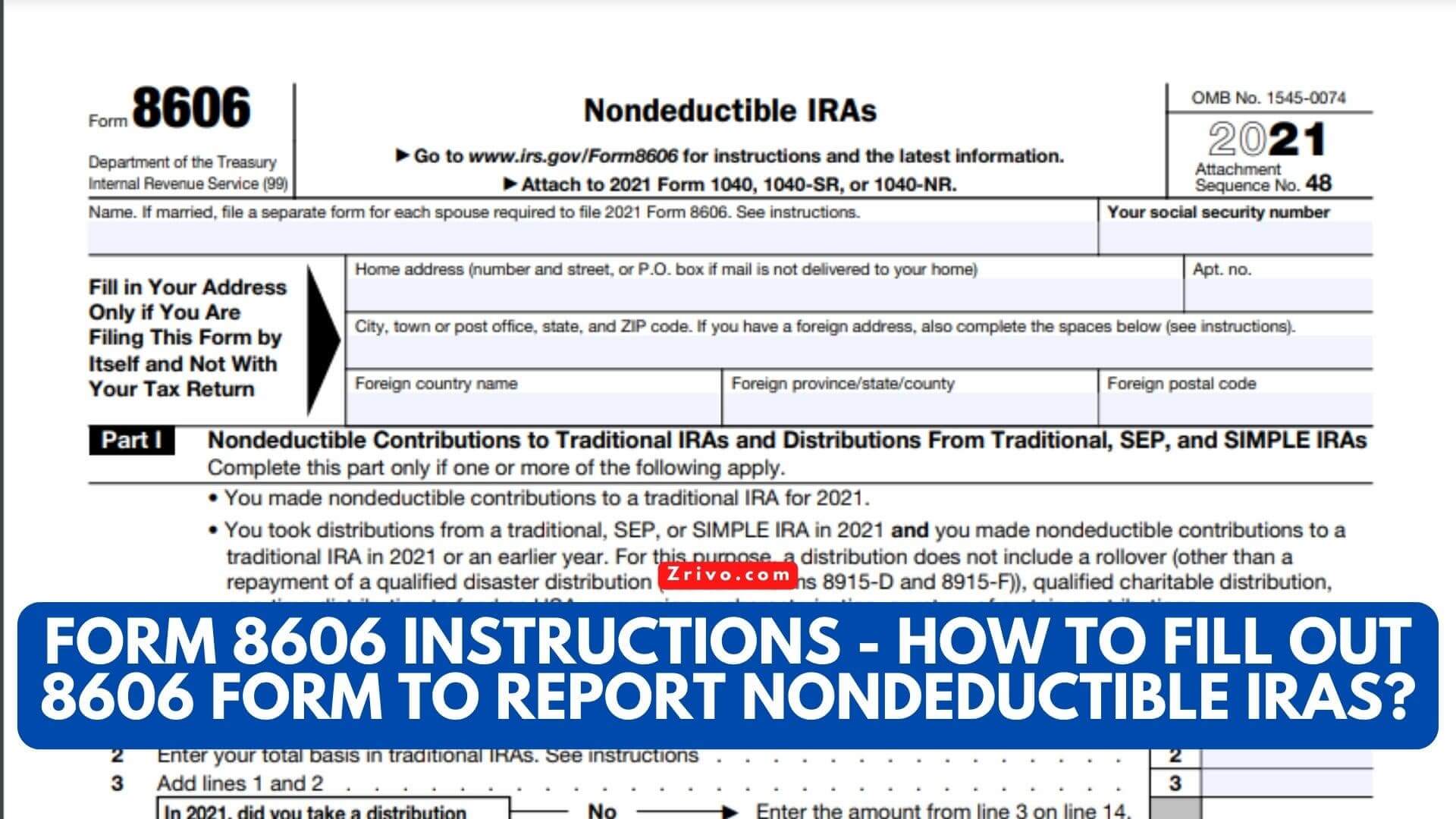

2023 Form 8606 Instructions How To Fill Out 8606 Form To Report

Form 8606 should be filed with your federal income tax return for the year you made nondeductible contributions or took. This will involve part ii: Web filing form 8606 with the irs when to file. Web your spouse may need to file their own form 8606 in certain circumstances; Taxpayers can file form 4868 by mail, but remember to get.

IRS Form 8606 What Is It & When To File? SuperMoney

Speak to your advisor for specific guidance. If you aren’t required to. Web when and where to file. If married, file a separate form for each spouse required to file. Form 8606 should be filed with your federal income tax return for the year you made nondeductible contributions or took.

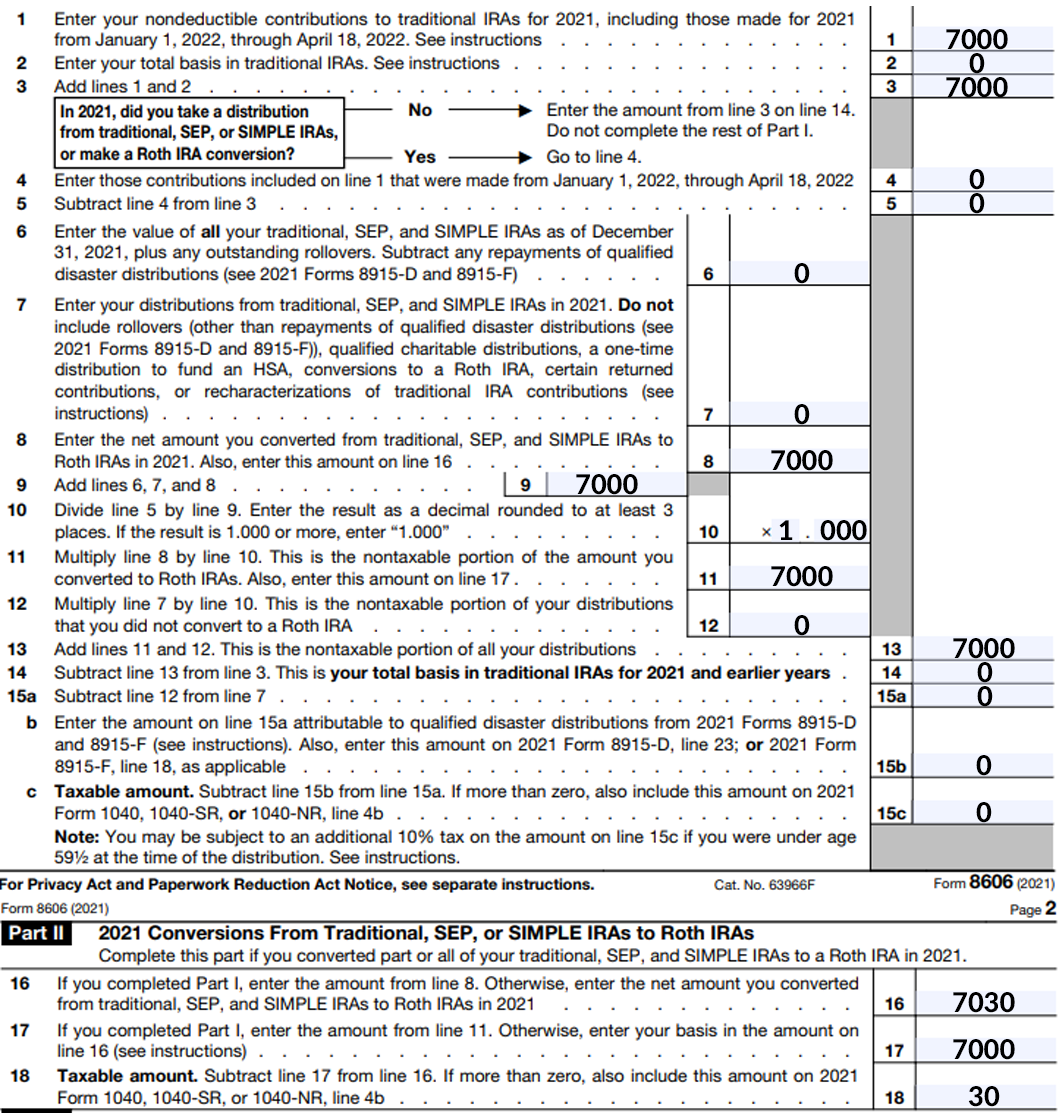

Backdoor Roth IRA Contributions Noble Hill Planning

If you're not required to file an income tax return but are required to. If you’re required to file form 8606 but. Web file form 8606 with form 1040 or 1040nr by the due date, including due dates for extensions. If married, file a separate form for each spouse required to file. Web your spouse may need to file their.

IRS Form 8606 LinebyLine Instructions 2022 How to File Form 8606

If you aren’t required to. If married, file a separate form for each spouse required to file. Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. Web solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill.

Form 8606 What If I To File? (🤑) YouTube

If you're not required to file an income tax return but are required to. “2020 conversions from traditional, sep, or simple iras to roth. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web when and where to file. Web filing form 8606 with the irs when to file.

Form 8606 Nondeductible IRAs (2014) Free Download

Web file form 8606 when you convert a traditional ira to a roth ira. Web form 8606 is used to report a variety of transactions related to traditional individual retirement agreements (iras), roth iras, and other types of retirement plans. Speak to your advisor for specific guidance. Taxpayers can file form 4868 by mail, but remember to get your request.

Speak To Your Advisor For Specific Guidance.

If you aren’t required to. Web solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you reported any of these on. If married, file a separate form for each spouse required to file. If you took a distribution from your traditional ira in 2021 then you will need to file form 8606.

Web File Form 8606 When You Convert A Traditional Ira To A Roth Ira.

Web when and where to file. You will need to amend the 2021 return once the first. If you’re required to file form 8606 but. If you're not required to file an income tax return but are required to.

Web Filing Form 8606 With The Irs When To File.

Web form 8606 is used to report nondeductible contributions to traditional iras and to report distributions from traditional ira with a basis and distributions from roth. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. “2020 conversions from traditional, sep, or simple iras to roth. Web file form 8606 with form 1040 or 1040nr by the due date, including due dates for extensions.

Web When And Where To File.

If married, file a separate form for each spouse required to file. This will involve part ii: If you aren’t required to. Web your spouse may need to file their own form 8606 in certain circumstances;