When Was Form 8938 First Required

When Was Form 8938 First Required - For individuals, the form 8938 due dates, include: Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. When and how to file attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web 8938 form filing deadline. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Taxpayers to report specified foreign financial assets each year on a form 8938. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return, but the fbar has been around since 1970. Instructions for form 8038 created date: Web summary of fatca & fincen the purpose of this article is to summarize the fbar vs 8938 comparison — and when each form is required by the irs.

Web form 8938 and fbar filing requirements. When and how to file attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web bank and investment accounts must be reported. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds. The standard penalty is a fine of $10,000 per year. Web in this situation, you only need to file a form 8938 when on the last day of the current tax year the fair market value of their asset exceeds $50,000, or the value. Web failing to file form 8938 when required can result in severe penalties. The due date for fatca reporting is the date your tax return is due to be filed. Web by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets if the total value.

When and how to file attach form 8938 to your annual return and file by the due date (including extensions) for that return. Web summary of fatca & fincen the purpose of this article is to summarize the fbar vs 8938 comparison — and when each form is required by the irs. Web fatca form 8938 is new and was first introduced on the 2011 1040 tax return, but the fbar has been around since 1970. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. If the irs notifies taxpayers that they are delinquent, they. Owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds. Web bank and investment accounts must be reported. Web the form 8938 is a part of the tax return. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial.

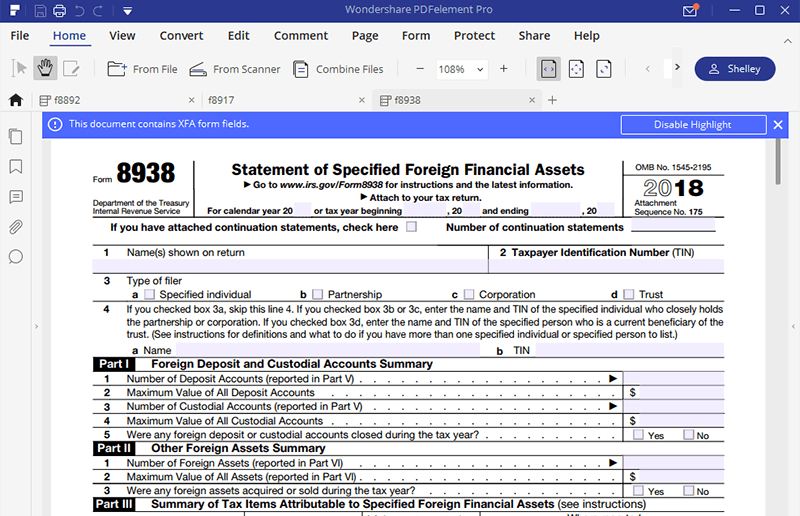

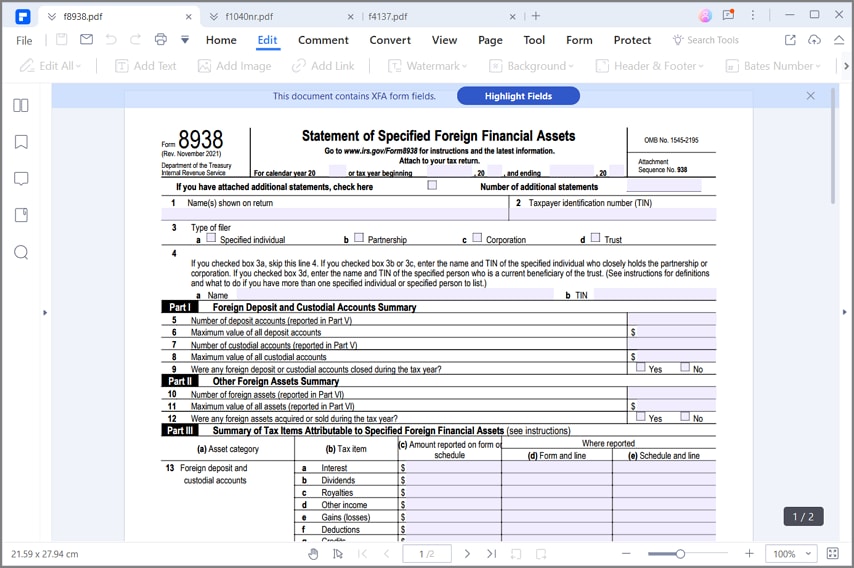

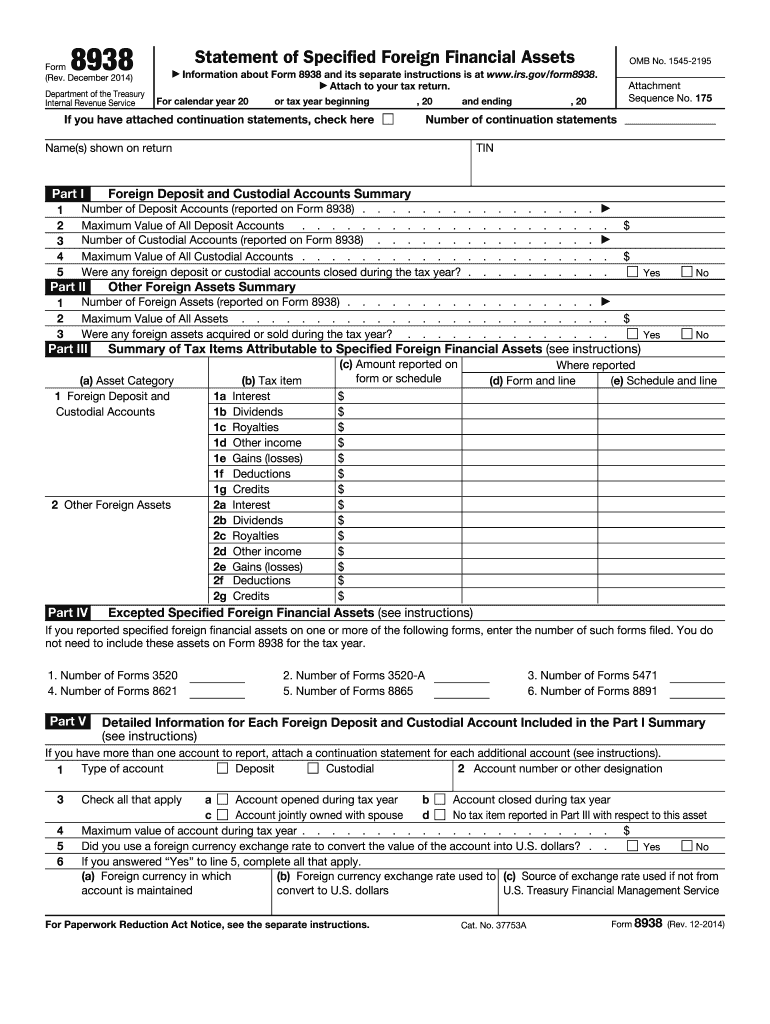

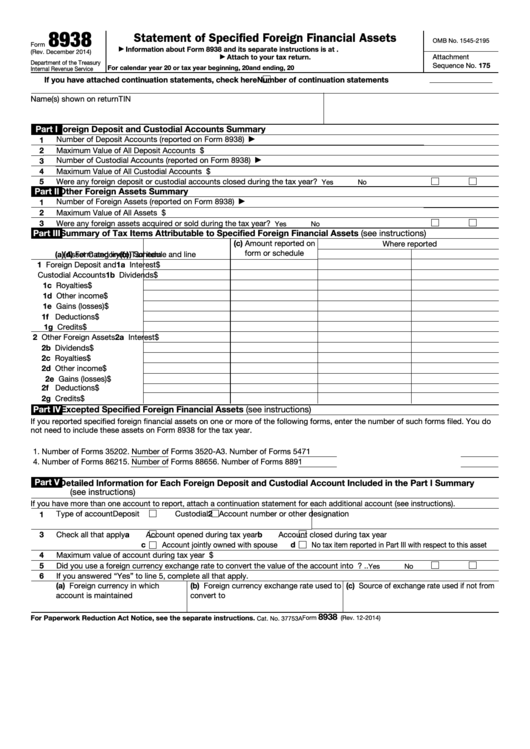

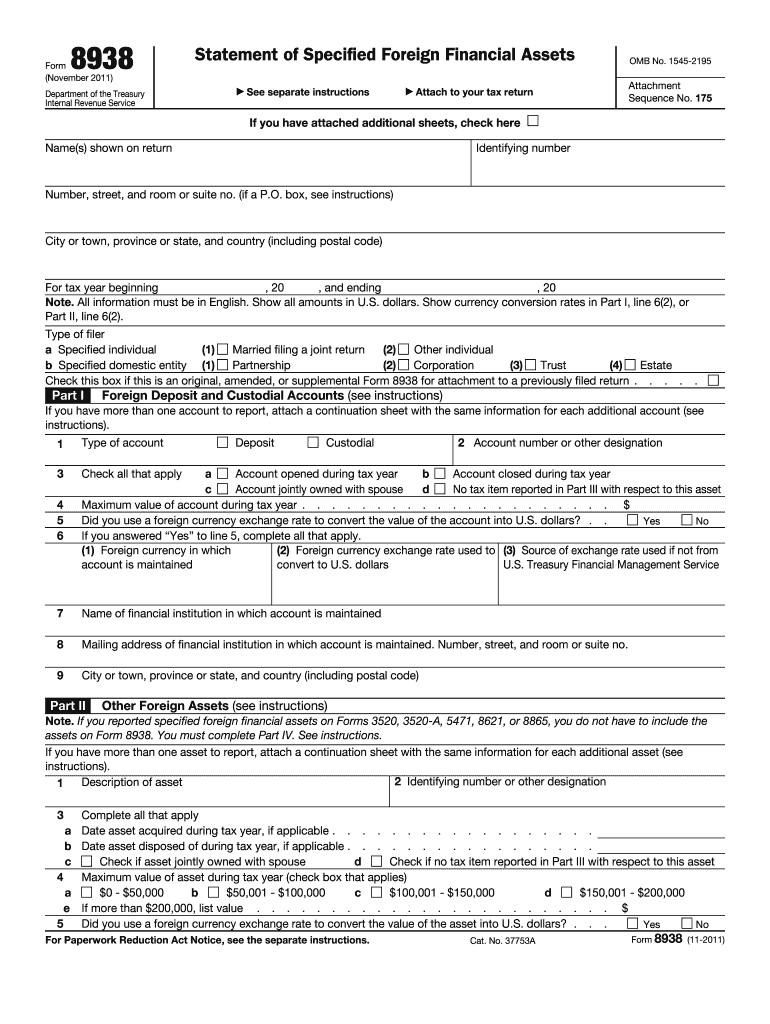

IRS Form 8938 How to Fill it with the Best Form Filler

Use form 8938 to report your. Instructions for form 8038 created date: If the irs notifies taxpayers that they are delinquent, they. Web 8938 form filing deadline. Web the form 8938 is a part of the tax return.

IRS Form 8938 How to Fill it with the Best Form Filler

When and how to file attach form 8938 to your annual return and file by the due date (including extensions) for that return. Instructions for form 8038 created date: Web form 8938 and fbar filing requirements. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign.

Form 8938 Fill Out and Sign Printable PDF Template signNow

Taxpayers to report specified foreign financial assets each year on a form 8938. Naturally, you'll also need to. The due date for fatca reporting is the date your tax return is due to be filed. Web the form 8938 is a part of the tax return. Instructions for form 8038 created date:

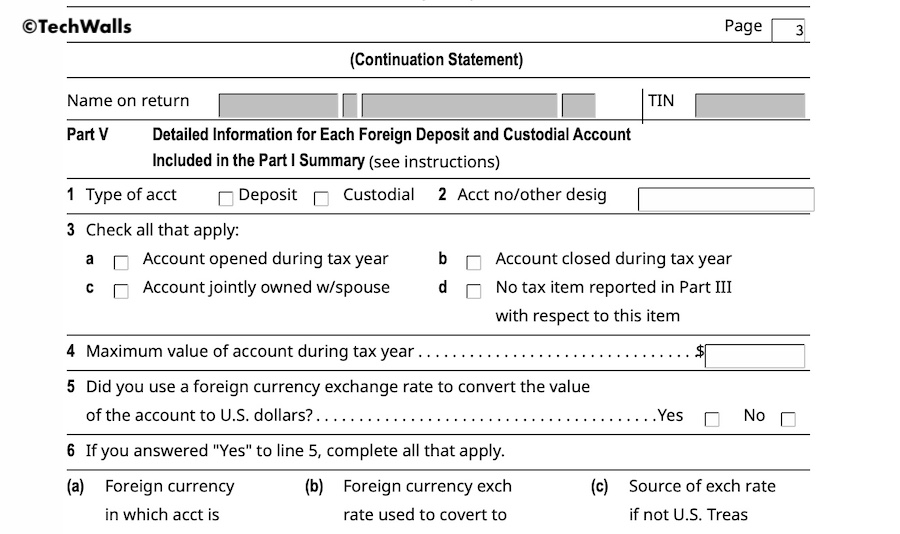

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Use form 8938 to report your. Web summary of fatca & fincen the purpose of this article is to summarize the fbar vs 8938 comparison — and when each form is required by the irs. Web 8938 form filing deadline. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web failing to file.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Instructions for form 8038 created date: The standard penalty is a fine of $10,000 per year. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only. Web form 8938 and fbar filing requirements. For individuals, the form 8938 due dates, include:

Is Form 8938 Reporting Required for Foreign Pension Plans?

It was developed by fincen (financial crimes. The standard penalty is a fine of $10,000 per year. Web bank and investment accounts must be reported. For individuals, the form 8938 due dates, include: Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Web bank and investment accounts must be reported. Instructions for form 8038 created date: Web the form 8938 is a part of the tax return. The form 8938 instructions are complex. Web comparison of form 8938 and fbar requirements.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Instructions for form 8038 created date: Web comparison of form 8938 and fbar requirements. Web 8938 form filing deadline. Web how do i file form 8938, statement of specified foreign financial assets? If the irs notifies taxpayers that they are delinquent, they.

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web comparison of form 8938 and fbar requirements. If the irs notifies taxpayers that they are delinquent, they. Web the form 8938 is a part of the tax return. Web form 8938 and fbar filing.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web failing to file form 8938 when required can result in severe penalties. Web in this situation, you only need to file a form 8938 when on the last day of the current tax year the fair market value of their asset exceeds $50,000, or the value. Naturally, you'll also need to. Use form 8938 to report your. Web by.

Web Summary Of Fatca & Fincen The Purpose Of This Article Is To Summarize The Fbar Vs 8938 Comparison — And When Each Form Is Required By The Irs.

Web form 8938 and fbar filing requirements. Web 8938 form filing deadline. It was developed by fincen (financial crimes. Web comparison of form 8938 and fbar requirements.

Web Information About Form 8938, Statement Of Foreign Financial Assets, Including Recent Updates, Related Forms And Instructions On How To File.

Owning the following types of assets also must be reported on form 8938 if your total foreign asset value exceeds. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial assets, and to the. Use form 8938 to report your. For individuals, the form 8938 due dates, include:

Web Failing To File Form 8938 When Required Can Result In Severe Penalties.

Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. Instructions for form 8038 created date: Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial.

The Due Date For Fatca Reporting Is The Date Your Tax Return Is Due To Be Filed.

Web in this situation, you only need to file a form 8938 when on the last day of the current tax year the fair market value of their asset exceeds $50,000, or the value. Naturally, you'll also need to. When and how to file attach form 8938 to your annual return and file by the due date (including extensions) for that return. If the irs notifies taxpayers that they are delinquent, they.