Where To Enter Form 3922 On Turbotax

Where To Enter Form 3922 On Turbotax - If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Persons with a hearing or speech disability with access to. Web federal income tax information source documents form 3922 transfer of stock acquired through an espp Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web form 3922, transfer of stock acquired through employee stock purchase plan. Web solved • by intuit • 415 • updated july 14, 2022. Sign in or open turbotax. Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Form 3922 is an informational statement and would not be entered into the tax return. Answer yes on the did you sell stocks, mutual funds, bonds, or other investments screen.

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. Web if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax year. Web get your taxes done i have tax form 3922 did the information on this page answer your question? If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Or even do your taxes for you. Form 3922 is an informational statement and would not be entered into the tax return. Web form 3922, transfer of stock acquired through employee stock purchase plan. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web irs form 3922 is for informational purposes only and isn't entered into your return.

It is for your personal records. Web get your taxes done i have tax form 3922 did the information on this page answer your question? Form 3922 transfer of stock acquired through an employee stock purchase plan under. Form 3922 is an informational statement and would not be entered into the tax return. Web 1 best answer. Web enter the name, address, and tin of the corporation whose stock is being transferred pursuant to the exercise of the option. Web similarly, a u.s. From our tax experts and community. Click on take me to my return. Enter this information only if the corporation is not.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

The irs 3922 form titled, “transfer of stock acquired through an employee stock purchase plan under section 423(c).” this form captures all of the espp. Answer yes on the did you sell stocks, mutual funds, bonds, or other investments screen. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Or even do your taxes for.

Documents to Bring To Tax Preparer Tax Documents Checklist

Keep the form for your records because you’ll need the information when you sell, assign, or. Sign in or open turbotax. Persons with a hearing or speech disability with access to. Web similarly, a u.s. Web you are not required to enter form 3922 on your return.

How to Enter 1099MISC Fellowship into TurboTax Evolving

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web 1 best answer. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c).

IRS Form 3922

Answer yes on the did you sell stocks, mutual funds, bonds, or other investments screen. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. The irs 3922 form titled, “transfer of stock acquired through an employee stock purchase plan under section 423(c).”.

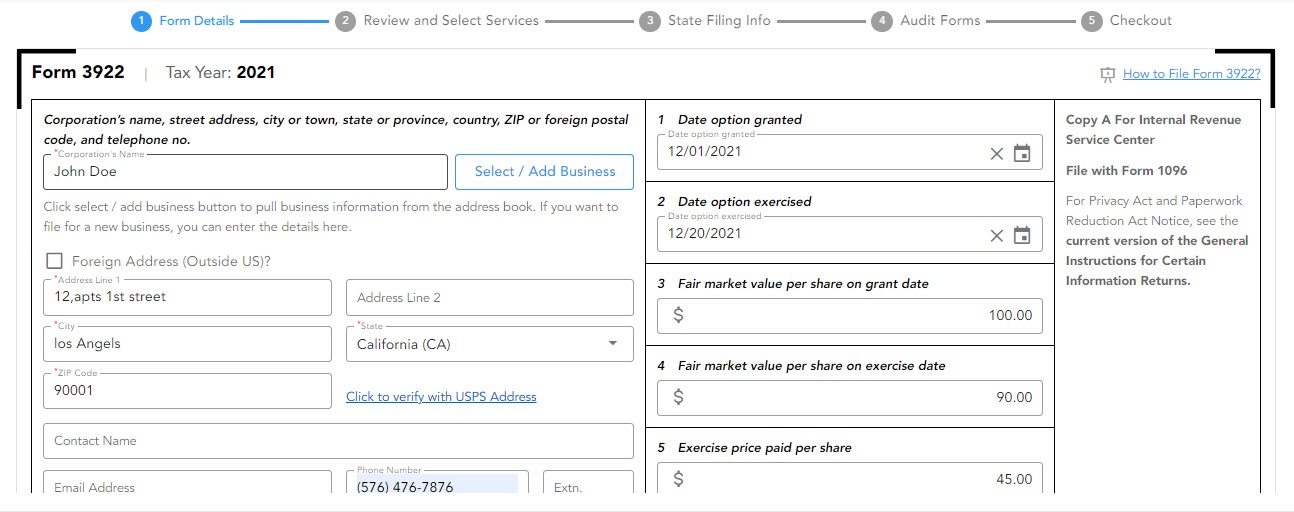

File IRS Form 3922 Online EFile Form 3922 for 2022

Web for the latest information about developments related to forms 3921 and 3922 and their instructions, such as legislation enacted after they were published, go to. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Sign in or open turbotax. Form 3922 transfer of stock acquired through an employee stock purchase plan under. Web solved.

A Quick Guide to Form 3922 YouTube

Web enter the name, address, and tin of the corporation whose stock is being transferred pursuant to the exercise of the option. Web if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of the tax year. Or even do your taxes for you. Web you are not.

Where do I enter my 1098T?

Form 3922 transfer of stock acquired through an employee stock purchase plan under. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web enter the name, address, and tin of the corporation whose stock is being transferred pursuant to the exercise of the option. Web solved • by intuit • 415 • updated july 14,.

Where Do I Enter a 1098 Tax Form in TurboTax Online TurboTax Support

Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the employment stock purchase plan. Web irs form 3922 is for informational purposes only and isn't.

What is an IRS 1099 Form? TurboTax Tax Tips & Videos Irs, Turbotax, Tax

Click on take me to my return. Web solved • by intuit • 415 • updated july 14, 2022. The irs 3922 form titled, “transfer of stock acquired through an employee stock purchase plan under section 423(c).” this form captures all of the espp. Web irs form 3922 is for informational purposes only and isn't entered into your return. From.

IRS Form 3922 Software 289 eFile 3922 Software

It is for your personal records. Or even do your taxes for you. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Click on take me to my return. Form 3922 transfer of stock acquired through an employee stock purchase plan under.

Web Form 3922 Is An Irs Tax Form Used By Corporations To Report The Transfer Of Stock Options Acquired By Employees Under The Employment Stock Purchase Plan.

Sign in or open turbotax. Persons with a hearing or speech disability with access to. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. Keep the form for your records because you’ll need the information when you sell, assign, or.

Click On Take Me To My Return.

Person filing form 8865 with respect to a foreign partnership that has made an mtm election described in treas. Web get your taxes done i have tax form 3922 did the information on this page answer your question? Web irs form 3922 is for informational purposes only and isn't entered into your return. Form 3922 transfer of stock acquired through an employee stock purchase plan under.

Web For The Latest Information About Developments Related To Forms 3921 And 3922 And Their Instructions, Such As Legislation Enacted After They Were Published, Go To.

Web form 3922, transfer of stock acquired through employee stock purchase plan. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web 1 best answer.

It Is For Your Personal Records.

From our tax experts and community. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web federal income tax information source documents form 3922 transfer of stock acquired through an espp