Where To File Form 8832

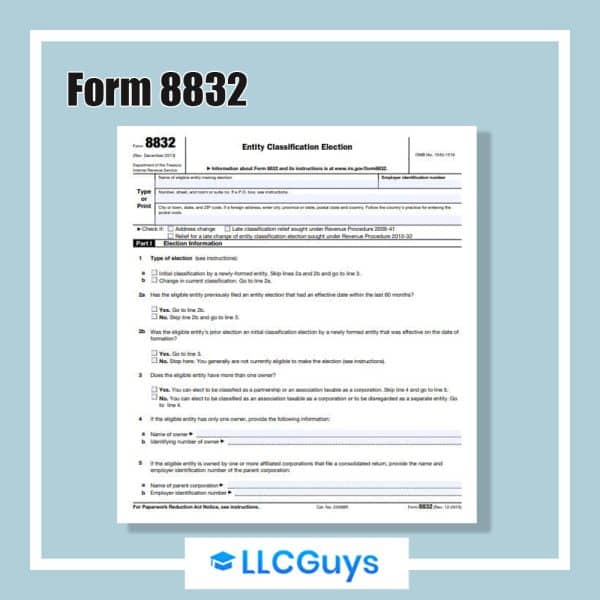

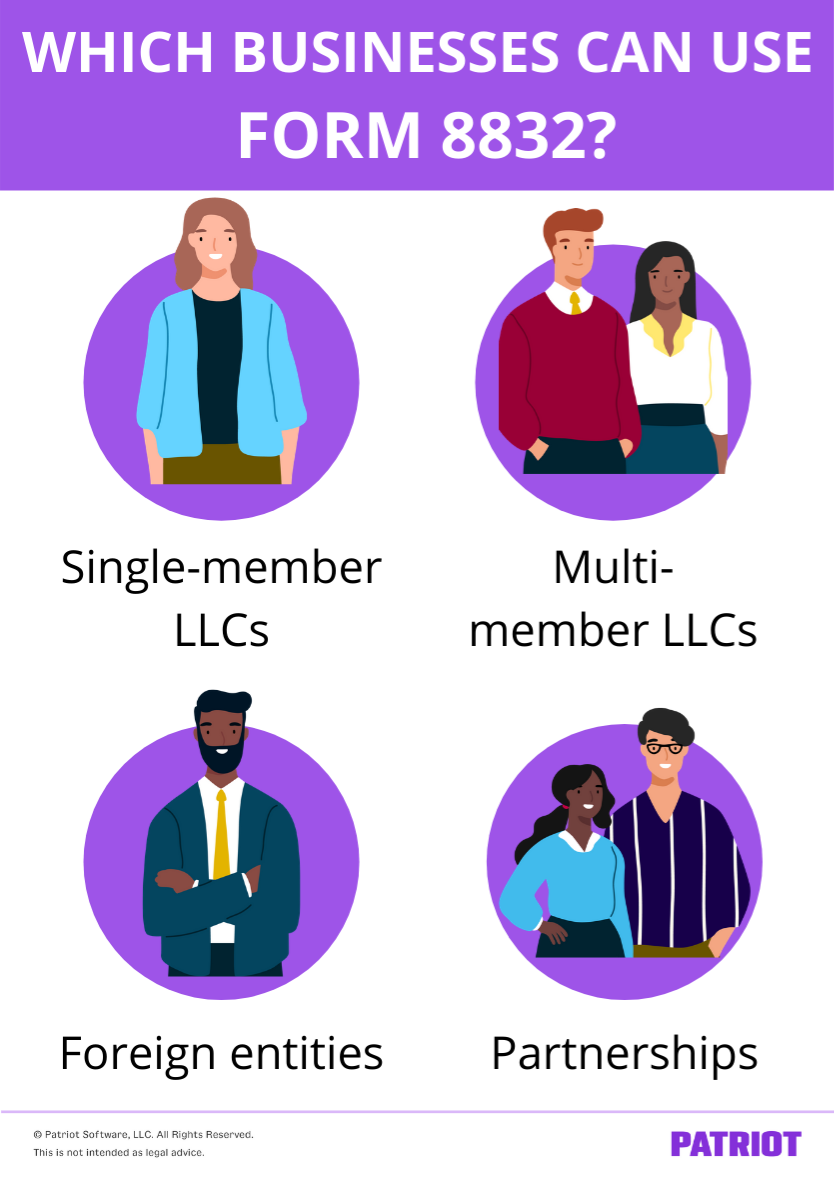

Where To File Form 8832 - Form 8832 is not available for submission through efile. Web where to file form 8832: Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a corporation. Who must file form 8832? You can find irs form 8832 on the irs website the first page of the form has information about where to. Web find irs mailing addresses by state to file form 8832. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. This confirms form 2553 must be filed n order to make the election: If you do not yet have an ein, you cannot fill out form 8832. Other tax election forms to know about.

Depending on where you live, there are two mailing addresses. Web llcs can file form 8832, entity classification election to elect their business entity classification. The irs form lists two addresses to mail in your form. You can find irs form 8832 on the irs website the first page of the form has information about where to. If you do not yet have an ein, you cannot fill out form 8832. Make sure to do the following: Complete part 2, late election relief. Filers should rely on this update for the changes described,which will be incorporated into the next revision of the form’s instructions. This update supplements this form’s instructions. Web do i need to file form 8832 and 2553?

Partnerships and limited liability companies can file irs form 8832. Before you rush to hand in form 8832, make sure you know about form. Who must file form 8832? Web new mailing address the address for mailing form 8832 has changed since the form was last published. Enter your business name and address. Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a corporation. Web unfortunately, you cannot file form 8832 electronically with the irs. Complete part 1, election information. Make sure to do the following: This confirms form 2553 must be filed n order to make the election:

Form 8832 and Changing Your LLC Tax Status Bench Accounting

One of the most common types of elections is for an entity to be treated as an s corporation instead of a c corporation so that the income flows through and there is only one level of tax. The location you send the form depends on the state or country your business calls home. Pursuant to the entity classification rules,.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Partnerships and limited liability companies can file irs form 8832. Depending on where you live, there are two mailing addresses. Web new mailing address the address for mailing form 8832 has changed since the form was last published. Form 8832 is not available for submission through efile. Web llcs can file form 8832, entity classification election to elect their business.

IRS Form 8832 Instructions and FAQs for Business Owners NerdWallet

Complete part 1, election information. Web where to file form 8832: Filers should rely on this update for the changes described,which will be incorporated into the next revision of the form’s instructions. Complete part 2, late election relief. The location you send the form depends on the state or country your business calls home.

Form 8832 All About It and How to File It?

Web new mailing address the address for mailing form 8832 has changed since the form was last published. Complete part 1, election information. Form 8832 is not available for submission through efile. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. 40% of small biz owners get paid by.

Form 8832 All About It and How to File It?

Who must file form 8832? Other tax election forms to know about. Web new mailing address the address for mailing form 8832 has changed since the form was last published. Before you rush to hand in form 8832, make sure you know about form. The updated mailing addresses are shown below.

Do I Need to File IRS Form 8832 for My Business? The Handy Tax Guy

Web what does this mean? Web find irs mailing addresses by state to file form 8832. The updated mailing addresses are shown below. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Form 8832 if you are located in.

What Is IRS Form 8832? Definition, Deadline, & More

Web new mailing address the address for mailing form 8832 has changed since the form was last published. Web llcs can file form 8832, entity classification election to elect their business entity classification. This update supplements this form’s instructions. Enter your business name and address. Web form 8832 can be filed with the irs for partnerships and limited liability companies.

What is Form 8832 and How Do I File it?

One of the most common types of elections is for an entity to be treated as an s corporation instead of a c corporation so that the income flows through and there is only one level of tax. Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Form 8832.

Using Form 8832 to Change Your LLC’s Tax Classification

Make sure to do the following: Web do i need to file form 8832 and 2553? Depending on where you live, there are two mailing addresses. Web form 8832 can be filed with the irs for partnerships and limited liability companies (llcs) if they want to be taxed as different kinds of companies, like a corporation. Who must file form.

What Is Form 8832 and How Do I Fill It Out? Ask Gusto

Before you rush to hand in form 8832, make sure you know about form. Web new mailing address the address for mailing form 8832 has changed since the form was last published. Web irs form 8832 instructions: Filers should rely on this update for the changes described,which will be incorporated into the next revision of the form’s instructions. Web llcs.

Web Where To File Form 8832:

Web llcs can file form 8832, entity classification election to elect their business entity classification. Enter your business name and address. Complete part 1, election information. Web unfortunately, you cannot file form 8832 electronically with the irs.

One Of The Most Common Types Of Elections Is For An Entity To Be Treated As An S Corporation Instead Of A C Corporation So That The Income Flows Through And There Is Only One Level Of Tax.

Web find irs mailing addresses by state to file form 8832. The location you send the form depends on the state or country your business calls home. 40% of small biz owners get paid by check. Form 8832 is not available for submission through efile.

The Irs Form Lists Two Addresses To Mail In Your Form.

It has to be mailed to the agency. Make sure to do the following: This confirms form 2553 must be filed n order to make the election: The updated mailing addresses are shown below.

Who Must File Form 8832?

Form 8832 if you are located in. Web do i need to file form 8832 and 2553? You can find irs form 8832 on the irs website the first page of the form has information about where to. Web what does this mean?