Where To Mail Extension Form 7004

Where To Mail Extension Form 7004 - What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form. Web follow these steps to determine which address the form 7004 should be sent to: As someone who’s in charge of an s corporation, make sure to. The irs is changing it’s mailing address for several of the forms that are associated with the. Web key takeaways what is form 7004? Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Follow these steps to print a 7004 in turbotax business: Web in this guide, we cover it all, including: Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. Check your state tax extension requirements.

Submit form 7004 before or on the deadline for the form for which you require an extension. Web key takeaways what is form 7004? Web purpose of form. Where to file the form and do i mail it? Web this is where you need to mail your form 7004 this year. Web follow these steps to determine which address the form 7004 should be sent to: Find the applicable main form under the if the. Web the extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the. When you file form 7004, you're promised an. Check your state tax extension requirements.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Depending on which form the company is requesting the extension for, the documents. Web purpose of form. Web follow these steps to determine which address the form 7004 should be sent to: Web irs form 7004 tax extension: Submit form 7004 before or on the deadline for the form for which you require an extension. When you file form 7004, you're promised an. Check your state tax extension requirements. Web address changes for filing form 7004: Web file a separate form 7004 for each return for which you are requesting an extension of time to file.

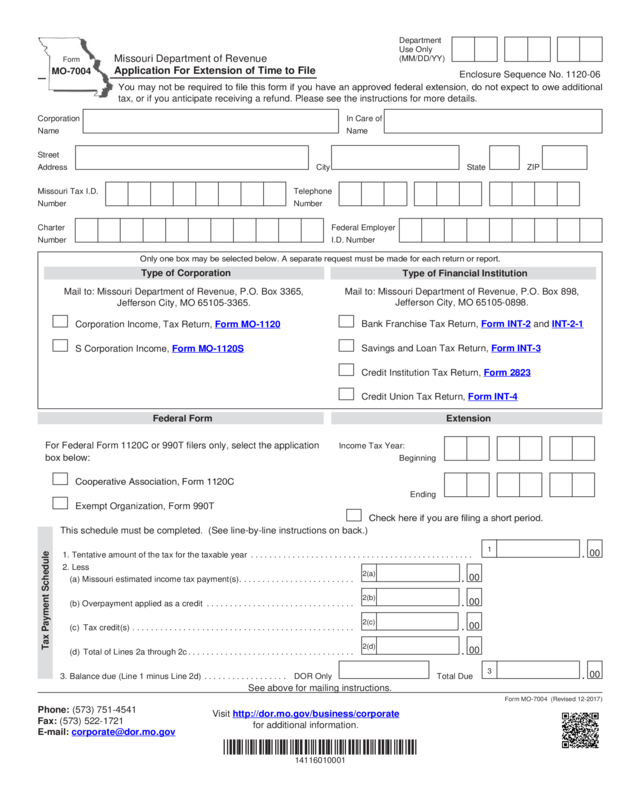

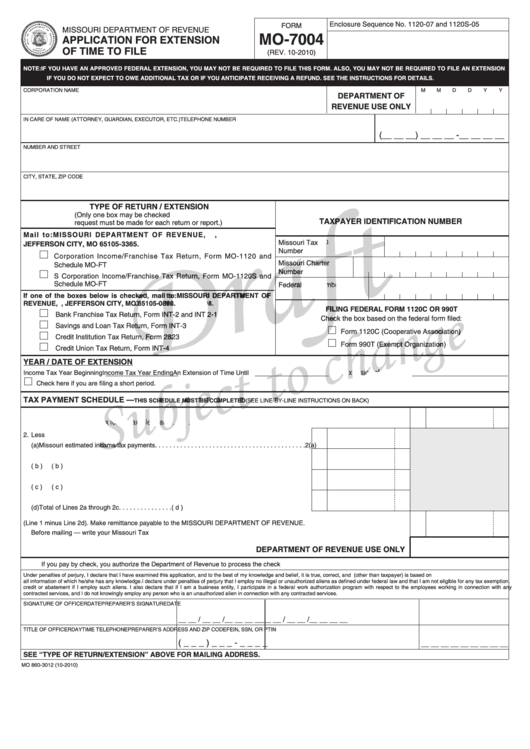

Form Mo7004 Application For Extension Of Time To File Edit, Fill

Web address changes for filing form 7004: The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web irs form 7004 extends the filing deadline for another: Find the applicable main form under the if the. Depending on which form the company is requesting the extension for, the documents.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web there are several ways to submit form 4868. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what is form. Submit form 7004 before or on the deadline for the form for which you require an extension. Web irs form 7004 tax extension: Web file a.

Irs Form 7004 amulette

Check your state tax extension requirements. Web follow these steps to determine which address the form 7004 should be sent to: Go to the irs where to file form 7004 webpage. Web key takeaways what is form 7004? Web the extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file.

Form Mo7004 Draft Application For Extension Of Time To File 2010

Web form 7004 is the extension form mainly used for form 1120s, the federal income tax return for s corporations. Web key takeaways what is form 7004? Web the extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which.

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

As someone who’s in charge of an s corporation, make sure to. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. This extension will apply only to the specific return identified by its line. Check your state tax extension requirements. Find the applicable main form under the if the.

This Is Where You Need To Mail Your Form 7004 This Year Blog

Web purpose of form. Submit form 7004 before or on the deadline for the form for which you require an extension. The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web hans jasperson in this article view all what is form 7004? Web form 7004 is the extension form mainly.

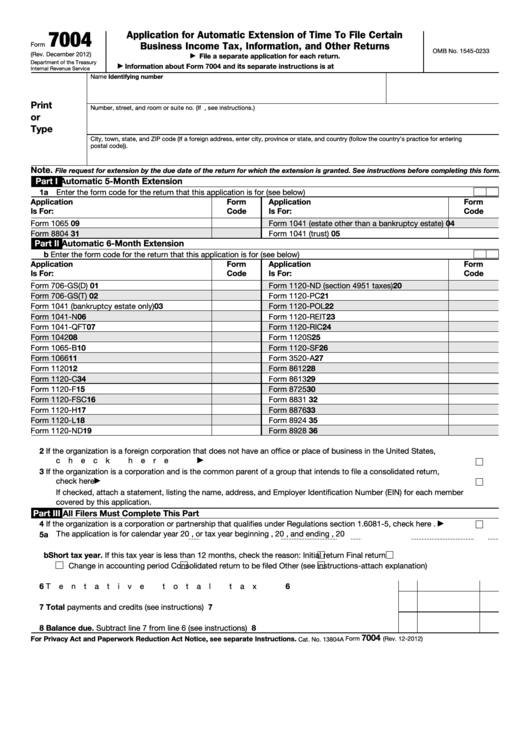

Fillable Form 7004 Application For Automatic Extension Of Time To

The address for filing form 7004 has changed for some entities located in georgia, illinois, kentucky, michigan, tennessee, and. Web there are several ways to submit form 4868. Web this is where you need to mail your form 7004 this year. The irs is changing it’s mailing address for several of the forms that are associated with the. What form.

This Is Where You Need To Mail Your Form 7004 This Year Blog

Web key takeaways what is form 7004? Web purpose of form. Web irs form 7004 is called the “application for automatic extension of time to file certain business income tax, information, and other returns.” whew—that’s a. Depending on which form the company is requesting the extension for, the documents. Web information about form 7004, application for automatic extension of time.

Last Minute Tips To Help You File Your Form 7004 Blog

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web irs form 7004 extends the filing deadline for another: Web there are several ways to submit form 4868. Web address changes for filing form 7004: Web in this guide, we cover it all, including:

Corporation return due date is March 16, 2015Cary NC CPA

Web irs form 7004 tax extension: Check your state tax extension requirements. Web information about form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, including recent updates, related. What form 7004 is who’s eligible for a form 7004 extension how and when to file form 7004 and make tax payments what.

What Form 7004 Is Who’s Eligible For A Form 7004 Extension How And When To File Form 7004 And Make Tax Payments What Is Form.

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web in this guide, we cover it all, including: Web irs form 7004 tax extension: As someone who’s in charge of an s corporation, make sure to.

Submit Form 7004 Before Or On The Deadline For The Form For Which You Require An Extension.

Web file a separate form 7004 for each return for which you are requesting an extension of time to file. This extension will apply only to the specific return identified by its line. Web the extension will be granted if you complete form 7004 properly, make a proper estimate of the tax (if applicable), file form 7004 by the due date of the return for which the. Check your state tax extension requirements.

Go To The Irs Where To File Form 7004 Webpage.

Web hans jasperson in this article view all what is form 7004? When you file form 7004, you're promised an. Web key takeaways what is form 7004? Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

Web Follow These Steps To Determine Which Address The Form 7004 Should Be Sent To:

The irs is changing it’s mailing address for several of the forms that are associated with the. Web there are several ways to submit form 4868. Web this is where you need to mail your form 7004 this year. Depending on which form the company is requesting the extension for, the documents.