Arkansas Tax Exemption Form

Arkansas Tax Exemption Form - File this form with your employer to exempt your earnings from state income tax withholding. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web file this form with your employer. File this form with your employer. Web claim exemption from tax in the state that would otherwise be due tax on this sale. Ad register and subscribe now to work on arkansas st391 form & more fillable forms. The seller may be required to provide this exemption certificate (or the data elements required on. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the arkansas sales tax. Web arkansas has a state income tax that ranges between 2% and 6.6% , which is administered by the arkansas department of revenue.

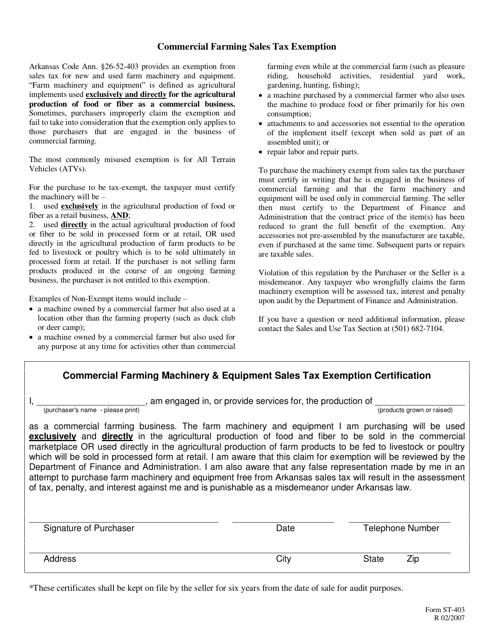

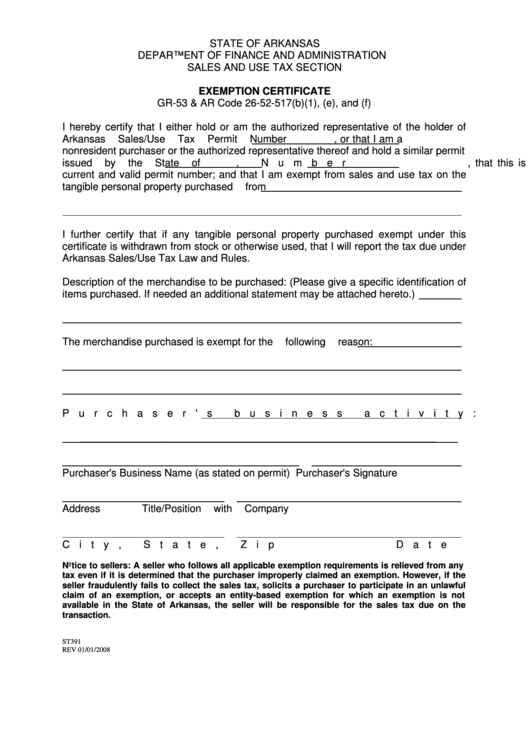

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the arkansas sales tax. Web claim exemption from tax in the state that would otherwise be due tax on this sale. Web arkansas has a state income tax that ranges between 2% and 6.6%. For other arkansas sales tax exemption certificates, go here. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. File this form with your employer to exempt your earnings from state income tax withholding. Ad register and subscribe now to work on arkansas st391 form & more fillable forms. The seller may be required to provide this exemption certificate (or the data elements required on. Web claim exemption from tax in the state that would otherwise be due tax on this sale. “ farm machinery and equipment” is defined as.

Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web sales tax exemptions in arkansas. Web file this form with your employer. For other arkansas sales tax exemption certificates, go here. Web you can download a pdf of the arkansas sales tax exemption certificate (form st391) on this page. File this form with your employer. Taxformfinder provides printable pdf copies. Quarterly payroll and excise tax returns normally due on may 1. Web claim exemption from tax in the state that would otherwise be due tax on this sale. Web arkansas has a state income tax that ranges between 2% and 6.6% , which is administered by the arkansas department of revenue.

Form ST403 Download Fillable PDF or Fill Online Commercial Farm

The seller may be required to provide this exemption certificate (or the data elements. File this form with your employer. Web arkansas has a state income tax that ranges between 2% and 6.6% , which is administered by the arkansas department of revenue. Web sales tax exemptions in arkansas. Taxformfinder provides printable pdf copies.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

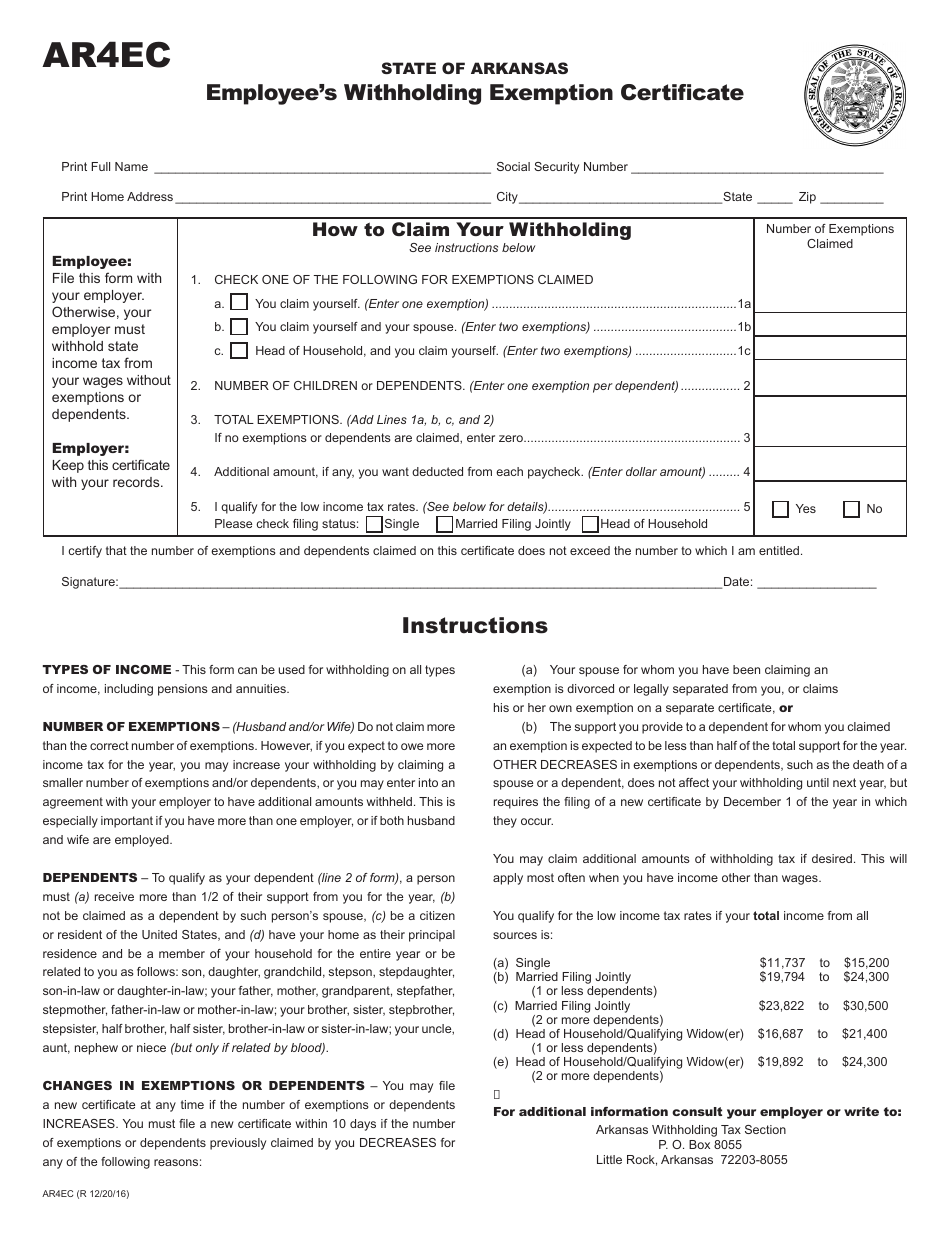

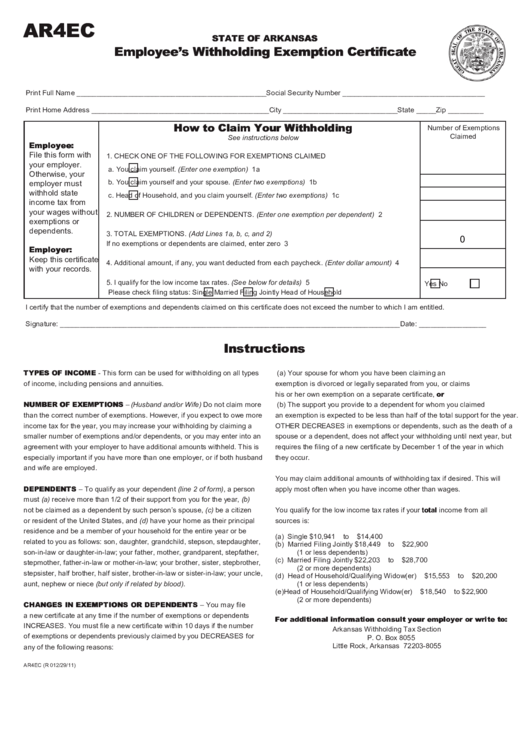

Department of finance and administration sales and use tax section. Ar4ec employee's withholding exemption certificate: Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. “ farm machinery and equipment” is defined as.

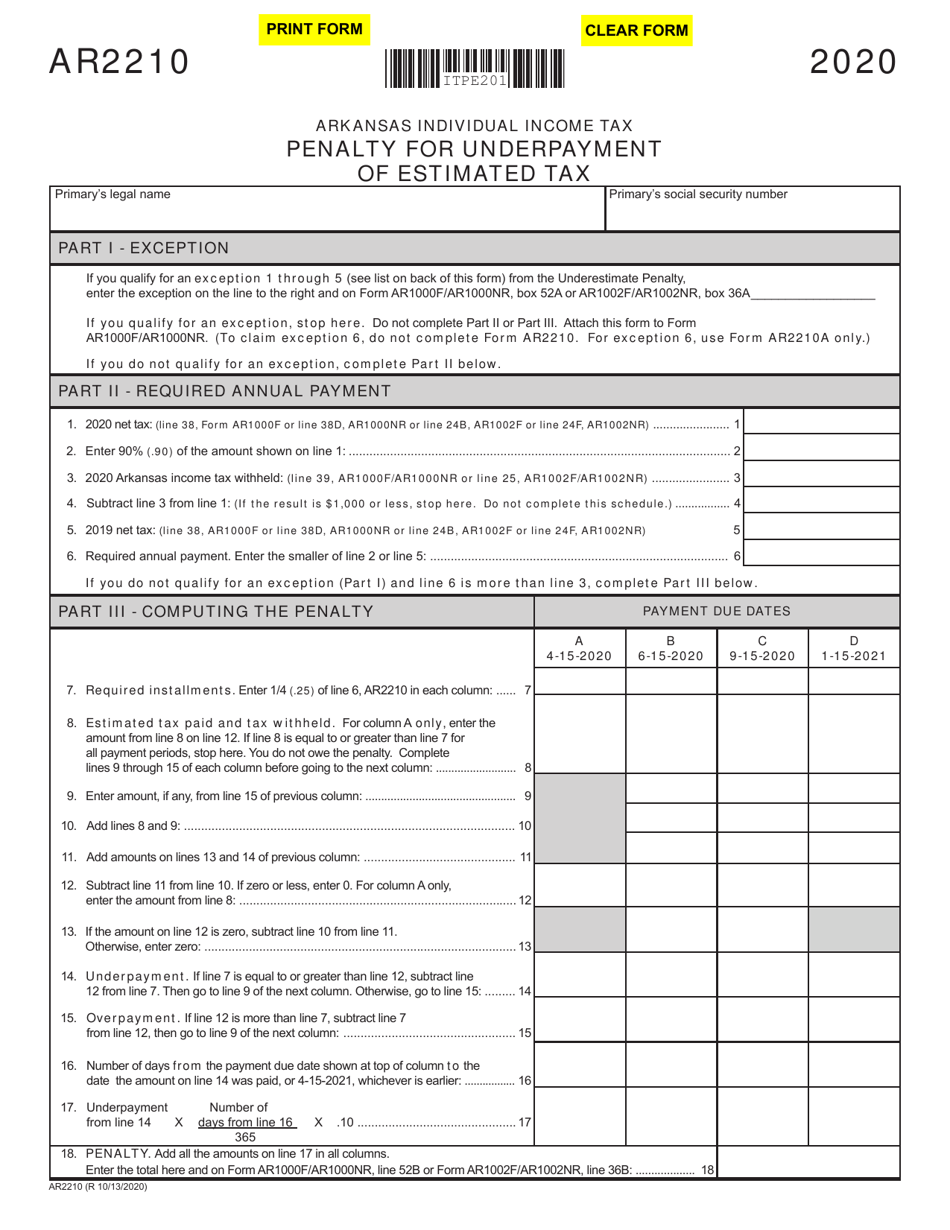

Form AR2210 Download Fillable PDF or Fill Online Penalty for

For other arkansas sales tax exemption certificates, go here. Ad register and subscribe now to work on arkansas st391 form & more fillable forms. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web ar1099pt report of income tax.

Form AR4ec Download Fillable PDF or Fill Online Employee's Withholding

Ad register and subscribe now to work on arkansas st391 form & more fillable forms. “ farm machinery and equipment” is defined as. Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Individual tax return form 1040 instructions;

Bupa Tax Exemption Form / Edd De 1446 Fill Online, Printable

Quarterly payroll and excise tax returns normally due on may 1. File this form with your employer to exempt your earnings from state income tax withholding. File this form with your employer. Web claim exemption from tax in the state that would otherwise be due tax on this sale. For other arkansas sales tax exemption certificates, go here.

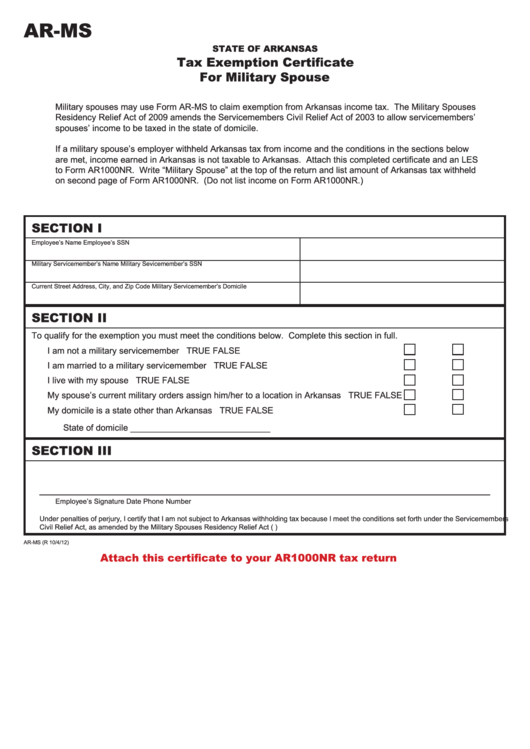

Fillable Form ArMs Tax Exemption Certificate For Military Spouse

Keep this certificate with your records. The seller may be required to provide this exemption certificate (or the data elements required on. File this form with your employer to exempt your earnings from state income tax withholding. Ar4ec employee's withholding exemption certificate: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are.

How to get a Sales Tax Exemption Certificate in Arkansas

Keep this certificate with your records. Web claim exemption from tax in the state that would otherwise be due tax on this sale. Ar4ec employee's withholding exemption certificate: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web 42 rows military personnel and military spouse information.

logodesignlabor Arkansas Tax Exempt Form

Web claim exemption from tax in the state that would otherwise be due tax on this sale. Department of finance and administration sales and use tax section. Quarterly payroll and excise tax returns normally due on may 1. Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. Web ar1099pt report of income tax withheld.

Fillable Form Gr53 & Ar Exemption Certificate Form State Of

For other arkansas sales tax exemption certificates, go here. Keep this certificate with your records. The seller may be required to provide this exemption certificate (or the data elements. Web sales tax exemptions in arkansas. Web 42 rows military personnel and military spouse information.

Arkansas Real Property Tax Affidavit Of Compliance Form Fill Online

File this form with your employer. Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the arkansas sales tax. Quarterly payroll and excise tax returns normally due on may 1. File.

The Seller May Be Required To Provide This Exemption Certificate (Or The Data Elements.

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the arkansas sales tax. Web ar1099pt report of income tax withheld or paid on behalf of nonresident member: Otherwise, your employer must withhold state income tax from your wages without exemptions or dependents. “ farm machinery and equipment” is defined as.

Web Claim Exemption From Tax In The State That Would Otherwise Be Due Tax On This Sale.

Individual tax return form 1040 instructions; The seller may be required to provide this exemption certificate (or the data elements required on. Ar4ec employee's withholding exemption certificate: Web you can download a pdf of the arkansas sales tax exemption certificate (form st391) on this page.

Taxformfinder Provides Printable Pdf Copies.

Web sales tax exemptions in arkansas. Quarterly payroll and excise tax returns normally due on may 1. Web file this form with your employer. For other arkansas sales tax exemption certificates, go here.

Department Of Finance And Administration Sales And Use Tax Section.

Web to apply for a farm tax exemption in arkansas, farmers must fill out and submit the st391 arkansas sales tax exemption certificate form. Ad register and subscribe now to work on arkansas st391 form & more fillable forms. File this form with your employer to exempt your earnings from state income tax withholding. Web arkansas has a state income tax that ranges between 2% and 6.6%.