Ca Pte Form 3893

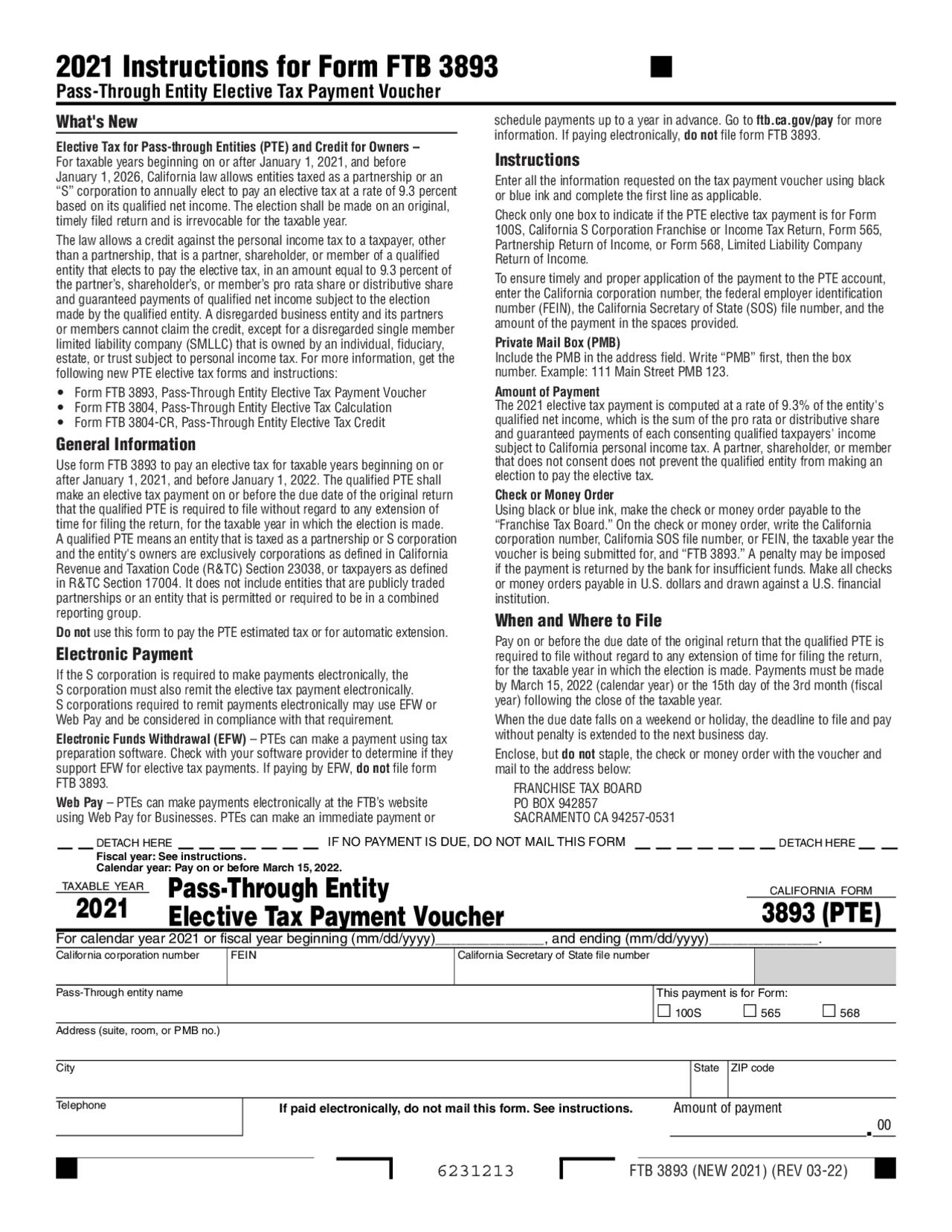

Ca Pte Form 3893 - We anticipate the revised form 3893 will be available march 7, 2022. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Or form 568, line 9); Can i calculate late payment. For this discussion, ignore the effect of. Web printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. Partnerships and s corporations may. However, the instructions to for ftb 3893 indicate. Web revised 2022, 2023 form 3893 instructions: Web form 3893 (2021) automatically activates when form 3804 is present.

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Can i calculate late payment. For this discussion, ignore the effect of. Partnerships and s corporations may. Web electronically, do not file form ftb 3893. However, the instructions to for ftb 3893 indicate. Or form 568, line 9); And the 3893 (pmt) will print, showing only. Web revised 2022, 2023 form 3893 instructions: Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________.

Web the full amount of pte tax will print on the “amount paid with form ftb 3893” line (form 565, line 30; Web information, get the following new pte elective tax forms and instructions: Web electronically, do not file form ftb 3893. And the 3893 (pmt) will print, showing only. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). If an entity does not make that first. For this discussion, ignore the effect of. Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Web revised 2022, 2023 form 3893 instructions:

Kwang Sing Engineering Pte Ltd Singapore

Or form 568, line 9); Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: If an entity does not make that first. The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. Web information, get the following new pte elective tax forms and instructions:

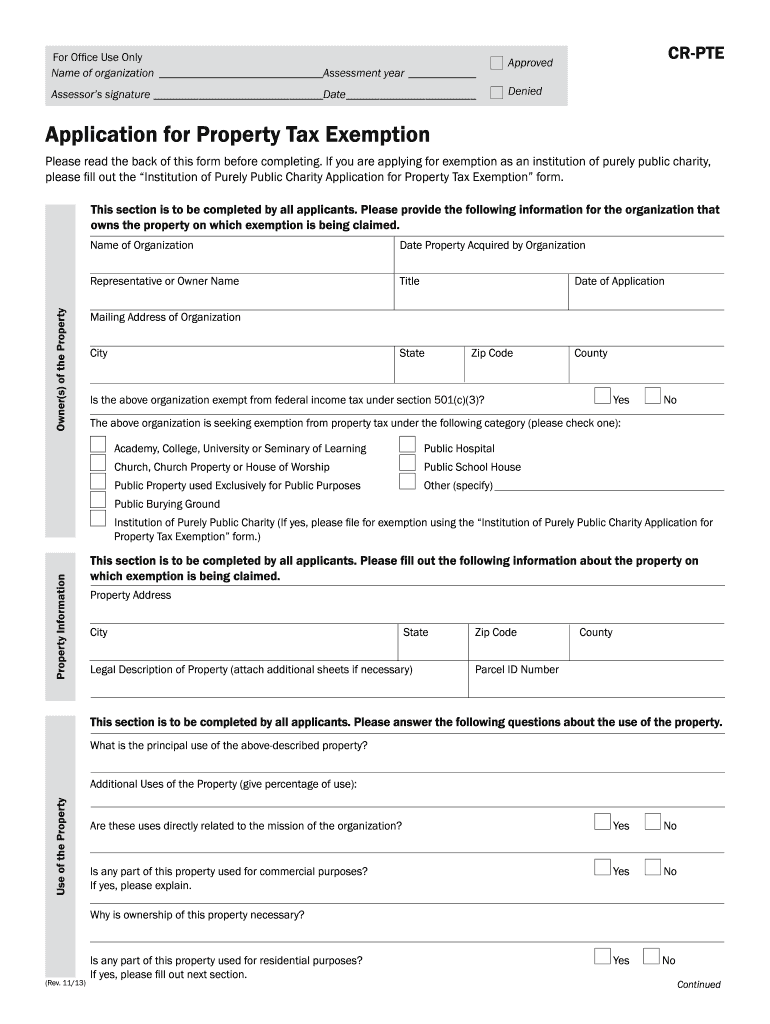

Cr Pte Form Fill Out and Sign Printable PDF Template signNow

Web the california franchise tax board dec. Web electronically, do not file form ftb 3893. The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. Instructions enter all the information requested on the tax payment voucher using black or blue ink and complete the first line as applicable. Or form 568, line.

2021 Instructions for Form 3893, PassThrough Entity Elective

Web information, get the following new pte elective tax forms and instructions: The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. We anticipate the revised form 3893 will be available march 7, 2022. Web the california franchise tax board dec. Can i calculate late payment.

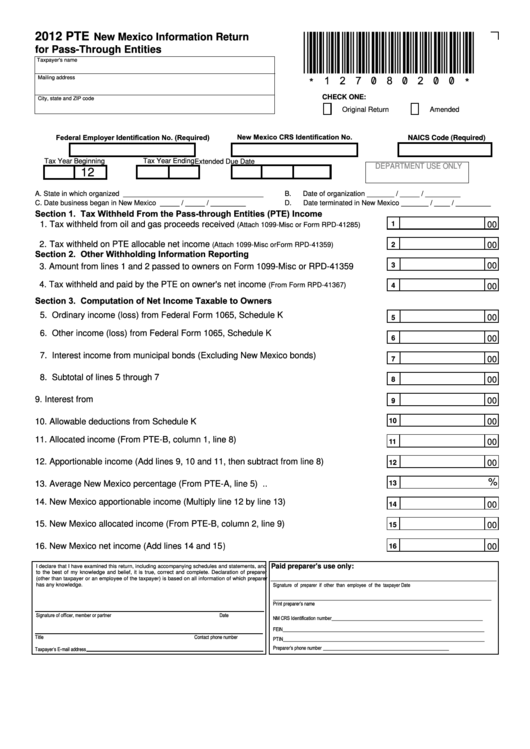

2014 Form NM TRD PTE Fill Online, Printable, Fillable, Blank pdfFiller

Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Web revised 2022, 2023 form 3893 instructions: Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). And the 3893 (pmt) will print, showing only. If an entity does not make that.

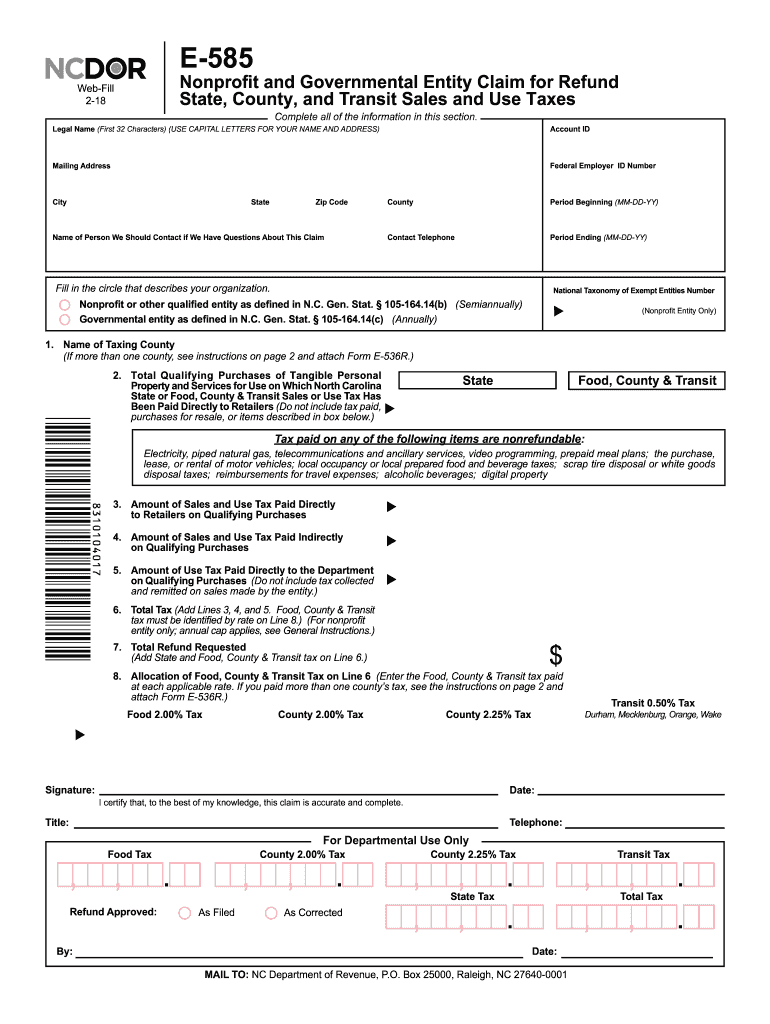

2018 Form NC E585 Fill Online, Printable, Fillable, Blank pdfFiller

Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Web the california franchise tax board dec. However, the instructions to for ftb 3893 indicate. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). We anticipate the revised.

Form Pte New Mexico Information Return For PassThrough Entities

For this discussion, ignore the effect of. Web revised 2022, 2023 form 3893 instructions: “ptes must make all elective tax payments either by using the free web pay application accessed through the ftb’s. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Web the full amount of pte.

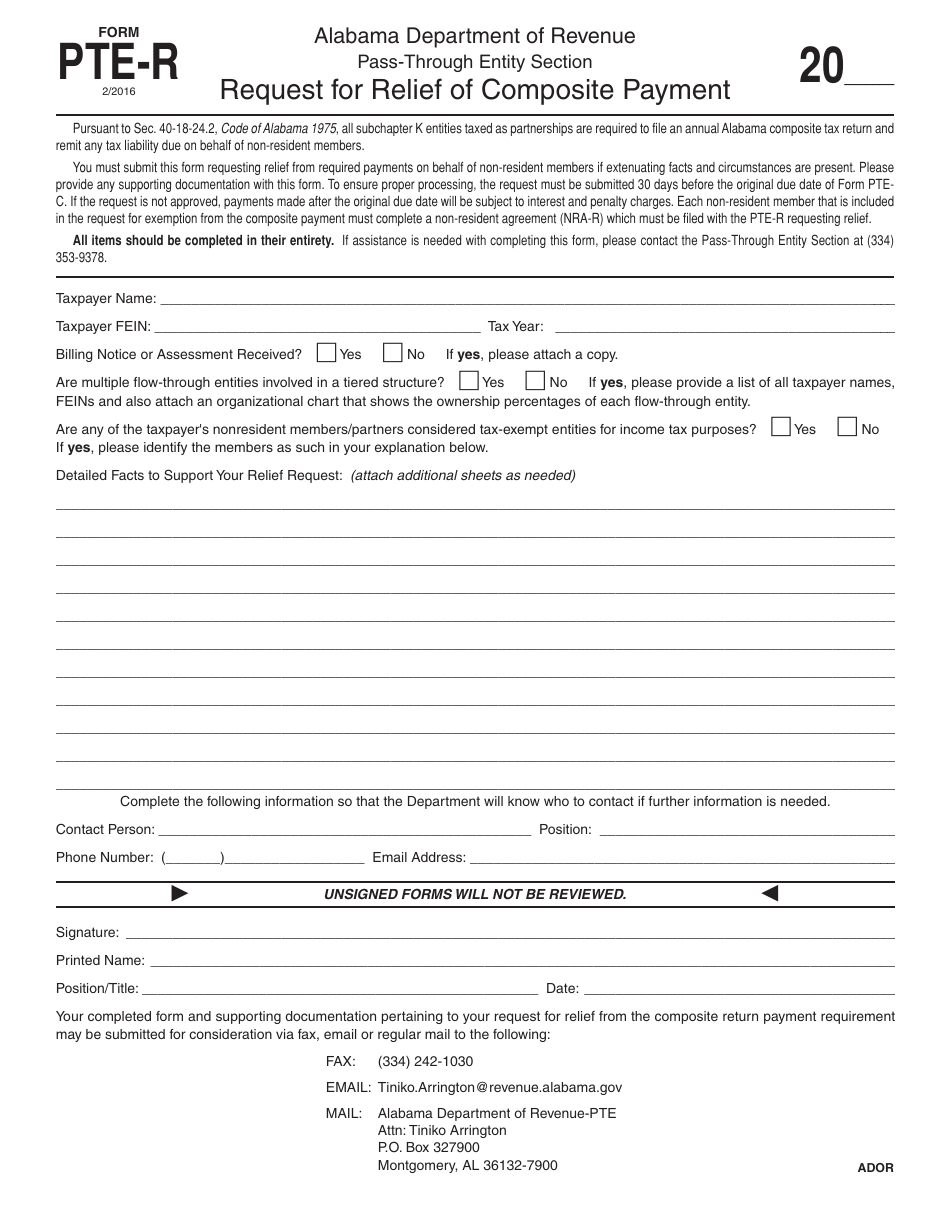

Form PTER Download Fillable PDF or Fill Online Request for Relief of

Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Partnerships and s corporations may. Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________. Can i calculate late payment. Instructions enter all the information requested on the tax payment voucher using black.

2009 Form VA DoT PTE Fill Online, Printable, Fillable, Blank pdfFiller

Can i calculate late payment. Partnerships and s corporations may. Or form 568, line 9); Web printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. However, the instructions to for ftb 3893 indicate.

Full form of PTE PTE full form PTE stands for PTE Means Exam

Web electronically, do not file form ftb 3893. Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Or form 568, line 9); Web revised 2022, 2023 form 3893 instructions: Can i calculate late payment.

California Form 3893 Passthrough Entity Tax Problems Windes

Or form 568, line 9); The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. We anticipate the revised form 3893 will be available march 7, 2022. Web information, get the following new pte elective tax forms and instructions: Partnerships and s corporations may.

Web Form 3893 (2021) Automatically Activates When Form 3804 Is Present.

Instructions enter all the information requested on the tax payment voucher using black or blue ink and complete the first line as applicable. Web printing the ftb form 3893 (2022) is automatic with the accountant, government, and client copies along side ty 2021 ftb form 3893. Can i calculate late payment. Web revised 2022, 2023 form 3893 instructions:

However, The Instructions To For Ftb 3893 Indicate.

Web on november 1, 2021, franchise tax board (ftb) published pte elective tax payment voucher (ftb 3893) on our website. Web the california franchise tax board dec. The amount on ftb 3893 amount of payment carries to form 100s, page 2, line 35 as paid. For this discussion, ignore the effect of.

“Ptes Must Make All Elective Tax Payments Either By Using The Free Web Pay Application Accessed Through The Ftb’s.

Web electronically, do not file form ftb 3893. If an entity does not make that first. Web information, get the following new pte elective tax forms and instructions: We anticipate the revised form 3893 will be available march 7, 2022.

And The 3893 (Pmt) Will Print, Showing Only.

Web the full amount of pte tax will print on the “amount paid with form ftb 3893” line (form 565, line 30; Web to make a payment of the ca ptet, the taxpayer must use the ca ptet payment voucher (form ftb 3893). Or form 568, line 9); Web california form 3893 (pte) for calendar year 2022 or fiscal year beginning (mm/dd/yyyy)______________, and ending (mm/dd/yyyy)______________.