Form 15112 Meaning

Form 15112 Meaning - This form came into introduction in january. More people without children now qualify for. Dependent social security numberdid the dependent live with you or your spouse in the. Request for transcript of tax return. Request for taxpayer identification number (tin) and certification. I mailed back the form 15112 but the form doesn't ask for my bank details or anything. Web “generally speaking, any taxpayer that gets a letter from the irs, there’s going to be information in that letter they can use to call the people who are dealing with that. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. You cannot claim the credit if you are married and filing a. “please place a check mark if this describes you:

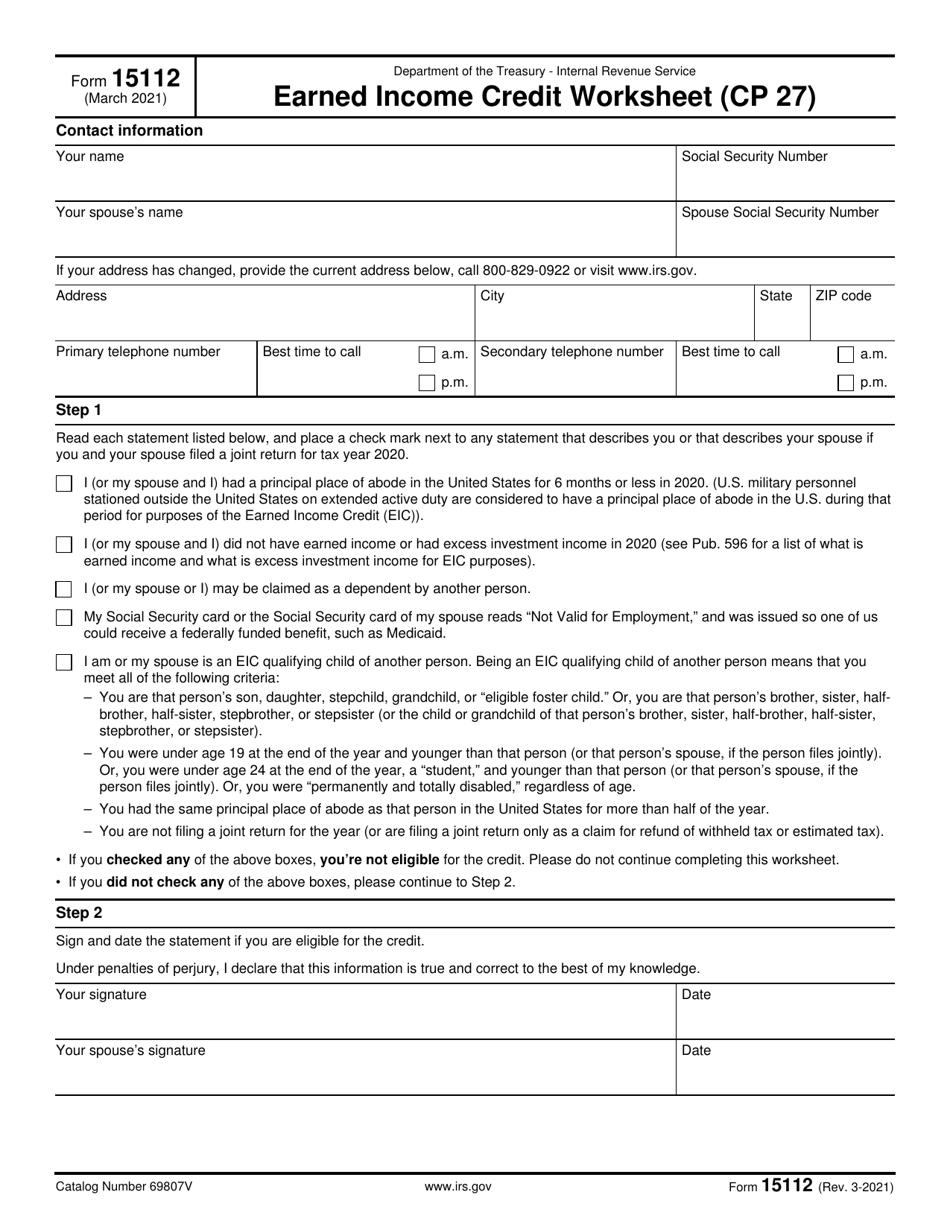

If the worksheet confirms you’re eligible. Request for transcript of tax return. Web form 1040 line 27 irs instructions define a specified student as you qualify as a specified student if you were enrolled in a program that leads to a degree,. Web “generally speaking, any taxpayer that gets a letter from the irs, there’s going to be information in that letter they can use to call the people who are dealing with that. If you qualify, you can use the credit to reduce the taxes you. Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. Earned income credit worksheet (cp 27) (irs) form. Web then i received a letter in the mail saying i'm eligible for eic refund. I mailed back the form 15112 but the form doesn't ask for my bank details or anything. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint.

Web read your notice carefully. Web “generally speaking, any taxpayer that gets a letter from the irs, there’s going to be information in that letter they can use to call the people who are dealing with that. You cannot claim the credit if you are married and filing a. This form came into introduction in january. If you have your eligible child (ren) entered as dependent (s) on. Web irs form 15112 january 2022 is a document produced by the u.s. If you qualify, you can use the credit to reduce the taxes you. I had a principle place of. Form 15112 is for the earned income tax credit, not the child tax credit. Ago by payt_ form 15112 got this in the mail today, saying i may be eligible.

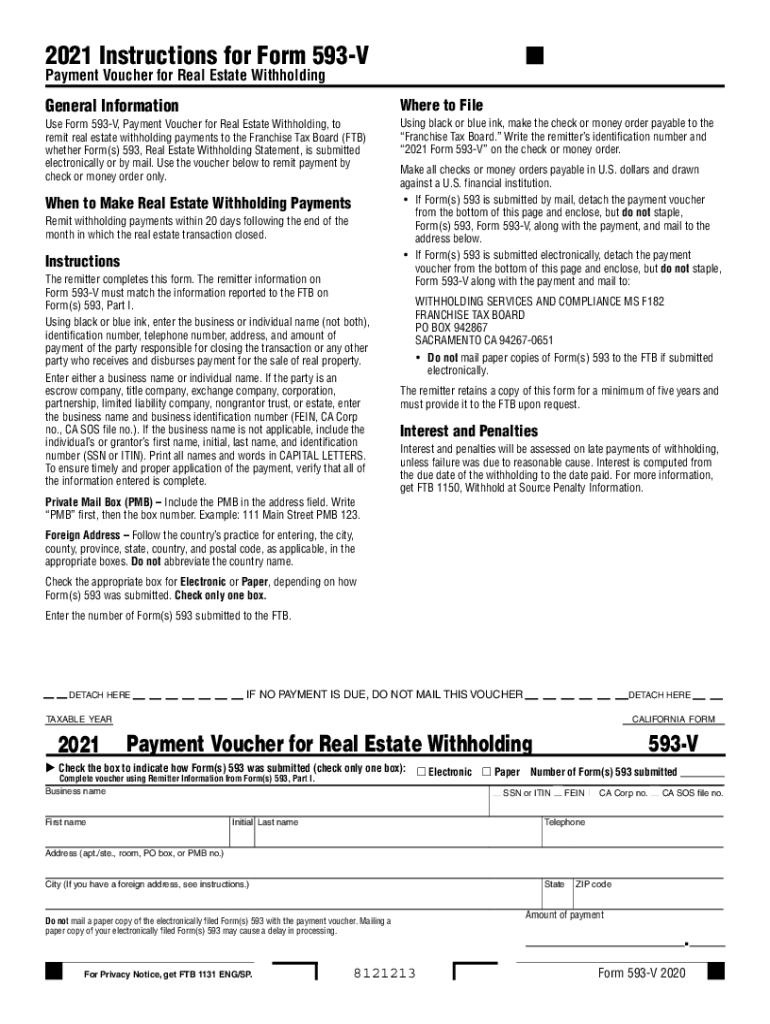

California Withholding Form 2021 2022 W4 Form

Web irs form 15112 january 2022 is a document produced by the u.s. How will i actually get the. I mailed back the form 15112 but the form doesn't ask for my bank details or anything. Request for transcript of tax return. Web august 13, 2022 3:03 pm.

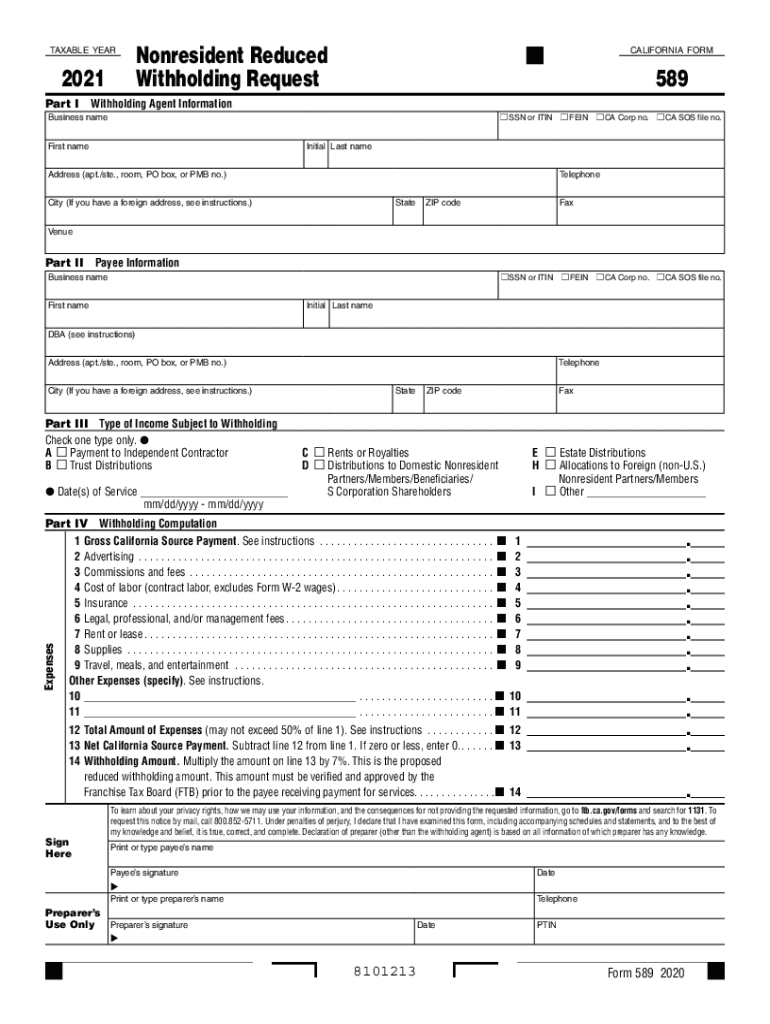

2021 Form CA FTB 589 Fill Online, Printable, Fillable, Blank pdfFiller

Request for transcript of tax return. How will i actually get the. Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. This form came into introduction in january. If you have your eligible child (ren) entered as dependent (s) on.

Fill Free fillable IRS PDF forms

Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Web form 1040 line 27 irs instructions define a specified student as you qualify as a specified student if you were enrolled in a program that leads to a degree,. This form came into introduction in january. If you have your eligible child (ren).

First Name Meaning Scrolls Personalized Sinnsprüche, Aus die maus

Web august 13, 2022 3:03 pm. Web level 1 earned income credit letter from irs just received a letter from irs stating you may be eligible for a refund of up to $1502 for the earned income credit. Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. What’s.

Lake Homes That Give ‘Après Ski’ New Meaning Mansion Global

This is my first year filing. Web august 13, 2022 3:03 pm. Web fill online, printable, fillable, blank form 15112: Use fill to complete blank online irs pdf forms for free. Web form 1040 line 27 irs instructions define a specified student as you qualify as a specified student if you were enrolled in a program that leads to a.

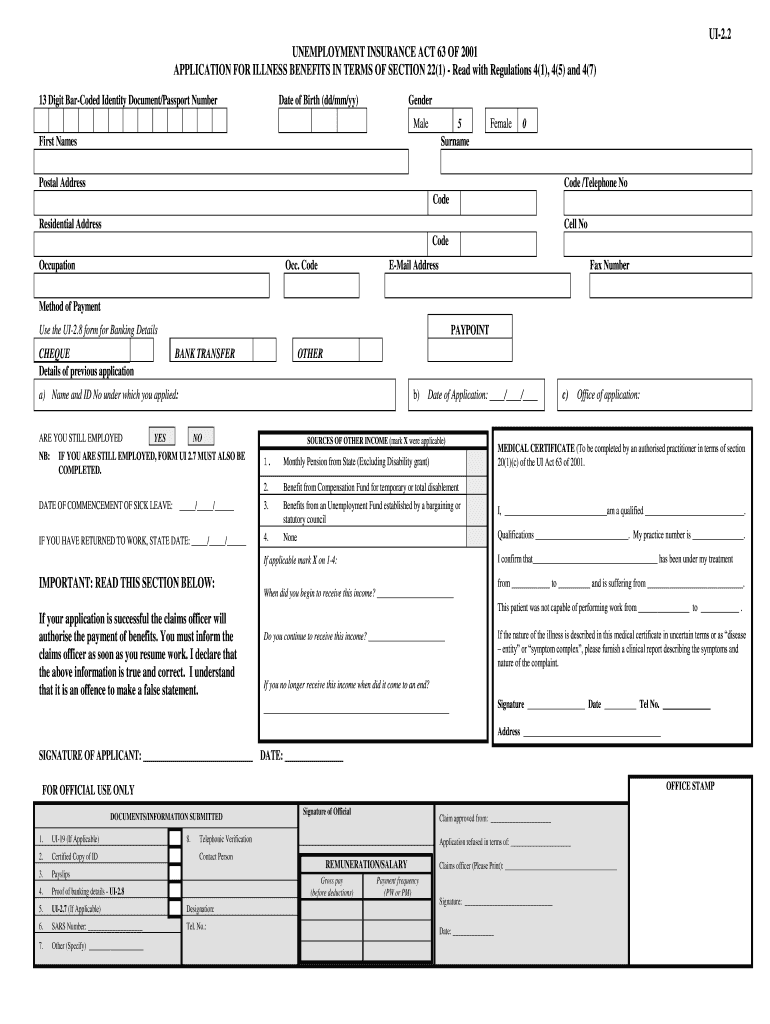

Ui2 2 Form Fill Out and Sign Printable PDF Template signNow

If you qualify, you can use the credit to reduce the taxes you. If you have your eligible child (ren) entered as dependent (s) on. I mailed back the form 15112 but the form doesn't ask for my bank details or anything. Earned income credit worksheet (cp 27) (irs) form. Web step 1 read each statement listed below, and place.

social security worksheet 2022

Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your spouse filed a joint. “please place a check mark if this describes you: Web form 1040 line 27 irs instructions define a specified student as you qualify as a specified student.

IRS releases drafts of 2021 Form 1040 and schedules Don't Mess With Taxes

This form came into introduction in january. More people without children now qualify for. I mailed back the form 15112 but the form doesn't ask for my bank details or anything. Web step 1 read each statement listed below, and place a check mark next to any statement that describes you or that describes your spouse if you and your.

Prior year tax returns irss mvlader

This is my first year filing. Dependent social security numberdid the dependent live with you or your spouse in the. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Web “generally speaking, any taxpayer that gets a letter from the irs, there’s going to be information in that letter they can use to.

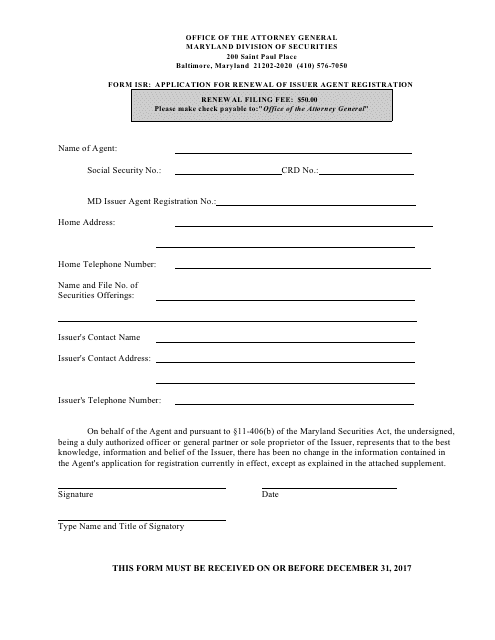

Form ISR Download Printable PDF or Fill Online Application for Renewal

Use fill to complete blank online irs pdf forms for free. What’s this form all about? “please place a check mark if this describes you: Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. Web level 1 earned income credit letter from irs just received a letter from.

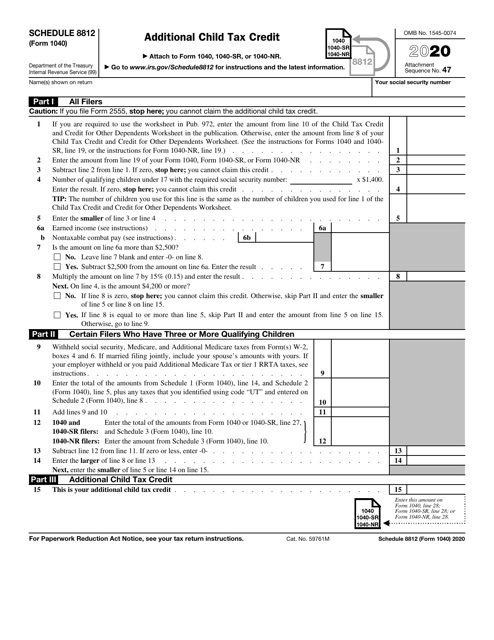

Earned Income Credit Worksheet (Cp 27) (Irs) Form.

What’s this form all about? I mailed back the form 15112 but the form doesn't ask for my bank details or anything. Complete earned income credit worksheet on form 15111, earned income credit (cp09) pdf of the notice. Web “generally speaking, any taxpayer that gets a letter from the irs, there’s going to be information in that letter they can use to call the people who are dealing with that.

Web Level 1 Earned Income Credit Letter From Irs Just Received A Letter From Irs Stating You May Be Eligible For A Refund Of Up To $1502 For The Earned Income Credit.

Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. Dependent social security numberdid the dependent live with you or your spouse in the. Request for transcript of tax return. If the worksheet confirms you’re eligible.

This Is My First Year Filing.

“please place a check mark if this describes you: Web form 1040 line 27 irs instructions define a specified student as you qualify as a specified student if you were enrolled in a program that leads to a degree,. You cannot claim the credit if you are married and filing a. Ago by payt_ form 15112 got this in the mail today, saying i may be eligible.

Web August 13, 2022 3:03 Pm.

Web then i received a letter in the mail saying i'm eligible for eic refund. This form came into introduction in january. Web read your notice carefully. Form 15112 is for the earned income tax credit, not the child tax credit.