Form 5330 Late Contributions

Form 5330 Late Contributions - Determine which deposits were late and calculate the lost earnings necessary to correct. Report late deposits on the forms 5500 for each year until full correction is made. Web file form 5330 to report the tax on: Subtract the total of lines 5 and 6 from line 4 taxable excess contributions. Sign the form 5330 use the correct plan number do not leave plan number blank double check the plan number file. Nondeductible contributions to qualified plans (section 4972). Web file a form 5330 with the irs for each affected year to pay the excise taxes. Add lines 3 and 7 excess contributions tax. For 2013, all but the first two deposits. Contributions (elective deferrals) or section 4971(g)—multiemployer amounts that would have otherwise who must file plans in endangered or critical been payable to the.

Add lines 3 and 7 excess contributions tax. Current revision form 5330pdf about form 5330, return of excise taxes related to. Web the employer must correct the late deposit and pay the excise tax using form 5330. Web instructions pdf tips for preparing form 5330: Web late payrolls are corrected by: Web file form 5330 to report the tax on: A minimum funding deficiency (section 4971). Reimburse participants for the lost opportunity to. Depositing the participant contributions into the plan promptly after discovering an issue. Sign the form 5330 use the correct plan number do not leave plan number blank double check the plan number file.

A minimum funding deficiency (section 4971). Web this tax is paid using form 5330. •a prohibited tax shelter transaction (section 4965(a)(2)); Depositing the participant contributions into the plan promptly after discovering an issue. Current revision form 5330pdf about form 5330, return of excise taxes related to. For 2013, all but the first two deposits. Web please reference the form 5330 instructions attributable to irc section 4975 excise tax. If the earnings owed are not paid in the same year the deposit was due, the 15% excise tax applies again in the next year. Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Web the employer must correct the late deposit and pay the excise tax using form 5330.

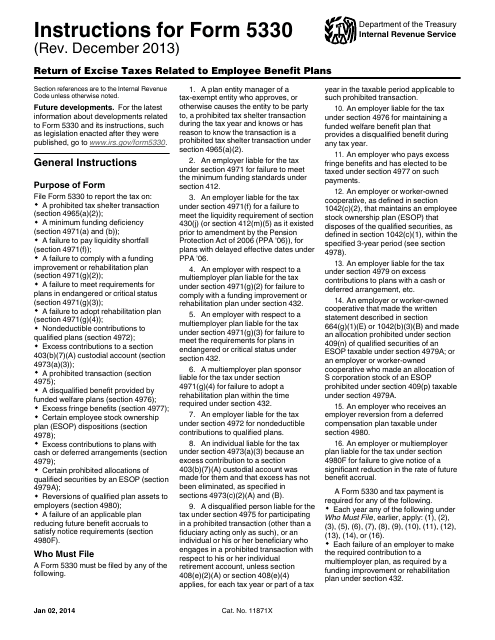

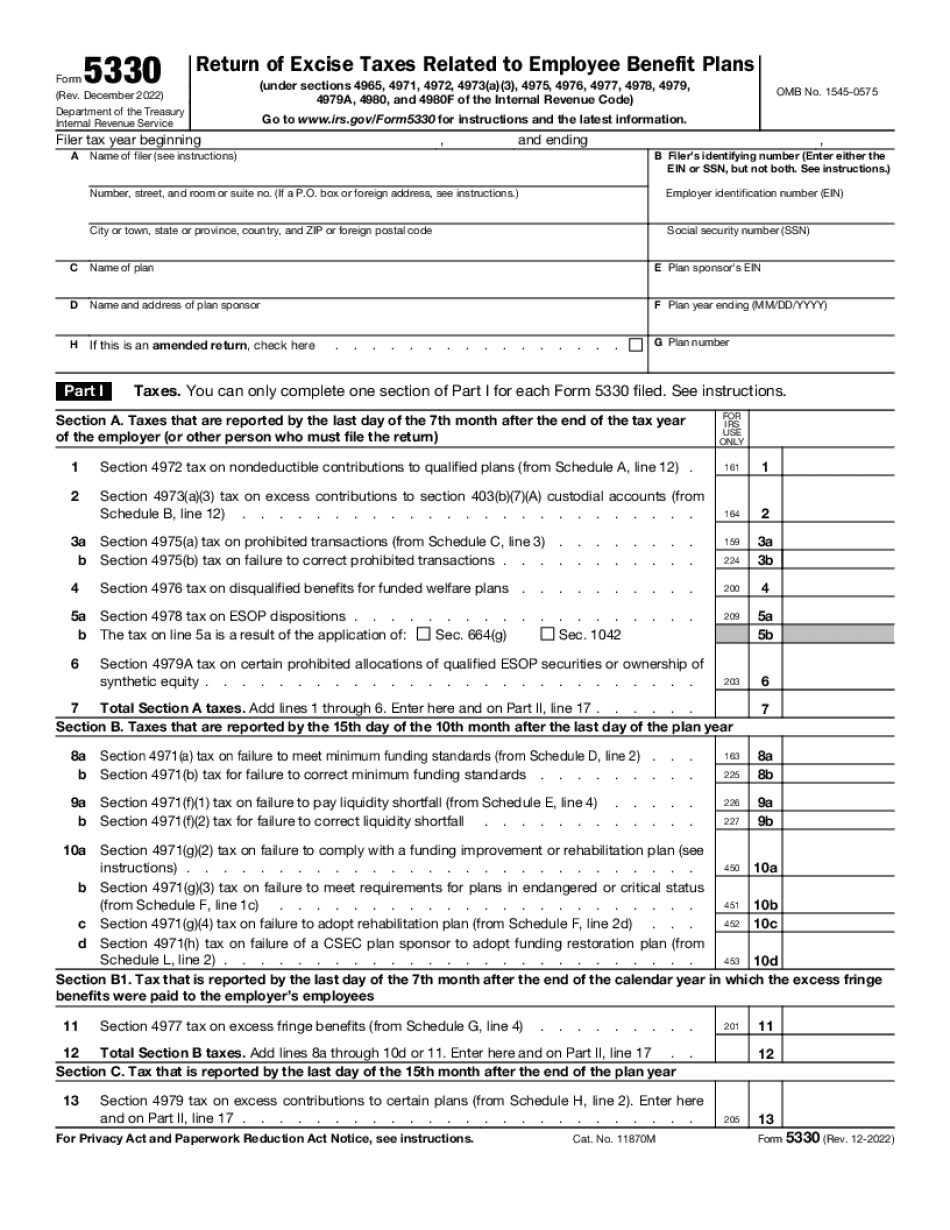

Form 5330 Return of Excise Taxes Related to Employee Benefit Plans

•a prohibited tax shelter transaction (section 4965(a)(2)); Deposit any missed elective deferrals,. Web this form is used to report and pay the excise tax related to employee benefit plans. The example provided for the session was for the excise tax related to late. Add lines 3 and 7 excess contributions tax.

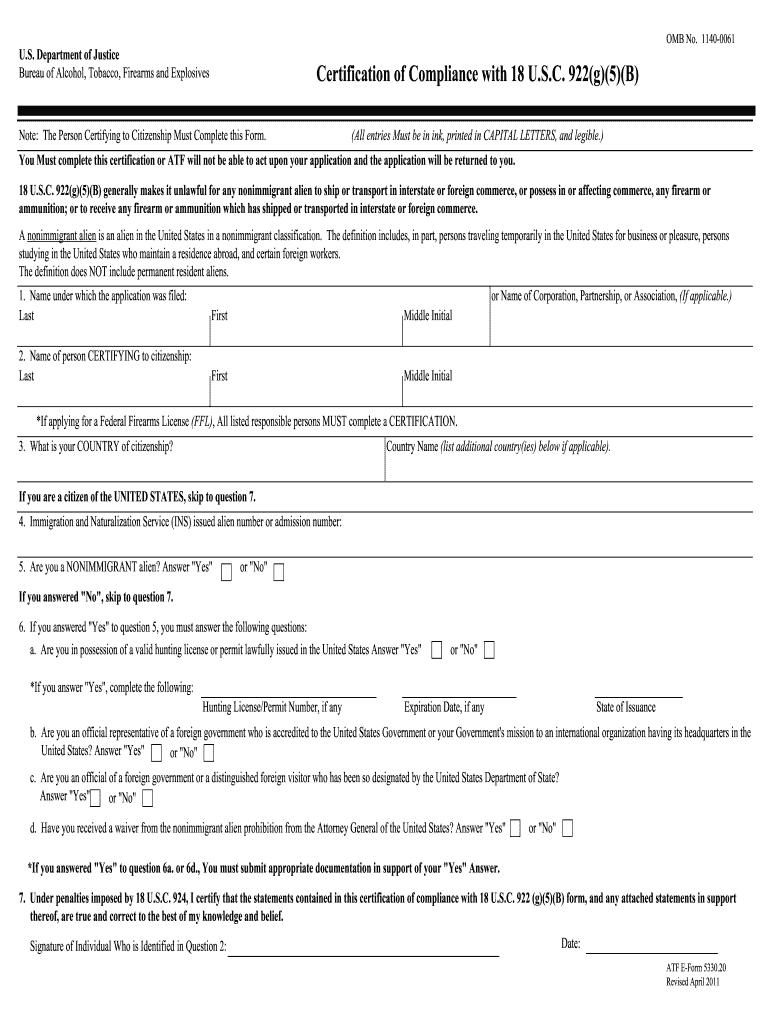

Atf Eform Fill Out and Sign Printable PDF Template signNow

Web file form 5330 to report the tax on: Determine which deposits were late and calculate the lost earnings necessary to correct. We have a client with late contributions to their plan. Web posted august 29, 2001. A minimum funding deficiency (section 4971).

The Plain English Guide to Form 5330

Report late deposits on the forms 5500 for each year until full correction is made. Nondeductible contributions to qualified plans (section 4972). Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Web late payrolls are corrected by: Deposit any missed.

Managing contributions NOW Pensions

Web posted august 29, 2001. Reimburse participants for the lost opportunity to. Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Web file a form 5330 with the irs for each affected year to pay the excise taxes. Web this.

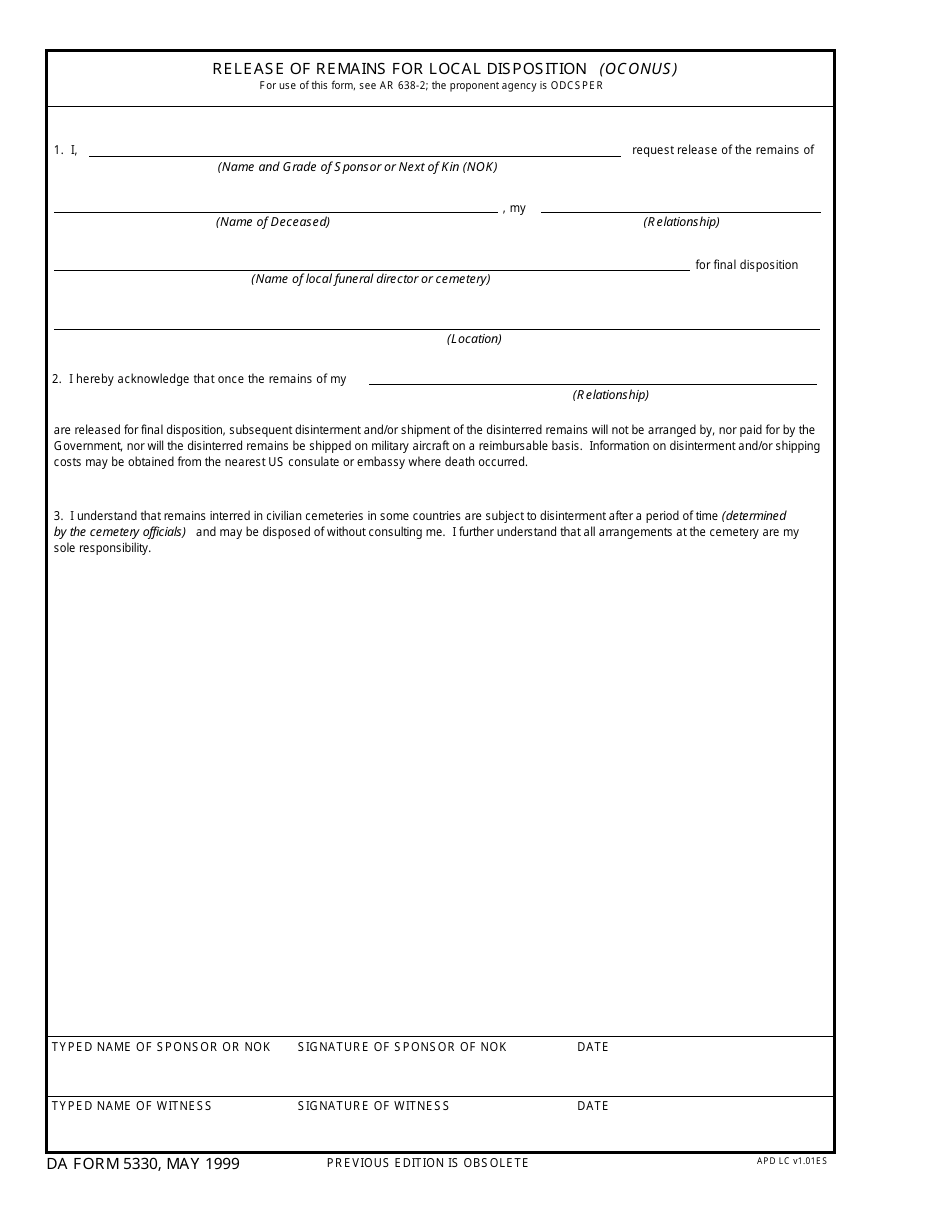

DA Form 5330 Download Fillable PDF or Fill Online Release of Remains

A minimum funding deficiency (section 4971). Add lines 3 and 7 excess contributions tax. Web instructions pdf tips for preparing form 5330: Nondeductible contributions to qualified plans (section 4972). Sign the form 5330 use the correct plan number do not leave plan number blank double check the plan number file.

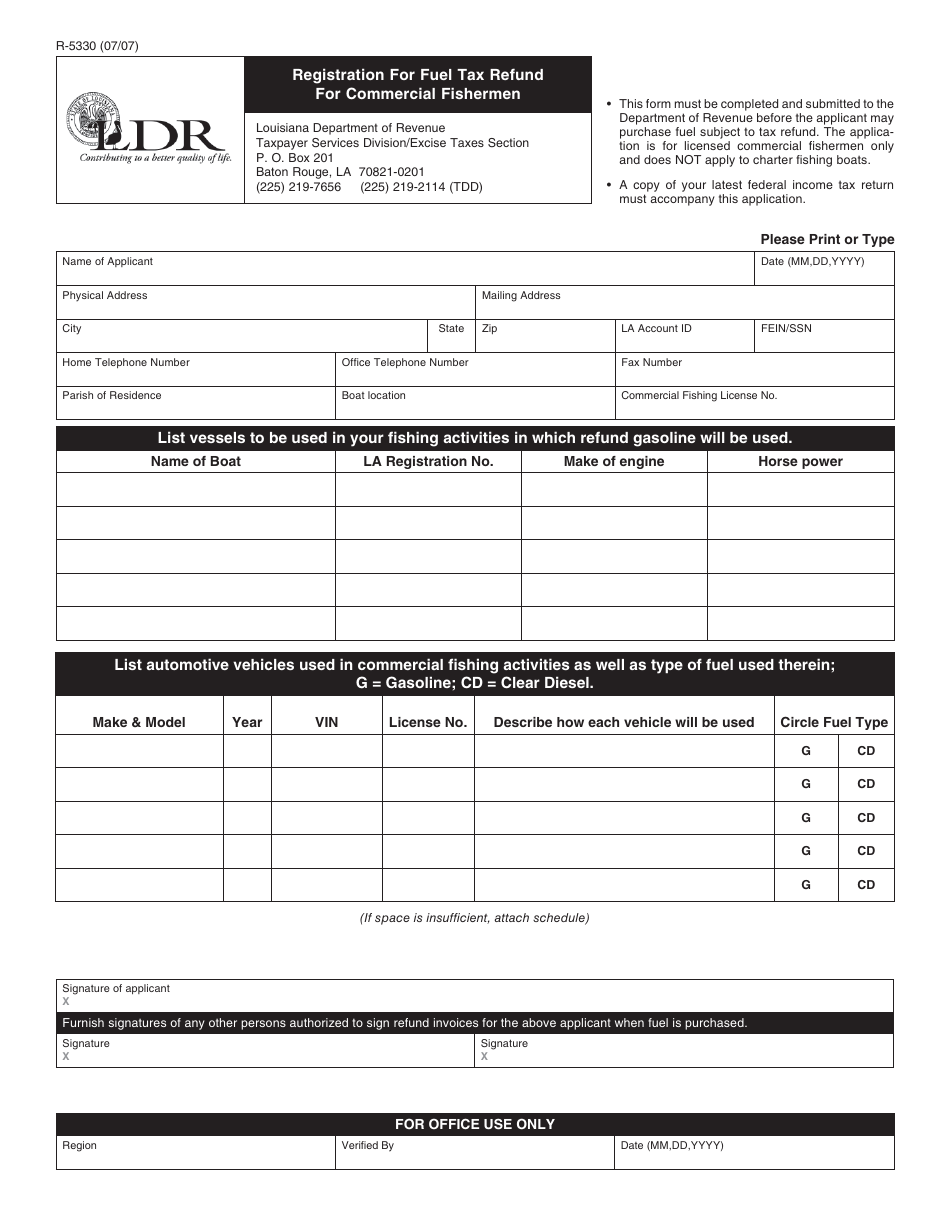

Form R5330 Download Printable PDF or Fill Online Registration for Fuel

Web correction for late deposits may require you to: We have a client with late contributions to their plan. Web file form 5330 to report the tax on: Web this tax is paid using form 5330. Web please reference the form 5330 instructions attributable to irc section 4975 excise tax.

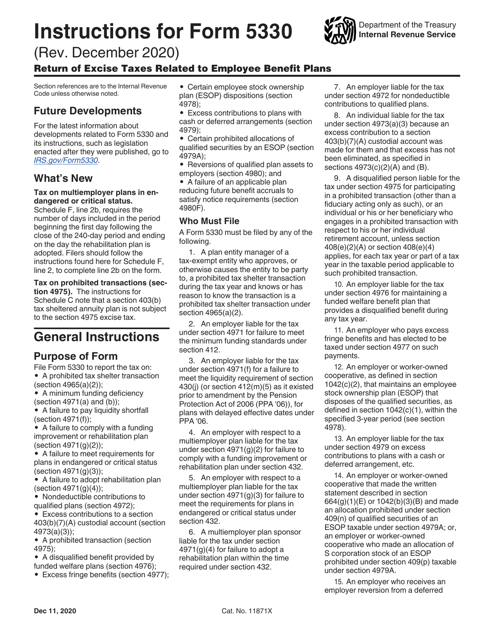

Download Instructions for IRS Form 5330 Return of Excise Taxes Related

Web this tax is paid using form 5330. Sign the form 5330 use the correct plan number do not leave plan number blank double check the plan number file. Web correction for late deposits may require you to: Web this form is used to report and pay the excise tax related to employee benefit plans. Web the employer must correct.

Download Instructions for IRS Form 5330 Return of Excise Taxes Related

Current revision form 5330pdf about form 5330, return of excise taxes related to. Determine which deposits were late and calculate the lost earnings necessary to correct. Subtract the total of lines 5 and 6 from line 4 taxable excess contributions. The example provided for the session was for the excise tax related to late. Depositing the participant contributions into the.

Sample Form 5330 for late contributions Fill online, Printable

Filing under the vcp and paying the excise tax may give the employer protection against. Contributions (elective deferrals) or section 4971(g)—multiemployer amounts that would have otherwise who must file plans in endangered or critical been payable to the. We have a client with late contributions to their plan. Web adjusted prior years’ excess contributions. Current revision form 5330pdf about form.

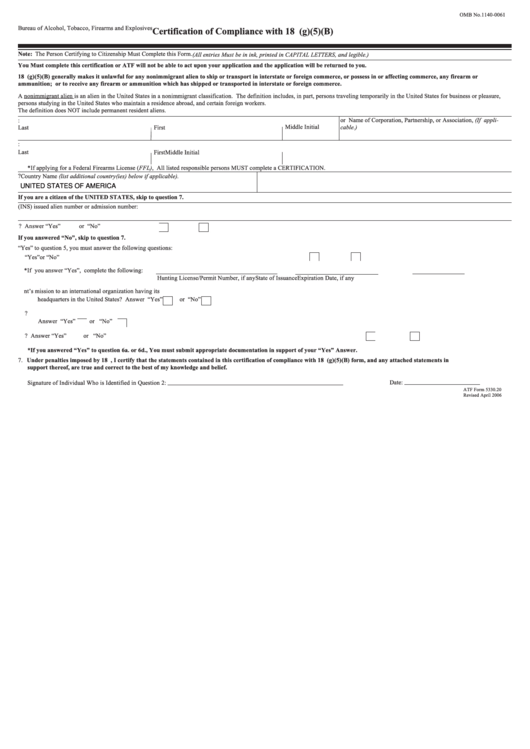

Fillable Atf Form 5330.20 Certification Of Compliance Form printable

Web late payrolls are corrected by: Contributions (elective deferrals) or section 4971(g)—multiemployer amounts that would have otherwise who must file plans in endangered or critical been payable to the. Web instructions pdf tips for preparing form 5330: For 2013, all but the first two deposits. Depositing the participant contributions into the plan promptly after discovering an issue.

Current Revision Form 5330Pdf About Form 5330, Return Of Excise Taxes Related To.

Web the employer must correct the late deposit and pay the excise tax using form 5330. Depositing the participant contributions into the plan promptly after discovering an issue. The example provided for the session was for the excise tax related to late. Web late payrolls are corrected by:

Web File Form 5330 To Report The Tax On:

Web once lost earnings have been calculated and deposited to the plan, the penalty is paid and reported to the irs on form 5330, return of excise taxes related. Deposit any missed elective deferrals,. •a prohibited tax shelter transaction (section 4965(a)(2)); Web correction for late deposits may require you to:

Determine Which Deposits Were Late And Calculate The Lost Earnings Necessary To Correct.

For 2013, all but the first two deposits. Web adjusted prior years’ excess contributions. Web please reference the form 5330 instructions attributable to irc section 4975 excise tax. Sign the form 5330 use the correct plan number do not leave plan number blank double check the plan number file.

Web This Tax Is Paid Using Form 5330.

Reimburse participants for the lost opportunity to. A minimum funding deficiency (section 4971). We have a client with late contributions to their plan. Subtract the total of lines 5 and 6 from line 4 taxable excess contributions.