Form 568 Instructions Pdf

Form 568 Instructions Pdf - Web you still have to file form 568 if the llc is registered in california. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. For calendar year 2018 or fiscal year beginning and ending. Llcs classified as a disregarded entity or. Save or instantly send your ready documents. Select the document you want to sign and click upload. Web download and fill out ca 568 instructions 2018 form california. Start completing the fillable fields and. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc.

Web california how do i file ca form 568 for a partnership? Save or instantly send your ready documents. Web complete 568 instructions online with us legal forms. Online library editform makes it fast and easy to fill out your ca 568 instructions 2018 form. Web 2016 instructions for form 568, limited liability company return of income. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. 2021 limited liability company return of income. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: 2018 limited liability company return of income.

I (1) during this taxable year, did another person or legal entity acquire control or. Web 2016 instructions for form 568, limited liability company return of income. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Select the document you want to sign and click upload. Llcs classified as a disregarded entity or. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Select the document you want to sign and click upload. Web you still have to file form 568 if the llc is registered in california.

Form 568 instructions 2013

Easily fill out pdf blank, edit, and sign them. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. 1a enter the california cost of goods sold from. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100,.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web 2016 instructions for form 568, limited liability company return of income. Web california how do i file ca form 568 for a partnership? Web i (1)during this taxable year, did another person or legal entity acquire control or.

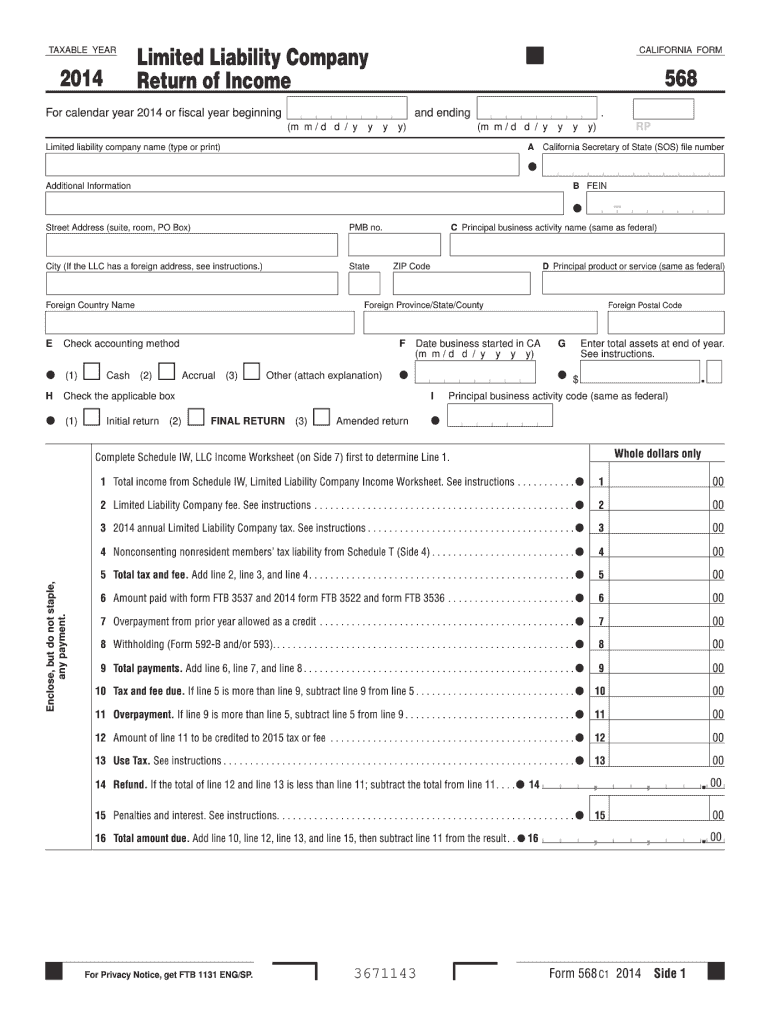

Form 568 Fill Out and Sign Printable PDF Template signNow

2021 limited liability company return of income. Web 2016 instructions for form 568, limited liability company return of income. Web form 568 2018 side 1. Web california income tax brackets income tax forms form 568 california — limited liability company return of income download this form print this form it appears you don't. Save or instantly send your ready documents.

Form Ca 568 Fill Out and Sign Printable PDF Template signNow

Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. 2021 limited liability company return of income. Easily fill out pdf blank, edit, and sign them. Web 2016 instructions for form 568, limited liability company return of income. Web up to $40 cash.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web the california franchise tax board june 1 released a revised limited liability company tax booklet providing 2020 instructions for form 568, limited liability. Save or instantly.

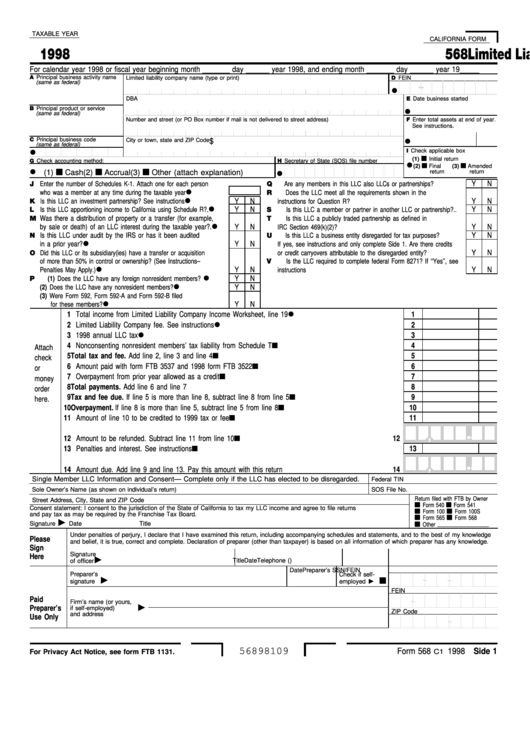

Fillable Form 568 Limited Liability Company Return Of 1998

Select the document you want to sign and click upload. Llcs classified as a disregarded entity or. Start completing the fillable fields and. Web complete 568 instructions online with us legal forms. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including.

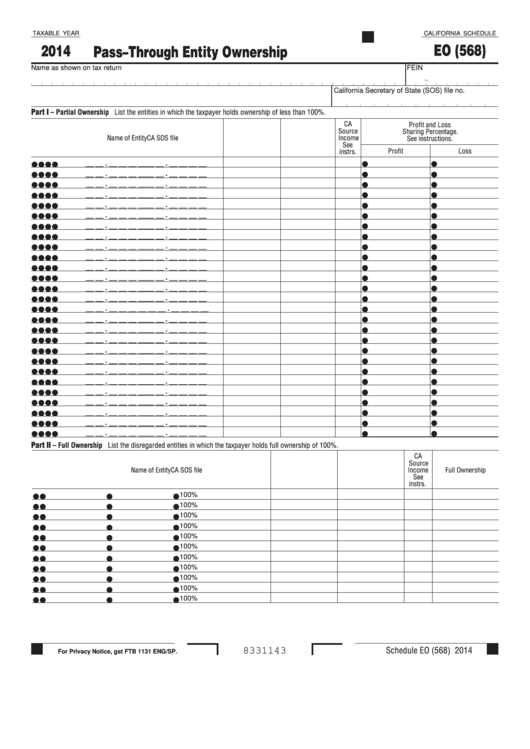

Fillable Form California Schedule Eo (568) PassThrough Entity

Online library editform makes it fast and easy to fill out your ca 568 instructions 2018 form. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Llcs classified as a disregarded entity or. 2021, form 568, limited liability company return of income: How to fill in california form.

Instructions For Form 568 Limited Liability Company Return Of

Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web california income tax brackets income tax forms form 568 california — limited liability company return of income download this form print this form it appears you don't. Use get form or simply.

568 Instructions Fill Out and Sign Printable PDF Template signNow

For calendar year 2018 or fiscal year beginning and ending. For calendar year 2013 or fiscal year. Use get form or simply click on the template preview to open it in the editor. References in these instructions are to the internal revenue code (irc) as of. Web california how do i file ca form 568 for a partnership?

20172022 Form CA FTB Schedule K1 (568) Instructions Fill Online

Save or instantly send your ready documents. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Select the document you want to sign and click upload. Web 2016 instructions for form 568, limited liability company return of income. References in these instructions are to the internal.

2021 Limited Liability Company Return Of Income.

Web california how do i file ca form 568 for a partnership? Online library editform makes it fast and easy to fill out your ca 568 instructions 2018 form. 2018 limited liability company return of income. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including.

Select The Document You Want To Sign And Click Upload.

Web download and fill out ca 568 instructions 2018 form california. Easily fill out pdf blank, edit, and sign them. Select the document you want to sign and click upload. Web complete 568 instructions online with us legal forms.

Web Form 568 Is The Return Of Income That Many Limited Liability Companies (Llc) Are Required To File In The State Of California.

Save or instantly send your ready documents. Web form 568 2018 side 1. For calendar year 2013 or fiscal year. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:.

Web I (1)During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority Ownership (More Than A 50% Interest) Of This Llc Or Any Legal Entity In Which The Llc.

Download this form print this form more about the. Limited liability company tax booklet members of the franchise tax board john chiang, chair betty t. Start completing the fillable fields and. Web 14 enter here and on form 568 side 1 line 1.