Form 8990 For 2021

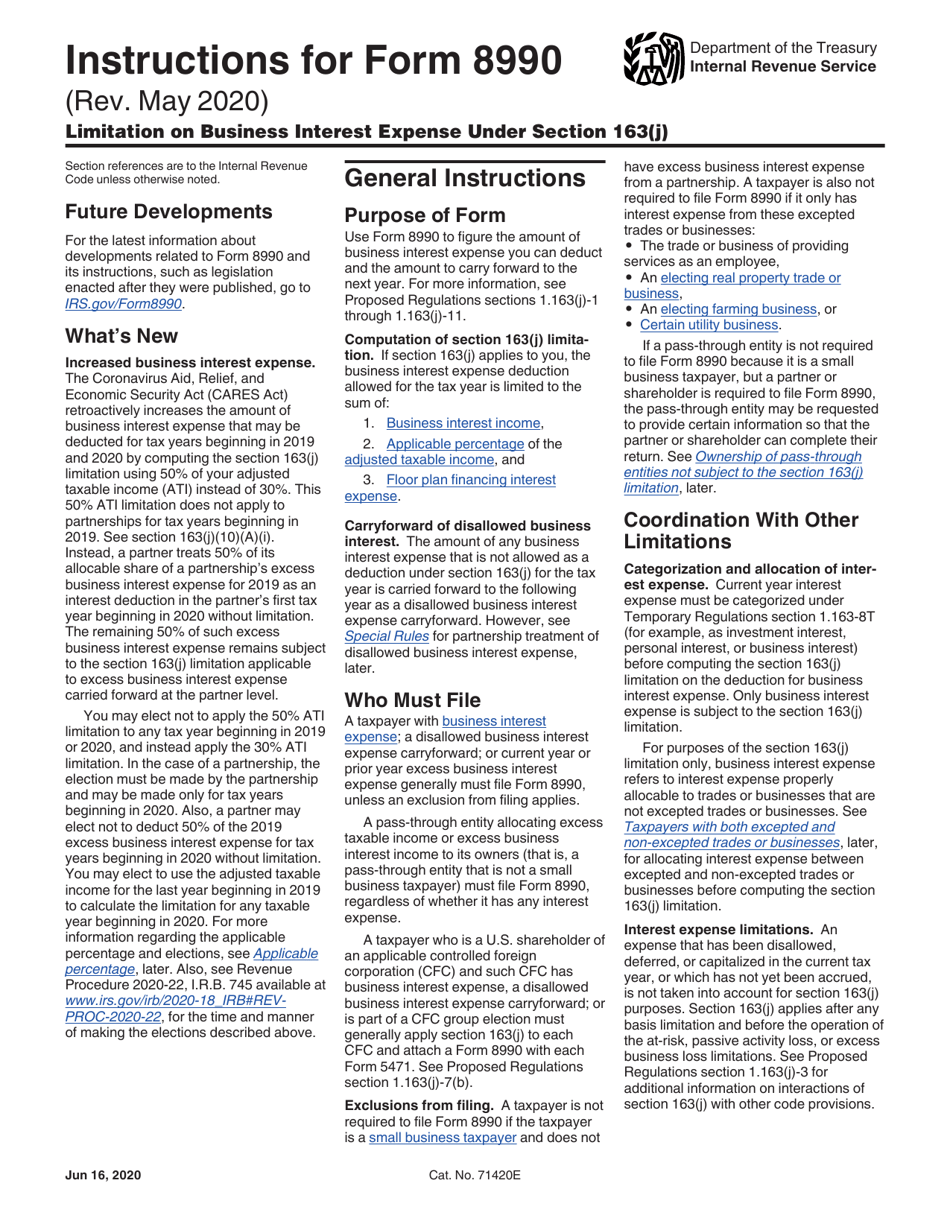

Form 8990 For 2021 - Web the sonoran institute 5049 e broadway blvd., suite 127 tucson, az 85711 phone: Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Web expense must generally file form 8990, unless an exclusion from filing applies. If gross receipts are $200,000 or more, or if total. Limitation on business interest expense under section 163(j). Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. If the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. The united states (us) treasury and the internal revenue service (irs) released a draft of form 8990,. Web how to generate form 8990 in proconnect.

Web irs form 8990, limitation on business interest expense under section 163 (j), is the form business taxpayers must use to calculate the amount of interest they. Web expense must generally file form 8990, unless an exclusion from filing applies. Web the sonoran institute 5049 e broadway blvd., suite 127 tucson, az 85711 phone: Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Form 8990 form 8990 calculates the business interest expense deduction and carryover. Limitation on business interest expense under section 163(j). Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. If gross receipts are $200,000 or more, or if total. Web categories corporate tax.

Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business interest expense under section 163. Web how to generate form 8990 in proconnect. Form 8990 form 8990 calculates the business interest expense deduction and carryover. Web categories corporate tax. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990. Attach to your tax return. The united states (us) treasury and the internal revenue service (irs) released a draft of form 8990,. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. The documents include pwc’s highlights. Web expense must generally file form 8990, unless an exclusion from filing applies.

Dd Form 2875 Army Fillable Army Military

May 2020) department of the treasury internal revenue service. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web categories corporate tax. Form 8990 form 8990 calculates the business interest expense deduction and carryover. Web irs form 8990, limitation on business interest expense.

IRS 8990 20202021 Fill and Sign Printable Template Online US Legal

Limitation on business interest expense under section 163(j). Web categories corporate tax. Web the sonoran institute 5049 e broadway blvd., suite 127 tucson, az 85711 phone: Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Web how to generate form 8990 in proconnect.

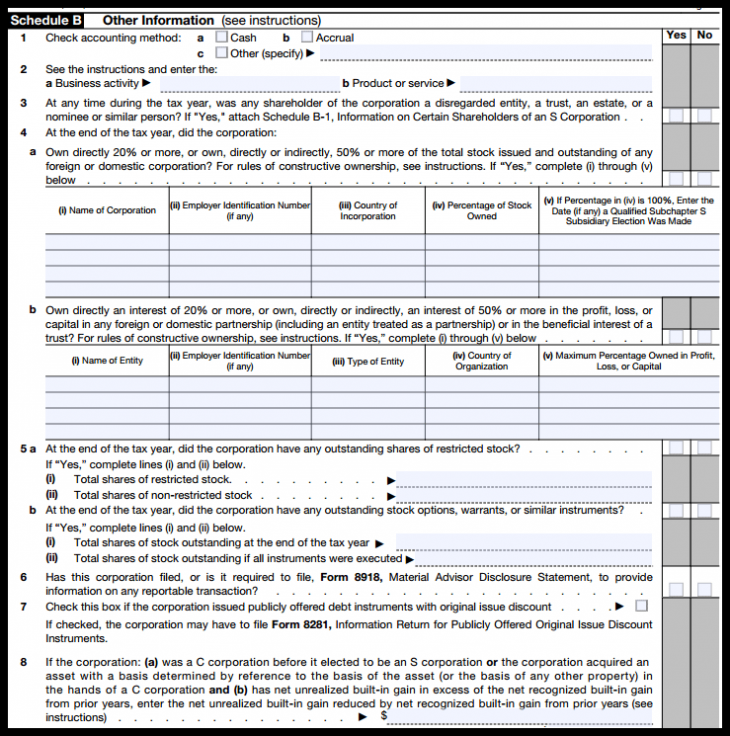

IRS Form 1120S Definition, Download, & 1120S Instructions

Web expense must generally file form 8990, unless an exclusion from filing applies. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. May 2020) department of the treasury internal revenue service. Web pwc is pleased to make available our annotated version of the 2021 form 990 and schedules and instructions for 2021 form 990..

Tax Newsletter November 2020 Secure Act Part 2? Basics & Beyond

May 2020) department of the treasury internal revenue service. Web categories corporate tax. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Solved•by intuit•27•updated february 07, 2023. If gross receipts are $200,000 or more, or if total.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web overview this article provides information about how to file form 8990 in ultratax cs/1040. May 2020) department of the treasury internal revenue service. If gross receipts are $200,000 or more, or if total. Limitation on business interest expense under section 163(j). Web this document contains final regulations that provide additional guidance regarding the limitation on the deduction for business.

Dos Form 7007 Fill Online, Printable, Fillable, Blank pdfFiller

If the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web categories corporate tax. Limitation on business interest expense under section 163(j). Web irs form 8990, limitation on business interest expense under section 163 (j), is the form business taxpayers must use to calculate the amount of interest they. Web form.

Irs Form 1120 Excel Template Budget For Business Excel Template

Web the sonoran institute 5049 e broadway blvd., suite 127 tucson, az 85711 phone: Limitation on business interest expense under section 163(j). If gross receipts are $200,000 or more, or if total. The documents include pwc’s highlights. The united states (us) treasury and the internal revenue service (irs) released a draft of form 8990,.

what is form 8990 Fill Online, Printable, Fillable Blank form8453

The united states (us) treasury and the internal revenue service (irs) released a draft of form 8990,. Web expense must generally file form 8990, unless an exclusion from filing applies. Web how to generate form 8990 in proconnect. If gross receipts are $200,000 or more, or if total. This article will help you enter information for form 8990, limitation.

What Is Sale/gross Receipts Of Business In Itr 5 Tabitha Corral's

Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. Web how to generate form 8990 in proconnect. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of.

What Is Federal Carryover Worksheet

If gross receipts are $200,000 or more, or if total. Web overview this article provides information about how to file form 8990 in ultratax cs/1040. Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Web pwc is pleased to make available our.

Web Learn & Support Community Hosting For Lacerte & Proseries How To Generate Form 8990 This Article Will Help You Enter Information For Form 8990 Limitation On.

Web categories corporate tax. This article will help you enter information for form 8990, limitation. If the partnership reports excess business interest expense to the partner, the partner is required to file form 8990. Web overview this article provides information about how to file form 8990 in ultratax cs/1040.

Web Pwc Is Pleased To Make Available Our Annotated Version Of The 2021 Form 990 And Schedules And Instructions For 2021 Form 990.

Attach to your tax return. May 2020) department of the treasury internal revenue service. The documents include pwc’s highlights. Web per the irs, form 8990 is used to calculate the amount of business interest expense that can be deducted and the amount to carry forward to the next year.

Web Expense Must Generally File Form 8990, Unless An Exclusion From Filing Applies.

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web irs form 8990, limitation on business interest expense under section 163 (j), is the form business taxpayers must use to calculate the amount of interest they. Web the sonoran institute 5049 e broadway blvd., suite 127 tucson, az 85711 phone: Web how to generate form 8990 in proconnect.

Solved•By Intuit•27•Updated February 07, 2023.

Form 8990 form 8990 calculates the business interest expense deduction and carryover. Add lines 5b, 6c, and 7b to line 9 to determine gross receipts. The united states (us) treasury and the internal revenue service (irs) released a draft of form 8990,. Limitation on business interest expense under section 163(j).