Form 982 Insolvency Worksheet

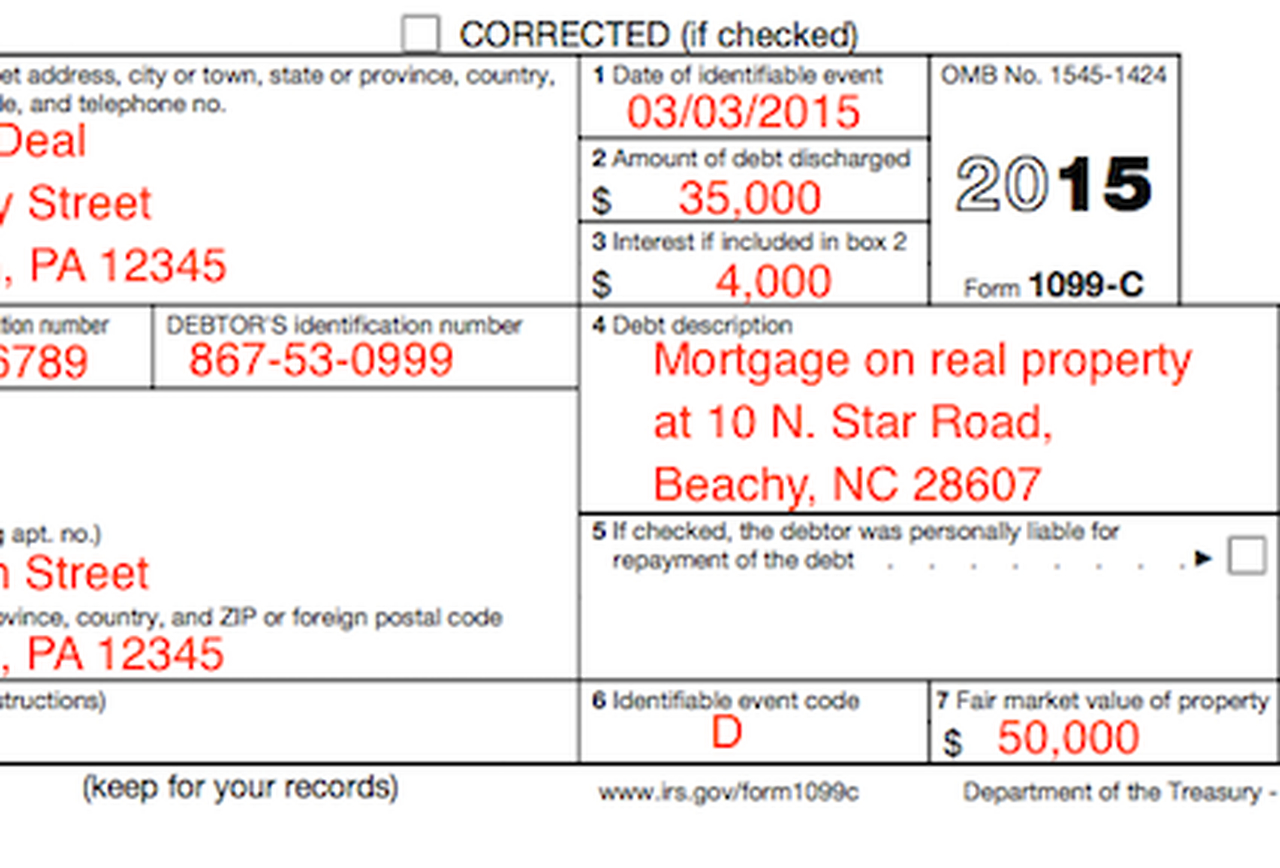

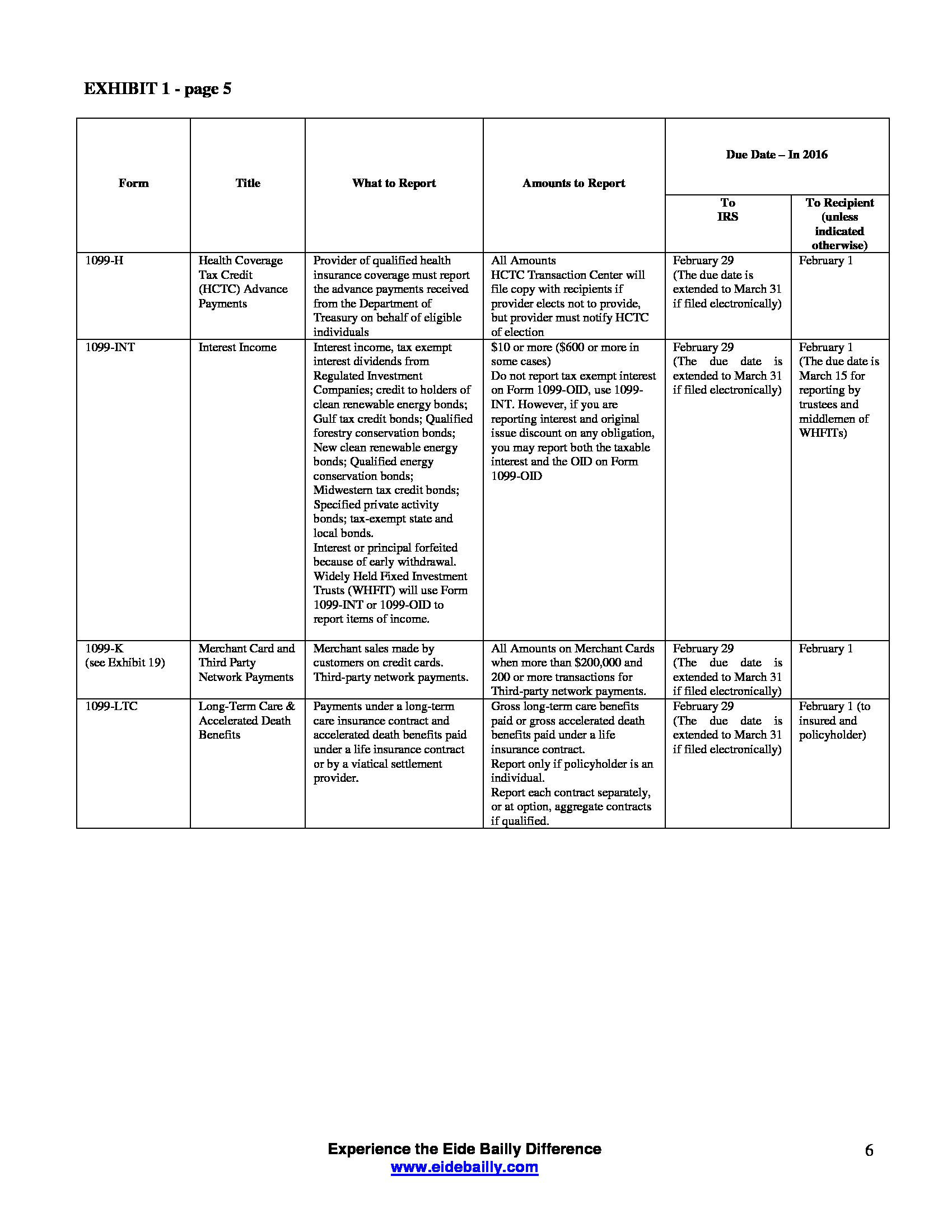

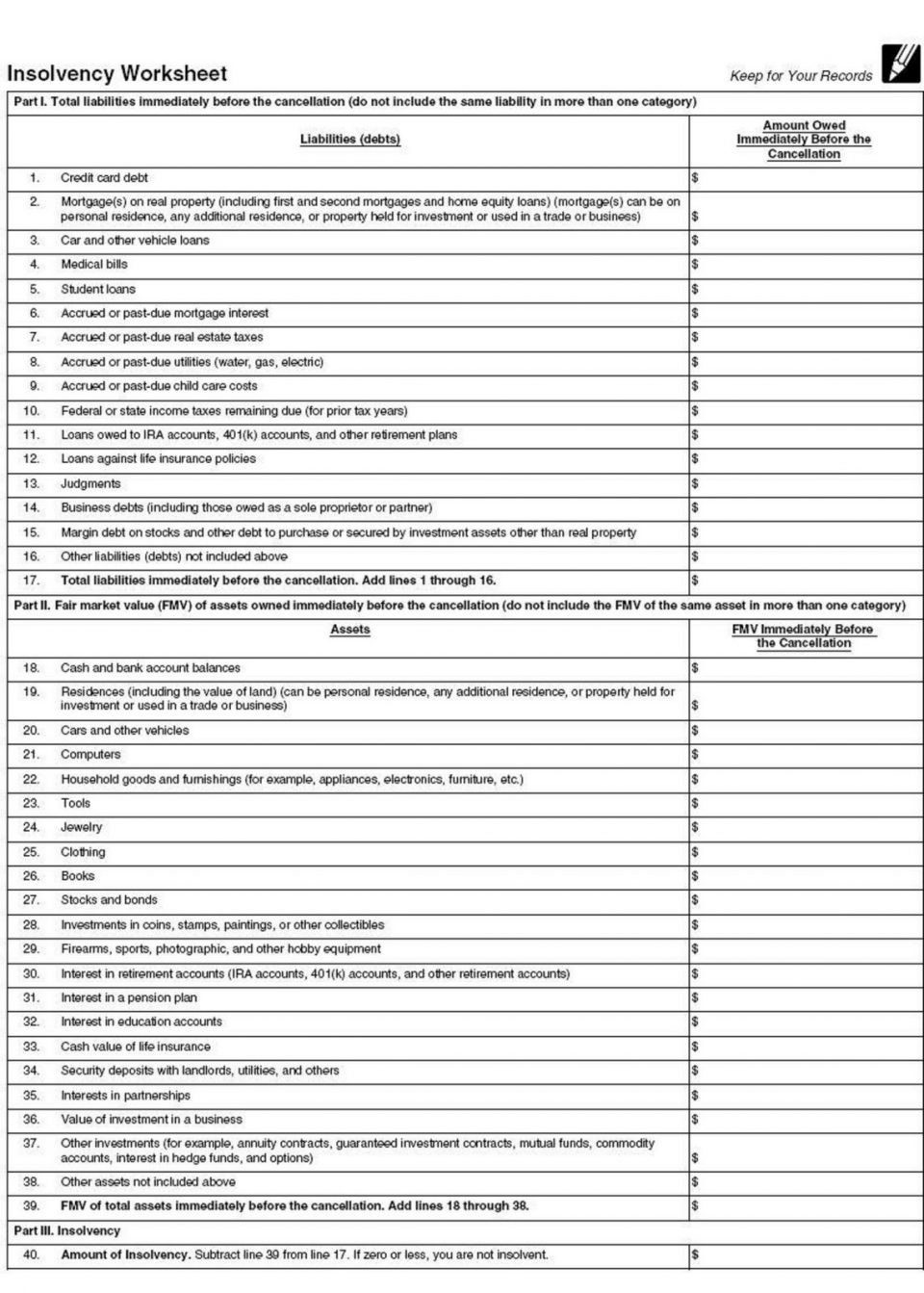

Form 982 Insolvency Worksheet - Attach/include, all of the above with your tax return. The insolvency determination worksheet can be used as a resource to determine whether a taxpayer is considered to be insolvent. Cents per dollar (as explained below). Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982 and mark the box that says, “discharge of indebtedness to the extent insolvent.” typically, no further explanation is necessary. Web use part i of form 982 to indicate why any amount received from the discharge of indebtedness should be use part ii to report your reduction of tax attributes. Web you must complete and file form 982 with your tax return to do so. This reduction in basis can increase the. Include the amount of canceled qualified real property business debt (but not more than the amount of the exclusion limit, explained earlier) on line 2 of form 982. Web instructions for form 982 (rev. Insolvency determination worksheet assets (fmv) liabilities homes $ mortgages $ cars home equity loans recreational vehicles, etc.

The insolvency determination worksheet can be used as a resource to determine whether a taxpayer is considered to be insolvent. March 2018)) section references are to the internal revenue code unless otherwise noted. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Attach/include, all of the above with your tax return. Fill out the insolvency worksheet (and keep it in your important paperwork!). Calculators, cancelation of debt income, cancellation of debt, form 982,. March 2018) department of the treasury internal revenue service. Web the zipdebt irs form 982 insolvency calculator. Web fill insolvency canceled debts, edit online. Common situations covered in this publication

This sample worksheet is for reference only. Web create the insolvency worksheet. Reduce document preparation complexity by getting the most out of this helpful video guide. Qualified real property business indebtedness If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. For instructions and the latest information. This reduction in basis can increase the. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Get your fillable template and complete it online using the instructions provided. December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982 (rev.

Tax Form 982 Insolvency Worksheet —

Irs publication 4681 (link opens pdf) includes an insolvency worksheet on page 8, which lists the. Web for details and a worksheet to help calculate insolvency, see pub. How to complete the form. If the discharged debt you are excluding is. The amount or level of insolvency is expressed as a negative net worth.

Tax Form 982 Insolvency Worksheet —

Qualified real property business indebtedness Web create the insolvency worksheet. March 2018) department of the treasury internal revenue service. December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982 (rev. For more details on what it means to be insolvent, please reference.

Form 982 Insolvency Worksheet

December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982 (rev. Web first, make a list of the total assets you owned immediately before the debt was canceled. Calculators, cancelation of debt income, cancellation of debt, form 982,. Get your fillable template.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

This reduction in basis can increase the. Web insolvency means that you are unable to pay your debts. For more details on what it means to be insolvent, please reference irs. Qualified real property business indebtedness Get your fillable template and complete it online using the instructions provided.

Worksheet Form 10 Insolvency Worksheet Worksheet Fun —

Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. For more details on what it means to be insolvent, please reference irs. Insolvency determination worksheet assets (fmv) liabilities homes $ mortgages $ cars home equity loans recreational.

Tax form 982 Insolvency Worksheet

Fill out the insolvency worksheet (and keep it in your important paperwork!). Attach/include, all of the above with your tax return. Web first, make a list of the total assets you owned immediately before the debt was canceled. Qualified real property business indebtedness Cents per dollar (as explained below).

Debt Form 982 Form 982 Insolvency Worksheet —

Open (continue) your return, if it's not already open. Common situations covered in this publication Qualified principal residence indebtedness ; Now, you have to prove to the irs that you were insolvent. Web irs form 982 insolvency worksheet.

Tax Form 982 Insolvency Worksheet

The reduction must be made in the following order unless you check the box on line 1d for qualified real property business indebtedness or make the election on line 5 to reduce Now, you have to prove to the irs that you were insolvent. Fill out the insolvency worksheet (and keep it in your important paperwork!). The insolvency determination worksheet.

Insolvency Worksheet Example Studying Worksheets

Web use part i of form 982 to indicate why any amount received from the discharge of indebtedness should be use part ii to report your reduction of tax attributes. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. Now, you have to.

Insolvency Worksheet Example worksheet

If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. For more details on what it means to be insolvent, please reference irs. Attach/include, all of the above with your tax return. Web.

Prepare Your How To Prove Insolvency In A Few Simple Steps.

Get your fillable template and complete it online using the instructions provided. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded from gross income. If you need more help, click below: Check entries on canceled debt worksheet.

Web Insolvency Determination Worksheet Determining Insolvency Is Out Of Scope For The Volunteer.

Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). How to complete the form. Web video instructions and help with filling out and completing sample of completed form 982 for insolvency. You were released from your obligation to pay your credit card debt in the amount of $5,000.

The Insolvency Determination Worksheet Can Be Used As A Resource To Determine Whether A Taxpayer Is Considered To Be Insolvent.

Open (continue) your return, if it's not already open. Attach this form to your income tax return. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982 and mark the box that says, “discharge of indebtedness to the extent insolvent.” typically, no further explanation is necessary. Web fill insolvency canceled debts, edit online.

Get Accurate Templates In The Easiest Way Online.

Check the box that says “discharge of indebtedness to the extent insolvent,” which appears at line 1b. Include the amount of canceled qualified real property business debt (but not more than the amount of the exclusion limit, explained earlier) on line 2 of form 982. Web insolvency means that you are unable to pay your debts. Reduce document preparation complexity by getting the most out of this helpful video guide.