Form 990 Due Date Extension

Form 990 Due Date Extension - If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. Web upcoming form 990 deadline: When is form 990 due with extension form 8868? Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Nonprofit filing deadline for form 990 is may 17. And will that extension request automatically extend to my state filing deadline? Web state deadlines are different! Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022.

Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. Web upcoming form 990 deadline: Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. To use the table, you must know when your organization’s tax year ends. Web can any officer file the extension request? If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. And will that extension request automatically extend to my state filing deadline? Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Corporations, for example, still had to file by april 15, 2021.

Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Web upcoming form 990 deadline: Nonprofit filing deadline for form 990 is may 17. Web can any officer file the extension request? Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Ending date of tax year. To use the table, you must know when your organization’s tax year ends. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. Web state deadlines are different! If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023.

form 990 due date 2018 extension Fill Online, Printable, Fillable

And will that extension request automatically extend to my state filing deadline? Web can any officer file the extension request? Ending date of tax year. Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Also, if you filed an 8868 extension on january 15, 2023, then your form.

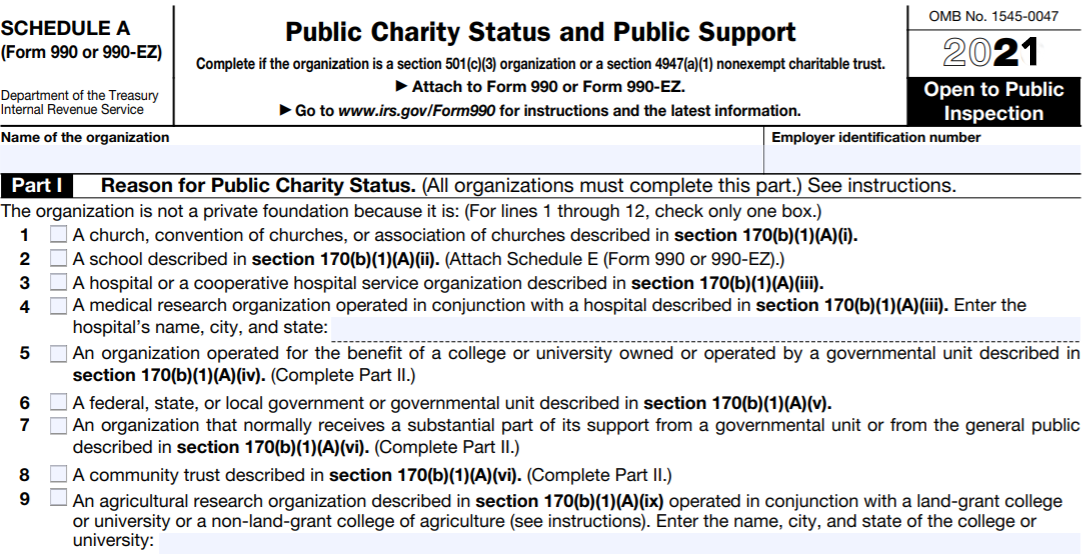

IRS Form 990 Schedules

And will that extension request automatically extend to my state filing deadline? Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. Nonprofit filing deadline for form 990 is may 17. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th.

Form 990 Filing Date Universal Network

Web can any officer file the extension request? Corporations, for example, still had to file by april 15, 2021. Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868.

Instructions to file your Form 990PF A Complete Guide

Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023..

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

And will that extension request automatically extend to my state filing deadline? If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17,.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web can.

What To Do When You Miss The IRS Form 990 Deadline ExpressTaxExempt

Web state deadlines are different! Corporations, for example, still had to file by april 15, 2021. Web upcoming form 990 deadline: When is form 990 due with extension form 8868? If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a.

form 990 extension due date 2020 Fill Online, Printable, Fillable

Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. Nonprofit filing deadline for form 990 is may 17. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. And will that extension request automatically.

How To Never Mistake IRS Form 990 and Form 990N Again

Corporations, for example, still had to file by april 15, 2021. Web state deadlines are different! If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. And will that extension request automatically extend to my state filing deadline? When is form 990 due with extension.

What Is The Form 990EZ and Who Must File It?

Web upcoming form 990 deadline: Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but.

Web Upcoming Form 990 Deadline:

If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. When is form 990 due with extension form 8868? To use the table, you must know when your organization’s tax year ends. Ending date of tax year.

And Will That Extension Request Automatically Extend To My State Filing Deadline?

Corporations, for example, still had to file by april 15, 2021. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web can any officer file the extension request? Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical.

Web State Deadlines Are Different!

Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Nonprofit filing deadline for form 990 is may 17. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is.