Hawaii State Tax Extension Form

Hawaii State Tax Extension Form - You can make a state. Web hawaii filing due date: Web your state extension form is free. Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. For information and guidance in. How to pay the state tax due? Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers). Individual income tax return, in lieu of the hawaii. Web file your personal tax extension now!

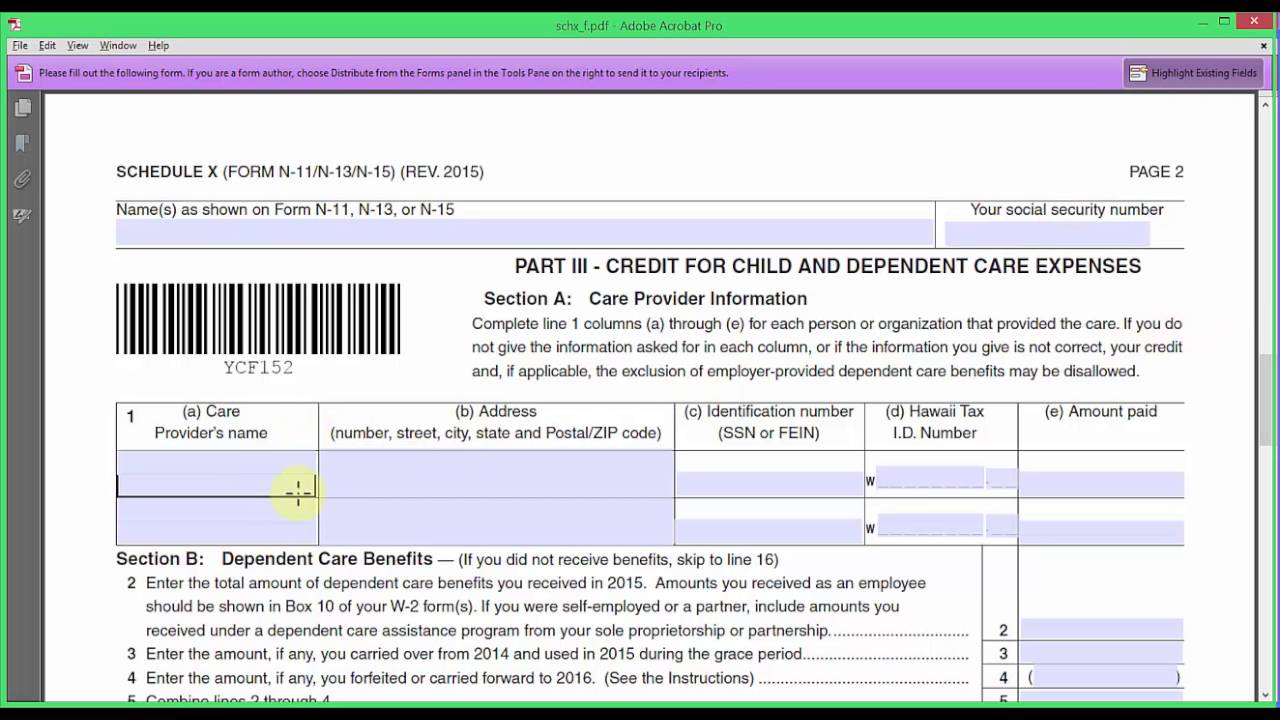

Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. Individual income tax return, in lieu of the hawaii. File this form to request an extension even if you are not making a payment. Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. 2019) do not write in this space state of hawaii — department of taxation application for automatic extension of. Web file your personal tax extension now! Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. How to pay the state tax due? Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). For information and guidance in.

To ensure your privacy, a “clear form” button. File this form to request an extension even if you are not making a payment. For information and guidance in. Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. You can make a state. Web hawaii filing due date: Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web your state extension form is free. Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers).

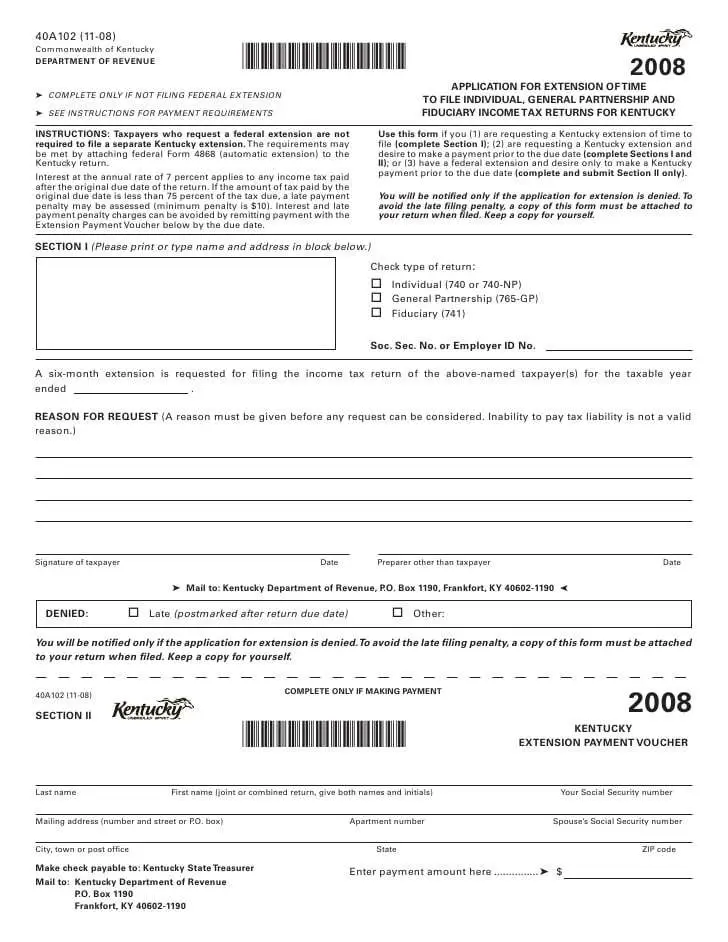

How To Apply For State Tax Extension

How to pay the state tax due? You can make a state. Web your state extension form is free. Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. Hawaii business tax returns are due by the 20 th day of.

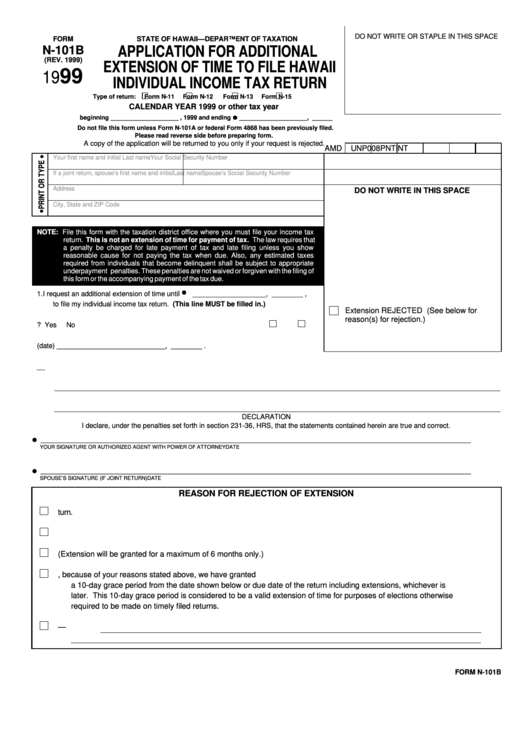

Form N101b Application For Additional Extension Of Time To File

File this form to request an extension even if you are not making a payment. To ensure your privacy, a “clear form” button. Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers). Business tax returns are due by april 20.

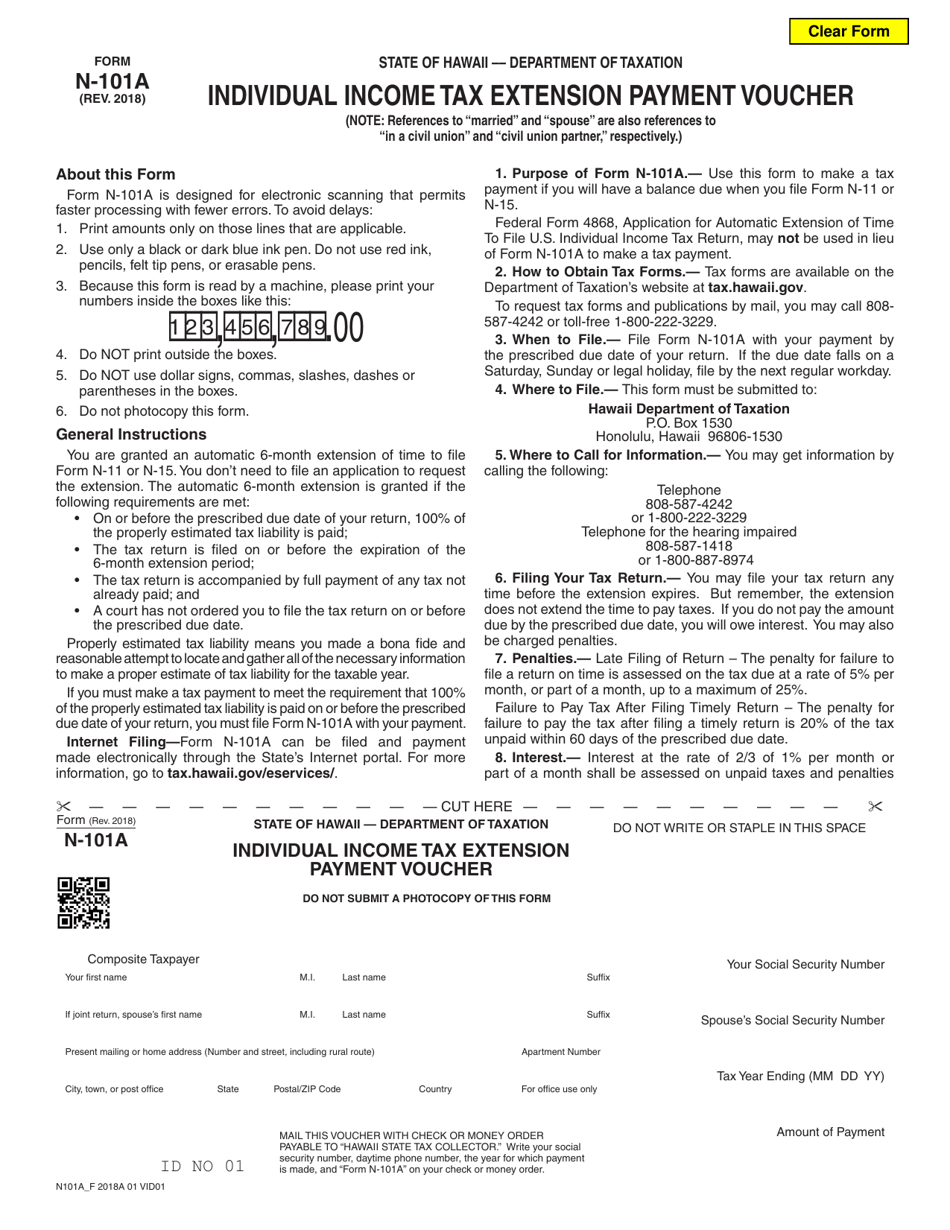

Form N101A Fill Out, Sign Online and Download Fillable PDF, Hawaii

How to pay the state tax due? For information and guidance in. Web hawaii filing due date: Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for.

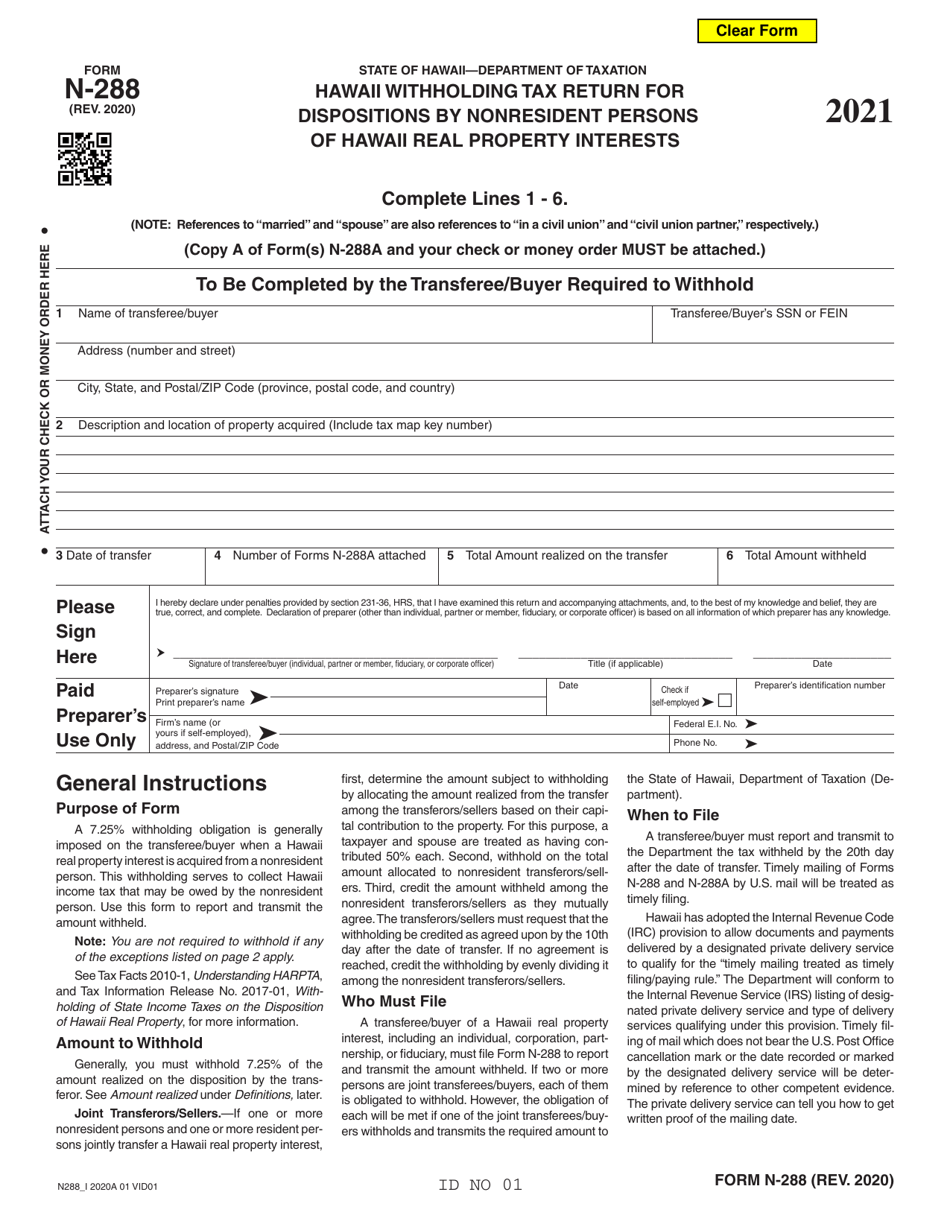

Form N288 Download Fillable PDF or Fill Online Hawaii Withholding Tax

You can make a state. File this form to request an extension even if you are not making a payment. How to pay the state tax due? Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web hawaii.

Hawaii N11 Tax Return, Part 4 (tax credits) YouTube

Web your state extension form is free. You can make a state. How to pay the state tax due? Web hawaii filing due date: Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s.

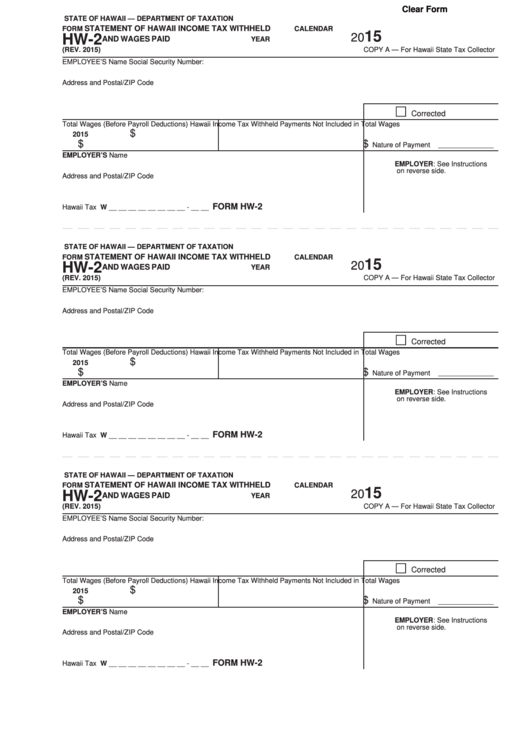

Fillable Form Hw2 Statement Of Hawaii Tax Withheld And Wages

Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year. How to pay the state tax due? Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for.

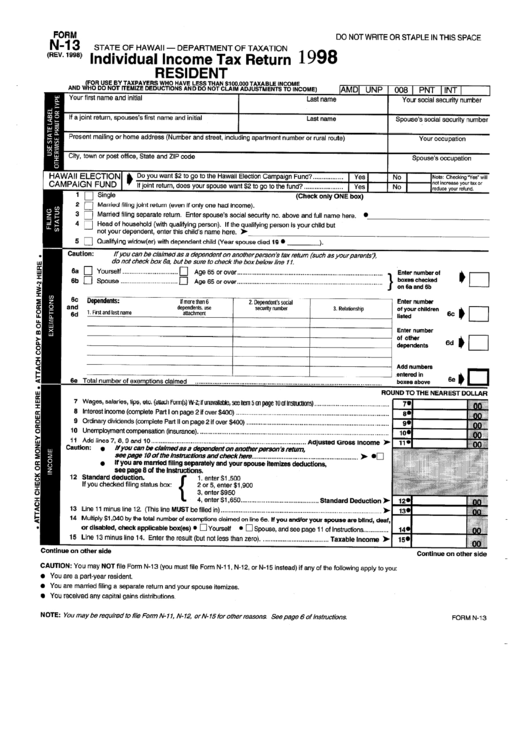

Fillable Form N13 Individual Tax Return Resident Hawaii

Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web your state extension form is free. Individual income tax return, in lieu of the hawaii. Hawaii business tax returns are due by the 20 th day of the.

Does Hawaii Tax Unemployment Benefits YUNEMPLO

To ensure your privacy, a “clear form” button. Hawaii business tax returns are due by the 20 th day of the 4 th month after the close of the tax year (april 20 for calendar year filers). Web hawaii filing due date: File this form to request an extension even if you are not making a payment. Web hawaii tax.

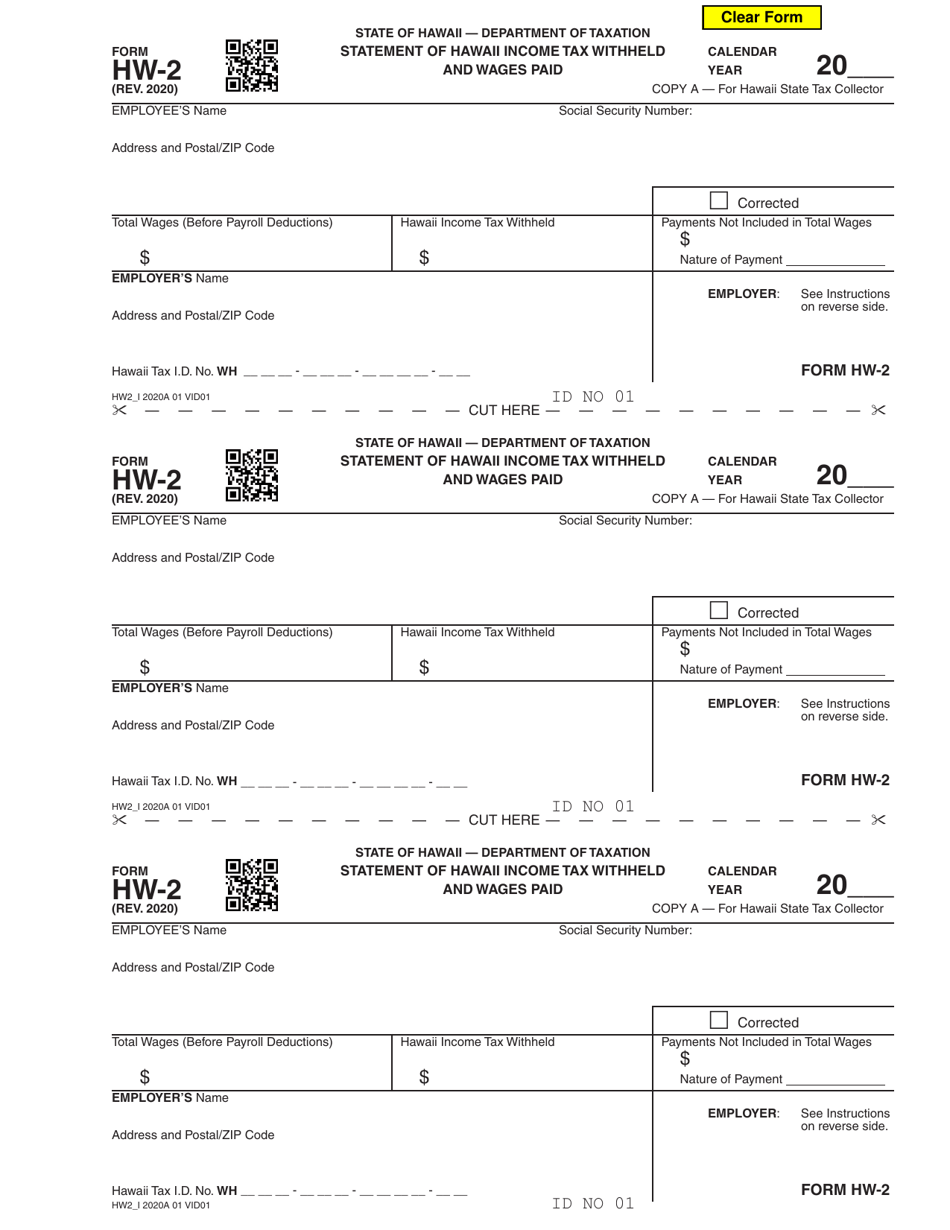

Form HW2 Download Fillable PDF or Fill Online Statement of Hawaii

Individual income tax return, in lieu of the hawaii. Web hawaii filing due date: Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Hawaii individual income tax returns are due by the 20th day of the 4th month.

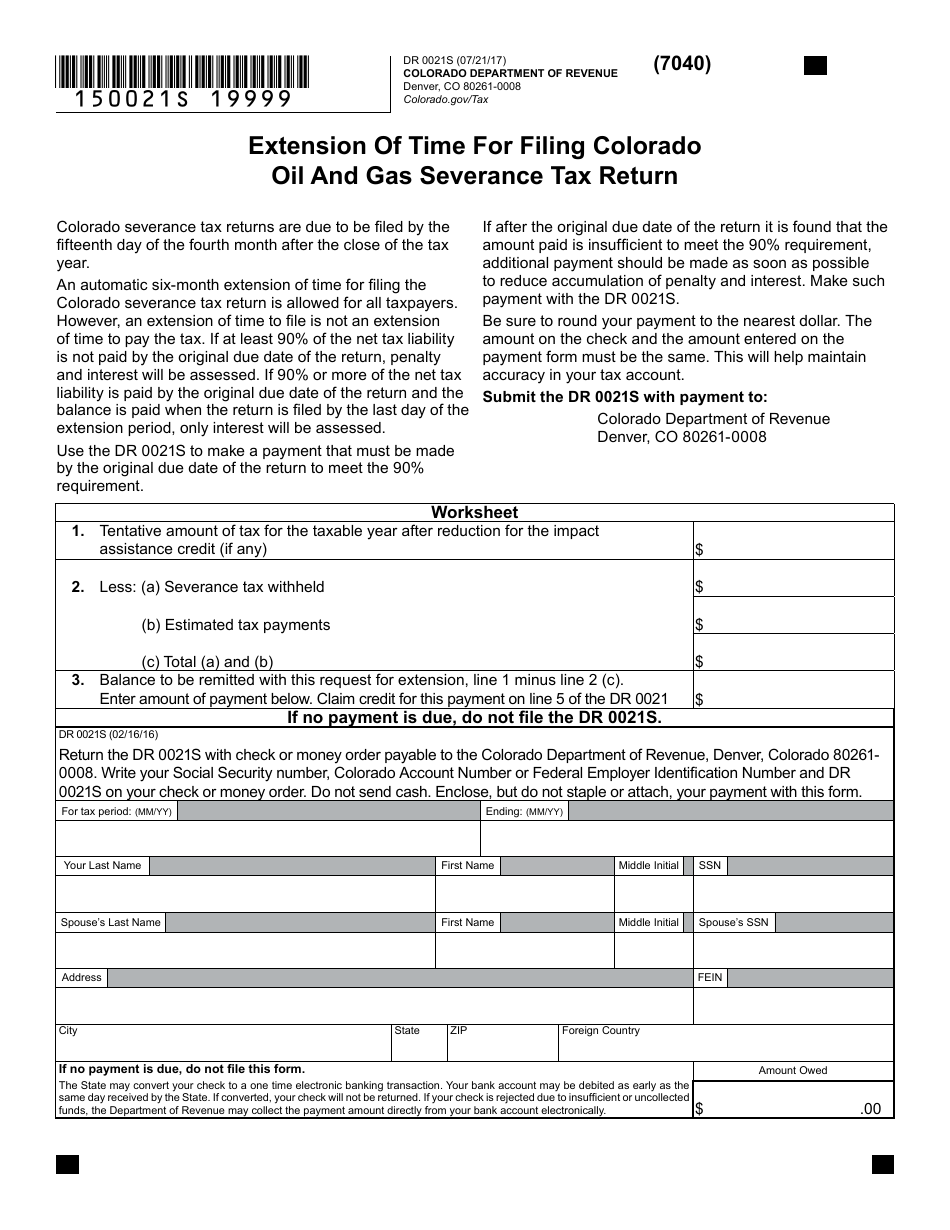

Form DR0021S Download Fillable PDF or Fill Online Extension of Time for

Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. File this form to request an extension even if you are not making a payment. Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options. You.

For Information And Guidance In.

How to pay the state tax due? To ensure your privacy, a “clear form” button. 2019) do not write in this space state of hawaii — department of taxation application for automatic extension of. Web hawaii tax extension filing method (paper/electronic) it supports both paper and electronic filing options.

File This Form To Request An Extension Even If You Are Not Making A Payment.

Individual income tax return, in lieu of the hawaii. Web does hawaii accept the federal form 4868, application for automatic extension of time to file u.s. Web your state extension form is free. You can make a state.

Hawaii Business Tax Returns Are Due By The 20 Th Day Of The 4 Th Month After The Close Of The Tax Year (April 20 For Calendar Year Filers).

Web hawaii filing due date: Business tax returns are due by april 20 — or by the 20 th day of the 4 th month following the close of the taxable year (for fiscal year filers). Web start gathering your tax records so you have enough time to obtain all forms and documents needed to accurately file your income tax return by the filing deadline,. Hawaii individual income tax returns are due by the 20th day of the 4th month after the end of the tax year (april 20 for calendar year.