How To Form S Corp In California

How To Form S Corp In California - Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: File by mail or in person Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. You may use the form or prepare your own statutorily compliant document. Choose your california registered agent. For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income you should use the below guidelines to file your state income taxes: Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. When a corporation elects federal s corporation status it automatically becomes an s.

When a corporation elects federal s corporation status it automatically becomes an s. Corporations can be taxed 2 different ways. Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s corp start an s corp let our experts file your business paperwork quickly and accurately, guaranteed! Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income you should use the below guidelines to file your state income taxes: Choose your california registered agent. You'll also need to include the number of shares the corporation has authorized. Choosing a company name is the first and most important step in starting your llc in california. Box address of the agent. For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809.

Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s corp start an s corp let our experts file your business paperwork quickly and accurately, guaranteed! Over 140 business filings, name reservations, and orders for certificates of status and certified copies of corporations, limited liability companies and limited partnerships available online. You may use the form or prepare your own statutorily compliant document. Choose your california registered agent. You'll also need to include the number of shares the corporation has authorized. When a corporation elects federal s corporation status it automatically becomes an s. File by mail or in person Corporations can be taxed 2 different ways. For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. Choosing a company name is the first and most important step in starting your llc in california.

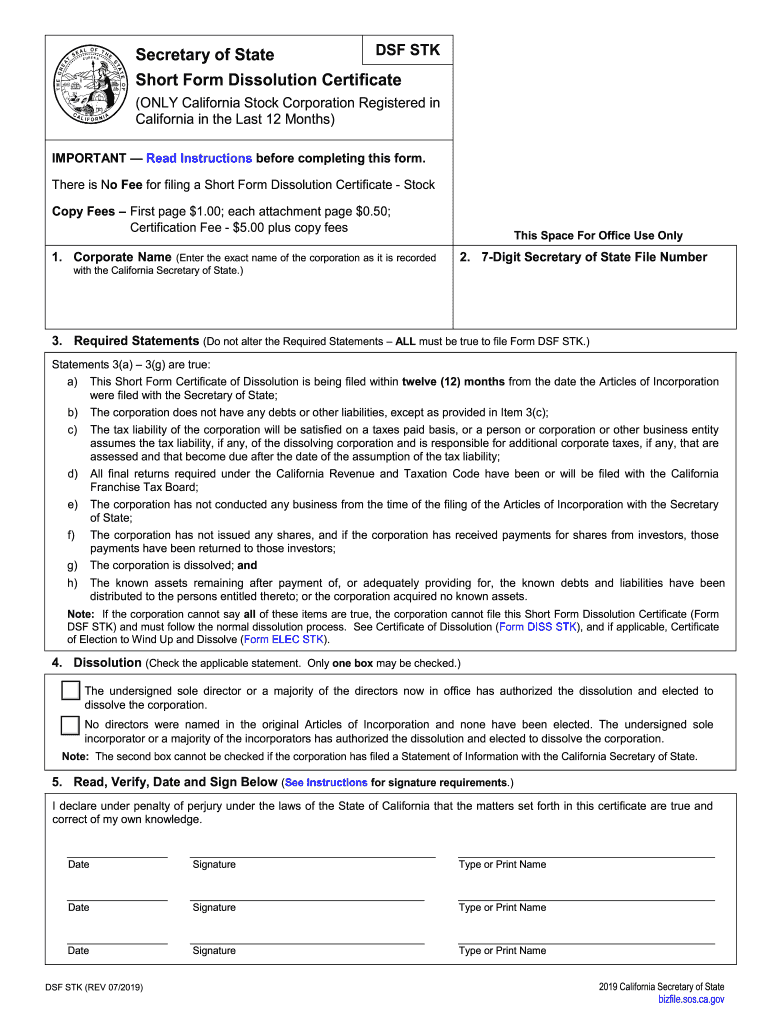

20192022 Form CA DSF STK Fill Online, Printable, Fillable, Blank

You'll also need to include the number of shares the corporation has authorized. When a corporation elects federal s corporation status it automatically becomes an s. Web to form your corporation, the articles of incorporation must be filed with the california secretary of state. Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s.

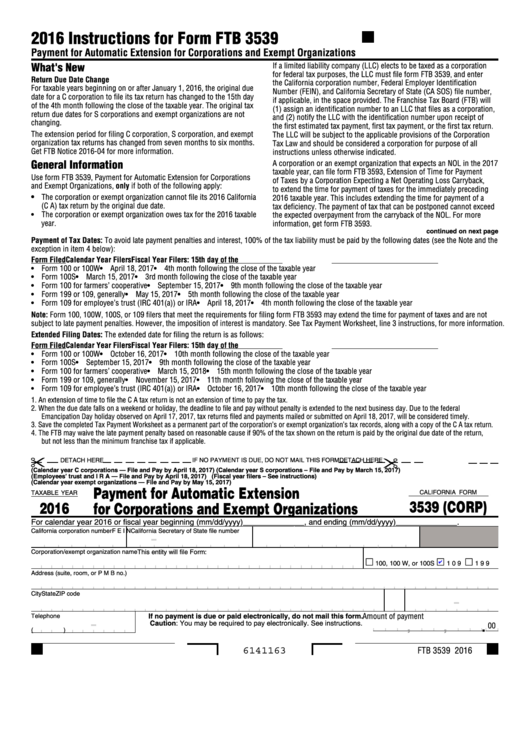

Fillable California Form 3539 (Corp) Payment For Automatic Extension

When a corporation elects federal s corporation status it automatically becomes an s. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or.

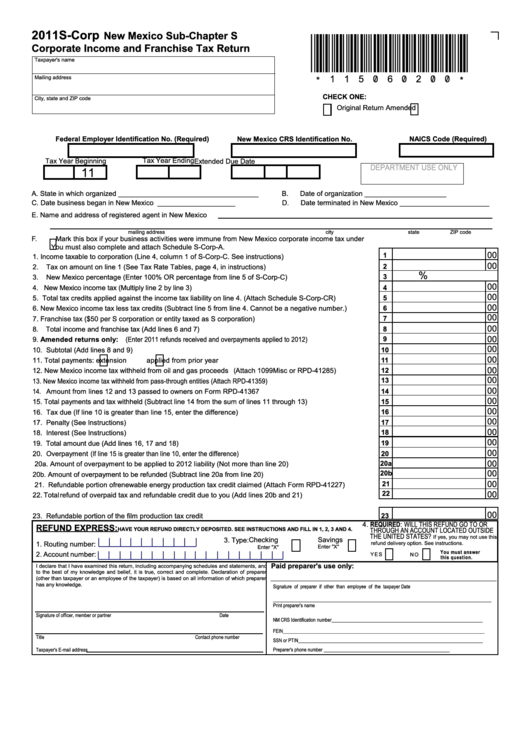

Form SCorp New Mexico SubChapter S Corporate And Franchise

Web overview a corporation is an entity that is owned by its shareholders (owners). Choosing a company name is the first and most important step in starting your llc in california. Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. When a corporation elects federal s corporation status it automatically.

How to Form an SCorp in California? Think Legal

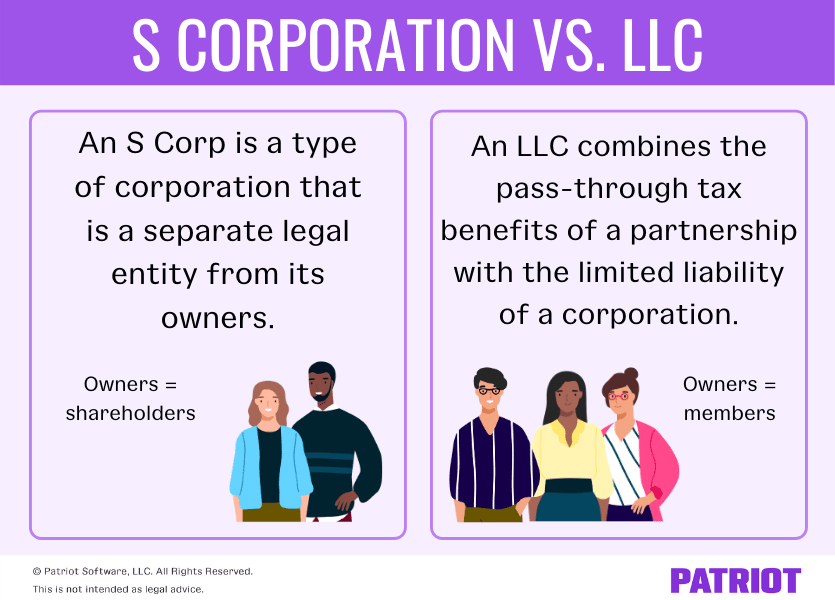

C corporation generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock s corporation File by mail or in person Forms for the most common types of articles of incorporation are available on our forms, samples and fees webpage. Corporations can be taxed 2 different ways. Zenbusiness.

S Corp vs. LLC Q&A, Pros & Cons of Each, & More

When a corporation elects federal s corporation status it automatically becomes an s. The details of this filing include: Web to form a corporation in california, articles of incorporation must be filed with the california secretary of state’s office. Corporations can be taxed 2 different ways. You may use the form or prepare your own statutorily compliant document.

Best Form Editor Company Tax Return

C corporation generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock s corporation Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness,.

LLC vs S Corp California

Web to form a corporation in california, articles of incorporation must be filed with the california secretary of state’s office. When a corporation elects federal s corporation status it automatically becomes an s. The details of this filing include: Web to form your corporation, the articles of incorporation must be filed with the california secretary of state. You'll also need.

How to Start an S Corp in California California S Corp TRUiC

Web to form a corporation in california, articles of incorporation must be filed with the california secretary of state’s office. Choose your california registered agent. Corporations can be taxed 2 different ways. When a corporation elects federal s corporation status it automatically becomes an s. Web to form your corporation, the articles of incorporation must be filed with the california.

California LLC vs. S Corp A Complete Guide Windes

Choosing a company name is the first and most important step in starting your llc in california. You may use the form or prepare your own statutorily compliant document. Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. The #1 rated.

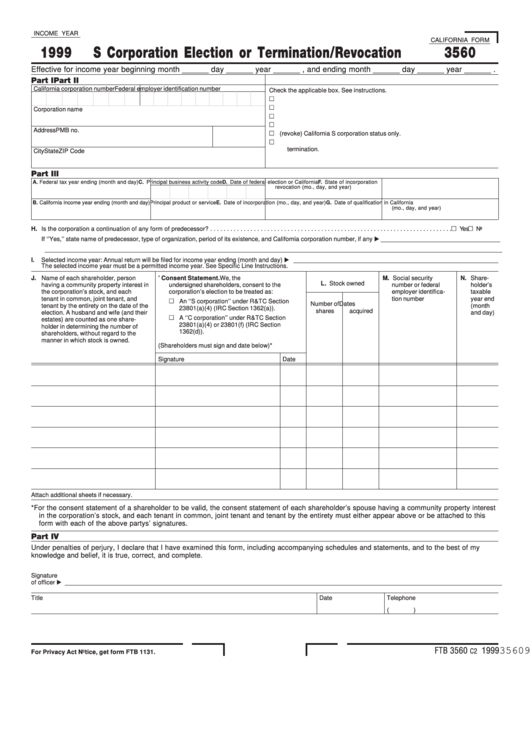

California Form 3560 S Corporation Election Or Termination/revocation

File by mail or in person The #1 rated service by Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur. Web to form your corporation, the articles of incorporation must be filed with the california secretary of state. For more information, get form ftb 3805z, form.

Web To Form Your Corporation, The Articles Of Incorporation Must Be Filed With The California Secretary Of State.

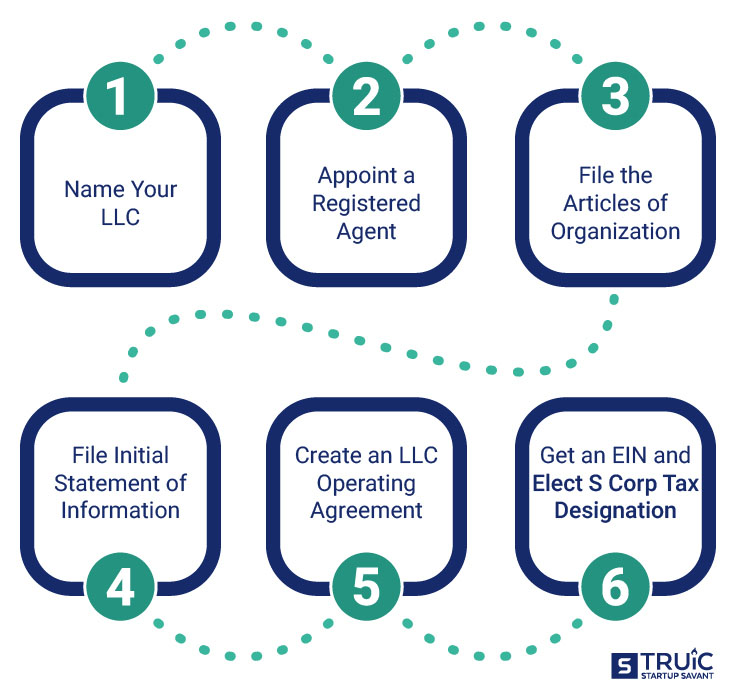

Web to form a corporation in california, articles of incorporation must be filed with the california secretary of state’s office. Web steps to form an llc and elect s corp tax status in california. Web overview a corporation is an entity that is owned by its shareholders (owners). You'll also need to include the number of shares the corporation has authorized.

Choosing A Company Name Is The First And Most Important Step In Starting Your Llc In California.

For more information, get form ftb 3805z, form ftb 3807, or form ftb 3809. File by mail or in person Nol carryover deductions for the ez, tta, or lambra are suspended for the 2020, 2021, and 2022 taxable years, if the corporation's taxable income is $1,000,000 or more. Web california corporations can be formed through startup lawyers, through incorporation services (such as zenbusiness, corpnet, or mycorporation), or directly by an entrepreneur.

Over 140 Business Filings, Name Reservations, And Orders For Certificates Of Status And Certified Copies Of Corporations, Limited Liability Companies And Limited Partnerships Available Online.

C corporation generally taxed on their income and the owners are taxed on these earnings when distributed as payments or when the shareholder sells stock s corporation You may use the form or prepare your own statutorily compliant document. Incorporated in california doing business in california registered to do business in california with the secretary of state (sos) receiving california source income you should use the below guidelines to file your state income taxes: Zenbusiness can help.” mark cuban, spokesperson play video excellent 12,647 reviews × create a california s corp start an s corp let our experts file your business paperwork quickly and accurately, guaranteed!

Box Address Of The Agent.

Choose your california registered agent. The #1 rated service by Corporations can be taxed 2 different ways. The details of this filing include: