Instructions For Form 9465

Instructions For Form 9465 - Web department of the treasury internal revenue service see separate instructions. Web federal form 9465 instructions. Online navigation instructions from within your taxact return ( online ), click the print center dropdown, then click custom print. In the filing steps, you’ll be. All • who owes income tax on form 1040, payments received will. Line 2 is now used for businesses that are no longer operating to provide their name and. How to fill it correctly february 20, 2023 irs forms are you looking for a comprehensive guide on how to fill. Go to screen 80, installment agreement (9465). Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. Upload, modify or create forms.

Try it for free now! Online navigation instructions from within your taxact return ( online ), click the print center dropdown, then click custom print. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. September 2020)) department of the treasury internal revenue. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Complete the information under the automatic. Web instructions for form 9465 (rev. Web the irs offers detailed instructions online to help you complete form 9465. Web follow these steps to enter form 9465 in the program: Web department of the treasury internal revenue service see separate instructions.

Web the irs offers detailed instructions online to help you complete form 9465. In the filing steps, you’ll be. Web department of the treasury internal revenue service see separate instructions. The irs will contact you to approve or deny your installment plan request. Web enter the most convenient time to call you at home (9465, line 3). Complete the information under the automatic. Form 9465 is used by taxpayers to request. All • who owes income tax on form 1040, payments received will. Under installment agreement request (9465), enter the. October 2020) installment agreement request (for use with form 9465 (rev.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

Get ready for tax season deadlines by completing any required tax forms today. Web general instructions purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice. Under installment agreement request (9465), enter the. Web enter the most convenient time to.

Instructions For Form 9465Fs Installment Agreement Request printable

Web the irs offers detailed instructions online to help you complete form 9465. Ad irs form 9465, get ready for tax deadlines by filling online any tax form for free. The irs will contact you to approve or deny your installment plan request. How to fill it correctly february 20, 2023 irs forms are you looking for a comprehensive guide.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

Business name and employer identification number. Web general instructions purpose of form use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax. Web general instructions purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe.

Ssurvivor Form 2555 Instructions 2017

Web department of the treasury internal revenue service see separate instructions. Web tax help blog instructions for form 9465: Line 2 is now used for businesses that are no longer operating to provide their name and. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Under installment agreement request (9465),.

How to Use Form 9465 Instructions for Your IRS Payment Plan Irs

Complete, edit or print tax forms instantly. All • who owes income tax on form 1040, payments received will. Pay as much of the tax as possible with your return (or notice). The irs will contact you to approve or deny your installment plan request. Web general instructions purpose of form use form 9465 to request a monthly installment agreement.

Irs Installment Agreement Form 9465 Instructions Erin Anderson's Template

In the filing steps, you’ll be. Web filing form 9465 does not guarantee your request for a payment plan. Web instructions for form 9465 (rev. Enter the most convenient time to call you at work (9465, line 4). Web federal form 9465 instructions.

Instructions For Form 9465 (Rev. December 2012) printable pdf download

Web to print form 9465: Online navigation instructions from within your taxact return ( online ), click the print center dropdown, then click custom print. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. You can also find the mailing address, which varies by state, to send form 9465 if.

How to Use Form 9465 Instructions for Your IRS Payment Plan Irs

Go to screen 80, installment agreement (9465). Web department of the treasury internal revenue service see separate instructions. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Web enter the most convenient time to call you at home (9465,.

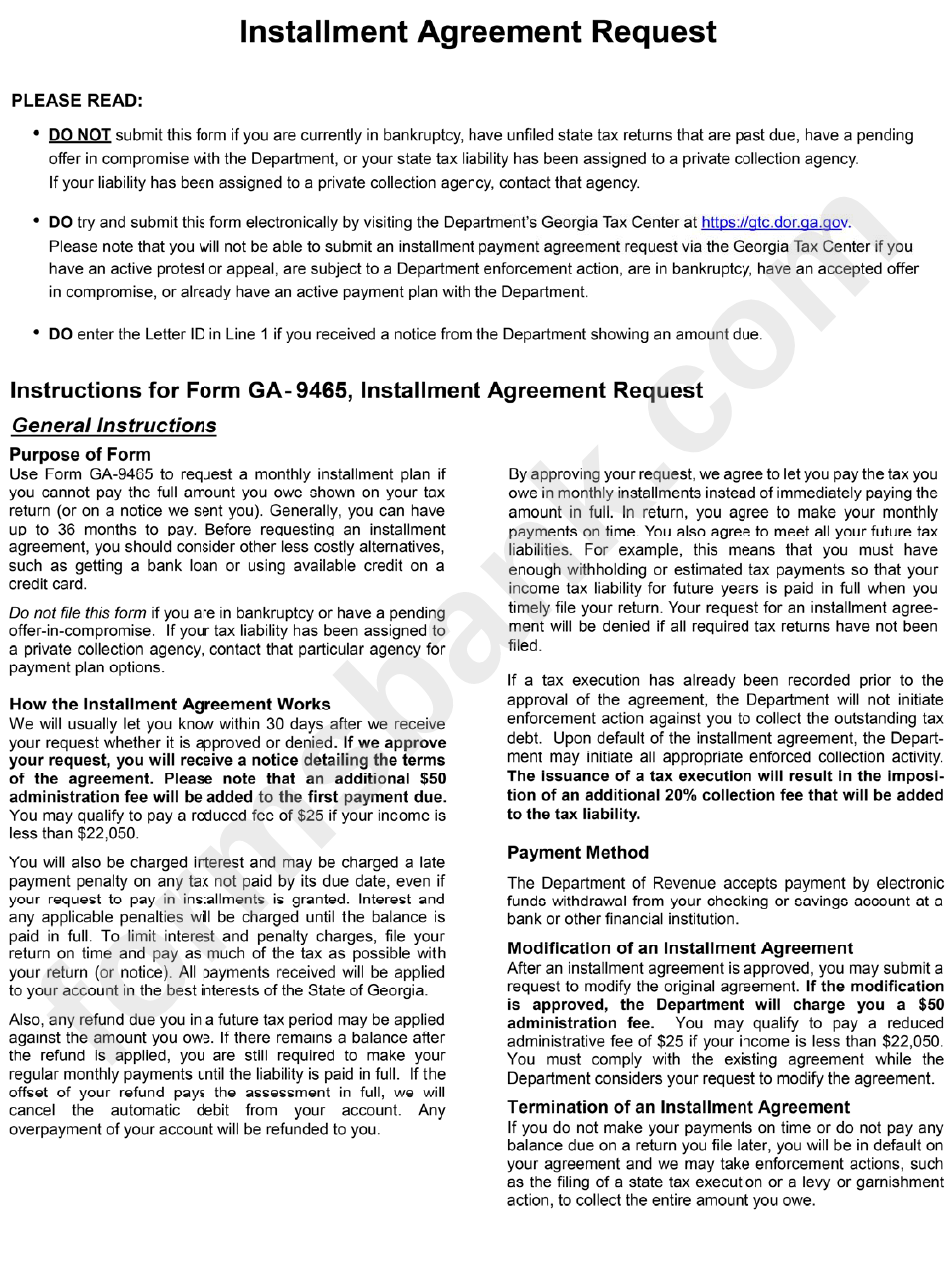

Instructions For Form Ga9465, Installment Agreement Request printable

Try it for free now! Web follow these steps to enter form 9465 in the program: Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Web federal form 9465 instructions. Web instructions for form 9465 (rev.

IRS Form 9465 Instructions Your Installment Agreement Request

Web department of the treasury internal revenue service see separate instructions. Go to screen 80, installment agreement (9465). Business name and employer identification number. All • who owes income tax on form 1040, payments received will. Web follow these steps to enter form 9465 in the program:

Online Navigation Instructions From Within Your Taxact Return ( Online ), Click The Print Center Dropdown, Then Click Custom Print.

Web to print form 9465: In the filing steps, you’ll be. How to fill it correctly february 20, 2023 irs forms are you looking for a comprehensive guide on how to fill. Form 9465 is used by taxpayers to request.

In The Forms And Schedules.

Web instructions for form 9465 (rev. Pay as much of the tax as possible with your return (or notice). Web general instructions purpose of form use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice. Web the irs offers detailed instructions online to help you complete form 9465.

September 2020)) Department Of The Treasury Internal Revenue.

Web federal form 9465 instructions. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. Web tax help blog instructions for form 9465: Under installment agreement request (9465), enter the.

Go To Screen 80, Installment Agreement (9465).

Line 2 is now used for businesses that are no longer operating to provide their name and. Business name and employer identification number. Get ready for tax season deadlines by completing any required tax forms today. Complete the information under the automatic.