Irs Form 8300 Car Dealer

Irs Form 8300 Car Dealer - Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. In early december i sold my old car for $15,000 ($2,000 less than what i bought it for if that's relevant) and i. A dealership doesn't file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000. Web answer (1 of 3): Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. I have never bought in cash, but made a car down payment for $10,000. You have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. File your taxes for free. Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership would:

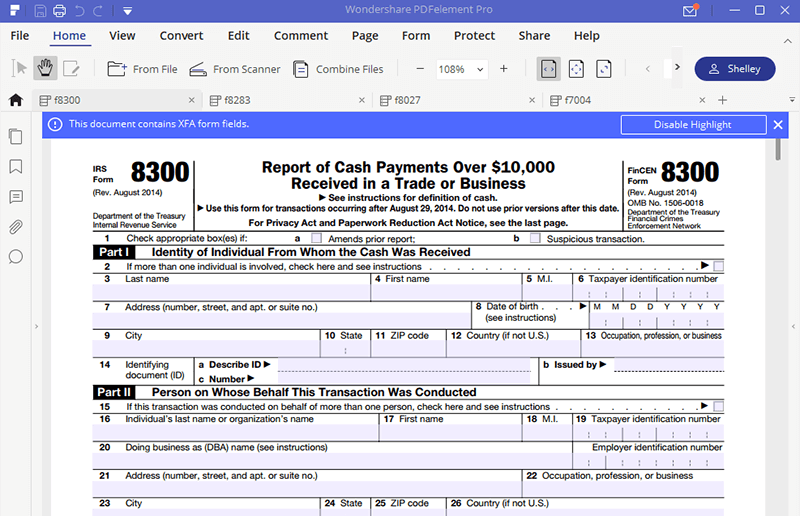

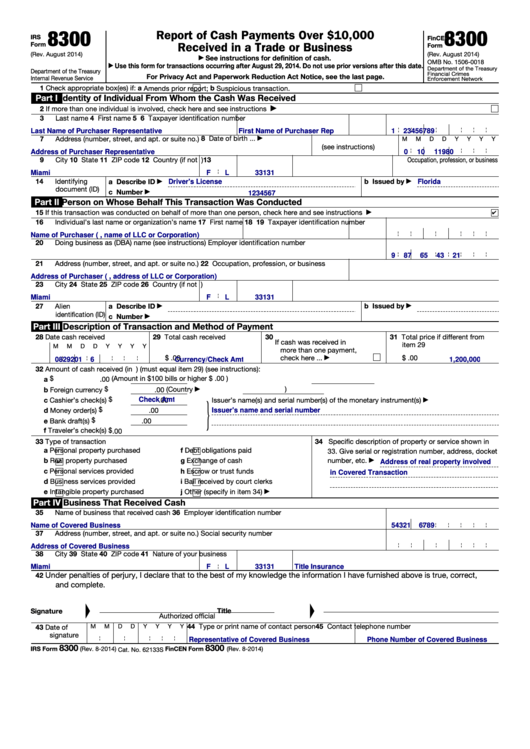

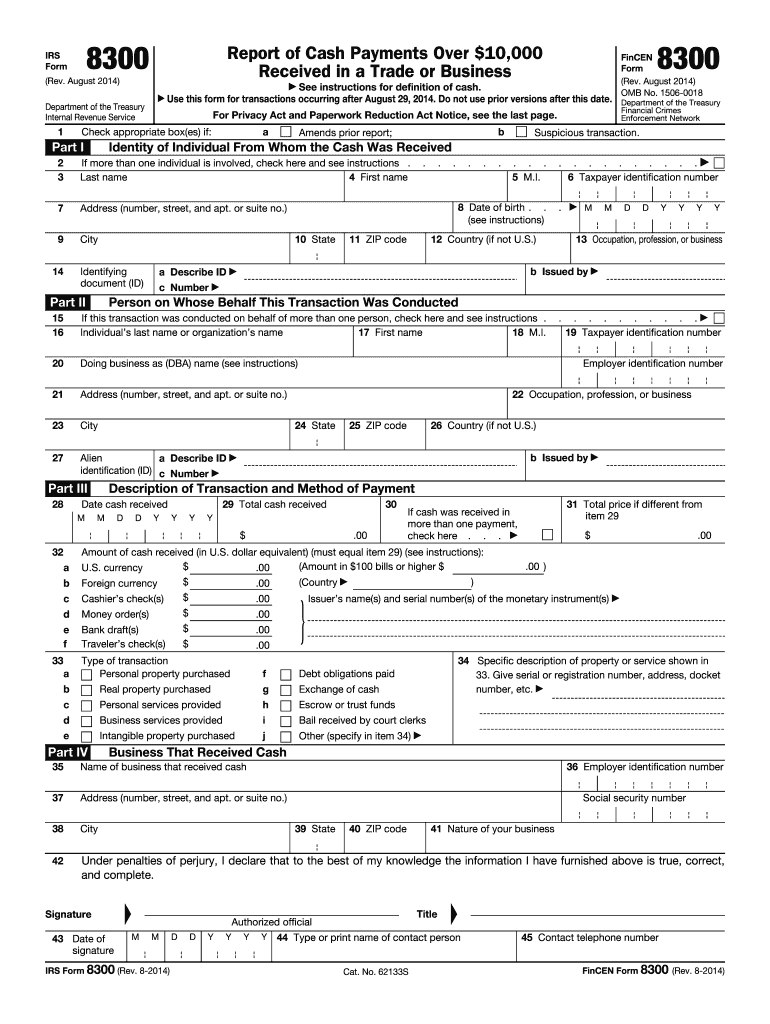

August 2014) department of the treasury internal revenue service. Web because you paid in cash and it was over $10,000, the dealer just needs to report this transaction to the irs. Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership would: Sign in to your account. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Report of cash payments over $10,000 received in a trade or business. A dealership doesn't file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000. Web either way, the dealer needs to file only one form 8300. A notice was sent to me that. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash.

Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership would: You have no reporting requirement for this transaction. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash. If using a private delivery service, send your returns to the street. Report of cash payments over $10,000 received in a trade or business. The dealership received that much. Web add up all of the individual items in a transaction that would be considered cash, robertson said. You have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. If the total exceeds $10,000, the dealership must file a form 8300. Web how can we help you?

IRS Form 8300 Fill it in a Smart Way

Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in a single transaction or two or more related. Web answer (1 of 3): Web for example, if an automobile dealership sells a car to a customer and receives cash payments from the customer, their mother, and their father, the dealership.

Fillable Form 8300 Fincen printable pdf download

Web add up all of the individual items in a transaction that would be considered cash, robertson said. You have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. Sign in to your account. I have never bought in cash, but made a car down payment for $10,000. Let’s say you.

IRS eFile is Available for Form 8300 Mac's Tax & Bookkeeping

If you do not title the vehicle within 30 days, there is a title. The dealer say “hey, nice person, wanna buy a car?” and you say “wanna buy a red one!. Web how can we help you? Web either way, the dealer needs to file only one form 8300. Web form 8300 is a document that must be filed.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

Web how can we help you? A dealership doesn't file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web for example, if an automobile dealership sells a car to a customer and receives cash payments from.

[View 37+] Sample Letter For Form 8300

Web irs form 8300 (rev. Web answer (1 of 3): Web because you paid in cash and it was over $10,000, the dealer just needs to report this transaction to the irs. You have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. Web add up all of the individual items.

IRS Form 8300 Reporting Cash Sales Over 10,000

I have never bought in cash, but made a car down payment for $10,000. Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. A notice was sent to me that. Web add up all of the individual items in a transaction that would be considered.

IRS Form 8300 It's Your Yale

Web what does the irs do with forms 8300 they receive? Sign in to your account. Report of cash payments over $10,000 received in a trade or business. I have never bought in cash, but made a car down payment for $10,000. You have 30 days from the date of purchase to title and pay sales tax on your newly.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

The dealer say “hey, nice person, wanna buy a car?” and you say “wanna buy a red one!. Web because you paid in cash and it was over $10,000, the dealer just needs to report this transaction to the irs. Web dealers must report to irs (using irs/fincen form 8300) the receipt of cash/cash equivalents in excess of $10,000 in.

The IRS Form 8300 and How it Works

I have never bought in cash, but made a car down payment for $10,000. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web answer (1 of 3): Report of cash payments over $10,000 received in a trade or business. In early december i sold my old car for $15,000 ($2,000.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web irs form 8300 after the purchase of a vehicle. If using a private delivery service, send your returns to the street. The dealership received that much. Web answer (1 of 3): The dealer say “hey, nice person, wanna buy a car?” and you say “wanna buy a red one!.

Web Irs Form 8300 After The Purchase Of A Vehicle.

Web form 8300 is a document that must be filed with the irs when an individual or business receives a cash payment over $10,000. The dealership received that much. You have 30 days from the date of purchase to title and pay sales tax on your newly purchased vehicle. A dealership doesn't file form 8300 if a customer pays with a $7,000 wire transfer and a $4,000.

I Have Never Bought In Cash, But Made A Car Down Payment For $10,000.

Web irs form 8300 (rev. Web automotive dealers are required to file form 8300, report of cash payments over $10,000 received in a trade or business, with the irs when they receive more than $10,000 in. Web add up all of the individual items in a transaction that would be considered cash, robertson said. If you do not title the vehicle within 30 days, there is a title.

If The Total Exceeds $10,000, The Dealership Must File A Form 8300.

Web accordingly, when your dealership receives more than $10,000 in cash in one transaction or in two or more related transactions, you must report this by filing the. Report of cash payments over $10,000 received in a trade or business. You have no reporting requirement for this transaction. Web introduction the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash.

A Notice Was Sent To Me That.

Web either way, the dealer needs to file only one form 8300. In early december i sold my old car for $15,000 ($2,000 less than what i bought it for if that's relevant) and i. Web what does the irs do with forms 8300 they receive? Web because you paid in cash and it was over $10,000, the dealer just needs to report this transaction to the irs.

![[View 37+] Sample Letter For Form 8300](https://www.carbuyingtips.com/pics/irs-form-8300.jpg)