New Mexico Pit Form

New Mexico Pit Form - Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. At the top of the page, click forms & publications. All others must file by april 18, 2023. Web the different pit type, pit usage, and pit duration. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web you can find personal income tax (pit) forms and instructions on our website at www.tax.newmexico.gov. Do not cut or resize the. Complete, edit or print tax forms instantly. Filing due date paper filers: Web this form is for taxpayers who want to make a quarterly estimated payment.

All others must file by april 18, 2023. This form is for income earned in tax year 2022, with tax. Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement. Upload, modify or create forms. If you are a new mexico resident, you must file if you meet any of the following conditions: If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Complete, edit or print tax forms instantly. Web this form is for taxpayers who want to make a quarterly estimated payment. Try it for free now! Web the different pit type, pit usage, and pit duration.

The document has moved here. All others must file by april 18, 2023. Web this form is for taxpayers who want to make a quarterly estimated payment. Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement. Do not cut or resize the. Web you can find personal income tax (pit) forms and instructions on our website at www.tax.newmexico.gov. Upload, modify or create forms. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. If you are a new mexico resident, you must file if you meet any of the following conditions: At the top of the page, click forms & publications.

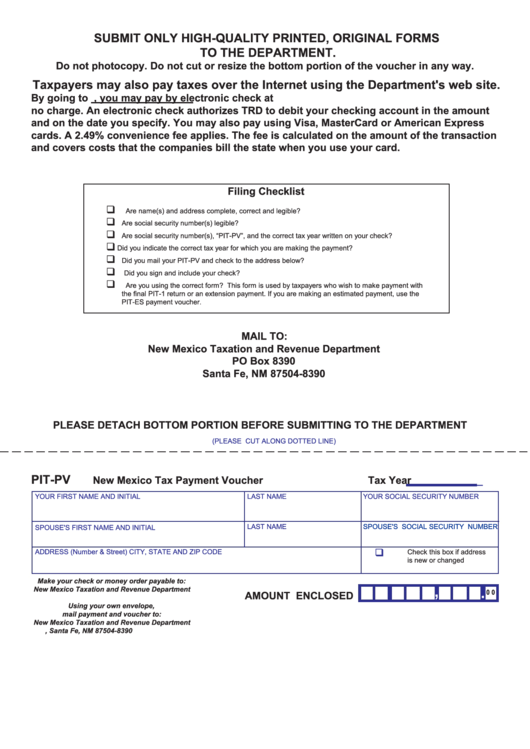

Form PitPv New Mexico Tax Payment Voucher printable pdf download

Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement. Web you can find personal income tax (pit) forms and instructions on our website at www.tax.newmexico.gov. The document has moved here. Web personal income tax and corporate income tax forms for the 2021.

2019 Form NM TRD PITADJ Fill Online, Printable, Fillable, Blank

• every person who is a new mexi co resident. Web you can find personal income tax (pit) forms and instructions on our website at www.tax.newmexico.gov. If you are a new mexico resident, you must file if you meet any of the following conditions: At the top of the page, click forms & publications. All others must file by april.

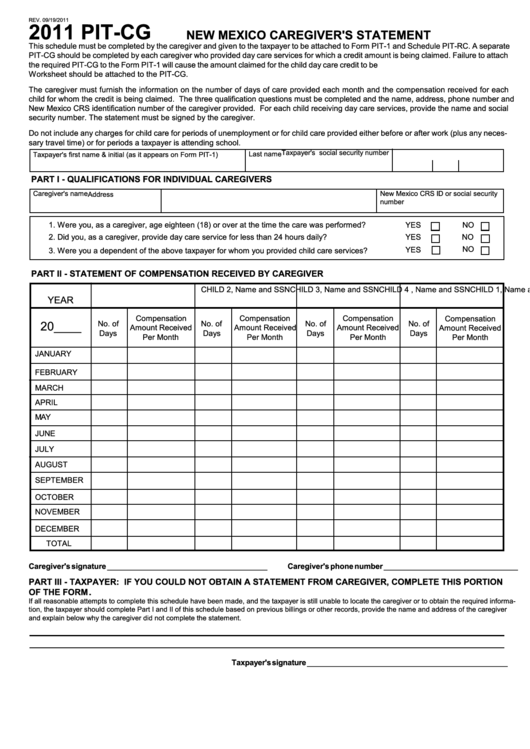

Form PitCg New Mexico Caregiver'S Statement 2011 printable pdf

Web the different pit type, pit usage, and pit duration. The document has moved here. All others must file by april 18, 2023. • every person who is a new mexi co resident. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023.

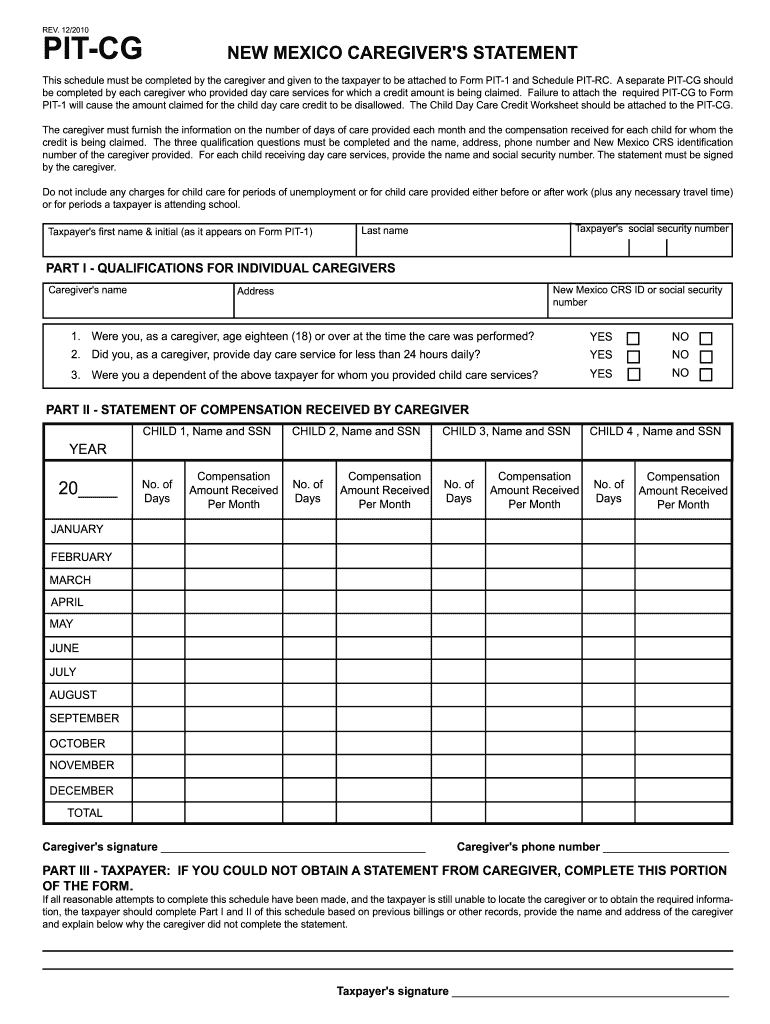

Download Pit Cg Form Tax Fill Out and Sign Printable PDF Template

The document has moved here. Complete, edit or print tax forms instantly. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. If you are a new mexico resident, you must file if you meet any of the following conditions: Do not cut or resize the.

2019 Form NM TRD PIT1 Fill Online, Printable, Fillable, Blank pdfFiller

Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. 2 if amending use form 2021. • every person who is a new mexi co resident. Upload, modify or create forms.

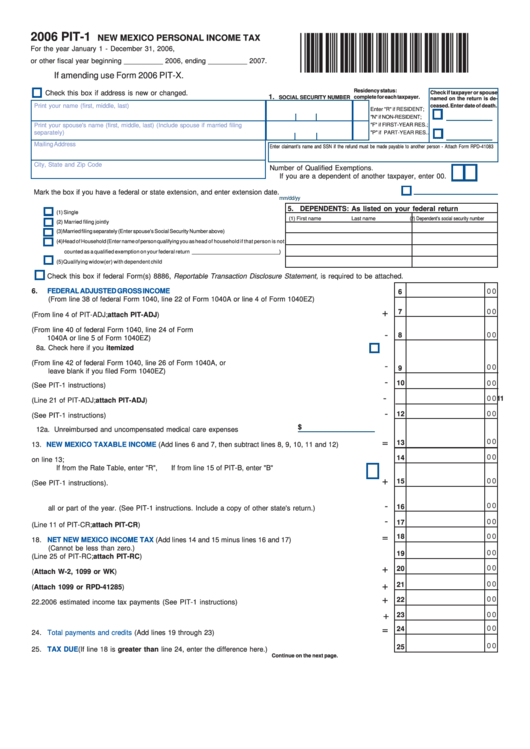

Form Pit1 New Mexico Personal Tax printable pdf download

Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. Complete, edit or print tax forms instantly. Do not cut or resize the. Try it for free now! If you are a new mexico resident, you must file if you meet any of the following conditions:

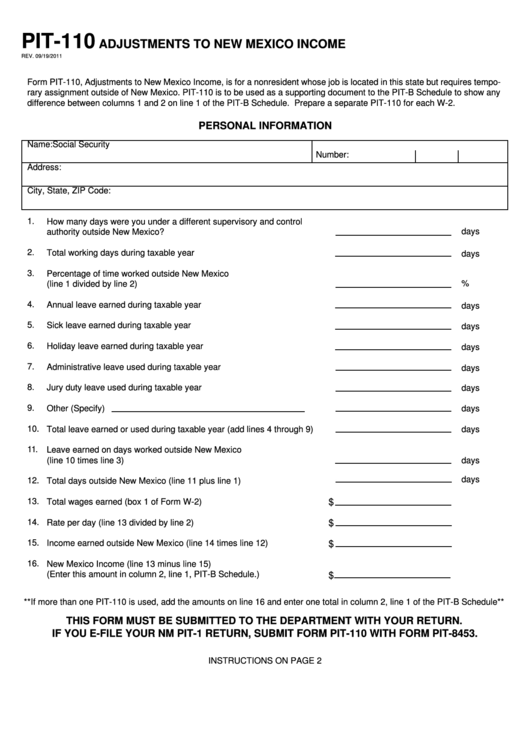

Form Pit110 Adjustments To New Mexico New Mexico Taxation

Web the different pit type, pit usage, and pit duration. Complete, edit or print tax forms instantly. Web this form is for taxpayers who want to make a quarterly estimated payment. 2 if amending use form 2021. Taxpayers, tax professionals and others can access the new forms and.

“The Pit” Renovation The University of New Mexico ChavezGrieves

Try it for free now! Taxpayers, tax professionals and others can access the new forms and. Do not cut or resize the. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. • every person who is a new mexi co resident.

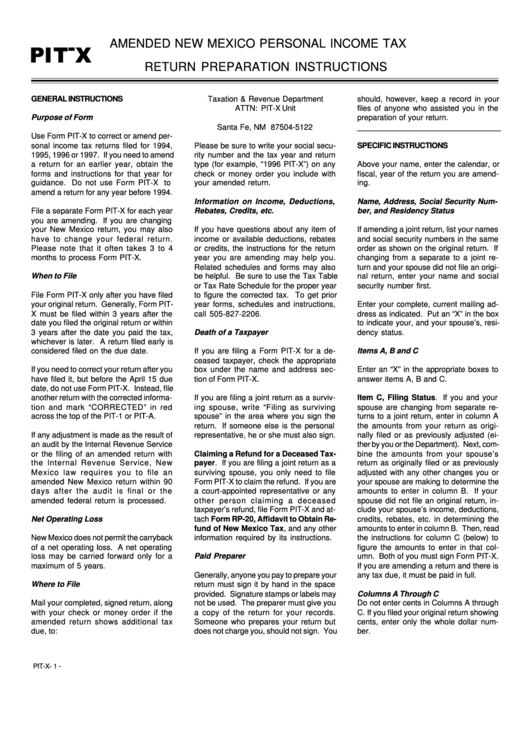

Form PitX Amended New Mexico Personal Tax Return Preparation

At the top of the page, click forms & publications. Web the different pit type, pit usage, and pit duration. 2 if amending use form 2021. Taxpayers, tax professionals and others can access the new forms and. Upload, modify or create forms.

HD Time Lapse The Pit (Univ. of New Mexico) YouTube

Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement. Taxpayers, tax professionals and others can access the new forms and. Try it for free now! Web you can find pit forms and instructions on our website at www.tax.newmexico.gov. If you are a.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Web the different pit type, pit usage, and pit duration. Do not cut or resize the. 2 if amending use form 2021. At the top of the page, click forms & publications.

Web This Form Is For Taxpayers Who Want To Make A Quarterly Estimated Payment.

Try it for free now! The document has moved here. If you file your new mexico personal income tax return online and also pay tax due online, your due date is may 01, 2023. Filing due date paper filers:

Taxpayers, Tax Professionals And Others Can Access The New Forms And.

If you are a new mexico resident, you must file if you meet any of the following conditions: Upload, modify or create forms. Web personal income tax and corporate income tax forms for the 2021 tax year are now available online. Web nonresidents, including foreign nationals and persons who reside in states that do not have income taxes, must file here when they have a federal filing requirement.

Complete, Edit Or Print Tax Forms Instantly.

All others must file by april 18, 2023. Web you can find personal income tax (pit) forms and instructions on our website at www.tax.newmexico.gov. • every person who is a new mexi co resident. Web you can find pit forms and instructions on our website at www.tax.newmexico.gov.