Opportunity Zone Tax Form

Opportunity Zone Tax Form - Do not file this form with your tax return. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Web 8996 2 is the taxpayer organized for the purpose of investing in qualified opportunity zone (qoz) property (other than another qualified opportunity fund (qof))? Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Web report the deferral of the eligible gain in part ii and on form 8949. Territories are designated as qualified opportunity zones. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications.

Get answers to commonly asked questions. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Do not file this form with your tax return. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Web 8996 2 is the taxpayer organized for the purpose of investing in qualified opportunity zone (qoz) property (other than another qualified opportunity fund (qof))? Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Territories are designated as qualified opportunity zones. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Web report the deferral of the eligible gain in part ii and on form 8949.

Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Web 8996 2 is the taxpayer organized for the purpose of investing in qualified opportunity zone (qoz) property (other than another qualified opportunity fund (qof))? Do not file this form with your tax return. Get answers to commonly asked questions. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Territories are designated as qualified opportunity zones. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance.

NAR Releases Qualified Opportunities Zone Toolkit Vermont Association

Do not file this form with your tax return. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no. A qof must hold at least 90% of its assets, measured on two annual testing.

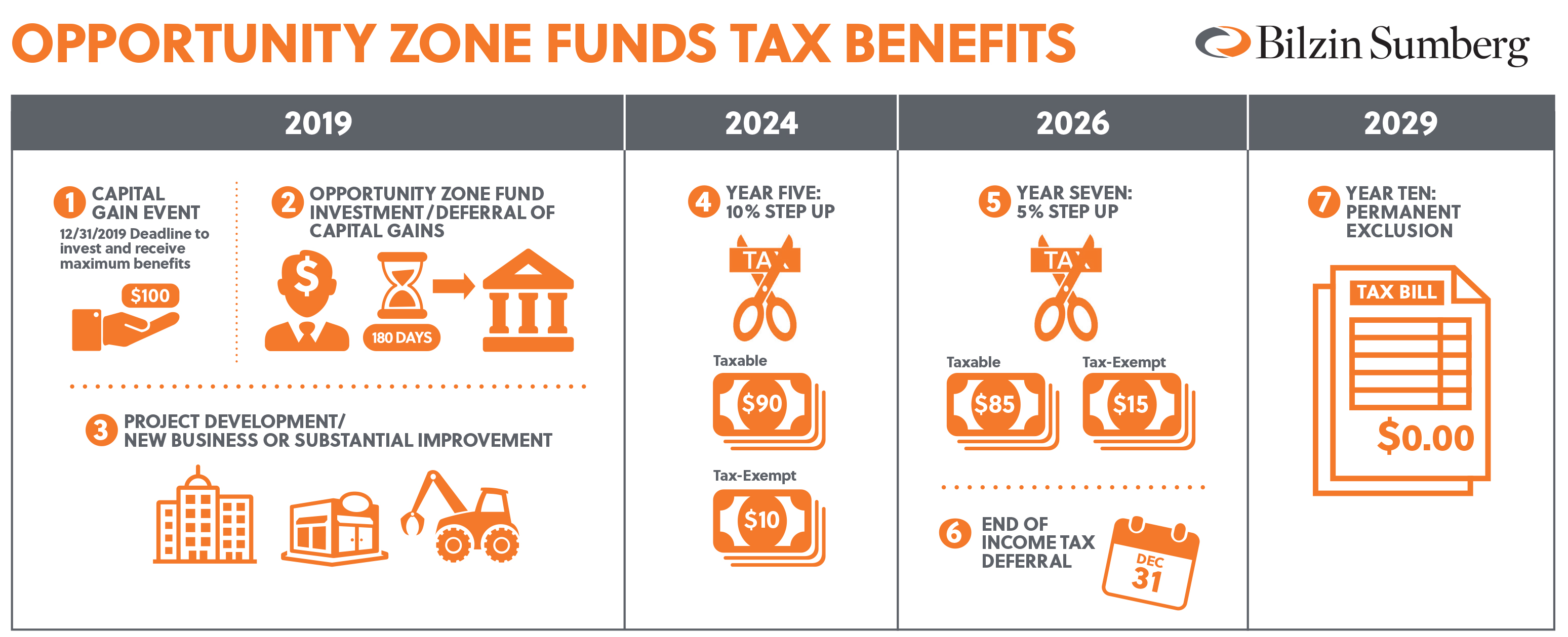

Bilzin Sumberg

Web report the deferral of the eligible gain in part ii and on form 8949. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Do not file this form with your tax return. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the.

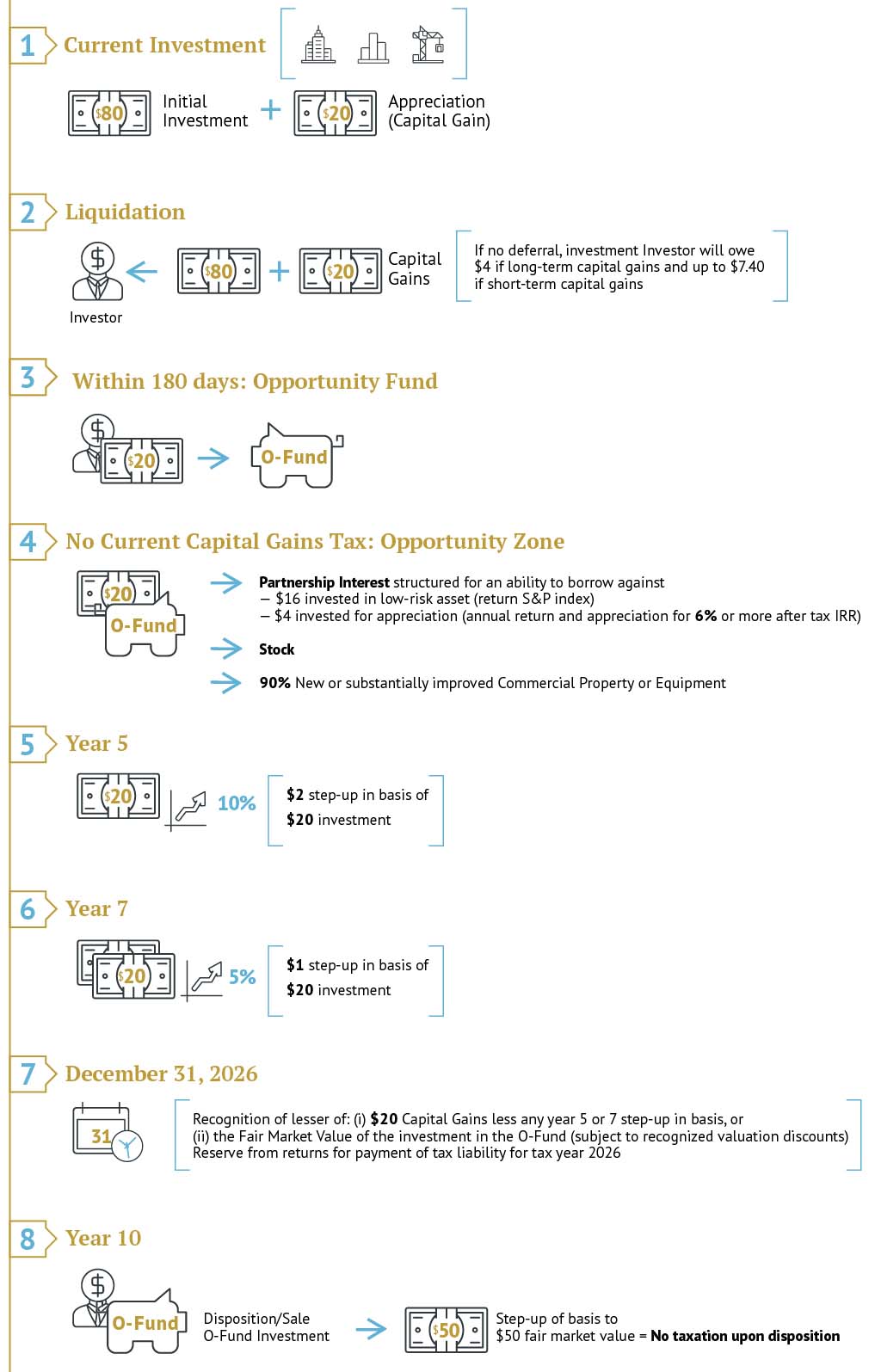

What is an Opportunity Zone? Tax Benefits & More Explained [Free Guide]

Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Get.

Opportunity Zones a 100 billion investment for the clean economy

Web 8996 2 is the taxpayer organized for the purpose of investing in qualified opportunity zone (qoz) property (other than another qualified opportunity fund (qof))? Territories are designated as qualified opportunity zones. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Web opportunity zones were created under the.

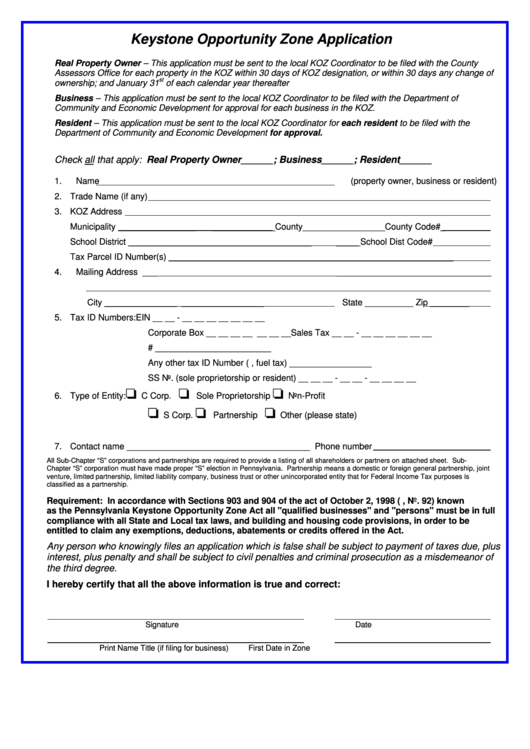

Keystone Opportunity Zone Application Form printable pdf download

Web report the deferral of the eligible gain in part ii and on form 8949. Territories are designated as qualified opportunity zones. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local,.

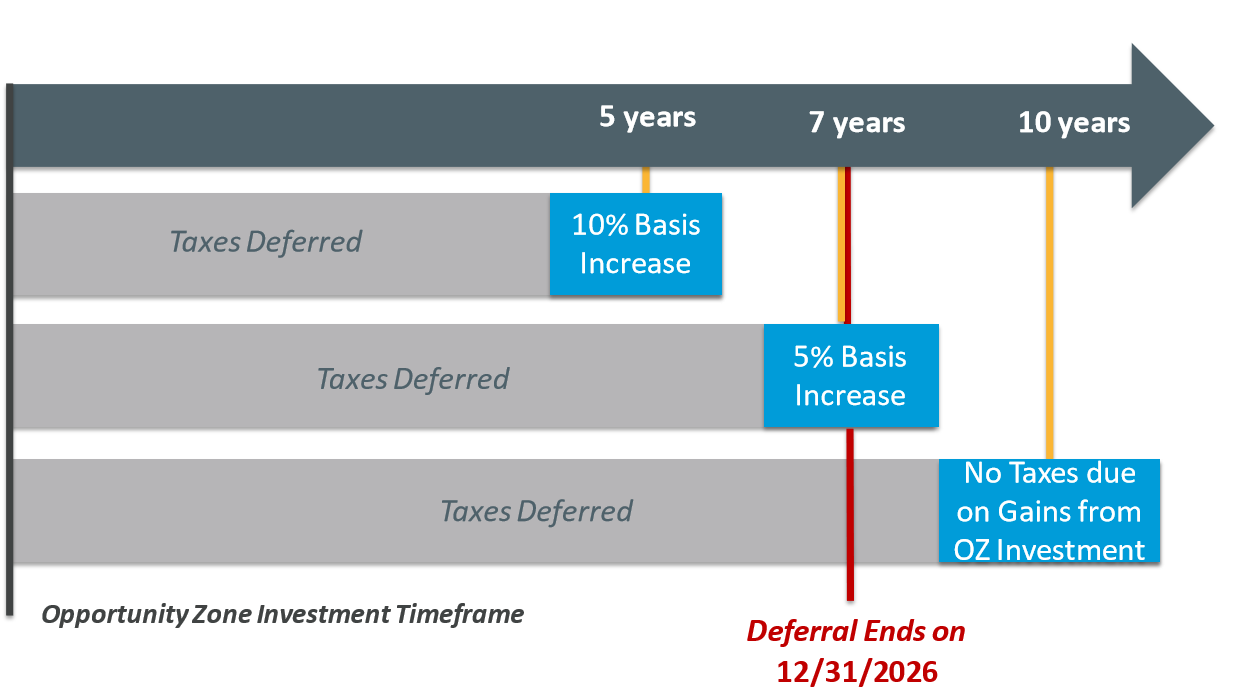

Opportunity Zones New Tax Deferral Opportunity

Do not file this form with your tax return. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Taxpayers who invest in qualified opportunity zone property through.

The IRS Regulations on Qualified Opportunity Zone Funds Crowdfunding

Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications. Do not file this form with your tax return. Additionally, localities can qualify as opportunity zones.

Opportunity Zone Program Bexar County, TX Official Website

Web 8996 2 is the taxpayer organized for the purpose of investing in qualified opportunity zone (qoz) property (other than another qualified opportunity fund (qof))? Get answers to commonly asked questions. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month.

Qualified Opportunity Zones and Tax Credit Incentives under the Tax

Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application. Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. The following questions and answers (q&as) were prepared in response to inquiries that have been proposed to the irs. Web.

Opportunity Zones City of Eau Claire Economic Development Division

Web find out how to invest in a qualified opportunity fund and the requirements for receiving the tax benefits. Territories are designated as qualified opportunity zones. Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Web opportunity zones were created under the tax cuts and jobs act of 2017 (.

The Following Questions And Answers (Q&As) Were Prepared In Response To Inquiries That Have Been Proposed To The Irs.

Web report the deferral of the eligible gain in part ii and on form 8949. Get answers to commonly asked questions. Relevant tax forms and instructions will appear on this site as soon as they reach their final form. Web opportunity zones were created under the tax cuts and jobs act of 2017 ( public law no.

Web Find Out How To Invest In A Qualified Opportunity Fund And The Requirements For Receiving The Tax Benefits.

Do not file this form with your tax return. A qof must hold at least 90% of its assets, measured on two annual testing dates, in qualified opportunity zone property, or pay a monthly penalty for every month it is out of compliance. Taxpayers who invest in qualified opportunity zone property through a qualified opportunity fund can temporarily defer tax. Web an opportunity zone is an economically distressed urban or rural community that has been identified by certain local, state, and federal qualifications.

Web 8996 2 Is The Taxpayer Organized For The Purpose Of Investing In Qualified Opportunity Zone (Qoz) Property (Other Than Another Qualified Opportunity Fund (Qof))?

Additionally, localities can qualify as opportunity zones if they have been previously nominated for the designation by the state. Territories are designated as qualified opportunity zones. Web form a and form b can be accessed on the first page of the ohio opportunity zone tax credit application.

![What is an Opportunity Zone? Tax Benefits & More Explained [Free Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/1mvtqLvt-What-is-an-Opportunity-Zone-Tax-Benefits-and-More-Explained-1024x536.png)