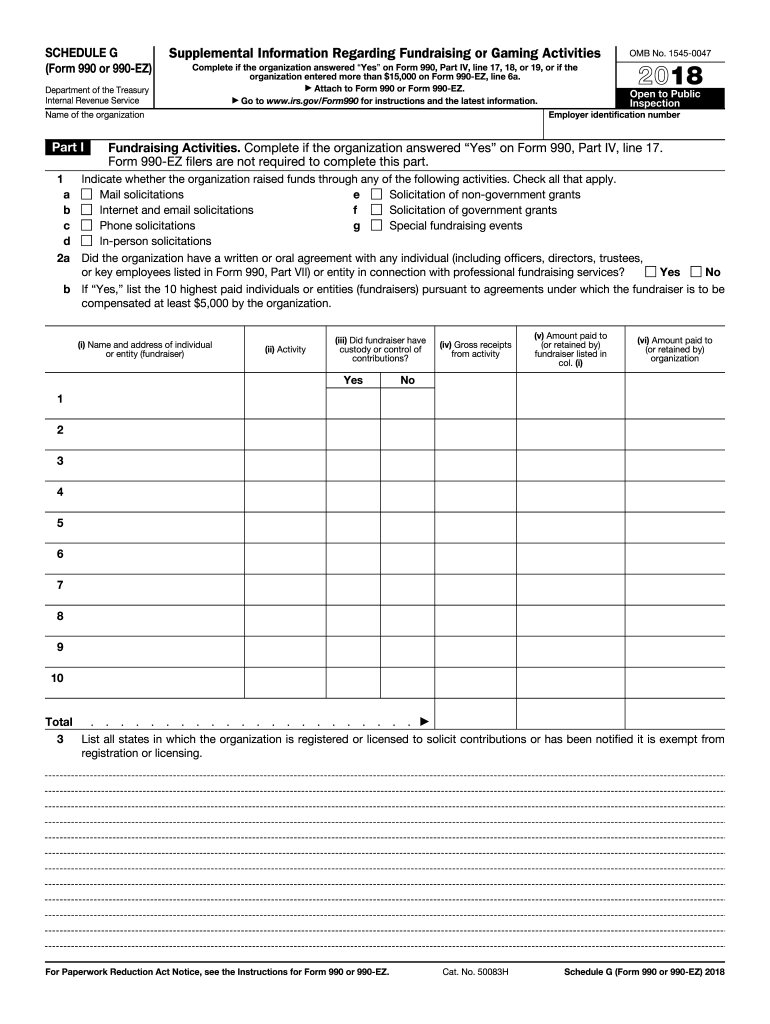

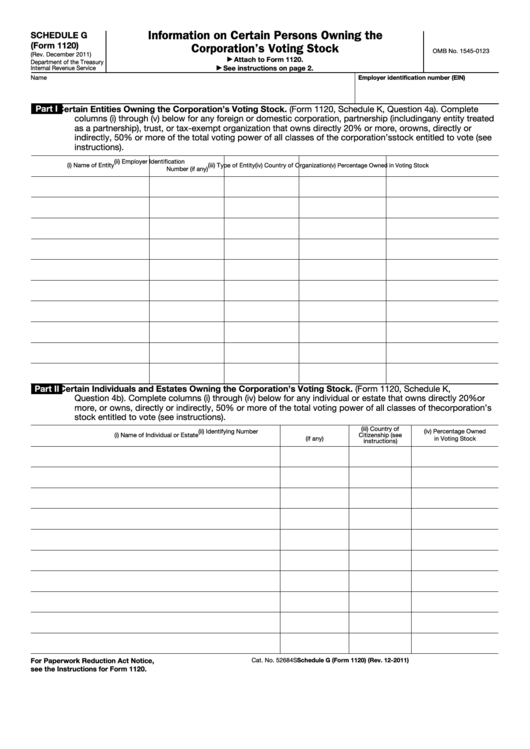

Schedule G Form 1120

Schedule G Form 1120 - Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. You may force or prevent the preparation of schedule g by. Ad get ready for tax season deadlines by completing any required tax forms today. I can't find the field that will change schedule k, question 4a to yes, which should then. We last updated the information on certain persons owning the corporation's voting stock. Work easily and keep your data secure with irs form 1120 schedule g 2023 online. Web information about schedule ph (form 1120) and its separate instructions is at. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Understanding the constructive ownership percentage for form 1120. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,.

Proconnect tax will automatically carry your. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Web more about the federal 1120 (schedule g) individual income tax tax credit ty 2022. Work easily and keep your data secure with irs form 1120 schedule g 2023 online. You may force or prevent the preparation of schedule g by. Get ready for this year's tax season quickly and safely with pdffiller! 1120 schedule g is a tax form used to report gains or losses from sales or exchanges of certain business property. I can't find the field that will change schedule k, question 4a to yes, which should then. Complete, edit or print tax forms instantly. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,.

Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal revenue service. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Get ready for this year's tax season quickly and safely with pdffiller! Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or. Ad get ready for tax season deadlines by completing any required tax forms today. Ad easy guidance & tools for c corporation tax returns. Complete, edit or print tax forms instantly. Understanding the constructive ownership percentage for form 1120. This form is for income earned in tax year 2022, with tax returns. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,.

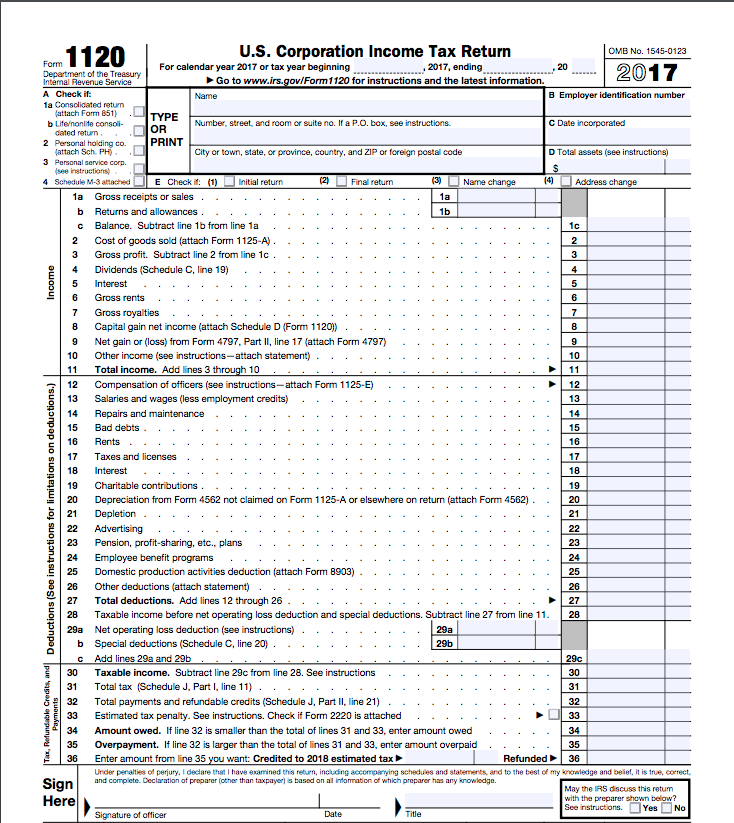

form 1120 schedule g 2017 Fill Online, Printable, Fillable Blank

Web schedule g is prepared when the cooperative's total receipts or assets at the end of the year are $250,000 or more. Get ready for this year's tax season quickly and safely with pdffiller! Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or.

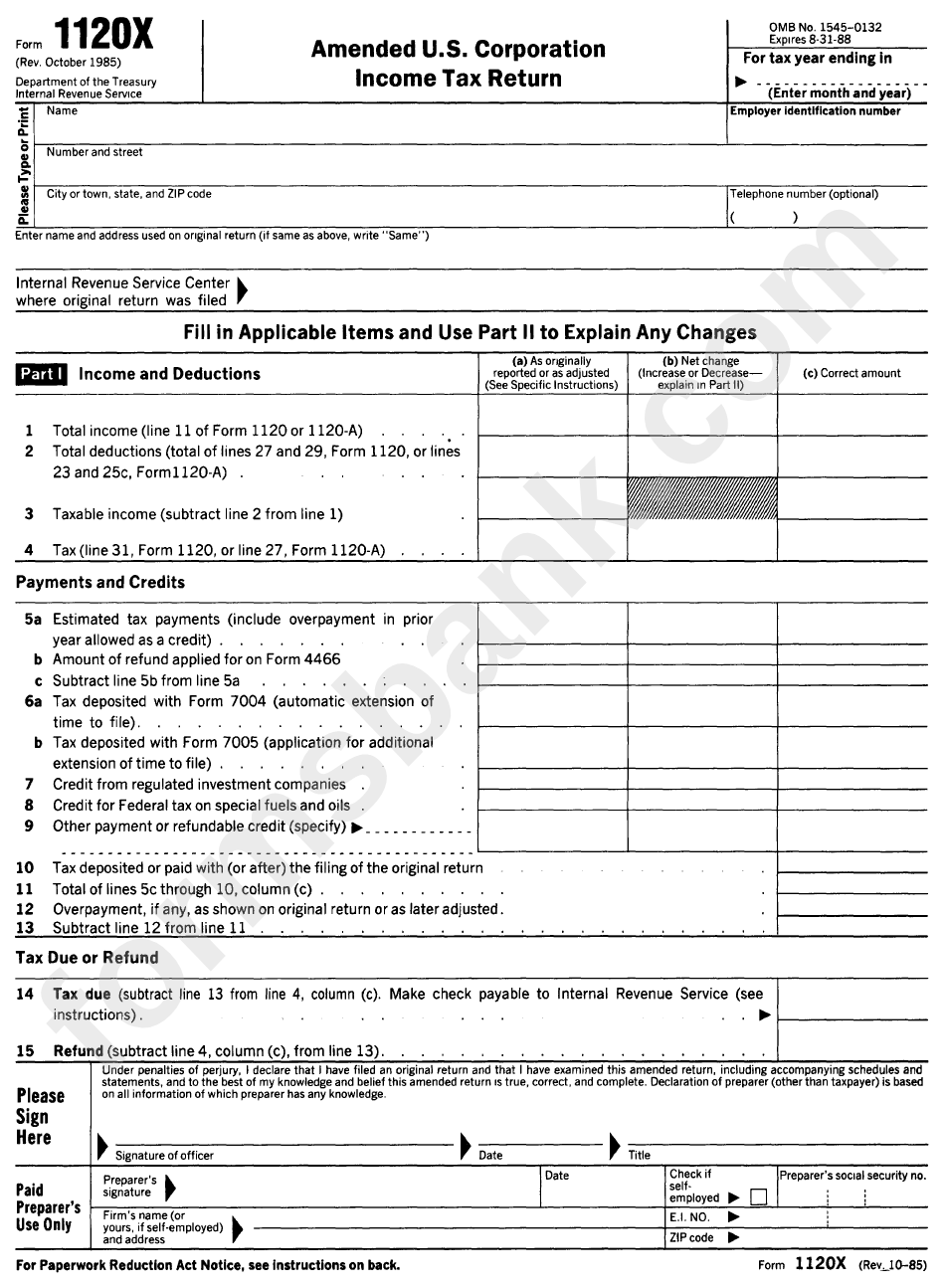

Form 1120x Amended U.s. Corporation Tax Return printable pdf

Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Web what is the form used for? Ad get ready for tax season deadlines by completing any required tax forms today. 1120 schedule g is a tax form used to report gains or.

Schedule G Fill Out and Sign Printable PDF Template signNow

Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. Web what is the form used for? I can't find the field that will change schedule k, question 4a to yes, which should then. Web we last updated federal 1120 (schedule g) in february 2023 from the federal internal.

General InstructionsPurpose of FormUse Schedule G (Form 11...

Web schedule g is prepared when the cooperative's total receipts or assets at the end of the year are $250,000 or more. Web more about the federal 1120 (schedule g) individual income tax tax credit ty 2022. Complete, edit or print tax forms instantly. Work easily and keep your data secure with irs form 1120 schedule g 2023 online. This.

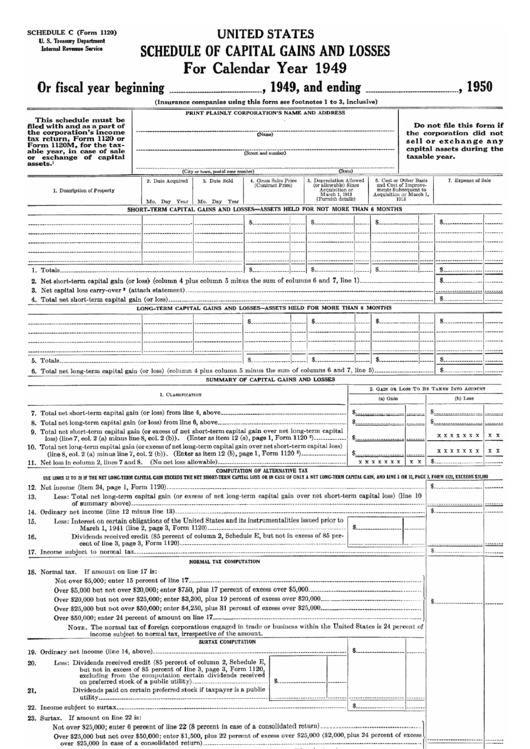

Form 1120 Schedule C Schedule Of Capital Gains And Losses 1949

Ad easy guidance & tools for c corporation tax returns. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Proconnect tax will automatically carry your. This form is for income earned in tax year 2022, with tax returns. Web information about schedule.

Form 1120 (Schedule G) Information on Certain Persons Owning the

Solved•by intuit•1•updated july 13, 2022. Proconnect tax will automatically carry your. Web what is the form used for? Get ready for this year's tax season quickly and safely with pdffiller! Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,.

Form 1120 schedule g 2017 Fill out & sign online DocHub

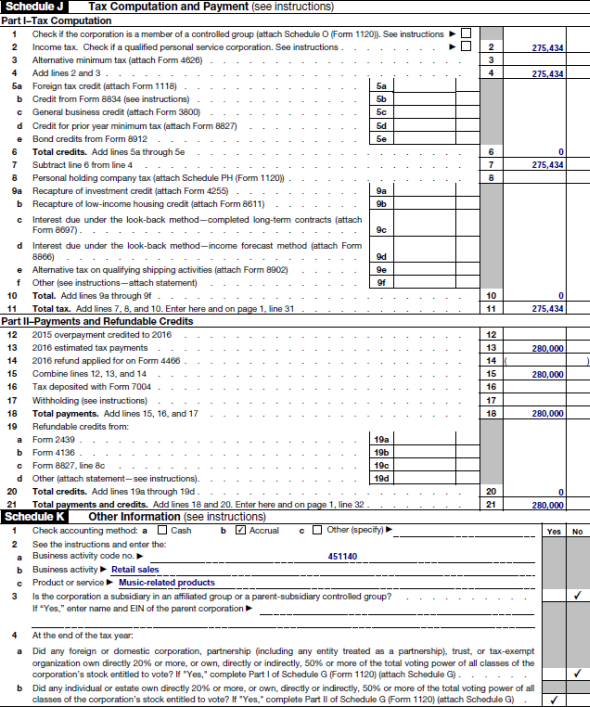

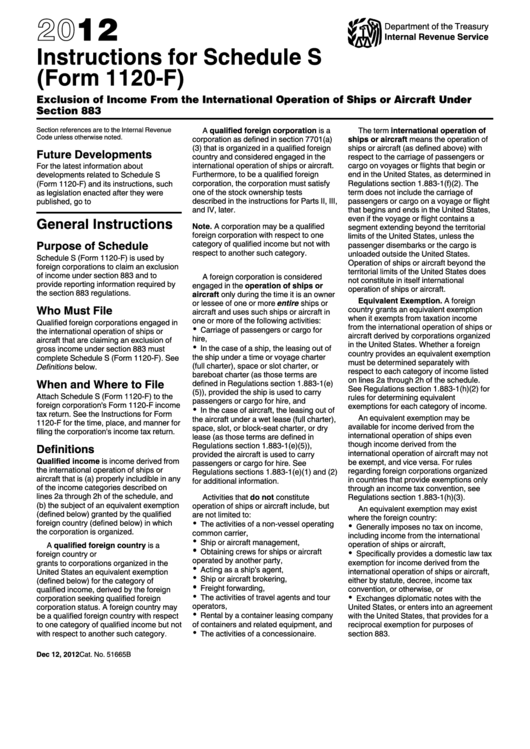

Form 7004 (automatic extension of time to file); Web schedule g is prepared when the cooperative's total receipts or assets at the end of the year are $250,000 or more. Complete, edit or print tax forms instantly. Understanding the constructive ownership percentage for form 1120. 1120 schedule g is a tax form used to report gains or losses from sales.

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Solved•by intuit•1•updated july 13, 2022. Ad easy guidance & tools for c corporation tax returns. Understanding.

Instructions For Schedule S (Form 1120F) 2012 printable pdf download

Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. Get ready for this year's tax season quickly and safely with pdffiller! Web what is the form used for? This form is for income earned in tax year 2022, with tax returns. I.

How Much Do Large Corporations Pay In Tax ? Probably Less Than

Web information about schedule ph (form 1120) and its separate instructions is at. Work easily and keep your data secure with irs form 1120 schedule g 2023 online. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,. You may force or prevent.

Web More About The Federal 1120 (Schedule G) Individual Income Tax Tax Credit Ty 2022.

This form is for income earned in tax year 2022, with tax returns. Form 7004 (automatic extension of time to file); Ad easy guidance & tools for c corporation tax returns. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or own, directly or indirectly,.

Web Schedule G Is Prepared When The Cooperative's Total Receipts Or Assets At The End Of The Year Are $250,000 Or More.

1120 schedule g is a tax form used to report gains or losses from sales or exchanges of certain business property. Proconnect tax will automatically carry your. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Complete, edit or print tax forms instantly.

Web Use Schedule G (Form 1120) To Provide Information Applicable To Certain Entities, Individuals, And Estates That Own, Directly, 20% Or More, Or Own, Directly Or Indirectly,.

Web information about schedule ph (form 1120) and its separate instructions is at. Schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20% or more, or. You may force or prevent the preparation of schedule g by. Ad get ready for tax season deadlines by completing any required tax forms today.

Web What Is The Form Used For?

Understanding the constructive ownership percentage for form 1120. Solved•by intuit•1•updated july 13, 2022. I can't find the field that will change schedule k, question 4a to yes, which should then. We last updated the information on certain persons owning the corporation's voting stock.