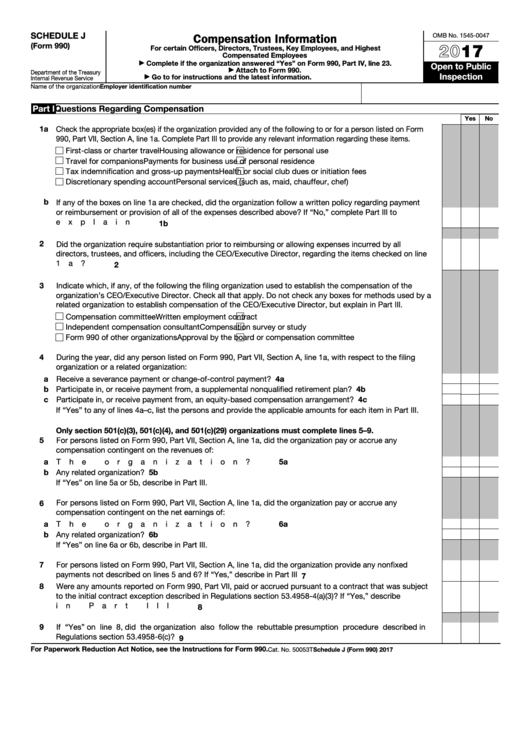

Schedule J Form 990 Instructions

Schedule J Form 990 Instructions - Web follow the simple instructions below: Web understanding the form 990, schedule j, for executive compensation analysis by cathy benfer, manager of workforce solutions on june 21, 2022 the. What is a form 990? Extracted financial data is not available for this tax period, but form 990. Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web instructions for form 990, return of organization exempt from income tax. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to. Ad get ready for tax season deadlines by completing any required tax forms today. Are all organizations that list individuals in form 990, part vii also required. How to complete schedule j?

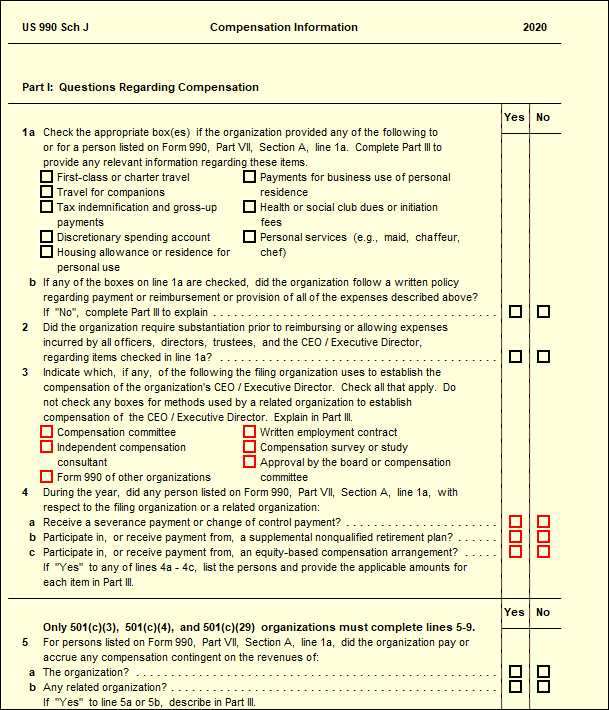

It appears you don't have a pdf plugin for this browser. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. Are all organizations that list individuals in form 990, part vii also required. What is the purpose of schedule j? Choose tax990 to file your form 990 with schedule j what is the. If people aren?t connected to document managing and law procedures, completing irs forms can be extremely hard. For each individual whose compensation must be reported. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to. How to complete schedule j?

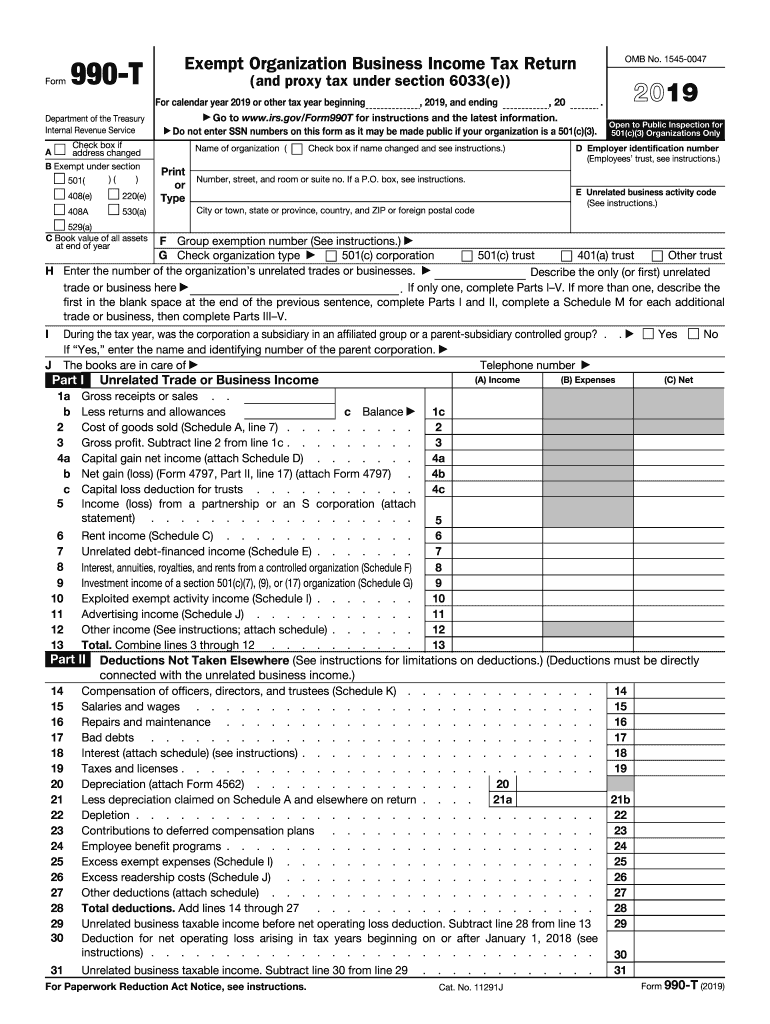

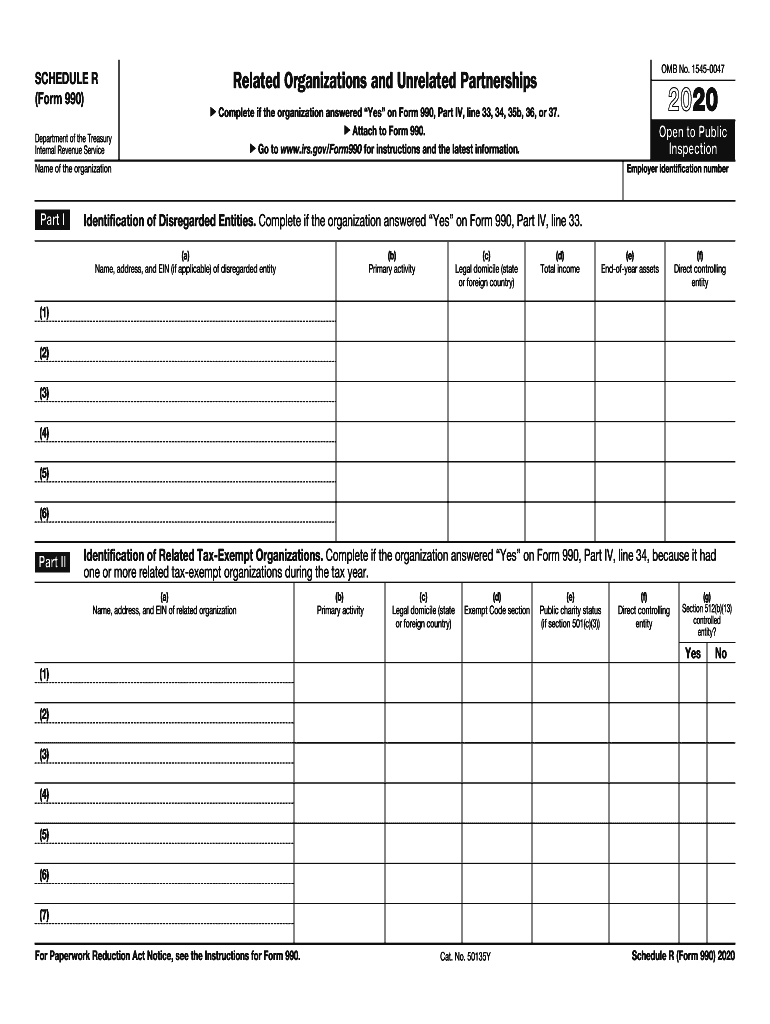

Web form 990 schedules with instructions. Web follow the simple instructions below: For each individual whose compensation must. (column (b) must equal form 990, part x, col. Are all organizations that list individuals in form 990, part vii also required. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web a public disclosure copy of the acs 2019 form 990, return of organization exempt from income tax, is available on the acs public website, with compensation information. Web understanding the form 990, schedule j, for executive compensation analysis by cathy benfer, manager of workforce solutions on june 21, 2022 the. What is the difference between the public inspection copy and the copy of.

Form 990 Schedule J Instructions

Web schedule j, “compensation information for certain officers, directors, trustees, key employees, and highest compensated employees.” in each instance,. Web understanding the form 990, schedule j, for executive compensation analysis by cathy benfer, manager of workforce solutions on june 21, 2022 the. Web schedule j (form 990) 2021 schedule j (form 990) 2021 page use duplicate copies if additional space.

Schedule J (990) Compensation Information UltimateTax Solution Center

Ad get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 990, return of organization exempt from income tax. Web exempt organization annual reporting requirements: Choose tax990 to file your form 990 with schedule j what is the. Web baa for paperwork reduction act notice, see the instructions for form 990.

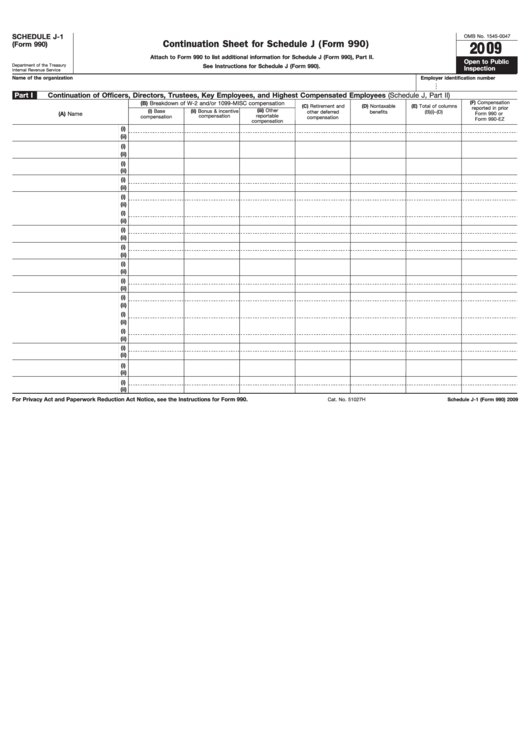

Fillable Schedule J1 (Form 990) Continuation Sheet For Schedule J

Web schedule j (form 990) 2021 page 2 part ii officers, directors, trustees, key employees, and highest compensated employees. Extracted financial data is not available for this tax period, but form 990. For each individual whose compensation must. It appears you don't have a pdf plugin for this browser. How to complete schedule j?

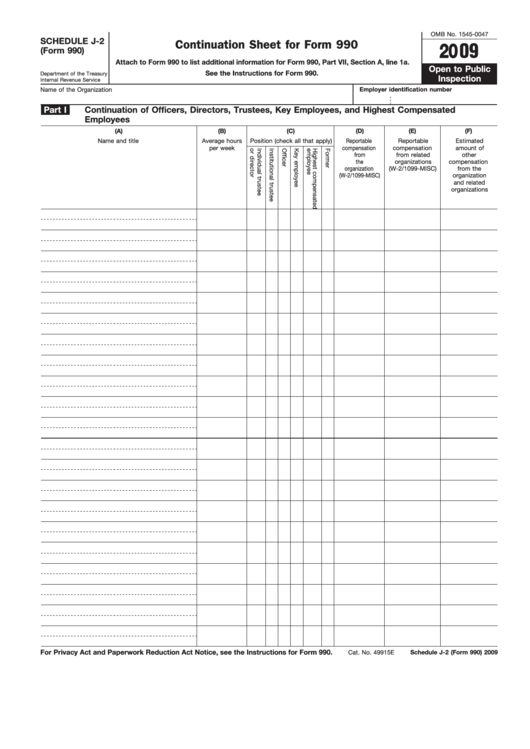

Fillable Schedule J2 (Form 990) Continuation Sheet For Form 990

Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web exempt organization annual reporting requirements: If.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

Web follow the simple instructions below: What is a form 990? Web schedule j, “compensation information for certain officers, directors, trustees, key employees, and highest compensated employees.” in each instance,. Web form 990 schedules with instructions. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and.

Fillable Schedule J (Form 990) Compensation Information 2017

Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule j (form 990) 2021 page 2 part ii officers, directors, trustees, key employees, and highest compensated employees. (column (b) must equal form 990, part x, col. Web schedule j (form 990) 2021 schedule j (form 990) 2021 page use duplicate copies if additional space.

990 T Fill Out and Sign Printable PDF Template signNow

Web schedule j, “compensation information for certain officers, directors, trustees, key employees, and highest compensated employees.” in each instance,. Purpose of schedule schedule j (form 990) is used by an organization that files form 990 to. Are all organizations that list individuals in form 990, part vii also required. Web the 2020 form 990 instructions contain reminders that, starting with.

Form 990 Schedule R Fill Out and Sign Printable PDF Template signNow

Are all organizations that list individuals in form 990, part vii also required. Schedule j (form 990) 2020 teea4101l 09/25/20 uc santa cruz alumni association 23. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Web follow the simple instructions below: Web schedule d (form 990) 2022 schedule d (form 990) 2022 page total.

2022 form 990 Schedule J Instructions Fill online, Printable

Extracted financial data is not available for this tax period, but form 990. For each individual whose compensation must. Filing requirements for schedule j, form 990. What are internet society’s legal responsibilities for posting the form 990? Web schedule j (form 990) 2021 page 2 part ii officers, directors, trustees, key employees, and highest compensated employees.

Fill Free fillable Compensation Information Schdul J Form 990 PDF form

What are internet society’s legal responsibilities for posting the form 990? Web schedule j (form 990) 2021 schedule j (form 990) 2021 page use duplicate copies if additional space is needed. Who must file schedule j? Web exempt organization annual reporting requirements: Filing requirements for schedule j, form 990.

Web Schedule J (Form 990) 2021 Page 2 Part Ii Officers, Directors, Trustees, Key Employees, And Highest Compensated Employees.

Web instructions for form 990, return of organization exempt from income tax. For each individual whose compensation must. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and. Web follow the simple instructions below:

Purpose Of Schedule Schedule J (Form 990) Is Used By An Organization That Files Form 990 To.

Choose tax990 to file your form 990 with schedule j what is the. Schedule a (form 990) 2022 (all organizations must complete this part.) see. Ad get ready for tax season deadlines by completing any required tax forms today. Web schedule j (form 990) department of the treasury internal revenue service compensation information for certain officers, directors, trustees, key employees, and.

Web Exempt Organization Annual Reporting Requirements:

Extracted financial data is not available for this tax period, but form 990. Schedule j (form 990) 2020 teea4101l 09/25/20 uc santa cruz alumni association 23. (column (b) must equal form 990, part x, col. Complete, edit or print tax forms instantly.

Web The 2020 Form 990 Instructions Contain Reminders That, Starting With Tax Years Beginning On Or After July 2, 2019, All Organizations Must File Form 990 Series Returns Electronically.

How to complete schedule j? If people aren?t connected to document managing and law procedures, completing irs forms can be extremely hard. What are internet society’s legal responsibilities for posting the form 990? Are all organizations that list individuals in form 990, part vii also required.