Tax Exempt Form Ohio

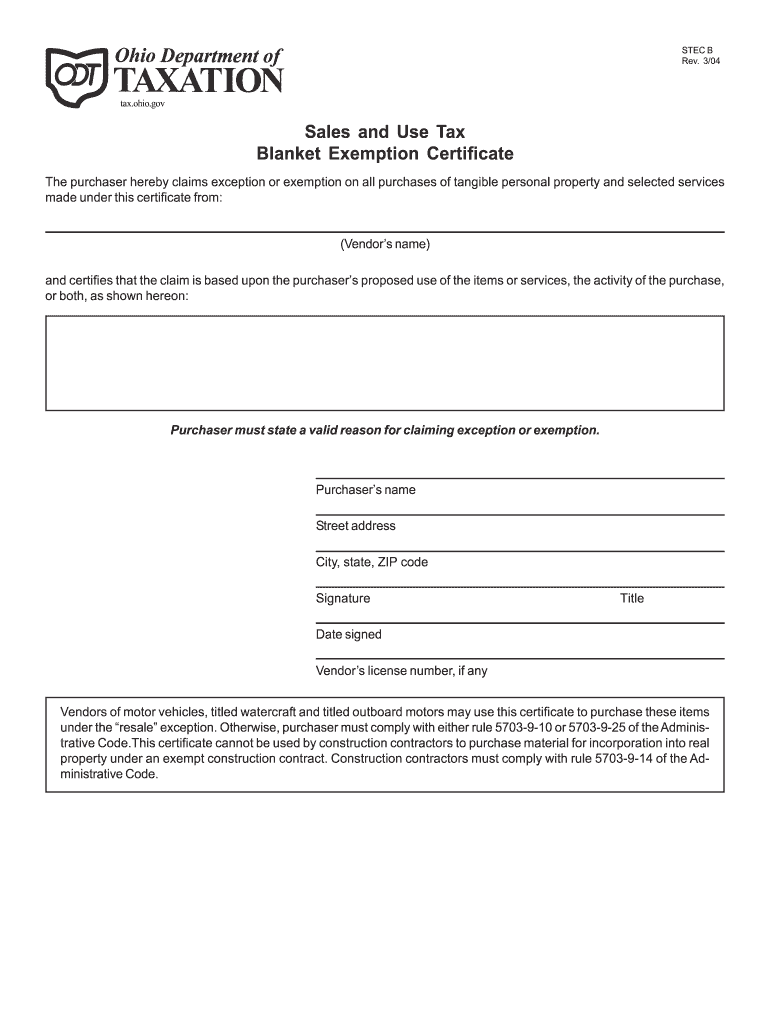

Tax Exempt Form Ohio - Access the forms you need to file taxes or do business in ohio. Web file charities and nonprofits ohio ohio state charities regulation state tax filings state filing requirements for political organizations: The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Other than as noted below the use of a specific form is not mandatory when claiming an exemption. Most forms are available for download and some can be. Vendor’s name was purchased for incorporation. 3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: If any of these links are broken, or you can't find the form you need, please let us know. Ohio department of taxation business *updated 02/03/22 Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on contract documentation the undersigned hereby certifi es that the tangible personal property purchased under this exemption from:

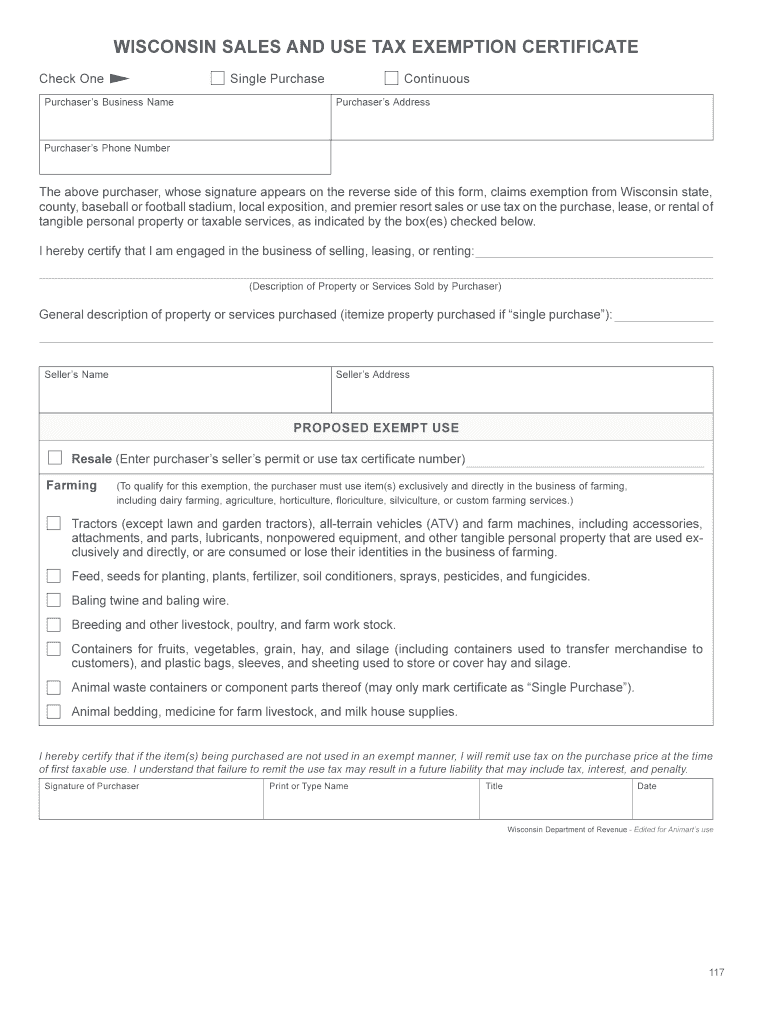

Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file. Most forms are available for download and some can be. Web exemption certificate forms the following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. You can find resale certificates for other states here. Access the forms you need to file taxes or do business in ohio. Candidates for local offices file with the county board of elections. However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax in a time where the vendor may be unsure of the validity of the transaction. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. If any of these links are broken, or you can't find the form you need, please let us know. Web contractor’s exemption certifi cate identifi cation of contract:

Web contractor’s exemption certifi cate identifi cation of contract: If any of these links are broken, or you can't find the form you need, please let us know. Web it 1040 es tax year: Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on contract documentation the undersigned hereby certifi es that the tangible personal property purchased under this exemption from: You can find resale certificates for other states here. Access the forms you need to file taxes or do business in ohio. 3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Candidates for local offices file with the county board of elections. Candidates for most state offices file reports with the secretary of state;

Ohio Residential Property Disclosure Exemption Form 20202022 Fill

3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: Candidates for local offices file with the county board of elections. Other than as noted below the use of a specific form is not mandatory when claiming an.

Ohio 3gov Tax Fill Online, Printable, Fillable, Blank pdfFiller

However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax in a time where the vendor may be unsure of the validity of the transaction. Most forms are available for download and some can be. Web contractor’s exemption certifi cate identifi cation of contract: Other than as noted below the.

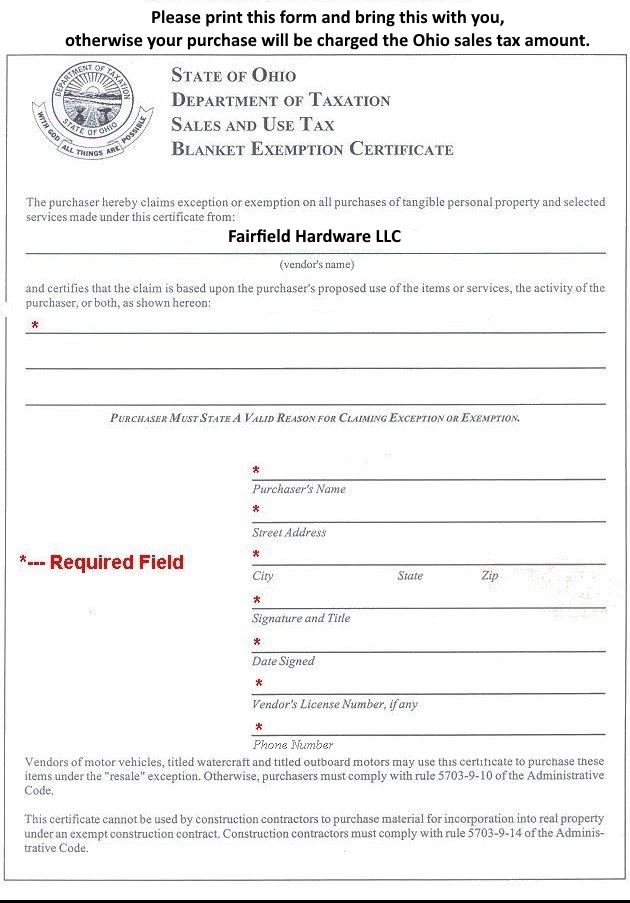

Fairfield Hardware Ohio Tax Exemption Form

However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax in a time where the vendor may be unsure of the validity of the transaction. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and.

Irs Tax Exempt Form 501c3 Form Resume Examples XV8oyPjjKz

Web file charities and nonprofits ohio ohio state charities regulation state tax filings state filing requirements for political organizations: Most forms are available for download and some can be. Vendor’s name was purchased for incorporation. Web exemption certificate forms the following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Web.

Printable Tax Exempt Form Master of Documents

Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on contract documentation the undersigned hereby certifi es that the tangible personal property purchased under this exemption from: However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax in a time where the vendor may be unsure.

Ohio Tax Exempt Form Fill and Sign Printable Template Online US

Who do i contact if i have questions? Access the forms you need to file taxes or do business in ohio. If any of these links are broken, or you can't find the form you need, please let us know. Web exemption certificate forms the following forms are authorized by the ohio department of taxation for use by ohio consumers.

Tax Exemption Form Fill Out and Sign Printable PDF Template signNow

Access the forms you need to file taxes or do business in ohio. Candidates for local offices file with the county board of elections. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web it 1040 es tax year: Contractee’s (owner’s) name exact location of job/project name of job/project as it appears on.

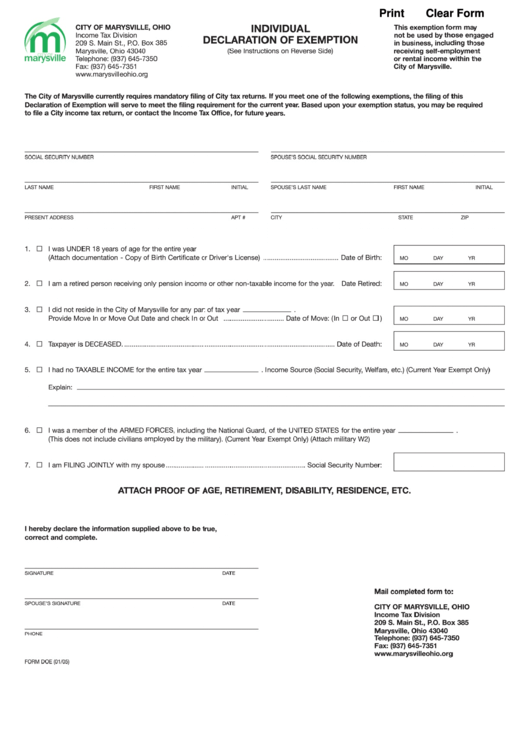

Fillable Individual Declaration Of Exemption Form Ohio Tax

Candidates for most state offices file reports with the secretary of state; The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate.

Tax Exempt Form Fill Out and Sign Printable PDF Template signNow

Candidates for local offices file with the county board of elections. Web exemption certificate forms the following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. Web we have three ohio sales tax exemption forms available for you to print or save as a pdf file. Access the forms you need.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

You can find resale certificates for other states here. Candidates for most state offices file reports with the secretary of state; Access the forms you need to file taxes or do business in ohio. Most forms are available for download and some can be. Web it 1040 es tax year:

Contractee’s (Owner’s) Name Exact Location Of Job/Project Name Of Job/Project As It Appears On Contract Documentation The Undersigned Hereby Certifi Es That The Tangible Personal Property Purchased Under This Exemption From:

Most forms are available for download and some can be. 3/15 tax.ohio.gov sales and use tax unit exemption certifi cate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: Web it 1040 es tax year: Candidates for most state offices file reports with the secretary of state;

Access The Forms You Need To File Taxes Or Do Business In Ohio.

Other than as noted below the use of a specific form is not mandatory when claiming an exemption. Candidates for local offices file with the county board of elections. Vendor’s name was purchased for incorporation. However, a sales and use tax blanket exemption certificate can help confirm the transaction is not subject to sales tax in a time where the vendor may be unsure of the validity of the transaction.

Ohio Department Of Taxation Business *Updated 02/03/22

You can find resale certificates for other states here. If any of these links are broken, or you can't find the form you need, please let us know. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web exemption certificate forms the following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases.

Web We Have Three Ohio Sales Tax Exemption Forms Available For You To Print Or Save As A Pdf File.

Web do i need a form? Web file charities and nonprofits ohio ohio state charities regulation state tax filings state filing requirements for political organizations: 3/15 tax.ohio.gov sales and use tax blanket exemption certificate the purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from: Who do i contact if i have questions?